Investors who have made decent headway in scaling their portfolio often hit a common roadblock: conventional underwriting is still income and DTI-driven. Even with a $150K-$400K annual income, your ability to keep adding financed properties can get constrained as monthly obligations pile up. Conventional loans also have a 10-property cap on how many properties you can be actively financing, which can force investors to look for alternatives sooner than expected. It’s a good idea to understand what a DSCR cash-out refinance is so you’re aware of all of your options.

At Defy Mortgage, DSCR loans are our specialty. With extensive experience in diverse real estate markets throughout the United States, we are familiar with the ins and outs of DSCR and non-QM financing. Whether you’re purchasing a short-term-rental, long-term-rental or cashing out the equity from your multifamily rentals, our DSCR cash-out refinance terms match your needs and your property’s capabilities.

In this guide, we’ll be covering everything you need to know about DSCR cash-out refinances:

TL;DR

- A DSCR cash-out refinance replaces your existing mortgage with a larger loan so you can pull out your rental property’s equity as cash.

- Loan amounts depend on your equity position, with most lenders allowing 70–75% LTV for DSCR cash-out refinances. Defy Mortgage’s DSCR cash-out LTVs go up to 80%

- Unlike traditional cash-out refinances, qualification is based on rental income through DSCR, not your personal income or DTI.

- Cash-out funds can be used for renovations, acquisitions, debt consolidation, emergencies, medical expenses, or large purchases.

- Ideal borrowers include investors scaling real estate portfolios, self-employed borrowers needing renovation capital, landlords with multiple rentals, and business owners seeking low-cost liquidity.

Should You Get a DSCR Cash-Out Refinance? (30-Second Assessment)

DSCR Cash-Out is RIGHT for you if:

- You own rental investment property with 20%+ equity

- Your rental income is strong but personal income documentation is complex

- You’re self-employed, 1099, or have multiple LLCs

- You need capital for: acquisitions, renovations, debt consolidation, or business expenses

- You’ve hit the 10-property conventional loan limit

- You’re a real estate investor in need of cash with profitable properties

- You need to close in 30-45 days

- You need up to 80% LTV cash-out

DSCR Cash-Out is WRONG for you if:

- This is your primary residence (not allowed for DSCR)

- Your property doesn’t generate rental income

- You have perfect W-2 income and can qualify conventionally at 1-2% lower rates

- You need more than 80% LTV (most lenders cap at 75%, Defy at 80%)

- Your property’s DSCR is below 0.55

What Is a DSCR Cash-Out Refinance and How Does It Work?

A DSCR cash-out refinance lets you convert the equity stored in your investment into cash on hand, usable however you see fit. Unlike a DSCR HELOAN or HELOC, DSCR cash-out refinances replace your existing mortgage with a larger DSCR loan, so you only have to make a single monthly payment.

The difference between the property’s appraised value and the amount you still owe on your previous mortgage is paid out in a lump sum of cash. This is especially advantageous in places where homes appreciate in value quickly, as your total equity will have a higher dollar value, directly translating to a higher lump sum.

Unlike traditional cash-out refinances, which use your personal income and financial profile to qualify you, DSCR loans focus qualification on the property’s rental income instead.

How much money you can borrow depends on the equity you have. Usually, LTV for DSCR cash-out is somewhere between 70–75% depending on the lender.

What Are Typical DSCR Requirements for Cash-out Refinance on Rental Properties?

For a cash-out refinance on rental properties, the typical DSCR requirements can vary depending on the loan program and the borrower’s credit score. It’s also worth noting that the DSCR requirements can vary depending on the property type, with some programs having stricter requirements for certain types of properties, such as non-warrantable condos or rural properties.

We recommend reviewing the specific loan program guidelines and consulting with a loan expert to determine the exact DSCR requirements for your specific situation. At Defy Mortgage, here are the typical DSCR requirements for cash-out refinance on rental properties:

- Max LTV: Up to 80% LTV (only for certain loan amounts and credit scores) (and up to 80% for rate-and-term DSCR refinances)

- Minimum DSCR: DSCR >1.000

- This means that the rental income from the property must be at least 1% more than the monthly mortgage payment, including principal, interest, taxes, and insurance.

- Maximum Loan Amounts: Unlimited cash-in-hand options and up to $2,000,000

- The maximum LTV for a cash-out refinance is 65% for the same credit score and DSCR requirements.

