With an ongoing housing shortage, rental demand in the state of Delaware remains high going into 2025 and is likely to stay that way, given that it’s the 7th fastest growing state in the US in terms of population. In this environment, building up a portfolio of competitive rental properties can be a lucrative long-term investment.

A DSCR loan or debt service coverage loan can be the perfect tool for entering the state’s rental market. A DSCR loan Delaware places greater focus on a property’s income potential rather than the borrower’s personal income.

At Defy, we specialize in providing tailored, non-traditional lending solutions to entrepreneurs, freelancers, business owners, real estate investors, and self-employed individuals. Alongside DSCR loans, we offer 75+ lending solutions that can be fully customized to fit your unique investment goals, including options such as foreign national loans for those without a US credit score and interest-only loans for those looking to maximize initial cash flow.

Tapping into our years of experience providing non-qualifying mortgages to investors across the US, we’ve written this blog to help those new to DSCR loans get through the application process. We’ll discuss the requirements you need to meet and the steps to take for a successful application. We’ll also go over the various benefits of this specific loan type.

Let’s begin!

Benefits of DSCR Loans in Delaware

The main advantage of a DSCR loan Delaware is its ability to give investors access to financing without the need for traditional income verification. Instead, DSCR loan approval mostly hinges on the potential income the property can generate. Below, we highlight some benefits of DSCR loans:

No Personal Income Verification

As mentioned above, DSCR loans focus more on a property’s income-generating potential rather than the borrower’s personal finances. Although aspects of the borrower’s finances are accounted for (e.g. credit score), most DSCR lenders do not ask for proof of income (e.g. pay stubs), making DSCR loans ideal for investors whose income may not reflect their financial capability. If you apply for a DSCR loan with Defy, we won’t ask you to submit tax returns or W-2 income.

Easier Qualification

With less of a focus on the borrower’s personal finances, it can be easier to get approved for a DSCR mortgage as long as you select a strong cash flow potential property. While impossible to predict the exact cash flow of a property, certain elements can set you up for success. For example, a property in a good location could generate higher demand and cash flow and a multi-family unit offers opportunities to rent out the property to multiple tenants.

No Property Limit

As long as you can show a strong track record of property management, lenders can confidently offer you as many DSCR loans as you need. This can help you quickly grow your portfolio of income-generating properties in Delaware. By contrast, conventional financing insured by Fannie Mae and Freddie Mac limit borrowers to 10 financed properties at any given time, with many traditional lenders seldom allowing borrowers to finance more than 4 or 5 properties.

With conventional real estate investment loans, your debt-to-income ratio (DTI) is also an important factor. This means it could be difficult to be approved for multiple conventional investment property loans if a significant chunk of your income is going towards debt payments like existing home loans, student loans and other loans you may have. Whereas, by and large, DSCR loans ignore your personal debt and instead focus on the debt borrowed against the actual property being financed.

Flexible Loan Terms

Being non-QM loans, some of the loan terms are left up to the discretion of the lender, making DSCR loans potentially much more flexible than conventional mortgages. For example, you can enjoy customizable repayment plans that can be more suited to your portfolio’s needs, which are commonly not available in conventional loans for investment properties.

