Searching for “DSCR Loan New Mexico?” You’re in the right place.

New Mexico has seen an increase in median rent by about $25 year-over-year according to data from Zillow (and it’s up a whopping 70% since 2017, one of the largest increases in the country).

That means if you owned a rental property that was generating $1,100 in monthly revenue in 2017, it’s generating $1,870 in monthly revenue today, all while average home prices nearly doubled.

There’s no question that investors love New Mexico rental properties – but there’s only one thing investors love even more: New Mexico DSCR loans.

If you’ve been involved in the real estate game for any amount of time, chances are that you’ve heard a thing or two about DSCR loans. In this article, we’ll break down exactly how they work and how they can help you build an empire of real estate properties.

Understanding DSCR Loans

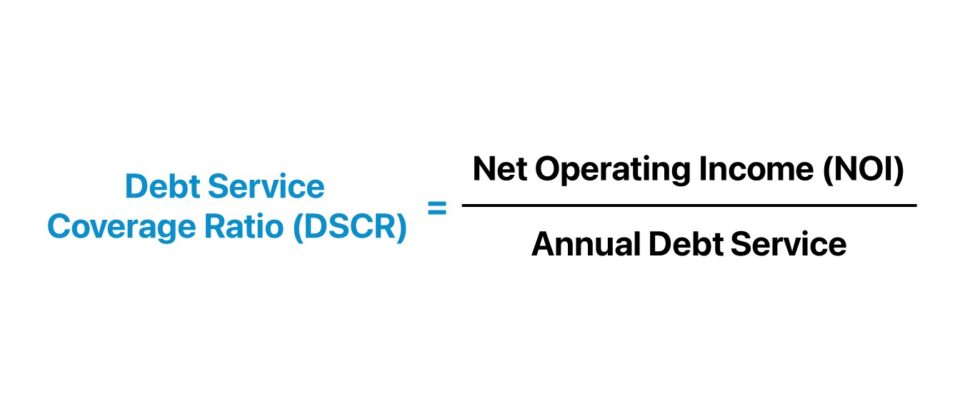

Debt Service Coverage Ratio (DSCR) loans are a type of financing tailored for real estate investors who want to scale their portfolios without relying on traditional income verification methods. Unlike conventional loans, which primarily assess your ability to repay based on personal income, DSCR loans evaluate the income-producing potential of the property itself. Simply put, these loans look at whether the property’s net operating income (NOI) is sufficient to cover the debt obligations.

How to Calculate Your Property’s DSCR

For example, if a rental property is rented out for $1,500 a month, it generates $18,000 in annual revenue. After factoring in expenses, though, the property might actually generate something like $15,000 annually.

If the mortgage costs $1,230/month, it would cost $14,760 annually.

$15,000 / $14,760 = 1.02 DSCR.

Most lenders require a DSCR of 1.25 or higher in order to qualify for a loan. However, Defy Mortgage has a minimum DSCR of just 0.75 for qualifying properties. Book a call with us to get more details and see if your property qualifies.

What DSCR Do I Need to Qualify?

When it comes to qualifying for a DSCR loan, the Debt Service Coverage Ratio (DSCR) is the key metric lenders evaluate. A DSCR of 1.25 or higher is typically considered strong, as it indicates that the property’s net operating income (NOI) is 25% greater than its debt obligations. In practical terms, this means the property generates enough cash flow to comfortably cover loan payments, with additional income left over.

A DSCR of 1.0 means the property is breaking even—its income is just enough to cover the loan’s debt service without any surplus. While some lenders may accept DSCRs close to 1.0, a higher ratio signals greater financial stability and is more likely to secure favorable terms.

How a DSCR Loan New Mexico Can Be a Portfolio Game-Changer

So why can a DSCR loan in New Mexico be a gamechanger for your portfolio? There are three primary reasons.

- Exposure to equity growth. As we mentioned in the introduction, the average home price is up 70% since 2017 in New Mexico. Owning a rental property with a DSCR loan exposes you to potential market appreciation.

- Lower-than-average vacancy rate. Demand for New Mexico real estate is high. Accordingly, the vacancy rate in New Mexico is roughly 1% lower than the US average. Fewer vacancies means more consistent income.

- More flexible financing requirements. With interest rates much higher than pandemic lows (but prices staying put), it’s harder than ever for buyers to qualify for rental properties using just their personal income. DSCR loans allow for greater flexibility.

Pros and Cons of a DSCR Loan New Mexico

DSCR loans are a powerful tool for real estate investors, but like any financing option, they come with both advantages and drawbacks. Here’s a breakdown to help you decide if it’s the right fit for your portfolio:

Pros:

- No Personal Income Verification: Unlike conventional loans, DSCR loans focus on the property’s cash flow rather than your personal income. This makes them ideal for self-employed investors or those with non-traditional income sources.

