What’s not to love about LA? With its year-round sunshine, diverse culture, world-class entertainment industry, and stunning beaches, it’s no wonder nearly 4 million people call it home. Whether you’re drawn to the city’s vibrant energy or its endless opportunities, Los Angeles remains one of the most desirable places to live.

But with high demand comes a challenge: housing affordability.

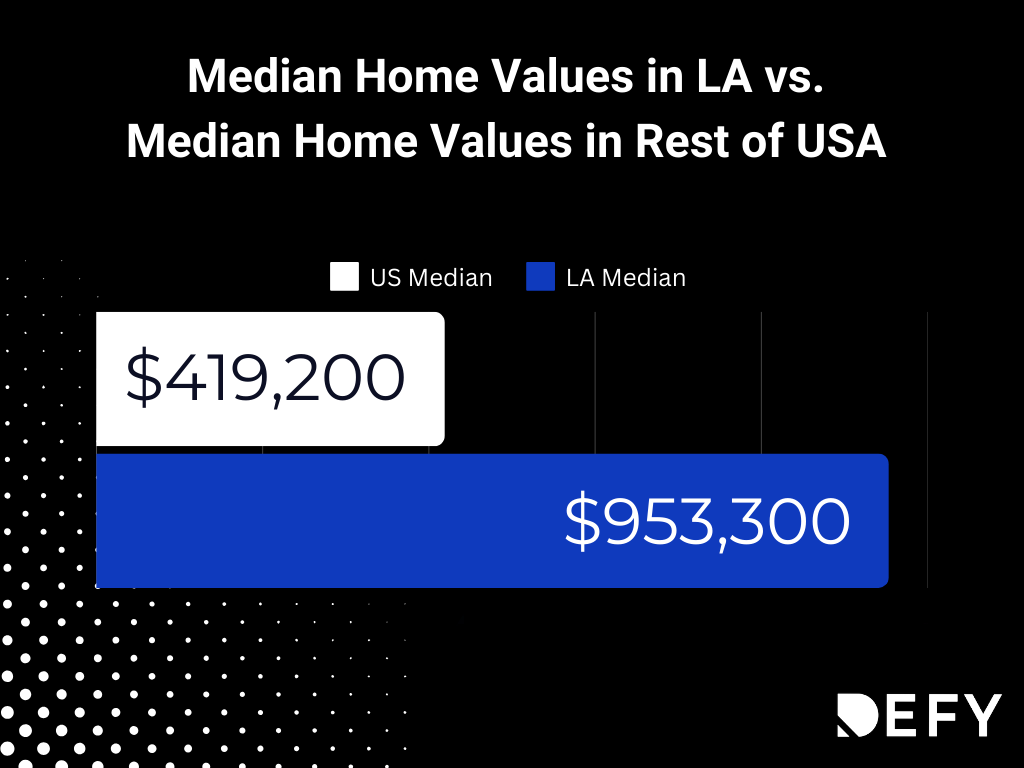

Unfortunately for many would-be homeowners, the Los Angeles housing market continues to be one of the most unaffordable in the nation. A whopping 97% of Los Angeles households can’t afford a mortgage.

If you’re struggling to qualify due to self-employment or non-traditional income, it can be even harder. That’s what Defy is designed to help with, though – so if you have an unconventional situation but would like to learn more about what we can do to help, schedule a time to talk with us.

As we move further into 2025, several key trends and economic factors are shaping the city’s real estate landscape. From rising home prices and limited inventory to changes in interest rates and demographic shifts, understanding the current state of the market is crucial for both buyers and investors. Let’s get into it.

2025 Los Angeles Housing Market Overview

Los Angeles remains a high-cost housing market, with median home prices hovering around $953,000.

As we mentioned above, this price point is out of reach for many residents, as the median household income in the city is approximately $79,000 — a stark contrast that continues to widen the affordability gap.