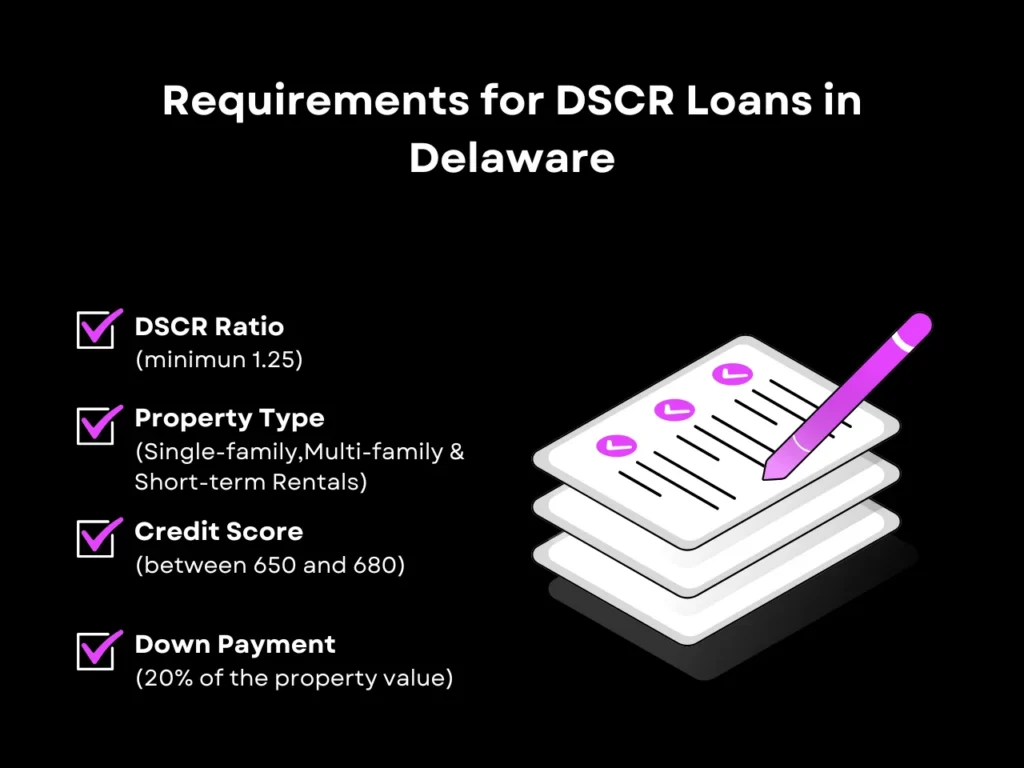

Requirements for DSCR Loans in Delaware

Securing a DSCR loan in Delaware primarily involves selecting a property with a healthy DSCR ratio. While there’s less emphasis on your personal income, lenders are still likely to look into your overall financial health to gauge your capacity to meet your debt obligations. Make sure you fulfill these essential requirements:

DSCR Ratio

Most lenders prefer that the real estate property you intend to purchase or refinance has a DSCR ratio of 1.25. DSCR is calculated by taking the annual income of a property after deducting operating expenses (also known as its net operating income) and dividing it by its total debt service, or the debt payments it has to meet every year, including the DSCR loan payments, as well as other fixed annual fees, like insurance and homeowner’s association dues.

A minimum DSCR of 1.25 means that the property’s cash flow should be at least 1.25 times that of the property’s debt burden. At Defy, however, we provide DSCR mortgage loans for properties with DSCR ratios as low as 0.75.

Property Type

DSCR loans are designed specifically for income-generating investment properties. Eligible property types include:

- Single-family Homes: Single-family homes are a great choice for those who are new to rental property management, as you only need to manage a single unit.

- Multi-family Homes: DSCR loans generally are only available for multi-family homes up to 4 units, including duplexes, triplexes, and fourplexes. Multi-family units can offer more income than single-family homes but are more complex to manage.

- Short-term Rentals: Delaware attracts millions of visitors each year, and tourism contributes to a significant portion of its economy. Sports tourism alone generated more than $250 million of spending in Delaware as of 2023. Many DSCR lenders accept vacation rentals listed on platforms like Airbnb and Vrbo, allowing you to take advantage of the state’s lively tourism seasons.

Credit Score

Your credit score is a key factor in getting approved for a DSCR loan. Most lenders require borrowers to have a minimum credit score between 650 and 680 to ensure that the borrower has a good history of managing their financial obligations. At Defy, we approve DSCR loans for borrowers with FICO scores as low as 620. However, scores above 700 yield the best rates.

