Maryland ranks among the states with the highest cost of living and real estate prices in the United States, making a DSCR loan Maryland a great financing solution for real estate investors and business owners. DSCR loan requirements focus on rental income and other property revenues rather than the borrower’s personal finances. This makes it more likely to secure a loan as long as you can demonstrate a property’s income capability and your own capability to administer it.

At Defy Mortgage, we have catered to real estate investors and entrepreneurs of all kinds, offering both traditional financing options like DSCR loans and non-traditional mortgage options – primarily in the non-QM loan space – each tailored to our clients’ specific needs. Having provided scores of DSCR loans on our seamless mortgage platform to customers across the U.S, we’re highly familiar with the criteria to judge borrowers’ eligibility for DSCR loans.

With our extensive experience with DSCR loans, we’ve crafted this blog to familiarize you with the eligibility criteria for DSCR loans in Maryland and how the state’s unique real estate circumstances affect them. This blog is here to provide insight into the potential DSCR loan process in Maryland and answer any questions you might have. We’ll also give you a step-by-step guide on how to compute your DSCR ratio, along with a real-world example. Finally, we’ll discuss the main types of properties eligible for DSCR loans in Maryland and the specific criteria for each.

Eligibility Criteria for DSCR Loans in Maryland

A DSCR loan Maryland follows similar eligibility criteria to DSCR loans in other parts of the US, such as the minimum DSCR ratio, the borrower’s credit score, and other financial information. However, these can be affected by conditions specific to the type of property and Maryland’s highly competitive real estate market.

Maryland’s highly competitive real estate market can lead certain lenders to be more stringent when assessing a property’s DSCR and the borrower’s personal finances, as well as when establishing payment requirements. Investors may be required to demonstrate stronger financial stability and a higher credit score to secure favorable loan terms.

Minimum DSCR Ratio Requirements

A DSCR ratio of 1.0 conveys to lenders that the property will at least be able to cover its debt obligations, if not turn a decent profit. But DSCR lenders in Maryland usually look for a DSCR of at least 1.25, with some preferring ratios that are even higher. Sensitivity to market volatility is one of the main cons of DSCR loans, so higher DSCRs ensure that the property can still cover its debt through the ups and downs of business.

Keep in mind though that all loans have pros and cons, so just because DSCR loans have some cons, it doesn’t mean that they aren’t a valuable loan option for real estate investors, especially if you have a rental property.

Credit Score and Financial History Considerations

Although DSCR lenders focus more on the property’s capacity to service its debt obligations, a borrower’s credit score and financial history can still significantly affect their eligibility for a DSCR loan. It’s advisable to maintain a minimum credit score of 620, which is widely recognized as the baseline level of creditworthiness.

However, some lenders may see a credit score of 620 as an indicator of past financial troubles. Hence, some may ask for documents detailing the borrower’s financial history. Regardless of whether the borrower has a good financial history, some DSCR lenders in Maryland may prefer a credit score higher than the bare minimum of 620, especially considering that Maryland’s real estate market is particularly competitive. At Defy Mortgage, for reference, our DSCR loan options require a 620 minimum FICO score.

Additional Financial Benchmarks and Requirements

Different lenders focus on different criteria when determining whether or not to approve DSCR loans and what terms to offer. Depending on the property and the specific loan amount that the borrower is asking for, lenders may consider other financial benchmarks besides DSCR and credit scores.

To determine your eligibility for a DSCR mortgage loan, lenders may look into additional information, including liquidity, credit reports, tax returns, personal income verification, and net worth. These criteria help assess the borrower’s overall financial health and ability to manage additional debt. Strong liquidity and substantial net worth can positively impact loan approval and terms.

Calculating Your Debt Service Coverage Ratio

Accurate calculation of the DSCR is vital for assessing investment viability and loan eligibility. By estimating the DSCR of an investment property based on a certain lender’s average interest rate and other fees, you can determine which investment property will most likely give you the optimal interest rate and minimum loan amount with that specific lender. Then, you can decide which piece of real estate will provide the best return on investment and align with your financial goals.