But those are just median estimated values (so they include homes that aren’t currently on the market). The median listing price is around $1.2M, making affordability an even bigger concern. Meanwhile, rental prices have also seen substantial increases, particularly for non-rent-controlled properties. Rent-controlled units have experienced moderate rent growth of around 4% for rent-controlled properties and up to 8.9% for non-rent-controlled properties, rising to about $2,644 per month. This increase is part of the reason why Los Angeles ranks as one of our top places to buy rental properties in the US in 2025.

Los Angeles Market Trends and Forecast for 2025

Despite concerns about affordability, the Los Angeles housing market is expected to continue its upward trajectory, albeit at a more moderate pace. Some key factors influencing the market in 2025 include:

- Modest Price Growth: Home prices are expected to see a slight increase over the next year, driven by strong demand and limited supply.

- Interest Rate Cuts: The FedWatch Tool from the CME group predicts that the Federal Reserve will implement at least two interest rate cuts before the end of 2025. Lower interest rates typically make mortgages more affordable, potentially boosting demand.

- Zillow Forecast: Zillow’s outlook suggests a small price increase at the beginning of 2025, followed by a brief dip, before prices resume their upward trend toward the end of the year.

- Annual Home Price Growth: Home values increased 10% year-over-year as of December 2024, indicating continued appreciation despite economic fluctuations.

Los Angeles Demographics and Migration Trends

Los Angeles is a city of nearly 3.8 million people, but affordability concerns and shifting work trends have led some residents to relocate. The unemployment rate stands at 5.8%, higher than the national average, which may influence some people’s ability to purchase homes.

The city’s housing shortage remains a pressing issue. Demand continues to outstrip supply, contributing to rising prices and fierce competition among buyers. Developers face numerous regulatory and zoning challenges that make building new housing difficult, ensuring that inventory constraints will persist for the foreseeable future.

Despite these challenges, Los Angeles remains attractive to real estate investors. The combination of long-term property appreciation, strong rental demand, and a resilient economy makes it one of the more stable investment markets in the U.S.

Factors Affecting the Los Angeles Housing Market

Several key factors are shaping the housing market in 2025. Perhaps the most significant is the ongoing supply and demand imbalance. Limited inventory continues to put upward pressure on prices, as there simply aren’t enough homes to meet demand. While bidding wars have become less frequent compared to the peak of the market, they still occur in particularly desirable neighborhoods.

Another critical factor is the expected decline in interest rates. If the Federal Reserve follows through with its anticipated rate cuts, mortgage rates will drop, making it easier for buyers to secure loans at more affordable terms. This could lead to an increase in demand and possibly another surge in home prices later in the year.

The luxury housing market, however, is showing some signs of cooling. Higher-end properties are staying on the market longer, as potential buyers weigh affordability concerns and interest rate movements.

In contrast, entry-level and mid-tier homes continue to attract strong demand, particularly from first-time buyers and investors looking for rental properties.

A Note on Recent Events in Los Angeles in 2025

The wildfires of January 2025 have had a devastating effect on parts of the city, displacing over 205,000 residents and destroying numerous homes. While the full economic impact is still unfolding, the immediate consequences include increased demand for rental housing, potential delays in reconstruction efforts, and rising insurance costs for homeowners in fire-prone areas.

Additionally, the lasting effects of the COVID-19 pandemic continue to shape the market. The sharp decline in home sales during the pandemic, combined with rising prices, has made it increasingly difficult for many residents to afford a home. While the market has since rebounded, affordability challenges remain a central concern.

Investment Strategies and Recommendations

For investors, Los Angeles remains a lucrative, though challenging, market. With high property values and strong rental demand, those who can afford to enter the market stand to benefit from steady appreciation and long-term income potential.

One of the key decisions investors face is whether to focus on single-family rentals (SFRs) or multi-family properties. Single-family homes tend to offer stable appreciation and high rental demand, making them a strong long-term investment. However, multi-family properties often provide higher cash flow potential and can help mitigate vacancy risks by diversifying rental income streams.

