Everything You Need To Know About Getting A DSCR Loan in California

Imagine buying an investment property without your personal income impacting your chances of qualifying. Debt-service coverage ratio (DSCR) loans can help you achieve those investment goals. If you live in California and want to learn more about getting a DSCR loan, you’ve come to the right place. Keep reading to find out!

DSCR Loans: What Are They?

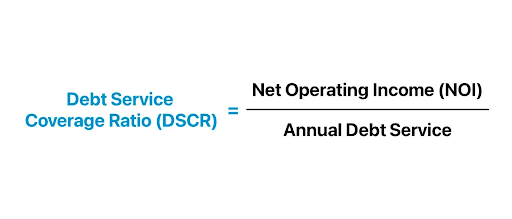

A DSCR loan is a type of mortgage that’s specifically designed for income-generating properties or investment properties. This could include rental properties and commercial real estate. A DSCR loan considers the income generated by the property as the main eligibility criterion rather than the borrower’s personal income. As its name suggests, DSCR loans use the DSCR metric to gauge the property’s ability to make sufficient income to cover its debt obligations. Here’s the way DSCR is calculated:

By using this formula, lenders can determine the property’s risk profile without having to consider the borrower’s income. When analyzing DSCR, a higher value is preferred since it indicates strong financial performance for the property. A DSCR of 1.0 or higher makes it favorable for financing because it indicates that the property generates enough income to cover its debt obligations.

DSCR loans can be a great choice for real estate investors since they take the focus off personal income and heavily rely on the income potential of the property itself. Since these loans are highly specialized, they tend to have tailored terms and conditions that align with the property’s income-generating potential.

Are DSCR Loans Non-QM?

Yes, DSCR loans fall under the non-QM (non-qualified mortgage) umbrella. If you’re not familiar with what non-QM loans are, they are simply loans that aren’t required to meet the strict requirements set by Fannie Mae and Freddie Mac. This gives non-QM lenders more flexibility to create non-QM loan products that cater to borrowers who might not qualify for conventional loans. Since DSCR loans use the property’s income for eligibility rather than the borrower’s personal income, it’s a non-traditional income verification method and falls outside of the realm of conventional mortgage lending.

Who Would Benefit From a DSCR Loan in California?

California DSCR loans can benefit a wide variety of borrowers, including:

- Real estate investors

- Property developers

- Landlords

- Foreign nationals looking to invest in US property

- First-time homebuyers looking to buy an investment property

- Self-employed individuals

- Small business owners

- Partnerships or corporate entities

- Individuals with complex income situations

DSCR Loans vs. Conventional Loans

Taking a look at DSCR loans and conventional loans side by side, they represent two distinct approaches to mortgage financing. Conventional loans are essentially standard loans that follow the eligibility criteria set by Fannie Mae and Freddie Mac. Typically, this includes reviewing the borrower’s personal income, creditworthiness, and employment history to qualify. On top of that, conventional loans don’t offer much flexibility when it comes to the loan terms and conditions since it’s a rather “cookie-cutter” loan.

On the other hand, DSCR loans prioritize the property’s income-generating potential instead of the borrower’s finances. Calculating the DSCR of a property allows lenders to properly analyze the borrower’s ability to repay based on factors like rental income, operating expenses, and debt service. DSCR loans provide flexibility for borrowers with terms and conditions that are more tailored to a property that’s generating income.

DSCR Loans vs. Fix-and-Flip and Construction Loans

While all three types of loans could be a good fit for real estate investors, each one’s functionality is different.

Fix-and-flip loans are primarily for real estate investors who are looking to fix up a property and sell it quickly for a profit. Whereas construction loans fund the building of a property from the ground up and the proceeds are usually released in installments. Both fix-and-flip and construction loans have the potential to generate a profit for investors, but the capital gain won’t be realized until the property is sold. Since the profit from these projects can often be variable, lenders don’t use it as an eligibility criterion.

In contrast, DSCR loans are for properties that generate regular income, which would typically be rental properties where the borrower can collect rental income. This income is then used to determine whether the property can “pay for itself” using the DSCR metric. DSCR loans are not meant to fund renovation or construction projects.

DSCR Loan Requirements

Each lender sets their own DSCR loan requirements, meaning that specific requirements may vary by lender. However, to give you an idea of what requirements to expect, here is what we would need at Defy:

- Minimum FICO score of 620+

- Maximum LTV of 85%

- Minimum DSCR ratio of 0.75

- 3 months cash reserve

- No maximum loan amount

- No income documents or tax returns

- Interest-only options available

DSCR Loan Interest Rates

When it comes to DSCR loan interest rates, they can vary depending on a number of factors such as the lender, the current market, and your financial profile. Overall, you can expect DSCR interest rates to be slightly higher than conventional loan interest rates since it’s a unique lending product. However, DSCR loans open up the door to real estate investment opportunities that might not have otherwise been possible without this alternative lending option.

Pros and Cons of DSCR Loans in California

Pros of California DSCR Loans:

- Qualify With Rental Income: Rather than using your personal financials to qualify for a loan, leverage your rental income for your next investment property.

- Consider Complex Income: Many Californians have income structures that are unique and non-traditional such as freelancers and tech startup owners.

- Higher Loan Amounts: Since DSCR loans consider property income, they can allow for larger loan amounts compared to conventional mortgages.

- Diverse Property Types: DSCR loans can be used for a wide range of property types, including single-family homes, multi-family properties, and even commercial properties.

- Investment Opportunities: There is no hard limit on how many DSCR loans you can get, so they provide an opportunity for investors to expand their real estate portfolios.

Cons of California DSCR Loans:

- Limited Availability: Not all lenders offer DSCR loans, which reduces the options for California borrowers.