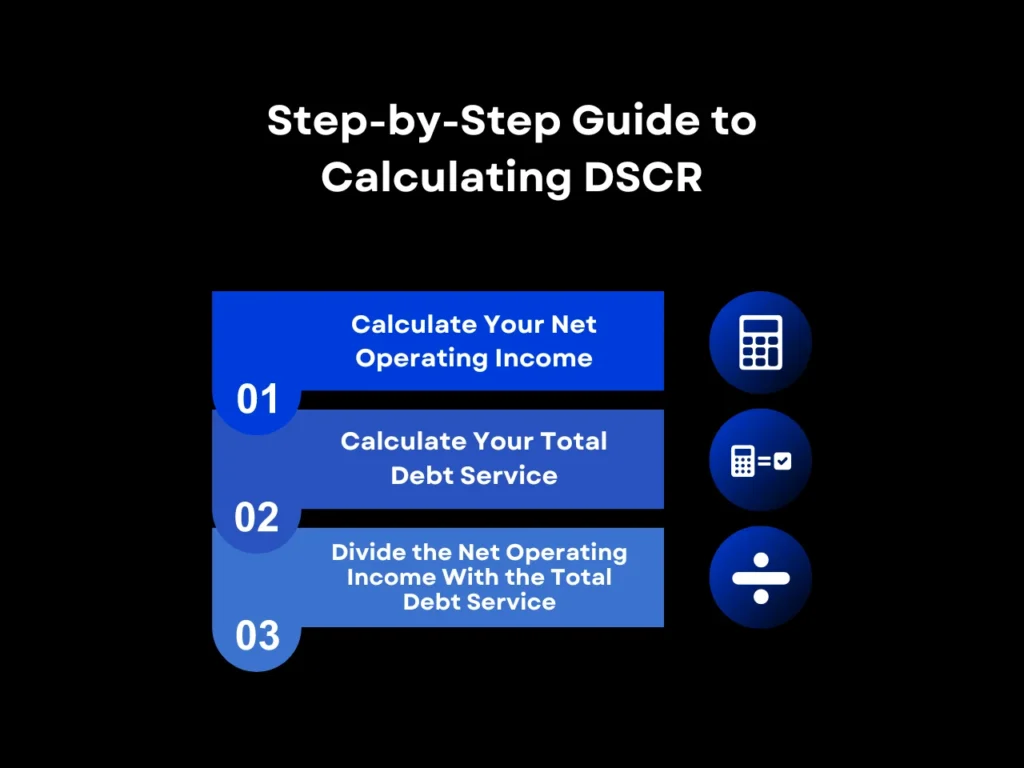

Step-by-Step Guide to Calculating DSCR

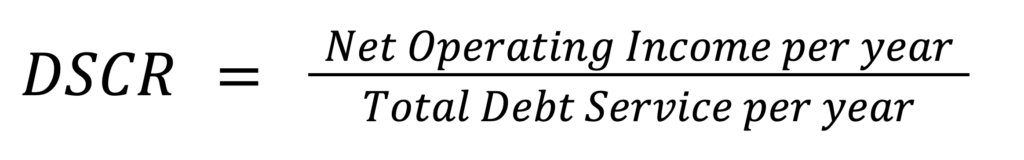

Calculating the DSCR can be done with a very simple formula. Simply divide the property’s yearly income after deducting all overhead costs by the total amount of debt obligations.

However, both of those values can require their own calculations. Follow these steps to calculate the Net Operating Income per year and the Total Debt Service per year in order to arrive at the DSCR ratio:

Step 1: Calculate Your Net Operating Income

To begin calculating your DSCR, determine how much the property earns each year after deducting all operating expenses. This will be your Net Operating Income or NOI:

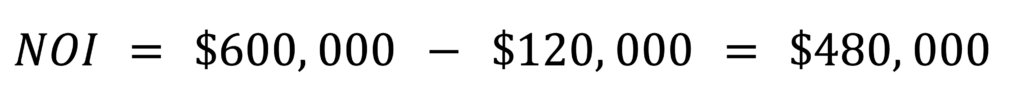

Suppose you have a property that earns a total of $50,000 from rent and other revenues each month. Multiplying that by 12 months per year, we get a gross operating income of $600,000 per year.

