An FHA loan Arkansas can be one of the best financing options in the state, with its pro-homebuyer terms serving as a great complement to the affordability of Arkansas’ real estate market. By understanding how FHA loans work and how you can maximize their benefits to your advantage, you can make your dream Arkansas home a reality with minimal financial burden.

At Defy Mortgage, we have simplified the home-buying process for scores of homebuyers. Although we currently don’t offer FHA loans in Arkansas, we have catered to the diverse needs of various homebuyers in Alabama, California, Colorado, Florida, Georgia, Oregon, Tennessee, and Texas. We’re very well-versed in maximizing the benefits of FHA loans and minimizing the costs involved.

Drawing on our solid experience in the field, we’ll give you all you need to know to take full advantage of FHA loans in Arkansas. We’ll go over the key advantages of FHA loans and the eligibility criteria you need to meet to get approved with favorable terms. We’ll also discuss the types of FHA loans and closing costs involved once you get approved.

Let’s get right into it.

FHA Loans in Arkansas

With a median home price of $256,000, Arkansas is one of the most affordable states for home purchases. Combined with this level of affordability, the favorable terms offered by an FHA loan Arkansas make home buying in the state accessible for a wider range of buyers.

The Basics of FHA Loans and How They Work

FHA loans, backed by the Federal Housing Administration (FHA) are financing products created to make homeownership more accessible to Americans. They offer various advantages, such as lower down payments, better interest rates, and more flexible credit requirements. This makes them a great option for those who might not qualify for conventional loans.

Why Choose an FHA Loan Over Conventional Loans?

FHA loans were created to help American homebuyers, particularly first-time homebuyers or those with low credit. With down payment options as low as 3.5% for those with a credit score of at least 580, they are much preferable to most conventional home loans that often require borrowers to put down at least 20%.

FHA loans are also much more forgiving in terms of Debt-to-Income (DTI) ratios. Borrowers with relatively high existing debts can still qualify, given they don’t exceed a certain threshold set by the lender, which is much higher than conventional loans.

FHA loans are also assumable, meaning the buyer of your home can take over your loan with the same favorable terms. This allows you to avoid paying higher interest if alternative housing options arise.

FHA Loans for Different Types of Borrowers

The FHA offers various types of loans to prospective homebuyers to meet diverse needs and circumstances. Here are some of the most common types of FHA loans:

FHA Purchase Loans

Also known as the FHA 203(b) loan, purchase loans are the most common type of FHA mortgage. These are intended for primary residences and involve mandatory mortgage insurance, with varying borrowing limits between states and counties.

FHA Refinance Loans

FHA refinance allows borrowers to adjust their mortgage terms to get lower interest rates or access equity. Eligibility requirements depend on credit score, debt-to-income ratio, and loan-to-value ratio. FHA refinancing options include streamlined refinancing, a quicker, lower-cost option that doesn’t require an appraisal or credit check, and cash-out refinancing, which requires at least 20% equity and a primary residence to take cash out.

FHA 203(k) Renovation Loans

This loan allows you to buy or refinance a fixer-upper, enabling you to finance the repairs with a single loan and monthly payment. There are two types of the 203(k) loans available: the limited 203(k), which is capped at $35,000 and involves less paperwork, and the standard 203(k), which is capped based on county loan limits, with an option to finance up to six months of mortgage payments if the home is uninhabitable while undergoing renovations.

FHA Energy-Efficient Mortgage Loans

Similar to 203(k) renovation loans, these are focused on financing energy-efficient improvements alongside an FHA-insured mortgage, which can further alleviate the financial burden. The loan limit for this type of loan typically depends on a home energy assessment to be conducted by an appraiser. Lenders may also impose their own limits, such as 5% of the adjusted value or up to 150% of the national conforming mortgage limit.

Home Equity Conversion Mortgage (HECM) loans

HECM loans allow homeowners aged 62 or older to convert part of their home equity into cash, offering options like fixed monthly payments or a line of credit. To qualify, you must own your home, live there as your primary residence, and meet specific requirements, including attending a counseling session while considering the risks of depleting home equity over time.

Please note that not all lenders offer all these types of FHA loans, so it’s important to ask any lender of interest what their FHA loan options are, along with state licensing, requirements and more.

