FHA loans are particularly beneficial for first-time homebuyers in Tennessee, providing an accessible path to homeownership. The FHA loan requirements TN make it easier for individuals with a lower credit score to qualify for a mortgage loan. These loans, insured by the Federal Housing Administration (FHA), come with specific eligibility criteria designed to assist more people in achieving their dream of owning a home.

At Defy Mortgage, we simplify the mortgage process for FHA loan borrowers. Our expert team provides personalized guidance and support at every step, ensuring you meet the required minimum credit score and eligibility criteria without hassle. Catering to various home loan options, including QM and non-QM loans, we help beginner or experienced homebuyers navigate the FHA appraisal process, making your homeownership as smooth as possible.

Utilizing our industry knowledge, we’ve compiled this guide to explore FHA loan requirements TN. We’ll cover FHA loan eligibility requirements in detail, including credit score, FHA appraisal, and monthly mortgage payments. At the end of this blog, you’ll have a clear understanding of the loan limits, loan balances, and the steps to qualify for an FHA home loan.

Let’s jump in!

Eligibility Criteria and FHA Loan Requirements TN

Understanding the specific criteria is crucial when considering FHA loans in Tennessee. FHA loans, known for being less stringent than conventional loans, offer an easier path to homeownership. However, meeting the eligibility criteria and FHA loan requirements TN ensures a smoother approval process. Let’s explore these requirements in detail.

- Down Payment Requirements: Homebuyers with a credit score of 580 or higher need a minimum down payment of 3.5%. Those with credit scores between 500 and 579 must provide a 10% down payment. This flexibility makes FHA loans attractive, especially for first-time homebuyers.

- Credit Score Requirements: The minimum credit score for FHA loans is 500. A score of 580 or higher allows for a lower 3.5% down payment, while lower scores necessitate a higher down payment. Maintaining a higher credit score can significantly ease the loan approval process.

- Debt-to-Income (DTI) Ratio: The DTI ratio, calculated by dividing total monthly debt payments by pretax income, should be 43% or lower. For those with strong credit and additional cash reserves, exceptions up to 57% are possible. Monitoring monthly debt payments helps maintain a favorable DTI ratio.

- Mortgage Insurance Requirements: FHA loans require both upfront and annual mortgage insurance premiums. The upfront mortgage insurance premium is 1.75% of the loan amount. Annual premiums range from 0.15% to 0.75%, based on the loan amount and loan-to-value ratio. These premiums add to the total cost of borrowing and monthly payments.

- Income Limits: Unlike some loan types, FHA loan requirements in TN do not impose income limits. This feature makes them accessible to a broader range of homebuyers, including those with higher incomes.

- Occupancy Requirements: FHA loans mandate that the home be the primary residence for at least one year. This requirement ensures that the loan benefits those intending to live in the property rather than use it as an investment property.

Additional Considerations for Multifamily Properties

FHA loans can finance multifamily properties with two to four units. Requirements include:

- A minimum credit score of 500 with a 10% down payment, or 580 for a 3.5% down payment.

- Primary residency in one of the units for at least one year.

- A DTI ratio at or below 43%.

- Adequate cash reserves if renting out additional units.

- Mortgage insurance premiums apply similarly to single-family homes.

Understanding FHA loan requirements in Tennessee is essential for homebuyers. Meeting these criteria, including down payment, credit score, DTI ratio, and mortgage insurance, ensures a smoother home-buying experience. FHA loans offer an accessible path to homeownership, accommodating various financial situations.

Property Requirements and Appraisals

Homebuyers must understand the property requirements and appraisal process for FHA loans in Tennessee. FHA loans, insured by the Federal Housing Administration, have specific guidelines that ensure the property’s value and condition meet the necessary standards. These requirements protect both the lender and the borrower.

Here, we’ll explain what appraisers look for during the appraisal process and the conditions a property must meet to qualify for an FHA loan in Tennessee.