- Min FICO: As low as 640

- Reserves: Minimum of 3-month reserves

- No Ratio Options: Yes

- Cash-in-Hand Limits: Unlimited pending LTV

- Credit: No tradeline options

- LLC Ownership: Purchasing under an LLC is allowed

- Seasoning: Options for no seasoning

- Property Types: Single Family (SFR, PUD, Town Home, Row Home, Site Built Condo, Modular Home), Condominium (Warrantable & Non-Warrantable), Co-ops, Condotels, 2-4 Units depending on loan program and other variables.

How Is DSCR Calculated for a DSCR Cash-Out Refinance?

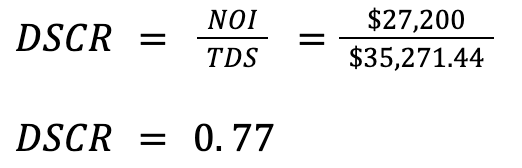

DSCR calculation for cash-out refinances works the same way as DSCR calculation for purchase loans. DSCR, or debt-service coverage ratio, measures a property’s ability to cover its debt obligations with its rental income.

Calculating DSCR is simple. Simply divide the property’s net operating income (NOI) with its total debt service (TDS).

NOI is the property’s income after deducting operating expenses. For many rentals, this only involves maintenance. Per the One Percent Rule of property maintenance, setting aside one percent of the property value per year for maintenance is usually enough. If your property is a single-family home in Florida worth $400,000, and you make $2,600 per month in rent, then your NOI will be:

NOI = Yearly rent – yearly maintenance

NOI = ($2,600 x 12) -($400,000 x 0.01)

NOI = $31,200 -$4,000

NOI = $27,200

Total debt service, on the other hand, is the sum of all annual dues, including mortgage payments, insurance, HOA fees, etc. Assuming an average mortgage rate of 6.5%, annual insurance fees of $5,000, $3,000 in property taxes, and yearly HOA fees amounting to $3,000, your TDS will be:

TDS = Mortgage payments (principal + interest) + insurance + taxes + HOA fees

TDS = $24,271.44 + $5,000 + $3,000 + $3,000

TDS = $35,271.44

That gives us the following DSCR:

A DSCR greater than 1.0 indicates the property generates enough income to cover its mortgage payments. The DSCR in our example is 0.77, meaning that it only makes 77% of what it needs to cover debt payments and other dues. Many lenders prefer DSCRs of at least 1.0. At Defy Mortgage, however, our DSCR loans can go as low as 0.55, with no-ratio options opening up for borrowers with 740+ FICO (max loan amount $1M).

Pros & Cons of a DSCR Loan Cash-Out Refinance

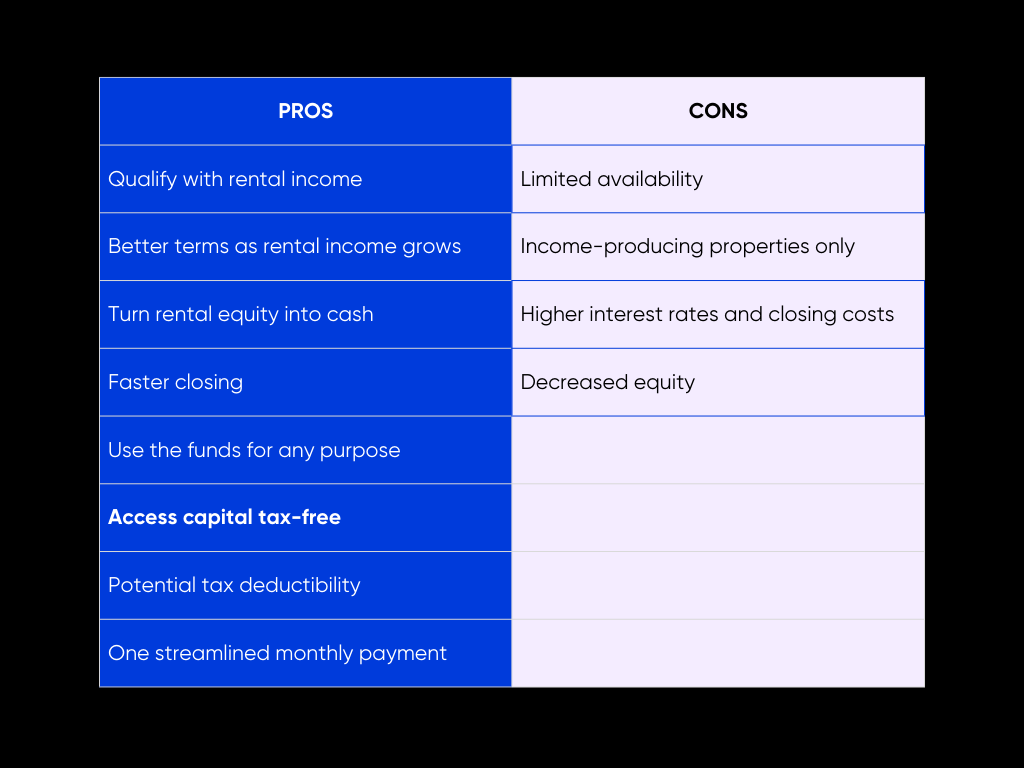

DSCR cash-out refinances have several advantages, primarily due to their DSCR qualification requirements.

