For investors with complex income streams, the challenge goes beyond choosing a high-performing property. Accurate rental property analysis is essential to ensure that your investment is safe and that your financing options can support it. If you’ve been running numbers on rental properties for months, only to end up second-guessing your calculations, we’re here to help.

At Defy Mortgage, we specialize in helping ambitious, self-made earners like you. Whether you’re analyzing your first property investment or scaling to your second or third, our non-QM financing options like DSCR loans give you the ability to act quickly and confidently without being limited by strict income verification rules.

In this article, you’ll learn:

- How to evaluate rental properties based on key financial metrics.

- A step-by-step guide on how to run a complete rental property analysis.

- How specialized financing like DSCR loans can strengthen your buying power.

TL;DR

- A rental property analysis evaluates income, expenses, and financing to determine a property’s profitability and ROI. Accurate analysis helps prevent underestimated costs, unrealistic rent projections, and other surprise expenses before committing capital.

- Key inputs include purchase price, market rent, operating expenses, and loan terms.

- Rental properties generally fall into three categories: residential, commercial, and mixed-use. Each has its own advantages and challenges.

- Conducting a proper analysis includes comparing pro forma vs. actual data, calculating expenses, researching market rents, and running cash-flow metrics.

- Essential profitability metrics include NOI, net cash flow, cap rate, cash-on-cash return, GRM, and ROI.

- Rental property financing depends on the investment strategy. DSCR loans are often best for scaling a portfolio of long-term rentals, because they qualify based on the property’s income rather than personal DTI.

- Remember to choose the right lender, ideally one that specializes in investor loans. This improves approval odds, underwriting speed, and loan structure.

Why Is a Rental Property Analysis Important?

A rental property analysis is a structured evaluation of a property’s income potential. It’s important because it gives investors a detailed understanding of the property’s profitability and return on investment. This enables them to make informed real estate investing decisions according to their financial goals and risk tolerance.

A rental property analysis creates a clear, data-backed picture of how the property will perform before you commit your capital. This avoids costly surprises like underestimated repairs, weak cash flow periods, or unrealistic rent projections. It also makes it easier to compare properties with quick metrics such as:

- Property price

- Expected rental income

- Operating expenses

- Financing costs

3 Types of Rental Properties

Once you understand how to analyze a rental property, the next step is knowing what kind of property you’re evaluating. Different rental property types generate income in different ways, carry different levels of risk, and require different operating strategies and analysis metrics

1. Residential Properties

Residential properties can be split into two main categories: single-unit properties and multi-unit properties. Single-unit properties include all standalone homes, such as single-family homes, condos, townhouses, and any other properties leased to one tenant household. These properties tend to be more affordable and easier to maintain, with fewer tenants to manage, less operational complexity, and more stable long-term tenancies.

Multi-unit or multi-family properties include duplexes, triplexes, four-plexes, and apartment buildings. These properties can generate multiple income streams from a single investment, helping to mitigate vacancy risk. They also let you tap into economies of scale, which essentially means your costs can be spread out over the total number of units you operate. Since multi-family homes have one roof, one property tax bill, one lawn-care contract, etc., you can support multiple rental income streams on a single overall operating budget.

2. Commercial Rental Properties

These are non-residential properties leased to business tenants, such as offices, retail spaces, or industrial facilities. These properties often require more capital and expertise, with complex considerations such as location, tenant vetting, and local business demand, but they can offer higher income potential and stability through longer-term leases.

This is primarily because commercial tenants typically sign multi-year agreements of up to 10+ years, reducing turnover and creating predictable cash flow. They are also more likely to take on a share of maintenance and operational costs through structures like NNN (triple-net) leases, decreasing your day-to-day expenses.

3. Mixed-Use Properties

You can also combine the perks of residential and commercial properties in the form of mixed-use properties. These buildings combine residential units with ground-floor or attached commercial spaces, such as retail shops, cafes, or small offices, giving you diverse income streams within a single asset. They can also offer more balanced risk and more resilient revenue thanks to commercial lease rates and consistent residential occupation.

How to Conduct a Rental Property Analysis

Next, let’s explore how to conduct a rental property analysis. Let’s cover it step-by-step.

Pro Forma vs. Actual Data

Pro forma and actual data are distinct types of data that can be incorporated into a rental property analysis. Pro forma data relies on estimations and projections, typically from the seller, that serve as a starting point for the analysis.

