ITIN loans offer a valuable opportunity for non-US citizens to achieve their homeownership dreams. These loans cater to individuals who lack a social security number but have an individual taxpayer identification number (ITIN). Applicants considering ITIN loans must carefully assess their eligibility, understand the application process, and recognize these loans’ advantages to maximize the chances of approval.

Defy Mortgage provides comprehensive mortgage solutions tailored to real estate investors, business-owners and non-US citizens who qualify. Our services for non-US citizens focus on individuals with an individual taxpayer identification number (ITIN), offering ITIN mortgage options without requiring a social security number. We also offer competitive foreign national loan options for primary, second, and investment properties—both purchase and refinance with cash-out.

In line with our professional experience in processing ITIN loans, we’ve crafted this comprehensive guide to explore eligibility criteria and documentation requirements. Whether you’re interested in single-family homes, condos, or commercial real estate, we’ll guide you through every step of the application process, helping you achieve your homeownership dreams with the support of mortgage lenders. Please note that we only offer ITIN loans in certain states. Please reach out with questions on state licensing for ITIN loans if you have any additional questions.

Okay, let’s dive in!

What are ITIN Loans?

ITIN loans are home loans for non-US citizens without a Social Security Number (SSN). Borrowers use an ITIN issued by the IRS to buy a primary residence or investment property. These loans enable individuals to engage in financial activities like buying a home within the United States.

ITIN loans differ from traditional loans in key ways. While traditional loans require an SSN, ITIN mortgages use a tax identification number. These loans often come from credit unions and specialized lenders. It provides a valuable option for building credit history in the United States, making them non-US citizen-friendly.

ITIN loans provide several benefits to holders, despite not granting work authorization or immigration status in the United States:

- Tax Filing: The primary function of an ITIN is to enable individuals without a Social Security Number to file US tax returns and comply with tax laws.

- Financial Services:

- Banking: Some institutions allow ITIN holders to open bank accounts.

- Credit: Certain lenders and credit card companies accept ITINs for credit applications.

- Mortgages: Some lenders offer ITIN mortgages, allowing holders to purchase homes.

- Housing: ITINs may be accepted by landlords as identification for rental agreements.

- Limited Government Services: In certain cases, ITINs can be used to access some government services.

It’s crucial to note that while an ITIN serves many functions similar to a Social Security Number, it is not a complete substitute and has limitations in its applicability.

Requirements for ITIN Loans

Qualifying for an ITIN mortgage loan involves meeting specific lender criteria. Non-US citizens can access home financing through ITIN mortgages, making homeownership possible. Here are the essential requirements to consider:

- Valid ITIN: Applicants must have a valid Individual Taxpayer Identification Number (ITIN) issued by the IRS. This number consists of nine digits that serve as an alternative identification for tax purposes.

- Proof of Employment or Income: Lenders typically require proof to verify your income. Prepare copies of your employment verification, tax returns, or bank statements to demonstrate your ability to repay the loan.

- Creditworthiness: Lenders even assess the borrower’s credit history and score. While more flexible than traditional loans, maintaining a good credit record increases approval chances and can secure better loan terms.

- Down Payment: A down payment is necessary for ITIN loans. The amount varies depending on the lender and borrower’s financial situation. Saving for a down payment in advance improves qualification chances and may result in a lower interest rate.

Understanding these criteria can help applicants navigate the loan process more effectively, improving their chances of approval. Prospective borrowers should consult with lenders to understand the specific requirements and tailor their financial plans accordingly.

Types of Properties You Can Buy with ITIN Loans

ITIN loans offer an opportunity for non-U.S. citizens to own or invest in a wide range of properties. Let’s explore various property types you can acquire using ITIN mortgages, highlighting their applicability and any pertinent considerations.

Residential Properties

Residential properties are designed primarily for living purposes rather than commercial or industrial use. They include various types of housing, such as:

- Single-Family Homes: Single-family homes are popular for buyers using ITIN loans. These properties offer owners privacy and freedom. ITIN mortgage programs often cater to this property type, providing competitive terms that make homeownership more accessible.

- Condominiums: Condos represent another viable option for ITIN loan recipients. For those seeking a less-maintenance residence, condos offer various amenities such as security, pools, and fitness centers. The ITIN mortgage program can facilitate the purchase of condos, often with guidelines similar to those for single-family homes.

- Multi-Family Units: Investing in a multi-family unit can benefit ITIN holders looking to live in one unit while renting out others. This arrangement can provide a steady income stream that helps cover the mortgage and maintenance costs. ITIN loans for multi-family units typically require a more comprehensive evaluation of the borrower’s financial stability and the property’s income-generating potential.

Investment Properties

Investment properties are real estate assets purchased to earn a return on investment either through rental income, future resale of the property, or both. These properties can include:

- Commercial Real Estate: For those interested in properties beyond residential, commercial real estate offers a profitable avenue. To establish or expand a business, ITIN loans for non-U.S. citizens can acquire commercial properties, including office spaces and retail locations. However, these loans might come with stricter criteria regarding the borrower’s business history and the property’s expected cash flow.