- Flexible Property Eligibility: DSCR loans can be used for a wide range of property types, including single-family rentals, multi-family properties, vacation rentals, and even short-term rentals like Airbnb.

- Streamlined Qualification: With fewer documentation requirements—no tax returns or W-2s needed—DSCR loans offer a simpler and faster approval process.

- Low DSCR Thresholds: Defy Mortgage offers loans with a DSCR as low as 0.75, giving you access to financing even for properties with lower immediate cash flow.

- Scalable Financing: DSCR loans enable you to acquire multiple properties, making them a great option for scaling your real estate portfolio.

- Interest-Only Payment Options: With interest-only options available, you can maximize cash flow during the initial years of ownership.

Cons:

- Higher Interest Rates: DSCR loans typically come with slightly higher interest rates compared to conventional loans, reflecting the increased risk to lenders.

- Larger Down Payments: While down payment requirements are flexible, they often range between 15-25%, which can be higher than some conventional loans.

- Property Performance Dependency: Your ability to secure a DSCR loan and favorable terms depends heavily on the property’s cash flow and DSCR.

- Limited Lender Options: Not all lenders offer DSCR loans, so finding the right lender who understands your investment goals is crucial.

DSCR Loan New Mexico Requirements

Defy Mortgage makes it easier than ever to secure a DSCR loan in New Mexico. Here’s what you’ll need to qualify:

- Minimum DSCR: 0.75

- Minimum Credit Score: 620+

- Maximum Loan-to-Value (LTV): 85%

- Cash Reserves: 3 months of reserves

- No Income Documents Required: Skip the hassle of W-2s, tax returns, and other paperwork.

- No Maximum Loan Amount: Finance properties of any size, from single-family rentals to larger multi-family investments.

- Interest-Only Options: Maximize your cash flow in the early years of the loan.

DSCR Loan New Mexico Interest Rates

While DSCR loans typically come with slightly higher interest rates than conventional loans, most investors find the benefits outweigh the costs. Higher interest rates are a tradeoff for the flexibility and simplicity of DSCR loans, especially in a hot market like New Mexico, where the potential for rental income growth and property appreciation can offset the added expense.

DSCR Loan New Mexico Down Payment Requirements

Down payment requirements for DSCR loans vary, but Defy Mortgage allows qualified borrowers to get started with as little as 15% down, depending on credit score and property type. This flexibility makes DSCR loans accessible for both seasoned investors and those just starting to build their portfolios.

Is My Property Type Eligible?

DSCR loans in New Mexico can be used to finance a variety of property types, including:

- Single-Family Homes: Perfect for long-term rentals in high-demand markets.

- Multi-Family Properties: Scale your portfolio with 2-4 unit or larger complexes.

- Vacation Rentals: Capitalize on New Mexico’s growing tourism industry.

- Short-Term Rentals: Platforms like Airbnb and Vrbo qualify, offering high-income potential.

- Some Commercial Properties: Eligibility depends on the lender, but mixed-use and small commercial properties may also qualify.

If you’re unsure whether your property qualifies, book a call with Defy Mortgage to explore your options.

DSCR Loan New Mexico Lenders

Choosing the right lender for a DSCR loan is key to maximizing the benefits of this financing tool. Look for a lender with expertise in DSCR loans and a clear understanding of the New Mexico market. Defy Mortgage specializes in DSCR loans and offers flexible terms to help you secure financing for your next investment property.

DSCR Loan New Mexico FAQs

- What is a DSCR loan?

A DSCR loan is a type of mortgage for real estate investors that focuses on the income potential of the property rather than personal income.

- Who qualifies for a DSCR loan New Mexico?

Any investor with a property meeting the lender’s DSCR, credit score, and down payment requirements can qualify.

- What types of properties can be financed with a DSCR loan New Mexico?

DSCR loans can be used for single-family rentals, multi-family properties, vacation rentals, short-term rentals, and some commercial properties.

- What is the minimum DSCR required for a DSCR loan New Mexico?

Most lenders require a DSCR of 1.25 or higher, but Defy Mortgage accepts ratios as low as 0.75.

- How does a DSCR loan differ from a conventional loan?

DSCR loans focus on property cash flow, while conventional loans primarily assess personal income.

- How can I calculate the DSCR for a property in New Mexico?

DSCR can be easily calculated by finding the net operating income of a property and dividing it by the total debt service (mortgage & interest payments). The lender will complete this for you during the underwriting process.

- Can DSCR loans be used for refinancing in New Mexico?

Yes, DSCR loans can be used to refinance existing investment properties.

- Where can I find reputable lenders offering DSCR loans in New Mexico?

Contact Defy Mortgage to learn more about DSCR loans and how they can work for your investment portfolio.