Appraisal Process for FHA Loans in Tennessee

An FHA appraisal evaluates the property’s market value and physical condition. The following points describe the specific aspects that appraisers focus on during this process:

- Market Value Assessment: Appraisers determine a property’s current market value by comparing the home’s purchase price with similar properties.

- Safety Standards: Ensure the property is safe for occupancy. Measures include checking for structural issues, such as cracks in the foundation or problems with the roof.

- Soundness and Security: Verify that the property is sound and secure and should not have major deficiencies compromising its structural integrity or security.

- Health Hazards: Involves identifying potential health hazards, such as lead paint, asbestos, or mold.

- Checking Utilities and Appliances: Ensuring all utilities (electricity, water, heating, etc.) and appliances are in working order and meet FHA standards.

- Permanent Foundation: Verifying that the property, particularly manufactured homes, has a stable and lasting foundation to meet FHA loan qualifications.

The appraiser provides a detailed report, known as the Uniform Residential Appraisal Report (URAR), which includes their findings and estimated costs for any required repairs. This appraisal ensures the home meets FHA guidelines and justifies the financed mortgage amount.

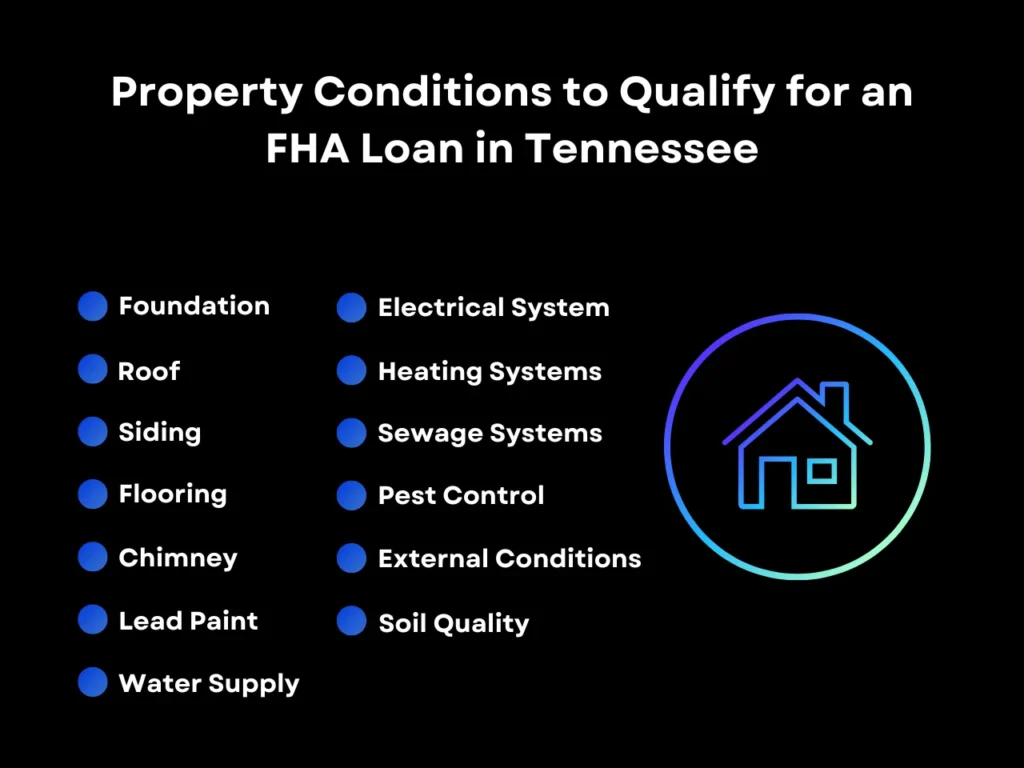

Property Conditions to Qualify for an FHA Loan in Tennessee

To meet FHA loan requirements TN, the property must adhere to the following conditions:

- Foundation: Must be stable and without significant cracks or damage.