DSCR Loan Cash-Out Refinance Pros

- Qualify with rental income: Borrowers are able to prove income using market rent analysis, leases, and rent rolls as well as tax returns, pay stubs, and W-2 forms.

- Get better terms with increasing rental income: The better your property can perform financially, the more likely you are to get ideal rates, loan amounts, and other terms. At Defy Mortgage, these start to unlock at 1.000 DSCR and up.

- Access your rental property’s equity as cash: Use your rental property’s equity instead of your primary or secondary residence. This keeps your personal home untouched, and if your rental income is sufficient to cover debt payments, it also protects your household budget from major housing costs.

- Faster closing: Qualifying with rental income means that underwriters have to look through less documentation. This speeds up the process, so you get your cash quicker than with non-DSCR home equity financing.

- Use the funds for any purpose: Fund renovations and more acquisitions, or consolidate debt and set aside the remainder as savings. Your cash-out refinance is entirely yours to use as you see fit.

- Access capital without a taxable event: Whereas selling the property to gain capital exposes you to capital gains tax, a cash-out refinance is not considered income, and is generally not taxable. You get to enjoy the entire amount tax-free.

- Potential tax deductibility: Depending on how you use the funds, you can potentially write them off your taxes. Business expenses like capital improvements are usually tax-deductible, but be sure to consult a tax professional to gain a more accurate picture.

- One streamlined monthly payment: Since it replaces your first mortgage, you only have to pay one mortgage payment per month.

DSCR Loan Cash-Out Refinance Cons

- Only for income-generating properties: Since it’s a type of DSCR loan, you can only take out a DSCR cash-out refinance on a property that isn’t owner-occupied and generates income. Primary homes, second homes, and investment properties that you are not renting out are ineligible.

- Higher interest rates and closing costs: Compared to primary home cash-out refinances, DSCR cash-out refinances can have a higher borrowing cost due to the increased risk that investment property lenders take on.

- Decreased equity: A lower equity position can limit your options in the future. If the market goes down, you’ll have a smaller buffer, which can make it harder to sell at a profit or refinance.

Conventional Cash-Out Refinance vs. DSCR Cash-Out Refinance

| Conventional Cash-Out | DSCR Cash-Out | |

| Qualification | Personal income, credit score, and DTI Better terms unlock with higher income and better credit profile | Property’s rental income and DSCR Better terms unlock with higher property income as well as credit score (personal DTI not a factor if borrowing under an LLC) |

| Flexibility | Less flexible | More flexible |

| LLC ownership | Not permitted | Permitted |

| Rate overview | Lower than DSCR cash-out on average, especially if secured on a primary home | Higher than conventional on average, but can be decreased with improved DSCR and credit score, as well as lower LTV |

| Current rates | 5.5% to 6.1% Please note that the conventional cash-out refinance rate above is related to a cash-out refinance in FL, $1M purchase price, $500k cash-in-hand, 760+ FICO, 30-year-fixed according to Bankrate. | 5.999% Please note that the DSCR cash-out refinance rate above is related to a DSCR cash-out refinance in FL, $1M purchase price, 70% LTV, $500k cash-in-hand, 800 FICO, 12.6 DSCR and 5-year-pre-pay 30-year-fixed. Rate as of January 1st 2026. |

| Maximum investment properties | Yes, you are capped at a certain amount such as 10 depending on the lender. | No maximum for the amount of investment properties that can be funded. Fund what you need! |

| Eligible properties | Primary homes, second homes, vacation homes, and investment properties | Income-generating properties only so investment properties. Here are the allowable property types for Defy Mortgage’s DSCR cash-out refinances: Single-family rentals (includes PUDs, town homes, row homes, site-built condos, modular homes), Multi-family rentals (2-4 units), Short-term rentals (Vacation homes, Airbnb, Vrbo), Condominiums (Warrantable & Non-Warrantable), Co-ops, Condotels |

| Documentation required | W-2s, tax returns, and pay stubs | DSCR, Market rent analysis, leases, and rent roll as well as standard income documentation |

| Maximum loan-to-value (LTV) | Usually up to 75% LTV | Up to 80% LTV |

| Ideal borrowers | Property owners with significant equity and reliable income | Property investors with consistently high rental income but limited personal income, such as landlords, entrepreneurs, and self-employed real estate investors. |

