Understanding FHA loan limits is crucial to setting realistic expectations and planning your home financing strategy. The same applies to taking out an FHA loan Oklahoma, where this type of financing has a key edge over other home loan options because of their pro-homebuyer loan terms.

At Defy Mortgage, we deliver 75+ non-traditional lending options tailored to each borrower’s unique needs. We have simplified the home-buying process for both novice and seasoned homebuyers with diverse needs, with options such as FHA loans, vacation home mortgages, and more. Although we currently don’t offer FHA loans in Oklahoma, we have catered to the diverse needs of various homebuyers in Alabama, California, Colorado, Florida, Georgia, Oregon, Tennessee, and Texas, our extensive experience in supporting homebuyers through the loan process has made us keenly aware of the nuances of effectively using FHA loans to secure housing.

Let’s get started.

Understanding FHA Loans in Oklahoma

FHA loans are government-backed mortgages designed to help Americans achieve homeownership. FHA loan Oklahoma is a good option to secure housing in the state, which ranked the 6th most affordable state to own a home in 2024. FHA loans have low down payment options and lighter eligibility standards.

Please note that Defy Mortgage does not offer FHA loans in Oklahoma at this time.

The Basics of FHA Loans

FHA loans are mortgage lending options provided by the Federal Housing Administration to homebuyers to give them more favorable terms when purchasing a new home. These include down payment amounts as low as 3.5%, competitive interest rates, and flexible credit score requirements, often accepting scores as low as 580.

Why They Are Popular Among Oklahoma Homebuyers

Oklahoma has historically been an inexpensive homebuying market. From urban areas like Oklahoma City to rural communities, home prices in the state have been below the national average. In 2024, the state ranked as the 45th most expensive state in the U.S.

The financing benefits of FHA loans, such as low down payment and competitive interest rates, further enhance the benefits of buying a home in Oklahoma’s affordable real estate market. Even with a subpar credit record, Oklahoma homebuyers can still secure housing at comfortable loan terms.

Comparing FHA Loans to Other Loan Types

FHA loans are appealing due to their lower down payment requirements and more lenient credit criteria, making them accessible to a wider range of borrowers. However, other loan types have certain advantages that can make them more effective in specific situations.

Conventional Loans

The primary advantage of conventional loans is that they don’t have any of the requirements that FHA loans have. If you have a strong financial profile and put down at least 20% of the home’s value, many conventional lenders will likely offer favorable terms like lower interest rates. However, they can be more challenging to qualify for because of stricter credit score and debt-to-income (DTI) ratio requirements.

VA Loans

VA loans are reserved for veterans and active-duty service members and offer significant benefits like no down payment and no mortgage insurance. These loans are particularly attractive because they don’t require private mortgage insurance (PMI) and often come with competitive interest rates. However, they do include a funding fee, which varies depending on the loan amount, type of service, and whether the borrower has used their VA loan benefit before.

Conventional loans are often best for those with strong credit and the ability to make a large down payment, while VA loans offer unbeatable benefits for eligible veterans. However, FHA loans remain the best option for borrowers with lower credit scores or limited savings, providing a more accessible pathway to homeownership.

Eligibility Criteria for FHA Loans in Oklahoma

FHA loans in Oklahoma are highly popular because of their favorable loan terms. Since the property market in Oklahoma is already very affordable, FHA loans make it even easier to secure housing by making mortgages remarkably manageable for qualifying homebuyers. However, you must meet certain eligibility requirements to increase the likelihood of approval for an FHA loan in Oklahoma with favorable loan terms:

Minimum Credit Score

The minimum credit score to get the lowest possible down payment of 3.5% is typically 580. You can still get approved for an FHA loan if you have a credit score of 500 to 579, but this will come with a higher down payment of up to 10%. Still, this is better than the 20% down you need to make with the average conventional loan, barring a few exceptions that go as low as 3% with stricter eligibility criteria.

Some lenders may require a higher credit score depending on how you score with the other eligibility criteria. However, since Oklahoma’s real estate market is one of the most affordable in the United States, certain lenders may be more lenient regarding credit scores.

