Why the Federal Reserve Made a Rate Cut and What the 0.50% Rate Cut Means for Homebuyers and Homeowners?

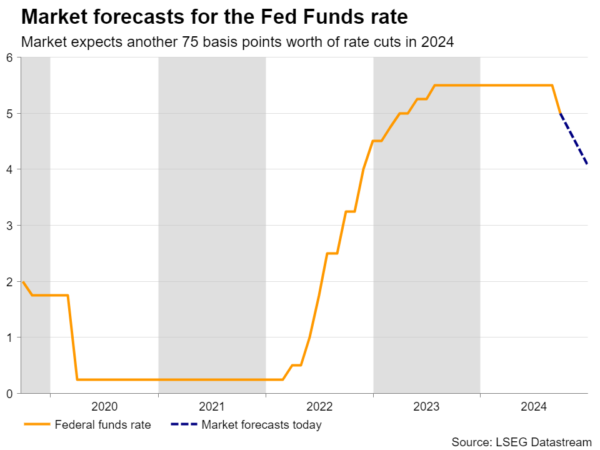

The time has come. Last week, the Federal Reserve cut interest rates by 0.50%, or 50 basis points, marking the first reduction since 2020 and twice as large as the quarter-point cut initially expected.

Wednesday’s rate cut concludes a challenging two-year period characterized by:

- Interest rates reaching a 20-year high of 5.25-5.50%

- 11 consecutive rate hikes totaling 525 basis points (see image below)

- The fastest pace of monetary tightening since the early 1980s

The Fed’s pivot suggests confidence in their progress against inflation, allowing a renewed focus on maintaining economic stability and fostering sustainable growth. So what does this mean exactly?

How does the rate cut affect affordability? What is the current state of the rates? How does it affect the housing market? Does the rate cut change lending strategy? What are the benefits for homebuyers and homeowners?

There is a lot of information out there currently surrounding the topic, yet not many sources address “WHY” and “WHAT” this means.

Rationale Behind the Federal Reserve’s Rate Cut

The Federal Reserve’s decision to implement a 50 basis-point rate cut reflects a strategic shift in monetary policy priorities. This move was primarily motivated by two key factors:

1. Labor Market Concerns:

- The Fed aims to prevent further job losses in a cooling economy

- Recent data shows the unemployment rate at 3.9%, up from its 50-year low of 3.4% in 2023

- Job openings have decreased to 8.8 million from a peak of 12 million in March 2022

2. Inflation Control:

- Core PCE inflation (Fed’s preferred measure) has declined to 2.8% from its peak of 5.4% in February 2022

- CPI inflation has dropped to 3.2% from its 40-year high of 9.1% in June 2022

The Fed Cuts Impact on Mortgage Rates

Myth: While many think the Fed rate cut is directly correlated to mortgage rates, that’s not entirely true. The Fed rate cut does not mean mortgage rate cuts.