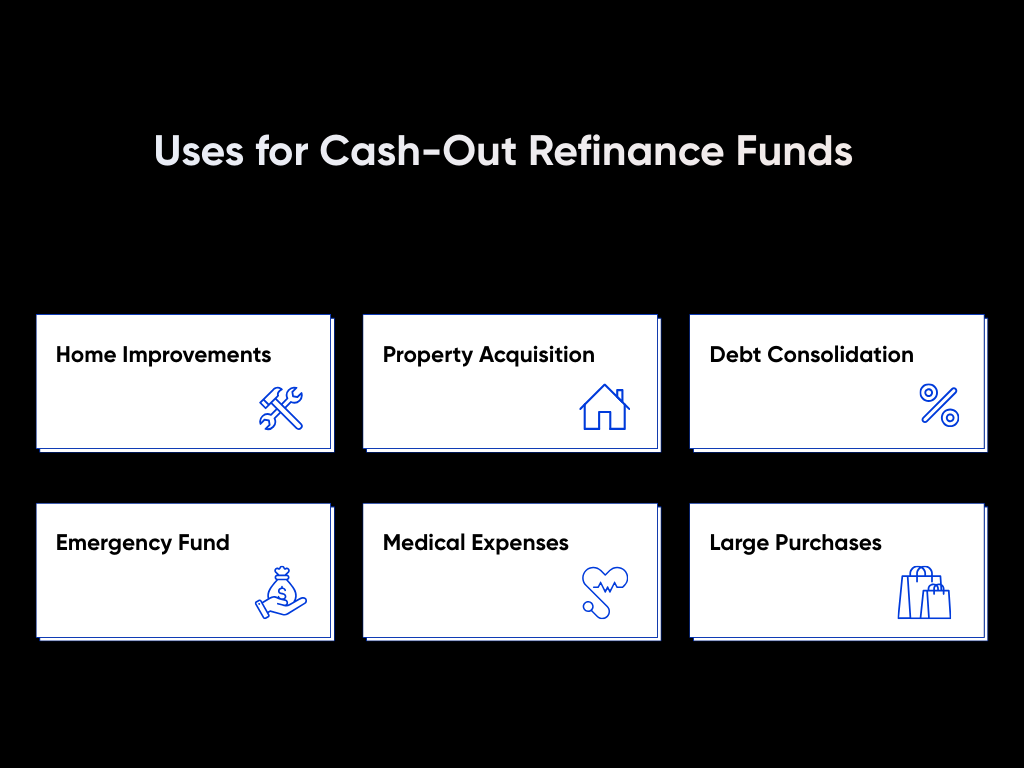

What Can Cash-Out Refinance Funds Be Used For?

Since cash-out refinance funds can be used for virtually any purpose, they

- Home improvements: Capital improvements for your investment properties can increase rental income potential and even be tax-deductible. You can also use the funds to renovate your own primary home if you’d like, essentially transferring equity from your

- Acquire more properties: Depending on how much you can get from a DSCR cash-out refinance (and how many properties you can refinance), you can have enough to make a down payment on another acquisition, adding another income-generating property to your overall revenue stream.

- Debt consolidation: Personal uses, like consolidating credit card debt, are also valid. A cash-out refinance lets you leverage your rental properties’ equity to resolve personal debt issues and get a much lower interest rate (credit card rates average at around 24%, while DSCR cash-out refinances average at 7%-9%.

- Emergency fund: You can also choose to hold the lump sum you get in reserve, for use in personal or business emergencies, or to act on business opportunities as soon as they arise.

- Medical expenses: One great example of an emergency use for cash-out funds is preparing for a future or current medical expense. This can be invaluable if your health insurance policy requires a large co-pay for your specific condition.

- Large purchases: You can also use the funds to purchase big-ticket items like a car or a piece of equipment. Like debt consolidation, this is also an easy way to get better rates for financing your purchase.

Top States for DSCR Cash-Out Refinances

With 6.5 million self-employed workers in the US, the conventional 10-property limit pushing investors to alternative lending options like DSCR loans, and rising rental income making DSCR qualification easier, it’s no wonder that in 2024, we saw non-QM lending volume up 47% year-over-year. Similar patterns for 2025 real estate investors as well.