Debt-to-Income Ratio and Employment History

Generally, your debt-to-income ratio should be under 43%, although some lenders approve FHA loans for those with higher DTIs. Your DTI ratio is the percentage of your monthly income used to pay your debts. These debts include mortgage payments and property taxes.

Lenders also assess a borrower’s employment history to ensure their ability to consistently meet mortgage payments. Typically, a steady income over the preceding two years is necessary to secure approval when submitting the application.

Property Eligibility

The FHA also requires borrowers to have the property they intend to purchase inspected by an FHA-approved appraiser. This inspection is akin to a buyer’s home inspection and ensures that the property meets specific safety standards and structural integrity requirements. These criteria include the absence of cracks, leaks, and other flaws, as well as a thorough assessment of the property’s electrical wiring, heating and cooling systems, and potential health hazards like pest infestations.

Applying for an FHA loan also requires submitting a valid ID, title insurance policy, homeowner’s insurance policy, and closing funds from FHA-approved sources. If you have issues with any of these requirements, you may want to consider taking out a non-QM loan instead of an FHA loan. Non-QM loans are typically not subject to stringent compliance regulations, unlike FHA loans which are Qualified Mortgages (QMs).

Detailed Overview of Oklahoma FHA Loan Limits

FHA loan limits in most U.S. states vary according to the median home purchase prices in each county. These per-county limits are based on a “floor” and “ceiling” set according to the national conforming loan limit, which is the maximum amount a borrower can finance through a conventional mortgage backed by Fannie Mae or Freddie Mac. Here is how this system came into play in the state of Oklahoma:

How Loan Limits Are Determined

The Department of Housing and Urban Development (HUD), the FHA’s governing body, sets these FHA loan limits yearly. This ensures that homebuyers can afford homes of reasonable quality in the county of their choosing, given current market conditions.

FHA loan limits are calculated annually by the FHA using two key factors: the national conforming loan limits set by the Federal Housing and Finance Agency (FHFA) and the median home prices in each area. The HUD sets the FHA loan limit “floor” at 65% of the national conforming loan limit, while the “ceiling” is set at 150%. Additionally, the FHA adjusts the loan limit to 115% of the median home sale price in a given county, provided it falls within the national floor and ceiling.