Regardless of the property type, investors should pay close attention to financing strategies, property management options, and local regulations, particularly those surrounding rent control and zoning laws. Proper research and financial planning are essential to navigating the complexities of the Los Angeles real estate market.

Los Angeles Housing Market 2025 Resources

For those looking to buy in Los Angeles, patience and preparation are key. With home prices remaining high and inventory limited, buyers must be financially prepared to move quickly when the right opportunity arises. Working with an experienced real estate agent and securing mortgage pre-approval can provide a competitive edge.

Sellers, on the other hand, still hold an advantage in many parts of the city. Well-priced homes in desirable neighborhoods continue to attract interest, though the market is not as frenzied as in previous years. Those selling higher-end homes may need to adjust their pricing expectations as demand in the luxury segment cools.

Final Thoughts on The Los Angeles Housing Market

The Los Angeles housing market in 2025 continues to be shaped by a mix of limited inventory, rising prices, and shifting economic conditions. While affordability remains a challenge, the market is expected to see modest price growth, particularly as interest rates decline later in the year.

For buyers, navigating the market requires careful planning and financial readiness, while sellers should remain realistic about pricing trends. Investors, meanwhile, will find strong opportunities in both single-family and multi-family properties, provided they approach the market with a long-term strategy.

Despite occasional cooling periods and external challenges, Los Angeles remains one of the most desirable and resilient real estate markets in the country. Whether you’re a homebuyer, seller, or investor, understanding the latest trends and forecasts will help you make informed decisions in this ever-evolving market.

FAQ: Los Angeles Housing Market Trends and Insights for 2025

What is the current state of the Los Angeles housing market in 2025?

Los Angeles remains one of the most expensive real estate markets in the country, with a median home price of $953,000 and a median listing price of $1.2 million. Affordability continues to be a major issue, as the median household income in the city is $79,000, making homeownership out of reach for most residents.

Why is housing affordability such a challenge in Los Angeles?

The affordability crisis in Los Angeles is driven by high home prices, low inventory, and slow wage growth relative to housing costs. Additionally, regulatory hurdles and zoning restrictions make it difficult for developers to build new housing, exacerbating the supply-demand imbalance.

How are interest rates affecting the market?

The Federal Reserve is expected to implement at least two interest rate cuts before the end of 2025, which could make mortgages more affordable and increase homebuying activity. However, the market remains competitive, and prices may continue to rise despite lower borrowing costs.

How can I find a lender who’s willing to help me build a new home in California?

Defy Mortgage helps buyers of all sorts of different backgrounds. We even have a guide on new constructions in California to get you started.

What is the forecast for home prices in Los Angeles in 2025?

Experts predict modest price growth throughout 2025. Home values increased 10% year-over-year as of December 2024, and while prices may experience a brief dip, they are expected to continue appreciating toward the end of the year.

How is the rental market performing in Los Angeles?

Rental prices have increased across the city, with rent-controlled units rising about 4% and non-rent-controlled units increasing by up to 8.9%, reaching an average rent of $2,644 per month. This strong rental demand makes Los Angeles one of the top markets for real estate investors in 2025.

Are people still moving to Los Angeles, or is there an outflow of residents?

While Los Angeles remains a desirable location, affordability concerns and shifting job trends have caused some residents to relocate to more affordable regions. The city’s unemployment rate is 5.8%, higher than the national average, which impacts some residents’ ability to purchase homes.

How did the January 2025 wildfires affect the housing market?

The wildfires displaced over 205,000 residents and destroyed many homes, increasing demand for rental properties and causing potential delays in reconstruction efforts. Additionally, insurance costs for homeowners in fire-prone areas are expected to rise.

Is the luxury housing market cooling down?

Yes, higher-end properties are staying on the market longer, as buyers are more cautious about affordability and interest rate movements. Meanwhile, entry-level and mid-tier homes continue to see strong demand from first-time buyers and investors.