As of December of 2025, we’re seeing cash-out refinancing as a growing trend. This is due to the increased demand for cash-out refinancing as many investors are using DSCR loans to access equity for new purchases. Investors who bought 2020-2023 now have 20-50% equity gains and are using DSCR cash-outs to scale portfolios without personal income verification hurdles. In fact, investor purchases accounted for 33% of all single-family homes sold in Q2 2025, and these early pandemic-era purchases have appreciated significantly.

When we look at geographics, here is a list of the top states where we see growing traction for DSCR cash-out refinances in 2025 and why.

1. Florida

- Why it’s dominating:

- Single-family rental investors are dominant in Florida, with high investor activity and strong rental yields

- High appreciation + strong STR market + no state income tax

- Short-term rental investors show high DSCR loan activity in Florida, particularly in markets like Tampa, Orlando, and Fort Myers

- No state income tax attracts both investors and tenants, improving net operating income for DSCR calculations

- By the numbers: Jacksonville offers rental yields estimated at 6.2%, while Port St. Lucie shows population growth at 2.5% per year

2. Texas

- Why it’s dominating:

- Texas shows booming rental market and landlord-friendly regulations, with single-family rental investors dominant in Texas

- No state income tax + business-friendly environment = higher cash flow for DSCR qualification

- Dallas is experiencing explosive population growth, with the metroplex projected to add over one million residents by 2030

- Market correction = opportunity: While supply has continued to grow since the end of the pandemic, demand has not kept pace, creating substantial rental property oversupply in some markets

- By the numbers: The Dallas-Fort Worth area had a 6.5% job growth rate in February 2025, which was higher than the national average of 1.7%

3. North Carolina

- Why it’s dominating:

- North Carolina shows strong DSCR loan adoption with single-family rental investors dominant, and high DSCR approval rates due to rapid population growth

- Charlotte and Raleigh emerging as major investor hubs with strong job markets and migration from expensive Northeast markets

- Charlotte and Raleigh are rising investor hubs with strong cash flow and DSCR loan availability

- Lower property costs than coastal markets but with strong rental demand from corporate relocations (particularly in Charlotte’s banking sector and Raleigh’s Research Triangle tech hub)

- By the numbers: Properties purchased 3-5 years ago have appreciated 20-30% by 2025, allowing investors to extract equity for further portfolio expansion in secondary NC markets.

4. Tennessee

- Why it’s dominating:

- Nashville’s explosive growth driven by corporate relocations, music/entertainment industry, and no state income tax

- Nashville provides cultural appeal that presents unique opportunities for real estate investors

- Tourism-driven markets: Gatlinburg, Pigeon Forge, and Smoky Mountains creating strong STR opportunities

- Landlord-friendly environment with straightforward eviction processes and minimal rent control

- By the numbers: Long-term rental owners in Nashville can cash out substantial equity (properties up 40-50% since 2020) to acquire STR properties in East Tennessee’s tourism corridors.

DSCR Cash-Out Refinance Lenders and Loan Options

Not all lenders offer DSCR cash-out options, so you must choose one specializing in DSCR financing. Specialized lenders help streamline the process and offer better terms.

Defy Mortgage offers flexible, customizable DSCR loan solutions and supports investors through the process.

Current DSCR Cash-out Refinance Mortgage Rates

As of December 27, 2025, the average rates for a conventional cash-out refinance in the US range from 5.5% to 6.1%*

As of December 27, 2025, the average rates for a DSCR cash-out refinance in the US is down to 5.999%.**

Since DSCR loan terms often improve with higher DSCR, refinancing a top-performing property can often yield much better rates than a property with 1.000 DSCR or under, especially if supported by a healthy credit score, low LTV utilization, and ample cash reserves.

*Please note that the conventional cash-out refinance rate above is related to a cash-out refinance in FL, $1M purchase price, $500k cash-in-hand, 760+ FICO, 30-year-fixed according to Bankrate.

**Please note that the DSCR cash-out refinance rate above is related to a DSCR cash-out refinance in FL, $1M purchase price, 70% LTV, $500k cash-in-hand, 800 FICO, 12.6 DSCR and 5-year-pre-pay 30-year-fixed.

How to Qualify for a DSCR Cash-out Refinance Mortgage

Qualifying for a DSCR cash-out refinance involves much the same requirements as DSCR purchase loans. Here’s a brief overview of the steps you need to take:

- Assess your financials: Although DSCR loans focus on property income, you also have to meet minimum credit score, down payment, and cash reserve requirements. At Defy Mortgage, we look for a minimum credit score of 640, minimum down payment of 20%, and at least 3 months’ cash reserve.