However, beyond these initial numbers, it’s important to uncover actual data before closing the deal. This could include asking for previous years’ tax returns, property tax bills, maintenance records, and more to help you compare the seller’s data with historical data. Knowing the difference and comparing these sets of data can help you identify discrepancies and get a more realistic understanding of the property’s financial performance.

Determine the Costs & Expenses

Owning a rental property comes with costs and expenses that investors should consider carefully before purchasing one. Here are some of the costs associated with owning a rental property:

Upfront Costs:

- Purchase price of the investment property

- Down payment of the investment property

- Closing costs

- Marketing and leasing fees to find new tenants (if applicable)

Ongoing Costs:

- Mortgage payments

- Utilities (if not paid by the tenants directly)

- HOA fees (if applicable)

- Homeowner’s insurance

- Property taxes

- Regular maintenance and repairs

- Landscaping

- Property management fees (if applicable)

Unexpected Costs:

- Vacancy costs

- Legal fees

Understanding and planning for these expenses is an essential part of creating an accurate rental property analysis, leading to a better chance of long-term success. To help you visualize them, here’s an example scenario:

Let’s say you bought a three-bed, two-bath single-family home in Florida. The property’s purchase price was $380,000, purchased with a 20% down payment.

Upfront costs:

| Down payment (20% of $380,000) | $76,000 |

| Closing costs | $11,000 |

| Marketing and leasing fees | $1,200 |

| TOTAL | $88,200 |

Ongoing costs:

| Mortgage payment (assuming an ideal rate of 6%) | ~$2,100 |

| Utilities paid by landlord (tenants usually pay for their own utilities) | $0 |

| HOA fees | $200 |

| Homeowners’ insurance | $176 |

| Property taxes | $241 |

| Maintenance | $317 |

| Landscaping | $80 |

| Property management costs | ~$160 |

| TOTAL | $3,274 |

This means that you’ll have to have $88,200 on hand to actually acquire the property, and charge rent higher than $3,274 to turn a profit. This is above the median for a three-bedroom in Florida, ~$2,500, which may make it a weaker investment in a relatively low-rent neighborhood.

To find out whether it’s feasible to charge higher rent, you’d need to do market research.

Research Market Rent in the Area for Comp Analysis

Researching market rent in the area provides you with insights into the property’s income potential and allows you to price it competitively. As part of your research, you should conduct a comprehensive comparative market analysis (comp analysis) to identify similar properties in the neighborhood and their rental rates.

This information can typically be found on online rental platforms (like Zillow, Redfin, and more), local real estate listings, property management companies, and rental market reports. Make sure to take factors like property size, amenities, location, and condition into consideration to accurately estimate the market rent for your property. This step in creating your rental analysis report will help you set realistic rent prices, attract tenants, and maximize your rental income.

Calculate and Analyze Cash Flow

Now that we have some of the basic numbers down, let’s explore a few different calculations you should consider to determine whether a rental property is a good investment.

Net Operating Income

Net operating income (NOI) represents the property’s total income after deducting all operating expenses but before accounting for debt service (mortgage payments) and income taxes.

Operating expenses typically include property management fees, maintenance costs, property taxes, insurance, utilities, and any other recurring costs associated with running the property. This metric helps investors evaluate the property’s financial performance.

| Example calculation: Given monthly rent of $2,500, your annual rent would be $2,500 x 12 = $30,000 per year Let’s assume tenants pay for their own utilities, you manage the property yourself, and there’s no need for landscaping. Therefore, your only periodic operating expenses will be maintenance. Per the One Percent Rule of maintenance, you should set aside 1% of the home’s value each year for maintenance. If the property’s purchase price was $380,000, then your operating expenses for the first year would be $3,800. $30,000 – $3,800 = $26,200 |

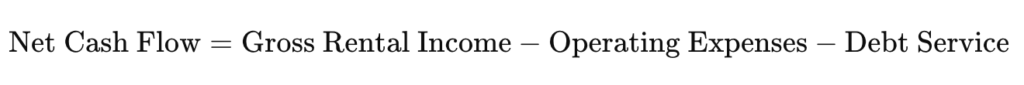

Net Cash Flow

Net cash flow represents the actual cash generated after all operating expenses and mortgage payments have been paid.