- Roof: Should have at least two years of life remaining and be leak-free.

- Siding: Must be intact with no large gaps or missing pieces.

- Flooring: Should be in good condition without large cracks or uneven areas.

- Chimney: Must be structurally sound and adequately ventilated.

- Lead Paint: Homes built before 1978 must be inspected for hazards.

- Water Supply: The property should have access to clean, hot water and adequate drainage from the home.

- Electrical System: Must be functional and meet current safety standards.

- Heating Systems: Should be operational and capable of heating the property adequately.

- Sewage Systems: Must be in working order and compliant with local health regulations.

- Pest Control: No evidence of termite infestation or other pests.

- External Conditions: Driveways and sidewalks should be in good condition, with no major cracks or hazards.

- Soil Quality: Must be free from contaminants like heavy metals.

These conditions ensure the property is safe for occupancy and a sound investment. FHA guidelines aim to protect both the borrower and the lender from future issues related to property conditions.

Additional FHA Requirements

FHA loans come with these additional considerations:

- FHA Mortgage Insurance: Required to protect lenders in case of borrower default. This includes an upfront premium and an annual MIP.

- Closing Costs: These may include appraisal fees, mortgage insurance payments, and other expenses related to the loan.

- FHA Loan Limit: Varies by county and impacts the maximum mortgage amount FHA borrowers can receive.

- Home Equity: Important for refinancing options or obtaining additional financing.

Meeting the property requirements and navigating the appraisal process are essential steps in securing an FHA loan in Tennessee. Ensuring the property adheres to FHA guidelines helps protect the investment for the homebuyer and the lender. Prospective buyers should prepare for this thorough evaluation to avoid surprises and ensure a smooth home-buying experience.