Eligibility Criteria for FHA Loans in Arkansas

Getting approved for an FHA loan in Arkansas involves essentially the same criteria used everywhere else in the United States. Specific criteria such as credit score minimums and property qualifications must be met to ensure loan approval and favorable terms. Let’s break down each of the major eligible criteria:

Minimum Credit Score and Down Payment Requirements

The FHA requires borrowers to have a credit score of at least 580 to qualify for the 3.5% down payment option. FHA lenders can still approve your loan if you have a credit score of 500-579, but you will have to make a 10% down payment.

Debt-to-Income Ratio and Employment Verification

Similar to conventional loans, a major determining factor of FHA loan terms and approval is your Debt-to-Income or DTI ratio. This is the ratio between your gross monthly income and your monthly debt obligations. FHA lenders usually look for a DTI of 43% or less, but some offer loans for those with up to 57% DTI.

Many lenders also ask for proof of income to ensure you can manage your monthly mortgage payments. This can include everything from submitting pay stubs, tax returns, and bank statements.

Property Eligibility: What Types of Homes Qualify?

Not all properties can be purchased with an FHA loan. The property has to be residential, ranging from condo units to multi-family homes. The borrower must also make the property their primary residence for at least 12 months.

Before approving an FHA loan, a property appraiser licensed by the U.S. Department of Housing and Urban Development (HUD) must conduct an inspection. The appraiser will verify whether the property is structurally sound and free of hazards such as contaminants and pests.

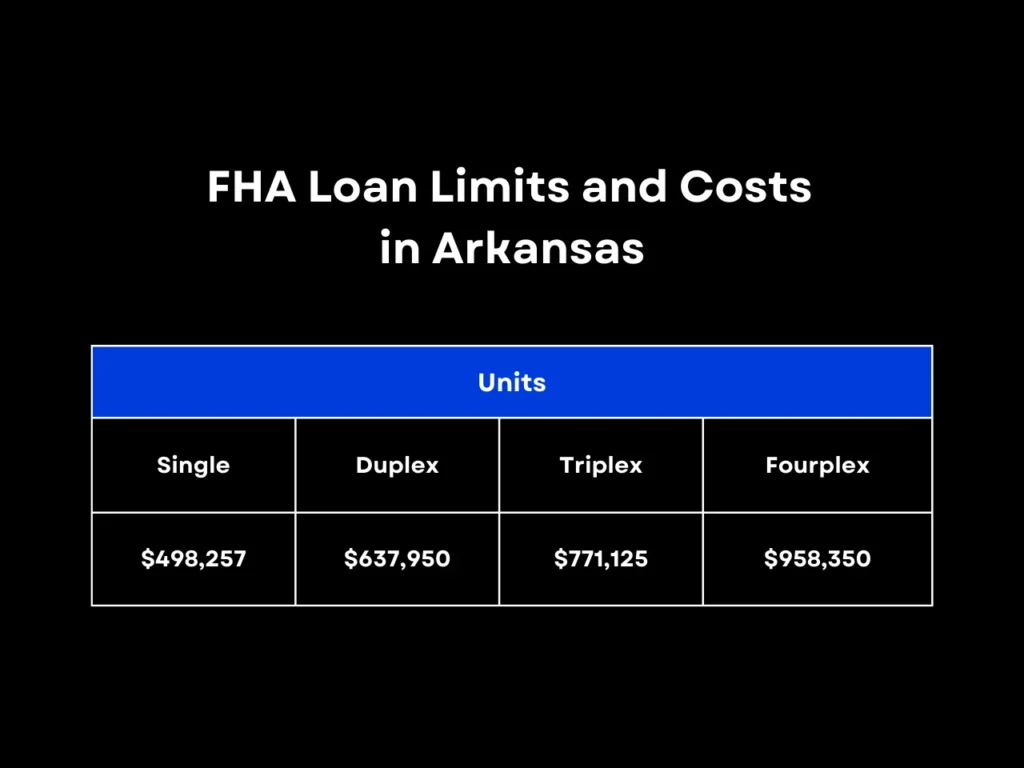

FHA Loan Limits and Costs in Arkansas

The maximum loan amounts in Arkansas are the same as the “floor” limits prescribed by the HUD. They are as follows:

Understanding the Maximum Loan Amounts

The HUD adjusts FHA loan limits yearly based on median home prices and the national conforming loan limits. They set a “floor” at 65% of the conforming loan limits and a “ceiling” at 150%. If a county’s median home sale price exceeds the floor price, the FHA sets its loan limits to 115% of the median price as long as it’s within 150% of the national limit.

While FHA loan limits tend to vary by county, this only applies to states with large disparities in property costs between counties. Given that Arkansas is one of the most affordable real estate markets in the United States, with a median home price of $256,300.