Or more simply:

This metric helps investors assess the property’s ability to generate positive cash flow and its viability as an investment. A positive net cash flow means the property is generating income, while a negative net cash flow means the property requires additional cash investment.

| Example calculation: Working off of the previous example, we already have an NOI of $26,200. Let’s reuse the ongoing expenses from an earlier example: |

| Monthly | Yearly | |

| Mortgage payment | ~$2,100 | $25,200 |

| HOA fees | $200 | $2,400 |

| Homeowners’ insurance | $176 | $2,112 |

| Property taxes | $241 | $2,896 |

| Maintenance | $317 | $3,800 |

| TOTAL | $2,793 | $36,412 |

| $26,200 – $36,412 = -$10,212 This indicates that the property has negative cash flow, and would need to raise rent or decrease expenses to turn a profit. |

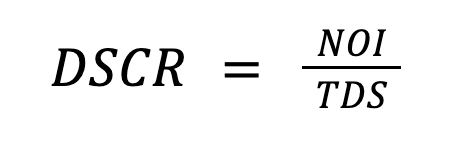

Debt Service Coverage Ratio

Debt service coverage ratio (DSCR) is the ratio between the net operating income and the total debt service (TDS), which includes all periodic expenses such as mortgage payments, taxes, insurance, and HOA fees.

DSCR serves as an easy-to-use metric to gauge how well a property can fulfill its debt obligations, and is the primary factor in DSCR loan qualification.

| Example calculation: Since we already have an NOI and a debt service figure, we simply have to divide them: |

| This means that the property is making roughly 71% of what it needs to meet its debt service obligations. At Defy Mortgage, we understand that it can take a while before rentals can reach their full potential, so we allow DSCR loans making as low as 55% of their total debt service. |

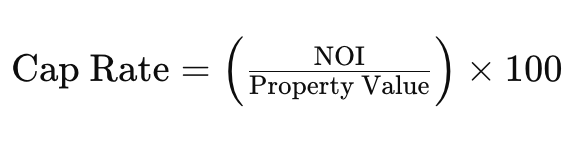

Capitalization Rate (Cap Rate)

The capitalization rate, or cap rate, represents the potential return on investment for a rental property. It’s the ratio of a property’s net operating income (NOI) to its current market value or purchase price, which provides a quick way to assess its profitability.

The cap rate helps investors to compare different properties and evaluate their income-generating potential in relation to their cost.

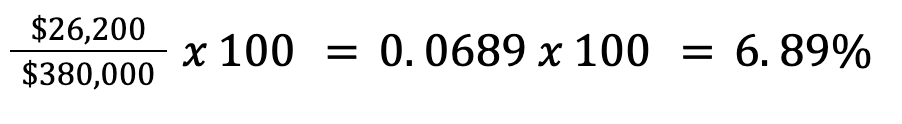

| Example calculation: Dividing our known NOI by the $380,000 property value and multiplying it by 100, we get: |

| Meaning that the property is making roughly 6.89% of its purchase price each year. |

Cash-on-Cash Return (CoC)

Cash-on-cash return (CoC) evaluates the annual return on an investor’s initial cash investment in a rental property. It provides investors with a clear picture of the immediate financial performance of their investment to assess its short-term profitability.

The annual pre-tax cash flow is the net income before taxes, and the total cash invested includes the down payment, closing costs, and any initial renovations.

| Example calculation: Given that cash flow before taxes is -$7,316, And total cash invested:

|

| Since the cash flow is negative, this indicates that the property is losing $8.25 per $100 you invested upfront, before taxes. |

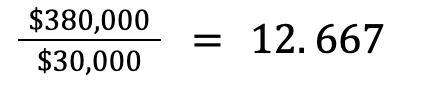

Gross Rent Multiplier (GRM)

The gross rent multiplier (GRM) is used to estimate the value of a rental property based on its gross rental income. It provides a quick way to compare investment properties without considering operating expenses or mortgage payments.

This metric also helps investors gauge how many years it would take for the property’s gross income to pay for its asking price.

| Example calculation: Purchase price: $380,000 Annual gross rent: $30,000 |

| This means it will take roughly 12 years and 9 months to make enough rent to equal the purchase price, not accounting for expenses. |

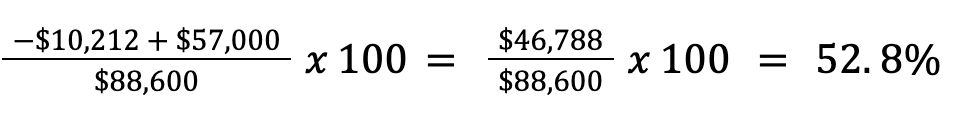

Return on Investment (ROI)

Return on investment (ROI) calculates the percentage return on the initial investment, which provides insight on how well the property is performing financially.

