With loan amounts exceeding conforming loan limits, jumbo loans give high-net-worth individuals access to luxury properties that conventional loans cannot finance. However, you’ll still face unique obstacles when seeking large mortgage loans, from high credit score requirements to strict debt-to-income (DTI) thresholds. That’s why the right jumbo mortgage lenders can make all the difference when tapping into the high-end housing market.

At Defy, we make it our mission to be the right lender for everyone, whatever your goals or financial situation may be. If you’re a real estate investor, you have a wealth of options at Defy, from jumbo loans for luxury homes to DSCR loans and home equity loans for flexible financing. Each of our financing tools is fully customizable to fit each borrower’s needs.

In this blog, we’ve selected our top 7 jumbo mortgage lenders based on the best interest rates, loan programs, and proven track records with high-net-worth clients. We’ll also discuss specifics on jumbo loan rates, how the jumbo mortgage process unfolds, and what you can do on your end to secure the best deal that maximizes both immediate savings and long-term wealth-building potential.

Let’s begin.

Understanding Jumbo Mortgage Qualifications

Because jumbo loans lack government backing, jumbo mortgage lenders generally have stricter underwriting standards, requiring higher credit scores and down payments, significant cash reserves, and a lower DTI ratio to mitigate risk. Extensive financial documentation is also required to prove sufficient income stability and cash reserves.

Credit Score Requirements

Lenders typically have a minimum credit score requirement of 620-650 for conventional mortgages, but a jumbo loan requires a higher score due to the added risk associated with much larger loan amounts. The usual minimum is 700, but the best rates and terms unlock at 740 or above.

Down Payment and Cash Reserves

Jumbo financing involves a substantial amount of upfront cash. While conventional loans can need as little as 3-5% down depending on the program, jumbo mortgages usually need 10-25%, minimum. Because of the larger loan sizes, jumbo loan down payments are also much larger than those of conventional loans. A jumbo loan for a home priced just above the standard conforming loan limit of $806,500 will have a minimum down payment of $80,650. By contrast, putting down the minimum of 5% for a median-priced home ($369,000) will cost just $18,450.

Aside from down payment, lenders often require proof of cash reserves equal to 6 to 12 months of mortgage payments to ensure financial resilience.

Income Verification

Lenders often require multiple years of documentation in the form of tax returns, W2s, and 1099s. Business owners, investors, and entrepreneurs with unconventional or multiple income streams can provide a complete picture of their finances using bank statements, investment statements, and profit and loss statements.

Top 7 Jumbo Mortgage Lenders of 2025

Choosing the right jumbo mortgage lender can potentially save you dollars over the life of your loan. Better service quality, underwriting flexibility, and experience can make even the most complex financial portfolios easier to navigate.

Here are seven of our expert-vetted options for 2025, each with their own approach to addressing the unique needs of high-net-worth borrowers:

1. Defy Mortgage

Defy Mortgage is a modern lending partner with innovative solutions designed for borrowers who don’t fit the traditional mold. Licensed in 37 states, Defy provides a wide variety of non-QM solutions for every lending situation.

Jumbo loan rates, terms, and requirements vary depending on the lender. However, they usually include the following:

- Eligible properties: 1-4 unit primary, second, and investment properties

- Minimum credit score: 700

- Minimum down payment: 20%

- Debt-to-income ratio: Not exceeding 43%, but ideally lower than 35%

- Max loan amount: Varies by lender

Defy takes a holistic approach to underwriting, considering alternative assets such as cryptocurrency portfolios for qualification purposes. Mortgage brokers can also take advantage of Defy’s flexible programs and underwriting standards through Defy TPO, allowing them to build partnerships with clients who may be turned away by traditional banks.

2. Chase Bank

America’s largest bank, Chase originated over $8 billion worth of jumbo loans in the first half of 2024 alone.

Jumbo Loan Terms:

- Maximum amount: $9.5 million

- Minimum credit score: 620

- Minimum down payment: 10%

- Rate: 5.875% for 30-year jumbo

Chase also offers a $5,000 closing guarantee if eligible loans don’t close on time because of delays on their side.

3. Rocket Mortgage

Like Defy, Rocket Mortgage is known for its comprehensive digital platform and commitment to mortgage education.