- Have a qualifying investment property: The property you aim to refinance must be non-owner-occupied and have sufficient income to meet your lender’s minimum DSCR requirement. At Defy Mortgage, our minimum is 0.55, with no-ratio options opening up for borrowers with 740+ FICO ($1M max loan amount). Your rental will also have to be one of the property types your lender allows.

- Provide rental income documentation: Be prepared to submit current lease agreements or an appraiser-supported market rent analysis to validate the property’s income. This is critical for DSCR calculation.

- Complete appraisal and underwriting: After you’ve submitted your documentation, the lender will order an appraisal to confirm the property’s value and rental viability. Once appraisal is complete, the lender will send you their final offer. At Defy Mortgage, standard closing times can take up to 30-45 days, but we aim to close as soon as possible, sometimes even as quickly as 2 weeks.

Top Lenders That Offer DSCR Cash-out Refinances

Not all lenders offer DSCR loans, and not all that do offer them actually specialize in them. Here are some of the top lenders specializing in DSCR, in no particular order:

- Defy Mortgage: We are a non-QM, investor-focused lender, enabling us to map terms to your property’s income potential with meticulous accuracy. Enjoy DSCR cash-out LTVs up to 80%, unlimited cash-on-hand pending LTV.

- Griffin Funding: Lender specializing in serving veterans and self-employed borrowers. Up to 75% LTV.

- Angel Oak Mortgage Solutions: Wholesale lender, best for borrowers seeking wholesale pricing. Max cash-out LTV not stated.

- Truss Financial: Non-QM lender focusing on investors, self-employed borrowers, and veterans. Exact max LTV for DSCR cash-out refinances not stated.

- Lima One Capital: Primarily serves real estate borrowers. Max LTV: 75%.

DSCR Cash-Out Refinance Costs

Costs vary but typically include appraisal fees, title insurance, lender fees, and origination fees/points.

Average closing costs: 2%–6% of the loan amount.

Be sure to review the lender’s loan estimate carefully. “No closing cost” options usually roll fees into the rate or loan amount.

DSCR Cash-Out Refinance Timeline

Typical timeline: 30 to 45 days.

You can speed up the process by:

- Providing documentation quickly

- Addressing underwriting conditions

- Ensuring a clear title

At Defy Mortgage, we aim to close DSCR refinances as quickly as possible with no surprises or stress.

Who Should Use a DSCR Cash-Out Refinance?

Because it’s a type of DSCR loan, DSCR cash-out refinances work best for property owners with significant rental income. Higher DSCRs unlock the best loan terms, including a higher maximum loan amount. Rental income qualification presents the best advantages for the following borrower types:

- Real estate investors interested in scaling: With loan amounts increasing with property income, DSCR cash-out refinances are excellent tools to fund down payments for further acquisitions. Paired with the fact that DSCR loans are only concerned with the DTI of the property itself (if borrowing under an LLC) and the lack of a hard property cap, you can essentially use cash-out refinances to fuel indefinite expansion.

- Self-employed investors looking to renovate or repair properties: If you’re self-employed, it can be difficult to get a conventional loan sufficient to cover renovations or repairs. But with a cash-out refinance, you can simply use the equity you have in one property to fund repairs in another, or even use a property’s equity to fund its own renovations, all without dipping into your own pocket.

- Landlords with large rental portfolios: The more properties you own, the more cash you can get. With a large equity pool, you can get cash-outs even up to the millions. This is especially true for lenders like Defy Mortgage. We offer unlimited cash-in-hand pending LTV.

- Business owners needing capital: Since you can use cash-out refinance funds whichever way you choose, they can be a fantastic, low-cost way to create capital. With a DSCR cash-out refinance, your investments can be more than passive income, and instead take an active role in fueling your other business ventures.