Here, the annual net profit is the income remaining after all expenses, including operating costs and debt service, have been paid, and the total investment includes the purchase price and any additional costs such as renovations. ROI helps investors determine the effectiveness of their investment and compare it against other potential investments or benchmarks.

| Example calculation: ROI is similar to CoC, but it accounts for taxes, tax benefits, and appreciation. Let’s say that in 10 years, the rental has increased by $57,000 in value. This has a marked positive effect on your annual net profit. Even without raising rent, your total ROI is now |

| This means that for every $100 you’ve invested, you’re making back $52.80, although that’s entirely in the form of equity. Unlike CoC, ROI takes into account all the value you’re gaining at a given point, not just cash. |

How to Decide if a Property Is a Good Investment

After completing cash flow projections and analyzing a property’s financial performance, there are a number of metrics you can use to determine whether a property is a good deal:

- Net Operating Income (NOI): A positive NOI shows the property produces more income than it costs to operate.

- Capitalization Rate (Cap Rate): Many investors look for an 8–12% cap rate, depending on market conditions and property type.

- Cash-on-Cash Return (CoC): A CoC of 8–12% is considered solid for long-term rental performance.

- Gross Rent Multiplier (GRM): A GRM between 4 and 7 usually indicates the property is well-priced relative to the income it generates.

- Return on Investment (ROI): Aim for an ROI that beats alternative investments, often 10% per year or higher.

But strong numbers alone don’t automatically make a property a “good investment.” There are also qualitative factors, such as your financial stability, your long-term goals, your tolerance for risk, and whether or not you’re willing to handle the ongoing responsibilities of a landlord. Even a high-yield property can be a poor fit if it demands more time, capital reserves, or hands-on management than you’re prepared for.

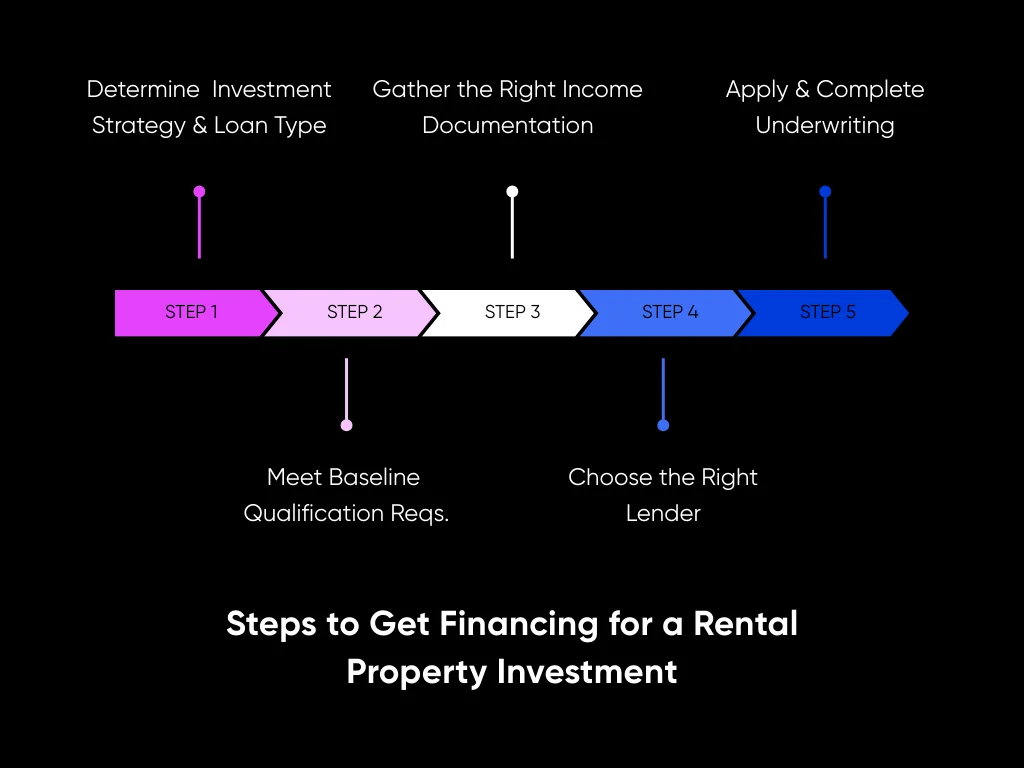

How to Get Financing for a Rental Property Investment?