Jumbo Loan Terms:

- Maximum amount: $3 million

- Minimum credit score: 680

- Minimum down payment: 10%

- Rate: 5.75% for 30-year jumbo, 5.625% for 30-year VA jumbo

Rocket’s standout feature when it comes to jumbo loans is its Jumbo Smart loan option, which doesn’t require private mortgage insurance at all.

4. Bank of America

Another major national bank and consumer banking division of JPMorgan Chase, Bank of America offers jumbo loans with unique interest-only options for the first 10 years, plus specialized programs for second homes, investment properties, and medical professionals.

Jumbo Loan Terms:

- Maximum amount: Up to $5 million on owner-occupied properties; up to $3 million on second homes; up to $1 million on investment properties

- Minimum credit score: 740

- Minimum down payment: 10%

- Rate: 6.125% for 30-year fixed, 6.000% for 15-year fixed.

Lower down payment options with no mortgage insurance for qualified borrowers on owner-occupied properties with loan amounts up to $2 million (not available with an interest-only payment option).

5. Navy Federal Credit Union

Navy Federal Credit Union is the largest member-owned credit union in the United States, serving military members, veterans, and their families.

Jumbo Loan Terms:

- Maximum loan amount: $2 million

- Minimum down payment: Typically 20%, but can be as low as 0% with Homebuyer’s Choice

- Rate: 6.875% for 30-year jumbo

Navy Federal Credit Union reserves their Homebuyer’s CHoice offering for veterans and active-duty military personnel, as well as qualifying members of their family.

6. SoFi

SoFi is a digital-first lender renowned for its seamless, tech-driven mortgage experience, offering jumbo loans that combine competitive pricing with modern convenience.

Jumbo Loan Terms:

- Maximum amount: $3 million

- Minimum credit score: 740

- Minimum down payment: 10%

SoFi members enjoy discounts on origination fees. You can save $500 if you’re a SoFi member, and an additional $500 if you’re a SoFi Plus member. They also don’t require PMI regardless of your down payment on a jumbo loan.

7. First Federal Bank

First Federal Bank is a community-focused financial institution with a reputation for personalized customer service.

Jumbo Loan Terms:

- Maximum amount: $2 million

- Minimum credit score: 680

- Minimum down payment: 10%

- Rate: 6.375% for 30-year fixed, 6.000% for 15-year fixed

First Federal has a dedicated local loan officer model, giving borrowers direct access to experienced professionals who specialize in navigating complex jumbo loan underwriting.

Comparing Jumbo Mortgage Terms and Rates

Unlike conventional mortgages with standardized guidelines, jumbo rates can vary widely from lender to lender, sometimes by as much as 0.50%.

How Loan Size Affects Rates

Jumbo loan rates are often competitive with conventional loan rates and can even be lower for borrowers with excellent credit profiles. However, because larger loan amounts carry more risk for lenders, many jumbo scenarios still come with slightly higher rates than conventional loans.

As of September 10 2025, 30-year fixed conventional loans at 720 FICO and 20% down average at 6.50%. 30-year fixed jumbo loans, on the other hand, average at 6.61% at 720 FICO and 20% down. This may not sound like a big difference, but jumbo loans’ larger loan sizes can significantly increase interest payments.

Fixed vs. Adjustable-Rate Options

Borrowers typically have two choices: fixed-rate jumbo mortgages or adjustable-rate mortgages (ARMs).

- Fixed-rate loans: Have the same interest rate throughout their lifetime. These have the advantage of letting you lock in a good rate, insulating you from higher monthly mortgage payments in the event of rate hikes.

- Adjustable-rate mortgages: Start with an introductory period of up to 10 years. The rate during this period is fixed and may be lower than average, but after that point will adjust according to market conditions, usually at intervals of 1, 3, or 5 years. The lower introductory rate can be an advantage for those planning to refinance or sell within 5-10 years. The eventual rate adjustment can also be an advantage if interest rates fall in the future, but conversely, they can leave the borrower with bigger monthly payments if they rise.

Negotiation Opportunities

Unlike conforming loans, where rates and terms are mostly non-negotiable, jumbo mortgages leave room for flexibility. Like most mortgages, making a bigger down payment can be a great way to lower your overall debt obligation and even unlock a lower rate. If you can’t afford a bigger down payment, many lenders may agree to reduce the interest rate if you agree to a slightly higher rate elsewhere in the loan structure.