Get Your DSCR Cash Out Refinance Loan with Defy Mortgage

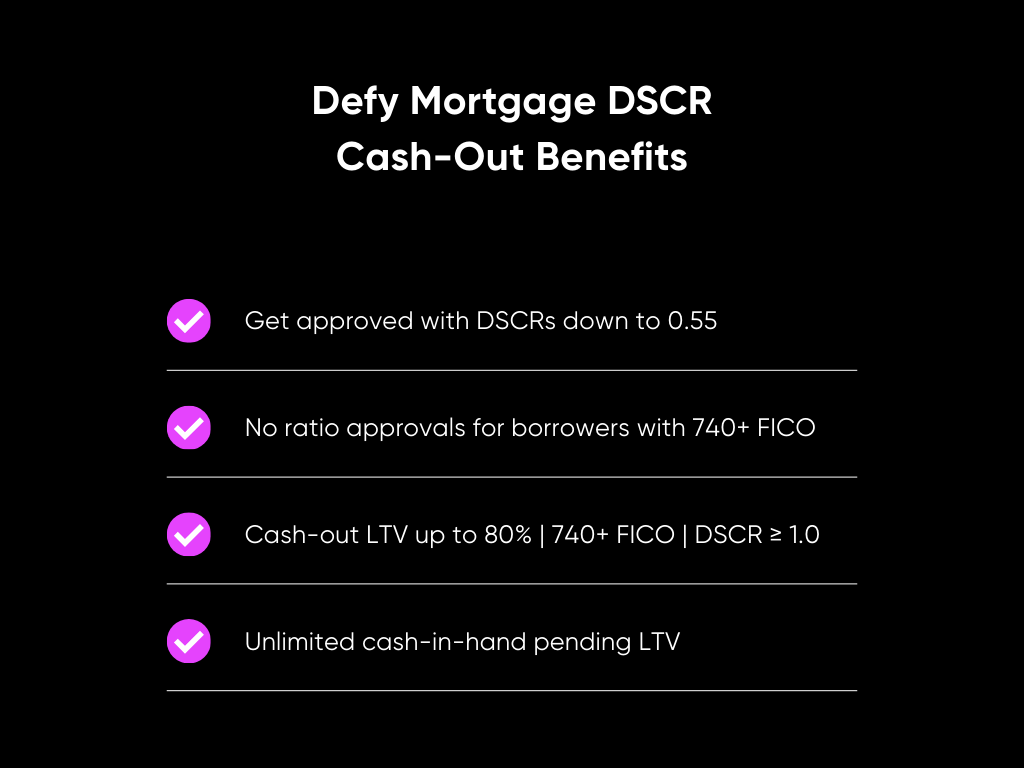

Real estate investors choose Defy Mortgage because we’re built for scale. Here’s what you can get with Defy Mortgage’s DSCR cash-out refinances:

- Get approved with DSCRs down to 0.55

- No ratio approvals for borrowers with 740+ FICO

- Cash-out LTVs up to 80% for borrowers with 740+ FICO and DSCR >= 1.000

- Unlimited cash-in-hand pending LTV

- Rate-and-term refinance options up to 80% LTV DSCR

- Options for foreign national real estate investors

Ready to put your equity to good use? Get your personalized DSCR cash-out refi quote from Defy Mortgage today.

Key Takeaways

A DSCR cash-out refinance can be one of your most strategic tools as an investor. Unlocking trapped equity can accelerate portfolio growth and improve your long-term returns, all using your property’s income performance. With a DSCR cash-out refinance, you have absolute freedom to use the capital for acquisitions, renovations, debt consolidation, redeployment into higher-yield assets, or even personal use.

If you’re ready to tap into your rental property’s equity with a DSCR cash-out refinance, Defy Mortgage is here to help. Schedule an appointment on our site or call (615) 622-1032, and a dedicated Mortgage Consultant will walk you through maximizing your LTV, structuring your cash-out efficiently, and securing terms tailored to your investment strategy.

And if you’re a mortgage broker, Defy TPO can give you access to Defy Mortgage’s industry-leading LTVs, lightning-fast underwriting, flexible ratio and no-ratio options, and pricing designed to help you place deals that traditional lenders might turn away. With Defy as your partner, you can close more DSCR cash-out refinances, serve more investor clients, and expand your pipeline without adding complexity to your workflow. Curious to see how it all works? Send us your pricing scenarios, and we’ll show you.

DSCR Cash-Out Refinance FAQs

What are the tax implications of a DSCR cash-out refinance?

A DSCR cash-out refinance is not considered taxable income for investors. Because you are simply replacing one loan with another and not selling the property, the cash you receive is treated as loan proceeds and not a realized gain or income for tax purposes. Plus, you can also write off what you use those funds on if they’re eligible capital improvements. Remember to consult a tax professional for a more accurate tax estimate.

What documents do I need to prepare for a DSCR cash-out refinance application?

DSCR cash-out refinances typically require the same documents you would submit for a DSCR purchase loan. These are:

- Leases

- Rent roll

- Market rent analysis

- Property documentation

- (Optional) W-2s, pay stubs, and tax returns if you would like to use your personal income as well

What credit score is needed for DSCR cash-out refinancing?