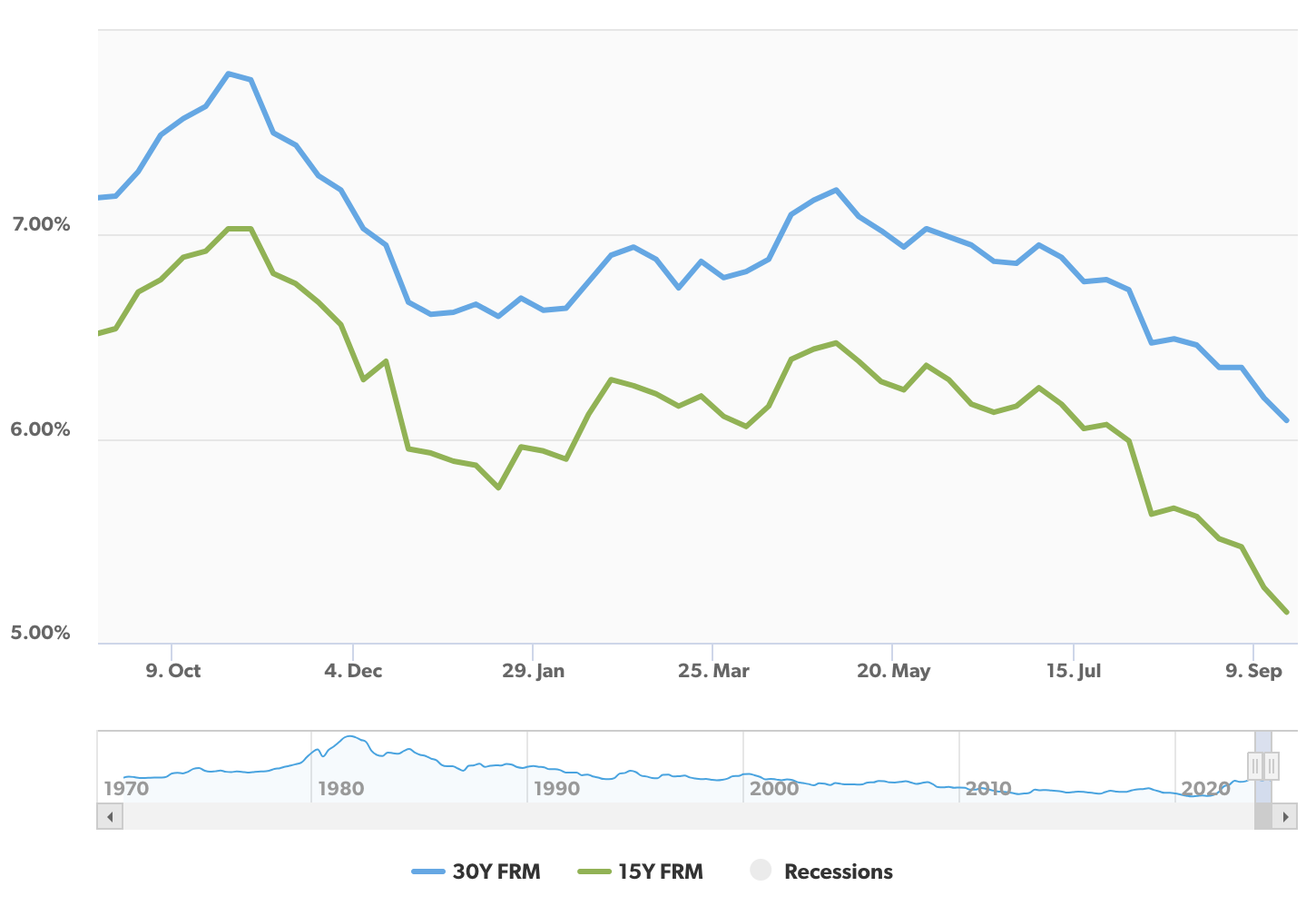

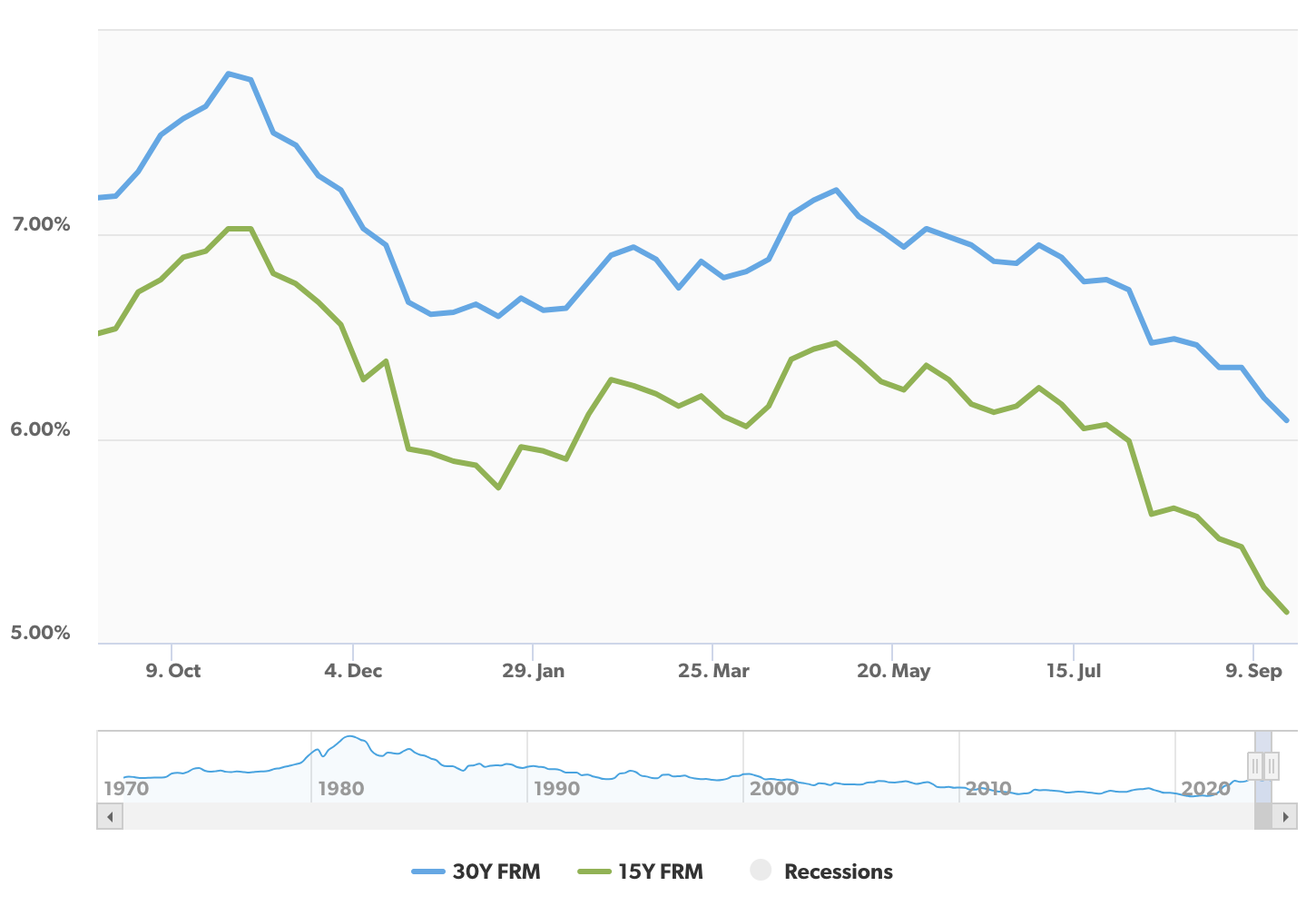

Truth: While the 50 bps rate cut didn’t immediately impact mortgage rates, we’ve seen a broader trend of declining rates over the past few months. Since November 2023, mortgage rates had dropped nearly 2%, with about half of that decline occurring just since mid-June. This translated to significant savings for real estate investors/homebuyers – on a $400,000 mortgage, we’re looking at roughly an 18% decrease in monthly payments.

This meant the following for homebuyers and real estate investors:

- Improved cash flow

- Enhanced ROI

- Increased purchasing power

- A more favorable environment for real estate investment

Yes, the Federal Reserve’s interest rate cuts can indirectly impact mortgage rates, however, they are not mutually exclusive. In fact, interest rates can increase from the Fed rate cut, and they did.

Mortgage Rates Are Slightly Up – How & Why?

Rates had declined and are actually up slightly since the official announcement. The 10-year note yield has risen from 3.60% to 3.80% in just 6 days. This is because leading up the the Feds decision, the market was fixated on what the Fed would do and trading was surrounding whether the Fed would cut 25 or 50 basis points. The truth is, it wouldn’t matter either way. It’s all about the selling the news.

This shows two important things:

- Mortgage rates don’t simply follow Fed rates in a straight line. The relationship is more complicated.

- Just because the Fed cuts rates doesn’t guarantee that mortgage rates will keep falling.

In fact, some mortgage rates had already dropped weeks before the Fed’s decision, suggesting the market had already “priced in” the expected rate cut.

“We expect rates will hover near existing rates through the end of the year or maybe slightly down with 30-yr mortgage rates between 6.25-6.50% at year-end” says Michael Rogan, President of Defy Mortgage.

The key is that the market often anticipates and prices in the Fed’s actions ahead of time. In the case of the recent 50 basis point cut, the market was already factoring in whether the Fed would cut by 25 or 50 basis points. So once the 50 basis point cut was announced, the “sell the news” dynamic kicked in, causing the 10-year Treasury yield to rise from 3.60% to 3.80% in just 6 days. When the 10-year Treasury yields rose in the wake of the Fed’s rate cuts, that was a clue for the near-term path for mortgage rates.

This demonstrates that the Fed’s rate decisions are not the sole driver of mortgage rates.