Financing a rental property works differently from financing a primary residence. The main difference is that investment property loans require you to prove the profitability of a property as well as your income, credit score, and other financials. Here’s how you can qualify for rental-property financing:

Step 1: Determine Your Investment Strategy and Loan Type

Before applying, clarify whether you’re financing a rental, a fix-and-flip, or a long-term hold. If your goal is to scale rental properties, Defy Mortgage typically recommends debt service coverage ratio loans (DSCR) because their terms depend on the property’s expected rent, instead of your income or DTI.

You should consider alternative options as well: Bank statement loans, asset-depletion loans, and jumbo loans can let you access properties above your local conforming loan limit, while fix-and-flip loans and construction loans are designed to finance fixer-uppers to be offloaded onto the market quickly.

Step 2: Meet Baseline Qualification Requirements

Once you’ve decided on a loan type, you should check whether your financials fit the loan product’s requirements. For example, our DSCR loans require:

| Minimum down payment | Down to 15% with DSCR above 1.000, 720+ FICO (Max loan amount $1.5M) for SFRs only that are purchase or rate-and-term refinances. Down to 20% for 2-4 unit DSCR and cash-out refinances for the same credit score and loan amount buckets. |

| Minimum credit score | 640 |

| Proof of reserves | At least 3 months’ worth of mortgage payments, but ideally more. |

| Minimum DSCR | 0.55 No Ratio DSCR loans are available for 740+ FICO (Max 75% LTV, max amount $1M, min amount $150K) |

Step 3: Gather the Right Income Documentation

After ensuring that your financials meet the minimum requirements, you can then begin gathering the necessary documentation for your application. Here’s what you’ll usually need to prepare:

- Lease agreement: This shows the monthly rent amount, lease term, and tenant details.

- Appraisal rent schedule: You can use documents like Fannie Mae’s Form 1007 or Form 1025, to show comparable market rents when the property is new or vacant. If you’re running a short-term rental (STR) like Airbnb and VRBO, you’ll need to provide a 12-month earnings history or a report from your property management software, plus documented expenses for things like cleaning and occupancy.

- Operating expense estimates or actuals: These will help underwriters accurately calculate NOI.

- Bank statements: To demonstrate you have funds to cover down payment, closing costs, and reserves.

Step 4: Choose the Right Lender

Not all non-QM lenders specialize in investment loans. We go in-depth into how you can choose the right lender here, but as a general rule of thumb, you’ll want a lender with extensive expertise in your chosen loan type.

Defy Mortgage, for example, is a DSCR loan specialist. Each of our Mortgage Consultants has decades of experience originating investment property loans, ensuring you’re working with a team that understands investor timelines, cash-flow-based underwriting, and the nuances of scaling a rental portfolio.

Once you’ve selected a lender, you can get preapproval to verify your buying power, lock in your loan structure, and confidently make offers. After that, you can proceed to appraisal and final closing.

Step 5: Apply and Complete Underwriting

Once pre-approved, you’ll complete a full application for the specific property. For DSCR loans, underwriting focuses on:

- Projected rents and expenditures: Lenders will look at your rental documents to determine the NOI (net operating income), which will then determine your DSCR.

- Property condition and marketability: The appraisal will assess whether the property is structurally sound, rentable, and comparable to other homes in the area.

- Your financial health: In addition to your DSCR, lenders will also look at your credit and reserves. At Defy Mortgage, our DSCR loans require a minimum of 640 FICO and 3 months’ reserve. Your DTI, including mortgage payments for the property, should also not exceed 43%. If you borrow under an LLC, your personal debts won’t be considered in DTI calculation.

Because DSCR loans rely on fewer documents, investors often experience faster processing compared to traditional mortgages.

Key Takeaways

Real estate investors, self-employed workers, and other non-traditional earners face several financing roadblocks, but thanks to non-QM options, those are steadily becoming a thing of the past. With alternative income verification, non-QM financing unlocks more leverage, allowing investors to scale faster and act on opportunities that traditional underwriting may cause them to miss. But to truly maximize the potential of non-QM loans, a rental property analysis is essential.

Beyond assessing income and expenses, a proper rental property analysis should also involve comparisons with different investment property types. You’ll want to evaluate whether residential, multi-unit, or commercial assets align better with your goals, cash-flow needs, and risk tolerance, then benchmark each option using metrics like NOI, cap rate, GRM, and cash-on-cash return. Investors should also validate pro forma numbers with actual historical data, research market rents through comparable listings, and stress-test cash flow against vacancies, maintenance spikes, and rising operating costs.