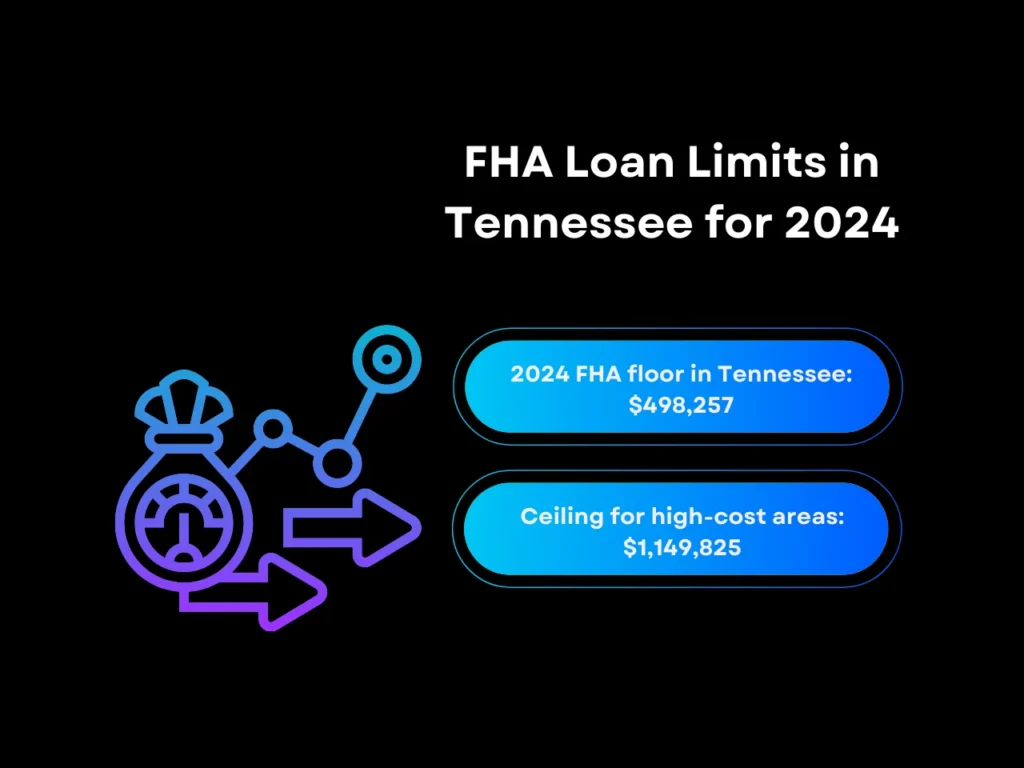

FHA Loan Limits in Tennessee for 2024

FHA loan limits in Tennessee are determined annually based on home sales data set by the Federal Housing Finance Agency (FHFA) for conventional mortgages. The FHA establishes a floor and ceiling for these limits. In 2024, the FHA floor in Tennessee is $498,257, while the ceiling reaches $1,149,825 for high-cost areas. These limits help homebuyers understand the maximum mortgage they can obtain through FHA lenders, impacting their purchasing decisions.

FHA loan limits can significantly impact homebuyers’ purchasing power. Higher limits allow homebuyers to consider more expensive homes without private mortgage insurance. This flexibility benefits those with student loans or lower monthly income, as FHA mortgage rates and requirements often offer more leniency than conventional mortgage loans.

Key Takeaway

Understanding FHA loan requirements TN is essential for first-time homebuyers in Tennessee. These loans offer a pathway to homeownership, especially for those with lower credit scores or limited savings for a down payment. Meeting the minimum credit score and down payment requirements opens doors to affordable housing. FHA loans also have specific property requirements and appraisal processes to ensure safety and value for both buyers and lenders.

Knowing the loan limits is crucial when considering an FHA loan in Tennessee. These limits vary by county and directly impact your purchasing power. Additionally, be prepared for closing costs and other fees associated with securing your loan. Proper understanding and preparation can make the process smoother. Staying informed about FHA guidelines ensures you meet all criteria, from credit reports to property standards.

Ready to explore FHA loan requirements TN further? At Defy Mortgage, we simplify the home loan process, offering tailored solutions for first-time homebuyers, entrepreneurs, and real estate investors. Visit our homepage to learn more and get started on your FHA loan application today. Your dream home in Tennessee awaits!

Frequently Asked Questions

1. What is the minimum credit score for an FHA loan in Tennessee?

A credit score of at least 580 is required to qualify for an FHA loan in Tennessee. Applicants with credit scores between 500 and 579 may still be eligible if they can provide a down payment of at least 10%.

2. How much down payment is required for an FHA loan?

FHA loan requirements in TN mandate a minimum down payment of 3.5% of the home’s purchase price. This lower down payment makes it easier for first-time homebuyers to secure financing as long as they have a credit score of 580.

3. What are the property requirements for obtaining an FHA loan in Tennessee?

Properties must meet the Department of Housing and Urban Development’s (HUD) minimum property standards. These standards ensure homes are safe, structurally sound, and secure by considering the roof’s condition, foundation, and electrical systems.

4. Are there income requirements for FHA loans?

There are no specific income requirements for FHA loans in Tennessee. However, lenders will evaluate your debt-to-income ratio, which should typically be 43%. This ratio can vary depending on your credit score but reaches up to 57%. Knowing the DTI ratio helps lenders assess your ability to manage monthly mortgage payments alongside existing debts.

5. Can I use an FHA loan to buy an investment property in Tennessee?

No, FHA loans are intended for primary residences only. You cannot use an FHA loan to purchase investment properties or vacation homes. The property must be your primary place of residence.

6. How can I apply for an FHA loan in Tennessee?

To apply for an FHA loan in Tennessee, contact an FHA-approved lender – we happen to be one of them. The lender of your choosing will guide you through the application process, which includes verifying your credit score, income, and other eligibility criteria. You can start this process online or by visiting a local or private lender’s office. If you’d like to move forward with us at Defy Mortgage, we’d love to hear from you.