However, the most effective way to invite lower rates by far is strengthening your financial profile. Achieving excellent credit is essential, but gathering significant liquid reserves can also be a powerful negotiating tool for favorable terms.

Borrowers who have built a strong relationship with their lender also tend to receive preferential rates, as the lender is familiar with how they operate and how lucrative their investments are. At Defy, every single loan is tailored to your unique needs. We build strong relationships with each borrower and secure the best rates for them and their investments.

Application Process and Timeline

One of the biggest concerns borrowers have when working with jumbo mortgage lenders is how long it will take to close. Because these loans are larger and riskier, the process is more intensive than conventional mortgages. Understanding the typical steps and timeline can help you prepare and avoid unnecessary delays.

Average Timeline for Jumbo Mortgages

Most jumbo loans take 30–45 days to close, though some can stretch to 60 days depending on the borrower’s financial profile and property type. However, experienced lenders with efficient underwriting teams may close in as little as 21–30 days with good documentation.

Key Stages of the Application

- Pre-Approval: Borrowers submit initial financial documents for lender review. This is where income, credit, and asset checks take place.

- Full Application: A formal application with supporting documentation, including tax returns, K-1s, W-2s, and bank statements.

- Underwriting Review: Lenders conduct a deep dive into financials, property appraisals, and reserves.

- Closing: Once underwriting is complete, the loan documents will be sent to you to be finalized and signed. The purchase funds are then disbursed to the seller, and you receive the keys to your new property.

Factors That Can Delay Closing

- Complex income structures: Underwriting is often more difficult for borrowers with complex income structures, such as self-employment income, business ownership, investment income, or multiple revenue streams. Unlike W-2 wage earners, whose income is steady and easy to verify, these borrowers require more detailed documentation and often additional verification steps, which can slow down approval.

- Incomplete documentation: The risk involved with jumbo loans requires comprehensive documentation for lenders to be absolutely confident that borrowers can make payments on time throughout the lifetime of the loan. Missing tax returns, bank statements, or verification of assets can halt processing, as underwriters cannot approve a high-value loan without complete financial visibility.

- Unique property types: Properties like historic homes, waterfront properties, multi-unit buildings, or luxury custom estates can require additional appraisal scrutiny because appraisers must consider specialized features, unique construction materials, or limited comparables, all of which complicate determining market value accurately.

- High loan amounts: Higher loan amounts carry higher risk, so lenders may layer on additional approval processes to ensure adequate collateral, confirm debt-to-income ratios, and stress-test the borrower’s ability to cover payments in case of income fluctuations. This often involves multiple underwriting reviews, secondary appraisals, or executive-level sign-offs, all of which can extend the timeline before closing.

How to Speed Up the Process

Closing on a jumbo loan can be faster when borrowers follow certain guidelines, such as:

- Gather clear documentation: Document each of your revenue streams, such as profit-and-loss statements, bank statements, investment records, and tax returns, to help underwriters evaluate your ability to repay more efficiently.

- Select properties that are easy to appraise: Those with clear comparables and standard features give underwriters an easy reference point to determine market value quickly and reduce appraisal-related delays.

- Choose responsive lenders: Lender responsiveness is a good indicator of a smooth, speedy underwriting process.