Down Payment

Most lenders allow a loan-to-value (LTV) ratio of 80%. LTV is the percentage of the property’s value that is tied up in debt. This means that you’ll have to put at least 20% of the property value down. This also means that you would need to have at least 20% equity in your home if you intend to apply for a DSCR refinance.

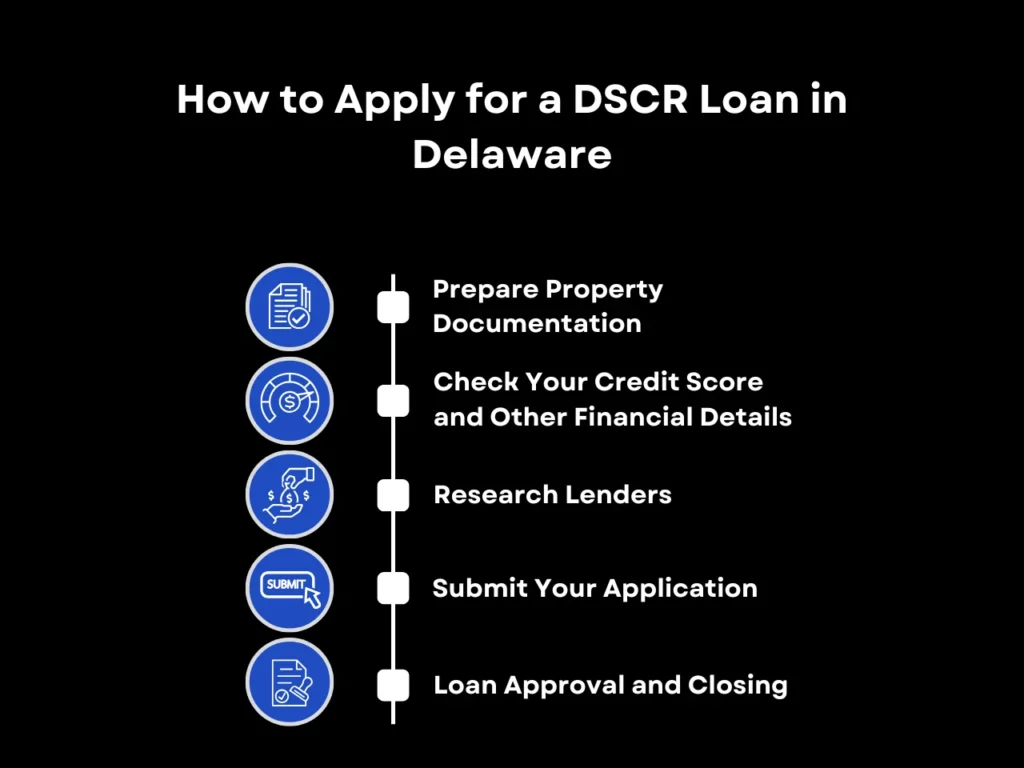

How to Apply for a DSCR Loan in Delaware

Applying for a DSCR loan follows a slightly different process than applying for a home loan insured by Fannie Mae or Freddie Mac. The most important factor is the property’s DSCR, so much of the application process will be dedicated towards collecting documentation supporting the property’s monthly cash flow.

Step 1: Prepare Property Documentation

Gather lease agreements and rental income statements to demonstrate the property’s earning potential, along with property expense records, insurance statements, and maintenance bills. It also helps to include appraisal reports or market analysis data if you have them.

Having all of these documents on hand will help speed up the lender’s verification of your DSCR. It can also help you calculate a rough estimate of your DSCR, which can help inform your decision, and if you may want to select a different property with a higher income potential to get more favorable loan terms.

If you’re refinancing an existing loan, you should also prepare your current loan agreement, mortgage statements, and any other documents that could show the remaining mortgage on the property.

Step 2: Check Your Credit Score and Other Financial Details

Confirm that your credit score meets the lender’s threshold. It could be worthwhile to take some time and improve it in order to maximize your chances of approval and getting the best loan terms. Paying down existing debts and consolidating your debt would help. You can also look through your credit reports to find and address any errors that might be deducting your score.