If you’re ready to take the next step, Defy Mortgage is ready to assist. Wherever your income comes from, our loan programs let you qualify based on your actual income, not just what’s reflected on your tax returns. Call us today at (615) 622-1032 or schedule an appointment on our site. We always have a Mortgage Consultant available 24/7 to provide assistance and answer all of your questions.

And if you’re a mortgage broker, Defy TPO offers you the chance to extend those same advantages to your borrowers. With Defy Mortgage’s loans in your toolkit, you’ll be able to structure files around real cash flow, navigate non-traditional income with confidence, and win more deals that conventional lenders would decline. Our TPO team is made up of seasoned brokers who understand the pressure of tight timelines and complex borrower profiles, so you get hands-on support, fast turn times, and pricing designed to help you dominate the market. If you’d like to see how flexible our programs are, send us your toughest scenario, and we’ll show you exactly how we can help you close it.

Frequently Asked Questions

How important is it for investors to use accurate/realistic income and expenses when analyzing a rental property?

Very important. Like any data analysis, a rental property analysis hinges on precision. Overestimating income or underestimating expenses can lead to a bad deal that will be difficult to get out of. Accurate cash flow modeling will help you understand how much rental income will remain after operating costs, debt service, and any sudden or seasonal expenses or income downturns.

What is the 50% Rule in rental property investment?

The 50% Rule is a simple, widely used guideline: roughly half of a property’s gross rental income will go toward operating expenses (excluding mortgage payments). While it’s not a very precise estimate, it’s a quick way to gauge cash flow and filter deals accordingly.

How do you calculate the Internal Rate of Return (IRR) for a rental property?

The IRR is the annualized rate of return that makes the net present value (NPV) of all cash flows (income, expenses, and sale proceeds) equal zero. It factors in cash flow, loan paydown, and eventual sale, giving you a long-term profitability metric that’s more comprehensive than simple ROI.

What are some effective strategies for minimizing transaction costs in rental property purchases?

One key strategy is holding on to properties instead of selling them when you move out. This lets you avoid the transaction costs when selling. Plus, making investment properties your primary home for a few years before renting them out can lead to lower financing costs and significant tax cuts, especially in tax-advantaged and high-property-appreciation states.

How does a comparative market analysis (CMA) benefit rental property investors?

A CMA helps you assess what similar properties in the area are renting for, how well they’re maintained, and how quickly they lease. This gives you realistic projections for your own rental income, helps avoid overpaying, and guides your underwriting assumptions.

How does leverage impact rental property investments?

Leverage is just another way of saying debt, as in using debt to finance a property investment. As opposed to using your own capital, leverage can amplify your returns because you’re controlling a larger asset with a smaller investment (just the down payment plus closing costs initially).

About the Author: Meet Todd Orlando, co-founder and CEO of Defy Mortgage and Defy TPO. With over 20 years of experience in banking and financial services at institutions like First Republic and Morgan Stanley, Todd has dedicated his career to broadening access to lending and revolutionizing the mortgage industry, particularly in the non-QM space.

In 2022, Todd launched Defy Mortgage to provide real estate investors, entrepreneurs, and self-employed individuals with a secure, streamlined, and personalized lending experience tailored to meet their specific needs. He knows firsthand how access to the right mortgage can make or break a project and how today’s borrowers need flexible financial partners and creative lending options designed for their unique needs and lifestyles. Traditional banks are rigid, and their one-size-fits-all approach is outdated. That’s why he created Defy Mortgage — to stay ahead of the curve, set new standards in lending, and deliver personalized, non-traditional solutions for those looking to purchase or refinance.

For the third year running, Todd has been recognized by Inman News for excellence in the mortgage and lending industry, landing on their prestigious Best of Finance list for 2025. He was also honored as a mortgage finance leader in 2023 and 2024 for the same award. His visionary leadership has earned him endorsements from esteemed former colleagues at prestigious institutions across the financial services spectrum.

Beyond his work in finance, Todd is also a co-founder of two software companies in commercial lending and healthcare tech, an active real estate investor, and a husband and father of three. An industry disruptor, Todd is here to redefine what’s possible in mortgage lending.

Mortgage broker itching to elevate client offerings? Check out our TPO business, Defy TPO: https://defytpo.com/