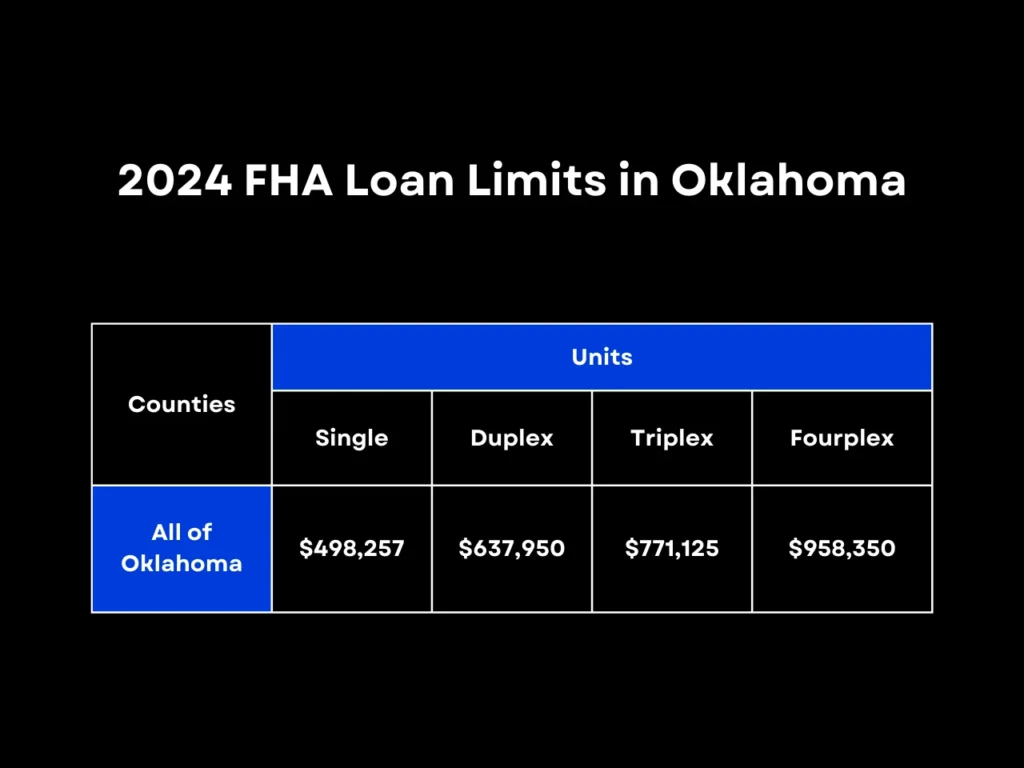

2024 FHA Loan Limits in Oklahoma

FHA loan limits were increased across the United States for 2024. While loan limits tend to vary to reflect higher real estate prices in certain counties, all of the state of Oklahoma uses the FHA-prescribed “floor” limits for low-cost areas:

How These Changes Affect Oklahoma Home Buying in 2024

Unlike in many other states, the limits for FHA loans in Oklahoma are the same in all of the state’s counties for 2024. This is likely due to Oklahoma’s long-standing history of affordable housing.

Still, the FHA’s “floor” limits increased from the previous year’s figures to reflect the increase in housing prices nationwide. This could potentially make it more affordable to purchase homes in Oklahoma counties that experienced little to no price increases.

FHA Loan Oklahoma FAQs

Can I Buy a Home in Oklahoma with a Low Down Payment?

Yes, FHA loans in Oklahoma can require as little as 3.5% down if you have a credit score of 580 or higher, making them accessible to many buyers. Please note that Defy Mortgage does not offer FHA loans in Oklahoma at this time

What If My Credit Score Is Below 580?

Borrowers with credit scores between 500-579 can still qualify for an FHA loan, but you must put 10% down instead of 3.5%.

Are There Specific FHA Loan Limits for Different Counties in Oklahoma?

Yes, FHA loan limits vary by county based on local home prices. Limits are higher in more expensive counties to ensure that FHA borrowers can afford homes of reasonable quality in those areas.

How Do FHA Loan Interest Rates Compare to Conventional Loans?

Conventional loans are typically free of many of the requirements that come with FHA loans, such as property assessments and mortgage insurance premiums. However, FHA can have as low as 3.5% down compared to the average conventional loan’s 20%, competitive interest rates, and more lenient credit score requirements.

Some conventional loans allow down payments as low as 3%, but these come with much stricter financial requirements. FHA loans’ leniency with borrowers’ financial history is why they are one of the top options for securing a home.

Can You Refinance an FHA Loan?

Yes, you can refinance an FHA loan to reduce your monthly payment or achieve other financial goals. FHA refinance programs such as Streamline Refinance offer that option for borrowers.

Key Takeaway

FHA loan Oklahoma can provide numerous benefits, especially in its highly affordable real estate market. With lower down payment requirements and credit score criteria, FHA loans make it easier to secure the right housing in Oklahoma. These advantages make it more feasible to purchase higher quality housing at a fraction of the cost compared to other states.

While FHA loan limits are consistent across all 77 counties in Oklahoma, it’s still wise to compare Oklahoma’s standard FHA limit to that of other states if you are considering relocating. When applying for an FHA loan in Oklahoma, consider your credit score, down payment, and debt-to-income ratio to increase your chance of approval.

Interested in taking out an FHA loan in the states of Alabama, California, Colorado, Florida, Georgia, Oregon, Tennessee, or Texas? Don’t hesitate to call Defy Mortgage to explore your options with FHA or other home financing products, or fill out a quick form here to schedule an appointment with us today. Should we ever offer FHA loans in Oklahoma, we will let you know!