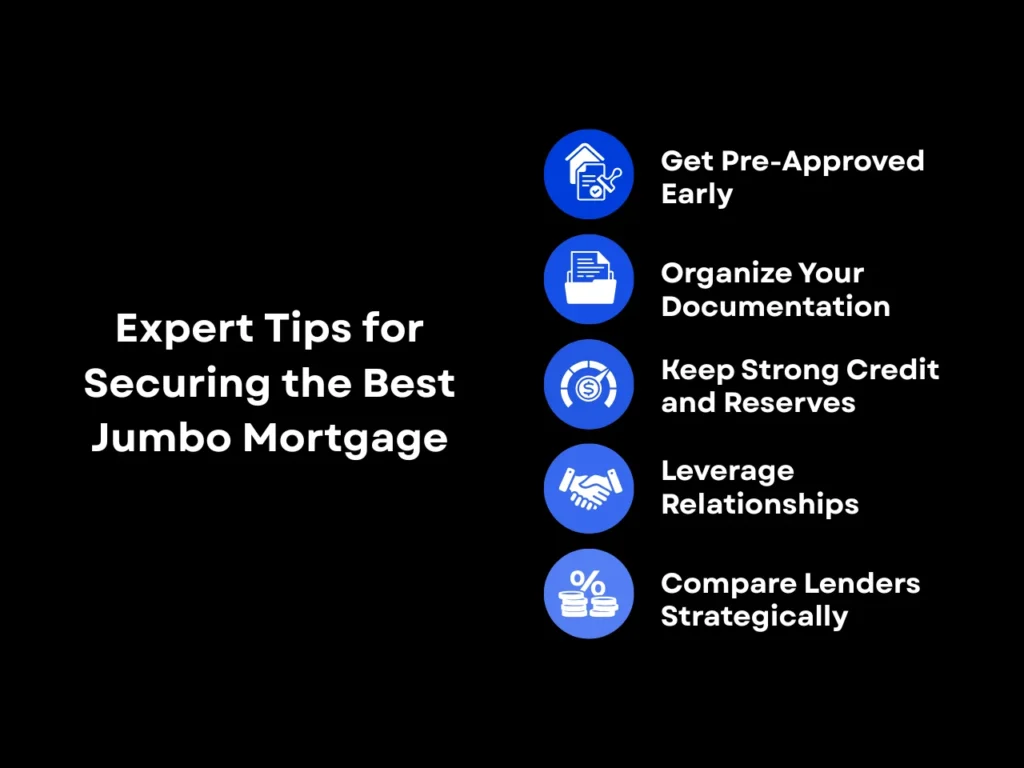

Expert Tips for Securing the Best Jumbo Mortgage

Whichever of the above jumbo mortgage lenders you choose, putting your best foot forward on your application is crucial to securing the best rates and terms. Through our years of experience working in the non-QM space, we at Defy have identified several behaviors that the most successful investors exhibit when securing their jumbo mortgage:

1. Get Pre-Approved Early

Obtaining pre-approval demonstrates to lenders that you’re a serious borrower with verified financials. Early pre-approval also allows you to identify any gaps in documentation or credit issues before starting the formal application.

2. Organize Your Documentation

For borrowers with complex income streams, organization is crucial. Prepare multiple years of tax returns, K-1s, bank statements, and investment account summaries. Having these ready can prevent delays and strengthen your negotiating position.

3. Maintain Strong Credit and Reserves

A higher credit score and robust cash reserves can unlock better interest rates and terms. The best jumbo loan lenders typically expect a minimum credit score of 700 and cash reserves covering six to twelve months of mortgage payments.

4. Leverage Relationships

Borrowers who have existing relationships with lenders may be eligible for rate discounts, reduced fees, or faster processing. With a heavy focus on personalized mortgage experiences, Defy is particularly well-suited for borrowers who want to leverage existing relationships for more favorable jumbo loan terms.

5. Compare Lenders Strategically

Don’t just chase the lowest rate. Sometimes the best lender for your situation will be the one with better flexibility, more experience, or higher responsiveness. These small differences in service quality can go a long way in terms of closing speed and overall satisfaction.

At Defy, we combine the expertise of our seasoned Mortgage Consultants with a streamlined digital platform to provide top-notch service. Our borrowers enjoy clear, personalized guidance every step of the way, with minimal paperwork delays and stress-free financing.

Conclusion

Choosing the right jumbo lender doesn’t end at finding the one with the lowest rate. Jumbo mortgage lenders that understand complex financial profiles are most likely to have the flexibility to give you fair terms that actually align with your full income picture and lightning-fast closing.

A lender’s responsiveness and history with high-net-worth borrowers are often the best indicator that they can deliver smooth underwriting and timely closings. Apart from this, careful evaluation of credit score requirements, down payment thresholds, and documentation expectations can help you avoid delays and secure terms that support long-term wealth-building.

Ready to finance your next luxury property? Defy is the partner that can turn your investment goals into reality. We offer holistic underwriting that encompasses all of your income sources, from assets to business income to crypto, giving you access to the full breadth of luxury housing options. Our innovative, personalized jumbo loan programs are tailored to fit your needs, not ours. Give us a call today at (615) 622-1032, email us at team@defymortgage.com, or schedule an appointment on our website and let’s have a chat about your financial strategy.