Although this price is over 8% higher than last year, it still falls below the FHA floor limit for single-family homes, which is $498,257. Therefore, it adopts those floor limits as its maximum amount for FHA loans.

Estimated Closing Costs and Fees for FHA Loans

Closing costs for FHA loans typically range from 2% to 6% of the loan amount. For instance, an FHA loan of $300,000 will involve closing costs ranging from $6,000 to $18,000. These include title insurance, appraisal fees, loan origination fees, Mortgage Insurance Premiums (MIP), and other expenses related to purchasing the property with an FHA loan. Keep in mind that these fees and cost can vary by lender.

You can reduce closing costs and fees in several ways. Some lenders offer lender credits, which will waive some closing costs in exchange for a slightly higher mortgage interest rate. You can also get the property’s seller to agree to a concession, where they will pay up to 6% of the home’s sale price to cover closing costs. Down payment assistance programs, such as those offered by the Arkansas Development Finance Authority, can also cover closing costs.

Mortgage Insurance Premiums (MIP)

All FHA loans require Mortgage Insurance Premiums (MIP) to protect lenders in case of default. MIPs are added to monthly payments and are typically calculated based on the loan amount, loan term, and loan-to-value (LTV) ratio. Borrowers pay an upfront MIP (UFMIP) at closing and an annual MIP divided into monthly installments.

You can reduce or eliminate MIP over time by refinancing to a conventional loan once you build enough equity. Lenders can also remove the MIP once you meet certain criteria, such as if your Loan-to-Value ratio exceeds 78% or if you have successfully paid 11 years of debt service, depending on your loan terms.

FHA Loan Arkansas FAQs

What Is the Current Interest Rate for FHA Loans in Arkansas?

The interest rates for FHA loans depend on your lender and credit profile. Factors such as credit score, debt-to-income ratio, and loan amount influence how high your interest rates can be. Make sure to shop around for the best rates. Please note that we don’t currently offer FHA loans in Arkansas at Defy Mortgage.

Can I Buy a Fixer-Upper with an FHA Loan in Arkansas?

Yes. It’s best to purchase a fixer-upper with an FHA loan through the FHA 203(k) program, which includes funds for renovations. However, as with other FHA loans, you have to make the home your primary residence. This means you can’t use the FHA 203(k) loan for investments unless you purchase a multi-family fixer-upper and live in one of the units.

How Long Does the FHA Loan Approval Process Take?

Approval for an FHA loan can take 30 to 60 days, depending on the lender. Your financial situation, such as your credit score, income verification, and debt-to-income ratio, can also impact the approval timeline.

How Much Do I Have to Pay in Mortgage Insurance for an FHA Loan?

Borrowers must pay two types of mortgage insurance premiums for FHA loans. The first is an upfront mortgage insurance premium (UFMIP), which is 1.75% of the loan amount and is typically rolled into the loan. The second is an annual mortgage insurance premium (MIP) paid monthly, the amount depending on your loan term, loan amount, and loan-to-value (LTV) ratio.

Are There Any Special Programs for First-Time Homebuyers in Arkansas?

Yes, several assistance programs exist in Arkansas for first-time homebuyers. These include the Arkansas Development Finance Authority’s Down Payment Assistance Program, which gives qualifying low-income buyers up to $15,000 to help with down payment and closing costs. The ADFA also offers Low-Income Housing Tax Credit (LIHTC) gap financing and HOME program funds, which can be used for rehabilitation, rental assistance, and new construction.

Key Takeaway

Securing an FHA loan Arkansas can be one of the most effective pathways to homeownership in the state. Coupled with the many assistance programs that the state of Arkansas provides for low- to moderate-income homebuyers, the Natural State is one of the easiest ones to become a homeowner in.

If you’re aiming to get approved for an FHA loan in Arkansas, make sure your credit score is over 580, your DTI is below 43%, and the property you’re interested in is free from structural defects and hazards. It’s important to consider closing costs and fees to manage your repayment expectations. Explore all of your options to reduce these fees and minimize the total cost of your loan.

Do you live in Alabama, California, Colorado, Florida, Georgia, Oregon, Tennessee, or Texas and want to use an FHA loan to help you achieve homeownership? Defy Mortgage is ready to assist you. While we don’t offer FHA loans in Arkansas at this time, we offer several non-traditional lending options to make homeownership easier to achieve, from FHA loans to non-QM options such as P&L loans.