The Factors That Do Influence Mortgage Rates

Fixed-rate mortgages are closely tied to the 10-year Treasury yield, as this benchmark rate serves as a key indicator for the fixed-rate mortgage market. When the 10-year Treasury yield goes up or down, fixed-rate mortgage rates generally follow suit. However, it’s important to note that the fixed mortgage rate is not exactly the same as the 10-year Treasury yield – there is typically a gap between the two rates.

Beyond the 10-year Treasury yield, several other factors also influence fixed-rate mortgage rates including but not limited to:

- Inflation: When inflation picks up, fixed interest rates tend to rise as well. This is because higher inflation erodes the purchasing power of future dollar payments, causing lenders to demand higher yields to compensate.

- Supply and demand: Mortgage lenders adjust rates based on their current level of business. When lenders have an abundance of mortgage applications, they may raise rates to curb demand. Conversely, when business is slow, they may lower rates to attract more customers.

More Fed Cuts to Come in 2024 & 2025

The Federal Reserve has also forecasted an additional 0.5% rate cut before the end of the year, which would bring its benchmark policy rate down to 4.4%. Looking ahead to 2025, the Fed anticipates further reductions, with rates expected to dip to 3.4%.

Prediction markets are now pricing a 59% chance of at least 3 more rate cuts in 2024 – a base case of at least 75 basis points in additional potential rate cuts.

How the Fed Cut Affects Home Affordability for Homebuyers

The recent rate cut, combined with the overall downward trend in mortgage rates, significantly improves the affordability of investments for buyers. The key here is the word “combined”. Let’s take a closer look at the downward trend of mortgage rates:

- The average 30-year fixed mortgage rate dropped from 6.2% on September 12 to 6.09% on September 19, 2024. This is a 170 basis point decrease from the October 2023 high of 7.79%

Lower rates on investment properties and properties in general translate directly into reduced monthly payments, which enhances cash flow for investors and saved monthly income for those looking to purchase a primary. This improved cash flow can make real estate investments more attractive and financially viable for a broader range of buyers.

The announcement of the Fed cut has already fueled a significant rally in the stock market and is poised to trigger a surge in real estate activity. For homebuyers and property investors, this means a more positive outlook and more opportunity; even if buyers lock in a higher interest rate today, they can confidently expect an opportunity to refinance at a lower rate within the next 18 months or so month — marking a major shift after two years of uncertainty.

The Fed’s Rate Cut Correlation to Home Equity

The recent rate cut by the Federal Reserve may increase the appeal of home equity borrowing, but the relationship is not directly proportional. Home equity borrowing rates typically follow the broader trend of the Fed’s benchmark rate, rather than moving in lockstep.

That said, the timing of this rate cut is notable, as CoreLogic’s Q2 analysis shows U.S. homeowners with mortgages (around 62% of all properties) have seen their home equity increase by a total of $1.3 trillion since the second quarter of 2023 – a gain of 8.0% year over year. This has brought the total net homeowner equity to over $17.6 trillion in the second quarter of 2024.

As the Fed’s benchmark rate falls, we could see a subsequent decrease in the cost of accessing this accumulated home equity through cash-out refinancing. This potential reduction in borrowing costs could lead to substantial savings for homeowners looking to tap into their built-up equity stemming from house appreciation.

However, it’s important to remember that lower rates, while making borrowing more affordable, do not necessarily make home equity borrowing the right decision for everyone. Your specific financial situation, goals, and risk tolerance should all be carefully considered when determining if now is an appropriate time to access your home’s equity.

Your Lending Options at Defy Mortgage

Our core lending strategy remains unchanged – we’re committed to helping our investors and clients achieve their long-term goals. However, the recent rate cut does offer some advantages. Lower rates improve affordability, allowing more of our borrowers and investors to succeed.

For example, the recent rate cut has created tangible benefits for many of our clients.

- First-time investors: We’ve had several clients finally able to enter the market with DSCR loans. One client secured a $500,000 property that was previously out of reach, as the lower rates reduced monthly payments to fit their budget.

- Portfolio expansion: Some experienced investors are leveraging lower rates to grow their holdings. A client refinanced their existing property, improving monthly cash flow by $300. This, combined with accessed equity, enabled them to put a down payment on a second investment property.

- Cash-out refinancing: As rates dropped, we’ve seen a significant uptick in cash-out refinancing including cash-out refinancing for investment properties. High equity gives you more leverage and options. One client pulled out $100,000 in equity at a favorable rate, using it as a down payment on a multi-unit investment property, effectively doubling their rental portfolio.