- Fluctuating Property Income: If the property’s income fluctuates, it may impact loan eligibility and terms.

- Slightly Higher Interest Rates: Since DSCR loans are a unique lending product, interest rates may be slightly higher than conventional interest rates.

The Top 5 California Cities for DSCR Loans in 2024

DSCR loans are generally popular in cities that have low vacancy rates, a large tenant pool, and appreciation potential. Below, we’ve gathered the top 5 cities in California for DSCR loans based on those factors:

- The Bay Area (San Francisco, Oakland, San Jose): This tech-focused area has a robust job market, strong tenant demand, and limited new construction, keeping vacancy rates low.

- San Diego: San Diego has a diverse economy and a growing population, leading to consistent demand for rentals and steady property appreciation.

- Los Angeles: Los Angeles has a diverse economy and many attractions, resulting in a large tenant pool, low vacancy rates, and strong appreciation potential.

- Sacramento: Sacramento is experiencing an economic boom, attracting new residents and businesses. It’s a more affordable option than coastal cities with a growing tenant pool and low vacancy rates.

- Irvine: Home to the University of California, Irvine, and a thriving tech sector, Irvine has consistent rental demand, making the vacancy rate here low with steady property value growth.

DSCR Loan Alternatives

If a DSCR loan isn’t the right fit for you, but you’re looking for other flexible lending options, here are some alternatives to consider:

- Fix-and-Flip Loans: Short-term financing for real estate investors looking to purchase, renovate, and sell a property to make a profit. This is a great option for property “flippers” who need quick financing for a short period.

- Construction Loans: Financing for a construction project where a property is being built from the ground up. Loan proceeds are usually released in installments as the project progresses. This is a great option for borrowers who would like to build a custom home and real estate investors or developers.

- Bank Statement Loans: Uses bank statements as the main eligibility criteria rather than traditional income documentation. This is a great option for self-employed individuals, freelancers, gig workers, and anyone else who has irregular or non-traditional income. In fact, we have a specific guide for California bank statement loans, too.

- Profit & Loss (P&L) Loans: Uses a business’s profit and loss statement as the main eligibility criteria rather than traditional income documentation. This is a great option for business owners.

California DSCR Loan FAQs:

- How do DSCR loans work?

DSCR loans focus on the property’s cash flow (rent minus expenses) to qualify you rather than your personal income. The lender calculates a DSCR ratio (cash flow divided by debt obligations) to see if the income covers the loan payments.

- Are DSCR loans hard to get?

If you have a property with a strong rental history and a high DSCR, getting a DSCR loan shouldn’t be too difficult. Since DSCR loans are considered to be non-QM loans, the approval process tends to be faster as well due to less bureaucratic red tape that you might experience with conventional loans.

- Who would benefit from a DSCR loan?

Real estate investors looking to finance income-generating properties benefit from DSCR loans, especially if they have multiple rental properties or plan to expand their portfolio.

- Should I get a DSCR loan?

A DSCR loan could be a good fit depending on your circumstances. Some factors to consider before getting one include the property’s income potential, investment goals, and individual financial position.

- What are the pros and cons of getting a DSCR loan in California?

Pros:

- Use of property’s income for qualifying rather than personal income

- Potentially higher loan amounts

- Flexibility for real estate investors with multiple properties

- Provides an opportunity to finance income-generating properties with strong cash flow potential

Cons:

- Limited availability

- Potential for fluctuating rental income to affect loan eligibility or terms

- What are the requirements for DSCR loans in California?

Specific requirements for California DSCR loans will vary by lender, but at Defy, we require:

- Minimum FICO score of 620+

- Maximum LTV of 85%

- Minimum DSCR ratio of 0.75

- 3 months of cash reserves

- No income documents or tax returns

- No maximum loan amount

- Interest-only options available

- What are the credit score requirements for DSCR loans?

The credit score requirements for a DSCR loan will vary by lender, but at Defy, we require a minimum FICO score of 620 to qualify.

- Where can I get a DSCR loan?

Since DSCR loans are considered to be non-QM loans, you’re likely to find them offered by private or alternative lenders, like us at Defy, rather than traditional banks and credit unions.

- How big of a down payment do you need for a DSCR loan?

Specific DSCR loan down payment requirements will depend on the lender and additional factors, such as your credit score, but tend to range between 15% to 30%. At Defy, we require a minimum of 15% down for DSCR loans.

- Can you get a DSCR loan with no down payment?

No down payment DSCR loans are very rare, so unfortunately, it’s not likely that you’d be able to get one without putting anything down.

- What are the interest rates for a DSCR loan?

Interest rates for DSCR loans may vary depending on the lender, the current market, and your financial profile.

- Can first-time homebuyers get a DSCR loan?

Yes! First-time homebuyers can get a DSCR loan as long as they meet the lender’s eligibility criteria for the loan.

- Can DSCR loans be used for new construction?

While some lenders allow DSCR loans to be used for new construction, we would recommend looking into construction loans instead. Getting a construction loan for a new construction means that the loan will be tailored for its intended use, making it easier to qualify for it. At Defy, we offer DSCR, construction, and fix-and-flip loans for real estate investors, so you can choose the option that’s right for you.

- What is the difference between a conventional loan vs. a DSCR loan?

The main difference between a conventional loan and a DSCR loan is the way that income is verified. With a conventional loan, traditional income documents like pay stubs, W2s, and tax returns are used to check if a borrower can repay a loan. In contrast, a DSCR loan uses the property’s cash flow to see if the property can essentially “pay for itself” with the income it’s making. A DSCR loan does not use the borrower’s personal income for qualification.