- Land Purchase: Acquiring land with an ITIN loan is possible but generally involves more stringent conditions. Lenders might require a detailed plan for the land’s use to ensure its potential for appreciation or development. This type of investment might also have higher down payment requirements and interest rates due to the perceived higher risk than developed properties.

How to Apply for an ITIN Loan

Applying for an ITIN loan allows non-US citizens to access financial services without a Social Security Number (SSN). Here’s a simplified, five-step guide to help you successfully navigate the process of obtaining an ITIN loan, ensuring you can secure the funding you need:

Step 1: Obtain Your ITIN

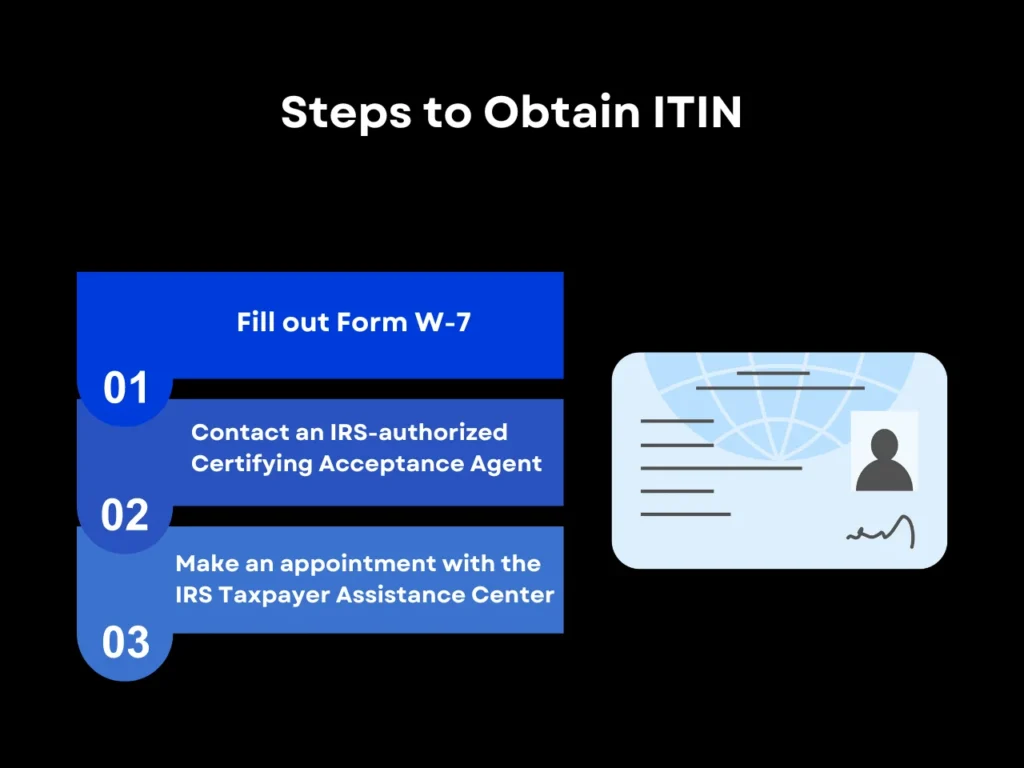

The first step involves obtaining an Individual Taxpayer Identification Number (ITIN). This number is crucial as it serves as a unique tax identification. Follow these steps to obtain your ITIN:

- Fill out Form W-7: Complete the Application for IRS Individual Taxpayer Identification Number (ITIN) and submit it with your tax return.

- Contact an IRS-authorized Certifying Acceptance Agent: This agent assists with the application process and ensure all documentation is correct.

- Make an Appointment with the IRS Taxpayer Assistance Center: Reaching out to an IRS representative helps verify your documents and finalize your ITIN application.

Having your ITIN ready is crucial as it is a mandatory requirement for applying for an ITIN loan. This number not only helps in tax reporting but also in securing financial products or services designed for non-US citizens.

Step 2: Gather Necessary Documents

Before applying for an ITIN loan, have all required documents ready. These documents typically include:

- Proof of your ITIN.

- Proof of income (such as pay stubs, tax returns, or bank statements).

- Employment verification.

- Identification documents (such as a passport or government-issued ID).

Preparing these documents helps streamline the application process, making it easier for the lender to verify your information and approve loans with your ITIN.

Step 3: Choose the Right Lender

A comprehensive and detailed lender selection is considered one of the most significant stages in the ITIN loan application. It is viable to all financial firms, a unique program that provides ITIN loan plans for non-US nationals, but the conditions will differ significantly. It is essential to review various financial institutions and their respective loan products to find the best options that match your financial situation.

Step 4: Submit Your Application and Await Approval

Once the lender is selected, the next stage is to send in your loan application. To put it in detail, this action implies completing the lender’s application form and sending a full set of required documentation. Consider all the details and ensure all information is correctly filled in to forestall the possible delay.