Aside from your credit score, lenders may evaluate other aspects of your financial health and personal assets, especially if the property you select has a lower DSCR ratio. This can include requesting to see bank statements detailing your cash reserves, future cash flow projections for the property, and your investment portfolio.

Lenders may also ask for proof of insurance and proof of LLC ownership if you’re purchasing under a business entity. In the case of purchasing under an LLC, you may also be asked to submit documentation of your LLC’s income and liquidity.

Step 3: Research Lenders

Once you’ve got your documents in order and you’re ready, you can begin comparing mortgage lenders and financial institutions that offer DSCR loans in Delaware. Consider lenders that specialize in non-QM loans such as DSCR loans (like Defy!) as they tend to have the most flexible repayment options and quickest approval processes.

You can also get pre-approved during this stage. Pre-approval will tell you the maximum loan amount that the lender is willing to loan you. This also strengthens your position as a buyer, as sellers tend to prefer buyers who are pre-approved.

Step 4: Submit Your Application

Upon selecting a lender, you can submit your application package, which includes all the documentation you’ve gathered. After ensuring that you meet all the requirements, the lender will order an appraisal from an appraisal management company to verify the income potential and market value of the property. They will then use these findings to determine the property’s DSCR.

Step 5: Loan Approval and Closing

After the underwriting process is complete, you’ll be notified by the lender that your loan application has been approved, along with the loan terms and conditions. If you’re happy with these, you can sign the loan agreement, pay the closing fees, and finalize the loan.

DSCR Loan Delaware FAQ

What is the minimum DSCR ratio required for a loan in Delaware?

Most DSCR lenders in Delaware look for a DSCR ratio of 1.25 or above, meaning that the property should be making 125% more in revenue than all of the debt taken out against it. However, at Defy, we offer DSCR loans for properties with DSCR ratios as low as 0.75.

Can I use a DSCR loan to refinance my existing property in Delaware?

Yes, you can refinance a property you already own in Delaware with a DSCR loan. Just like with a traditional mortgage, you can do a rate-and-term refinance or a cash-out refinance under a DSCR loan program.

What types of properties qualify for DSCR loans?

DSCR loans are designed specifically for income-generating investment properties. Eligible property types include single-family homes, multi-family homes (up to 4 units), commercial properties, short-term rentals, vacation homes, and mixed-use properties.

How quickly can I get approved for a DSCR loan in Delaware?

Approval can take as little as less than a week to up to 45 days, depending on how complete your documents are and how complex the situation is. Property evaluation and other processes on the lender’s end can extend the timeline.

Are there tax benefits associated with DSCR loans?

Like many other states, Delaware has a low-income housing tax credit (LIHTC) program for investors who purchase and maintain affordable rental properties. Interest payments and depreciation may also be tax-deductible. Incentives that you’re eligible for can vary depending on the nature of your investment property, so remember to consult a tax advisor to explore the deductions available to you.

Key Takeaway

A DSCR loan Delaware is one of the most powerful tools available to real estate investors in the state. Its flexible terms and easier qualification pair well with the state’s high demand for housing and short-term rentals, making it simpler to grow your portfolio and generate a return on your investment.

To get the best results with DSCR financing, make sure to carefully plan your property selection and financing strategy. Prioritize properties with strong cash flow potential and a DSCR ratio that meets or exceeds lender requirements. Maintain an excellent credit profile, as this can significantly impact the loan terms and interest rates you receive. Additionally, work with experienced lenders and advisors who understand your market and can tailor loan terms to your investment goals.

Would you like some expert guidance on your real estate investing journey? Reach out to Defy today and discuss your next moves with our mortgage advisors. We can fast-track you to success with our DSCR loan programs, or help you consider other options like jumbo loans and fix-and-flip loans.