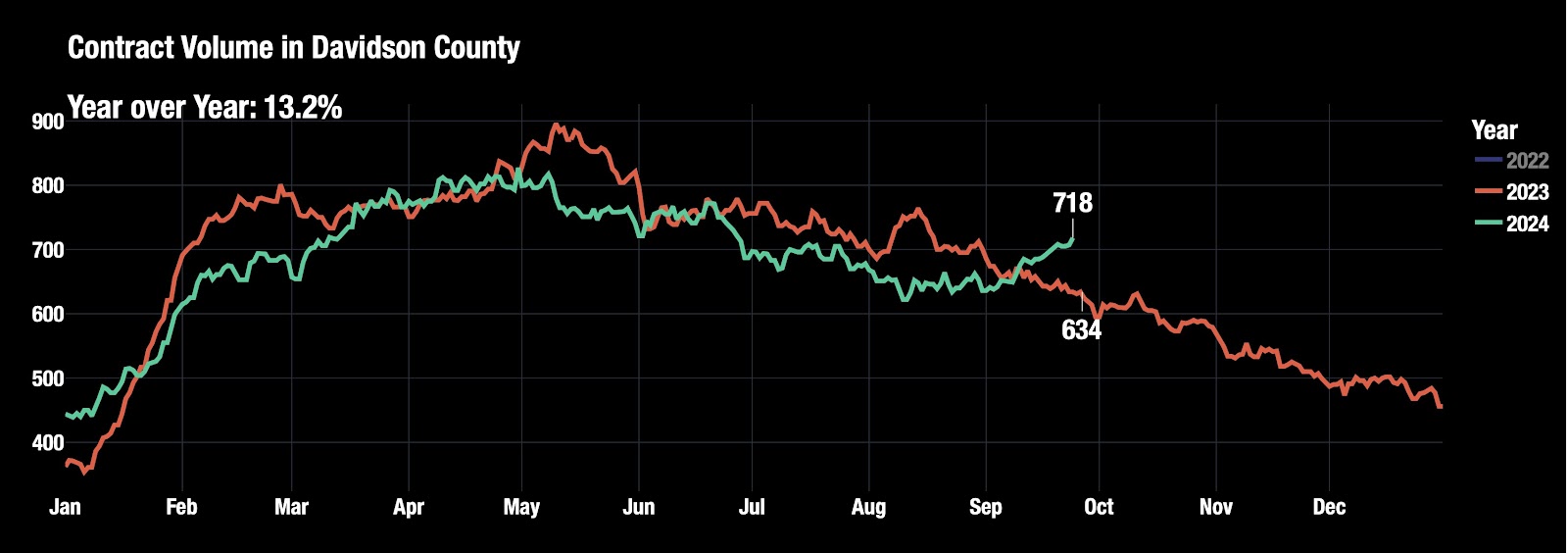

These examples show how the rate cut is opening up real opportunities for our clients to enter the market, expand their portfolios, and optimize their existing investments in meaningful ways. Likewise, we’ve seen an increase in demand for single-family homes in Nashville, TN – a sign of the unlocking of the housing market. 13.2% year-over-year to be exact. Check it out:

Refinancing Post Fed Rate Cut: Should You?

Refinancing when the Federal Reserve cuts interest rates can be a smart financial move, but it depends on your specific situation and the current interest rates. If your current mortgage rate is significantly higher than the current rates, than yes, refinancing could potentially lower your monthly payments and reduce the total interest you pay over the life of the loan.

Ultimately, refinancing when rates are low can help many homeowners save money on their monthly payments and even access built-up home equity. Refinancing also provides the opportunity to change your loan type, such as switching from an adjustable-rate mortgage to a fixed-rate mortgage to achieve payment stability.

Another option as mentioned previously is cash-out refinancing. Unlock the equity you’ve built up in one investment property to afford the down payment of another or use the cash from your equity to consolidate high-interest debts and/or invest in your future. You have options.

Purchasing Post Fed Rate Cut: Should You?

If you’re considering purchasing, it is crucial to get ahead of the anticipated surge in market activity. Leverage the current rate environment and opportunities at hand to grow your portfolio and maximize ROI before increased demand leads to heightened competition.

If you have questions, we have answers. Don’t hesitate to reach out or schedule a call to discuss your options.