After submitting your application, the lender will review your documents and assess your creditworthiness. Your ITIN loan application will likely be approved if everything is in order. However, the approval time can vary from one lender to another, so patience is critical.

Advantages of Securing an ITIN Loan

Non-U.S. citizens can benefit from ITIN loans, which offer a key resource for obtaining mortgages. These loans come with distinctive advantages that cater to the specific needs of individuals without a Social Security Number. Here, we explore the top five advantages that can help potential borrowers make informed decisions about their property investments.

Note: Since ITIN mortgages are typically considered to be non-Qualified Mortgages (non-QM), you’ll have to find specialized lenders who have experience serving this niche market. These lenders understand the unique circumstances of ITIN holders and structure their loan products accordingly. You can explore various types of ITIN mortgage loans, including fixed-rate and adjustable-rate mortgages, depending on your preferences and financial situation.

It’s important to note that not all lenders who specialize in non-QM loans offer ITIN mortgages.

However, there are alternative loan options for foreign nationals and those without a SSN, aside from ITIN mortgages, should these options be a better fit and should you not have an ITIN.

Facilitates Property Buying for Non-US Citizens

ITIN mortgages enable non-US citizens to purchase homes without a Social Security Number. This opportunity fosters financial inclusion and allows them to invest in real estate, establish personal equity, and contribute to community growth. Additionally, owning property can enhance credit profiles and provide long-term financial stability for borrowers. These loans open the door to homeownership for many who might otherwise find it challenging to secure a mortgage.

Build Credit History

Repaying ITIN loans can help non-US citizens build a strong credit history in the United States. Many non-US residents need help establishing credit profiles because they need an SSN. By making regular mortgage payments, borrowers show financial responsibility, which positively impacts their credit scores. An excellent credit report gives borrowers the ability to have financial opportunities in the future.

Broaden Financial Inclusivity

The ITIN mortgage program promotes financial inclusion by allowing a diverse range of individuals to obtain mortgage loans. These types of loans cater to non-US residents, those with different visa statuses, and even individuals with no permanent residency. By opening the mortgage market to these groups, ITIN loans help these individuals become part of the financial system and work towards reaching economic sustainability in their lives.

Access to Diverse Property Types

The ITIN loan allows borrowers to buy properties like single-family homes, condos, and investments. Thus, it is now easier for noncitizens to invest in diverse products and infrastructure and choose the one that suits their needs most. Whether seeking a primary residence or an investment property, ITIN loans provide the necessary financial support.

Competitive Interest Rates and Terms

Lenders offering ITIN mortgages often provide competitive interest rates and favorable terms. These loans can be as advantageous as traditional mortgages, ensuring non-US citizens receive fair financing options. Access to competitive rates helps make homeownership more affordable and attainable for a broader range of individuals.

Frequently Asked Questions

1. Can you obtain an FHA loan with an ITIN?

Generally, FHA loans require a Social Security Number and do not accept an ITIN, except for certain passive principals. For comprehensive guidelines on FHA loans, it’s advisable to consult the Department of Housing and Urban Development (HUD) website.

2. Is it possible to build credit using an ITIN?

Yes, you can build credit with an ITIN. Numerous financial institutions recognize ITINs for credit applications, including credit cards and loans.

3. Do ITIN loans allow the purchase of investment properties?

ITIN loans are primarily intended for buying primary residences. Some lenders permit the purchase of investment properties with an ITIN, but this is less common and should be verified with individual lenders.

4. What is the required down payment for an ITIN mortgage loan?

The required down payment for ITIN mortgage loans typically ranges from 10% to 25%, varying by lender and their specific criteria.

5. Are higher interest rates a feature of ITIN loans compared to standard mortgages?

Yes, ITIN loans usually carry higher interest rates than traditional mortgage loans, typically 0.5% to 1.5% higher, reflecting the increased risk assumed by lenders.

6. Do ITIN mortgages have prepayment penalties?

The presence of prepayment penalties on ITIN mortgages depends on the lender’s specific terms and conditions. It is crucial to review these details before signing any loan agreement.

7. Are ITIN and foreign national loans classified as non-QM loans?

Yes, ITIN and foreign national loans are considered Non-Qualified Mortgage (non-QM) loans. These loans cater to non-traditional borrowers and often feature less stringent requirements than traditional mortgages.

Key Takeaway

ITIN loans provide essential benefits for non-US citizens, opening mortgage opportunities that were previously unavailable. These loans enable individuals without a Social Security number to secure ITIN mortgages, facilitating homeownership and credit history building in the U.S.

When considering an ITIN property loan, it’s crucial to evaluate portfolio loan interest rates and terms. The ITIN mortgage program for non-US citizens offers various options tailored to unique financial situations. Understanding factors such as eligibility requirements and necessary documentation helps borrowers make informed decisions and optimize their mortgage experience.

Are you ready to take the next step toward homeownership? At Defy Mortgage, we will help you achieve your goals with ITIN loans pending loan qualification criteria being met. Our dedicated team guides you through the process, ensuring a smooth and successful application. Visit our website today to learn more and begin your journey.