The credit score you need depends mainly on the LTV and rate you’re targeting. If you’re fine with a lower LTV and standard rates, you’ll only need to meet the minimum set by your lender. At Defy Mortgage, our minimum is 640, but the best rates, LTVs, and amounts start to unlock at 740+.

Can I use a DSCR cash-out refinance to consolidate debt on my investment property?

Absolutely. Debt consolidation is one of the most common uses of cash-out refinances among investors. This is especially useful if you’ve accumulated high-interest debt on your investment property. However, remember to account for closing costs and prepayment fees (if applicable) when doing a cost-benefit assessment of consolidating debt with a DSCR cash-out refinance.

Can DSCR cash-out refinance funds be used for personal expenses?

This tends to depend on the lender. Some lenders place restrictions on where the funds can only be used for business purposes. At Defy Mortgage, however, we place no such restrictions. The funds can be used how you see fit, whether it’s for new investments, paying off debt, personal expenses like a family vacation, etc.

Should I work with a mortgage broker or a direct lender for a DSCR refinance?

This depends on your investment goals and resources available to you. Consider the following:

- Mortgage brokers: Can shop your file across multiple lenders and often find better pricing, more flexible programs, and loans that would be harder to qualify for directly. This can be especially useful for specialized products like DSCR and non-QM loans.

- Direct lenders: Fund loans themselves but may have narrower program options and stricter qualification guidelines. If a lender’s criteria don’t fit your situation, you may not get funded.

In other words, a broker often provides broader access and negotiation leverage. Direct lenders may be more limited in options, but you don’t have to work with a middleman and pay their intermediary fees.

What is the maximum LTV for a cash-out refinance DSCR loan?

Most lenders have a max LTV of 75%, although some, like Defy Mortgage, can go up to 80%.

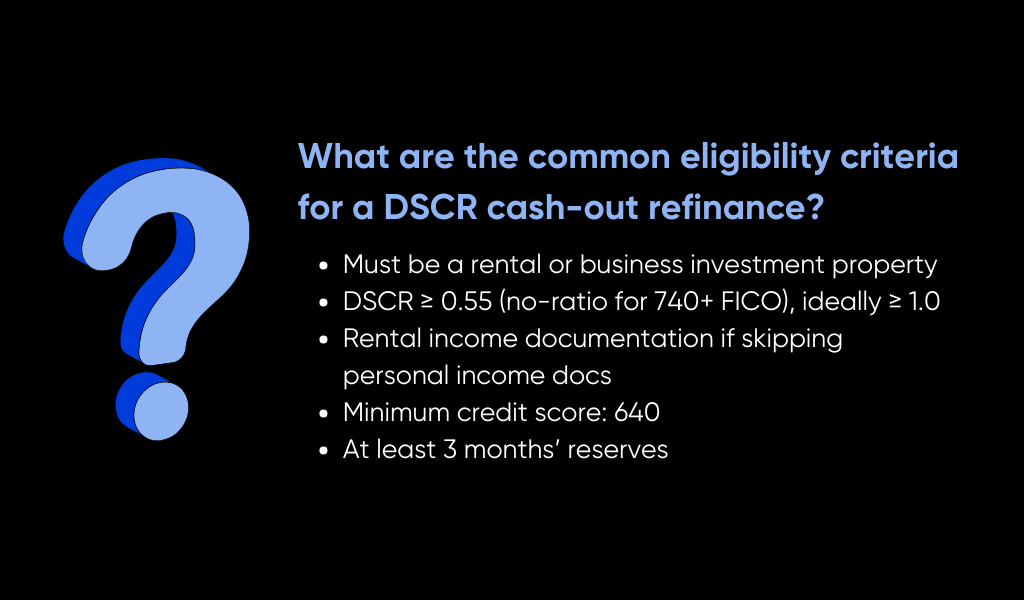

What are the common eligibility criteria for a DSCR cash-out refinance?

Common eligibility criteria for DSCR cash-out refinance loans at Defy Mortgage include:

- The property must be a rental or business-purpose investment.

- Debt service coverage ratio (DSCR) above 0.55 (no-ratio available for borrowers with 740+ FICO) but ideally at least 1.000.

- Documentation of rental income like rent rolls and lease agreements, if opting against personal income docs like tax returns and W-2s.

- Minimum credit score of 640.

- At least 3 months’ reserve.

Can you refinance a DSCR loan?

Absolutely. A DSCR cash-out refinance is a type of DSCR loan refinance. You can also take out a DSCR rate-and-term refinance, which can adjust your rate and other terms. This is particularly useful if market conditions change, such as lower mortgage rates or higher rental income. You can also refinance into a conventional loan for lower rates if your credit score and other financials qualify.