If you’re a mortgage broker, our jumbo loans can take you to the top. With DefyTPO, you can work with borrowers regardless of how unconventional their income is. Our flexible loan programs allow you to tap into the market that bigger players often overlook, giving you the competitive edge to dominate your niche and capture more of the luxury lending space. Send your pricing scenarios our way for a comprehensive analysis or try our AI Pricer for a quick quote!

Frequently Asked Questions

What exactly is a jumbo mortgage and when do I need one?

A jumbo mortgage is a loan that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). For 2025, this means loans above $806,500 in most areas, with high-cost regions allowing up to $1,209,750. You need a jumbo loan when purchasing luxury properties, high-end condos, or homes in expensive metropolitan markets.

Are jumbo mortgage rates higher than conventional mortgage rates?

Surprisingly, jumbo mortgage rates are often competitive with conventional rates. High-net-worth borrowers typically have stronger credit profiles and larger down payments, reducing lender risk. However, rates vary between lenders, making it crucial to shop around.

What credit score do I need for a jumbo mortgage?

Most jumbo loan lenders require a minimum credit score of 700, with the best rates reserved for 740+. Some lenders may consider scores as low as 680, though this usually comes with higher rates and stricter requirements.

How much income do I need to qualify for a jumbo mortgage?

While there is no strict income threshold, lenders generally prefer a debt-to-income ratio below 43% (sometimes up to 45%). For example, a $1 million mortgage at 4% requires roughly $11,000–$12,000 in monthly gross income. Lenders also assess assets and reserves.

What should I look for when comparing jumbo mortgage lenders?

Focus on five key factors: competitive rates and fees, loan program flexibility, experience with high-net-worth clients, customer service quality, and closing timeline efficiency. Consider the lender’s ability to handle unique property types or complex income structures.

How important is it to work with a lender that specializes in jumbo mortgages?

Specialized lenders understand the luxury market, complex income verification, and investor-friendly programs. They can provide faster approvals, flexible underwriting, and personalized service tailored to high-net-worth borrowers.

How long does the jumbo mortgage application process typically take?

Jumbo mortgages usually take 30–45 days to close, though experienced lenders and complete documentation can reduce this to 21–30 days. Complex income or unique property types may extend the timeline.

Can I get a jumbo mortgage for an investment property?

Yes, but requirements are stricter. Investment property jumbo loans often require 20–30% down, higher credit scores (typically 720+), larger cash reserves (2–6 months), and slightly higher interest rates (0.125–0.375% above primary residence rates). Alternatively, you might try a DSCR loan to qualify with your property’s cash flow, or a bank statement loan to qualify using 1-2 years’ worth of bank statements.

Are there special jumbo mortgage programs for high-net-worth individuals?

Yes. Many lenders, including private banking divisions, offer expedited processing, dedicated relationship managers, flexible underwriting, and competitive pricing based on overall assets. These programs are designed to streamline approvals and provide premium service.

About the Author: Meet Todd Orlando, co-founder and CEO of Defy Mortgage and Defy TPO. With over 20 years of experience in banking and financial services at institutions like First Republic and Morgan Stanley, Todd has dedicated his career to broadening access to lending and revolutionizing the mortgage industry, particularly in the non-QM space.

In 2022, Todd launched Defy Mortgage to provide real estate investors, entrepreneurs, and self-employed individuals with a secure, streamlined, and personalized lending experience tailored to meet their specific needs. He knows firsthand how access to the right mortgage can make or break a project and how today’s borrowers need flexible financial partners and creative lending options designed for their unique needs and lifestyles. Traditional banks are rigid, and their one-size-fits-all approach is outdated. That’s why he created Defy Mortgage — to stay ahead of the curve, set new standards in lending, and deliver personalized, non-traditional solutions for those looking to purchase or refinance.

For the third year running, Todd has been recognized by Inman News for excellence in the mortgage and lending industry, landing on their prestigious Best of Finance list for 2025. He was also honored as a mortgage finance leader in 2023 and 2024 for the same award. His visionary leadership has earned him endorsements from esteemed former colleagues at prestigious institutions across the financial services spectrum.

Beyond his work in finance, Todd is also a co-founder of two software companies in commercial lending and healthcare tech, an active real estate investor, and a husband and father of three. An industry disruptor, Todd is here to redefine what’s possible in mortgage lending.

Mortgage broker itching to elevate client offerings? Check out our TPO business, Defy TPO: https://defytpo.com/