Then, deduct yearly expenses from the gross operating income. Say the property costs $6,000 per month in utilities, and you have to pay $500 in maintenance, $2,500 to the staff, and $1,000 in miscellaneous costs to keep the property running. This means your total overhead per month is $10,000, which, multiplied by 12, gives us $120,000 in overhead per year.

Thus, the Net Operating Income is as follows:

Step 2: Calculate Your Total Debt Service

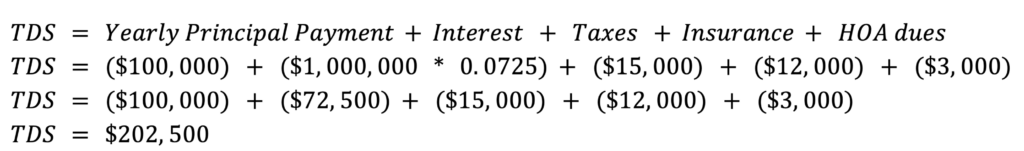

In order to find the DSCR, you need to divide the annual Net Operating Income by the total annual debt payments you have to make, also known as your Total Debt Service. To determine your Total Debt Service, you need to get the sum of your loan’s principal amount payments per year, the interest payments per year, and any other associated dues and payables related to the property, such as taxes and insurance.

Suppose you want to purchase a multi-family rental property with a DSCR loan program, whose total debt principal is $1,000,000 to be paid out over 10 years, giving us a yearly principal payment of $100,000. Let us assume that the loan will have the national average yearly interest rate of DSCR loans, which is 7.25%. Let us also suppose that you will have to pay $15,000 in taxes, $12,000 in insurance payments, and $3,000 in HOA dues annually.

Thus, the TDS can be obtained like so:

Step 3: Divide the Net Operating Income With the Total Debt Service

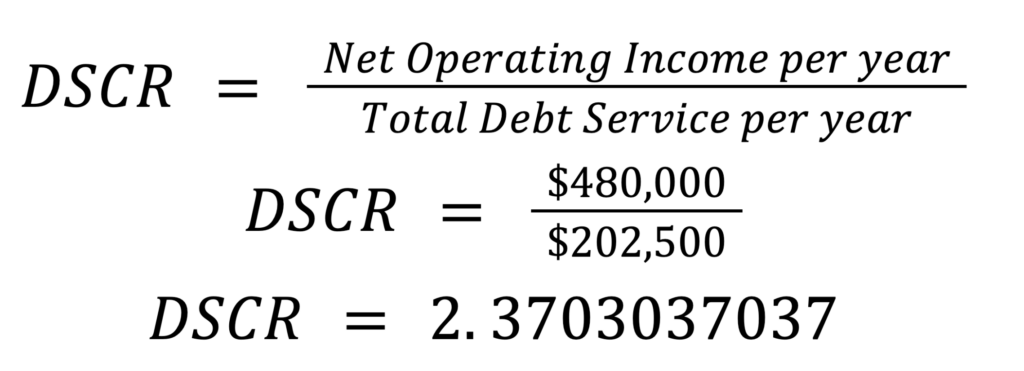

Now that we have both the net operating income and the total debt service, we simply have to divide the former by the latter to determine the Debt Service Coverage Ratio. Applying the formula:

Thus, the property has a DSCR of 2.37, meaning it makes 2.37 times the debt obligation per year in profit. Lenders prefer a DSCR of over 1.5, making them more likely to offer better interest rates and larger loan amounts.

Tools and Resources for DSCR Calculation

Various DSCR calculators are available online, with some even allowing you to add each component of the Net Operating Income and the Total Debt Service. However, the most reliable tools to use to calculate DSCR would be formula templates for Microsoft Excel/Google Sheets or financial modeling software such as Microsoft Power BI, Tableau, or Stata.

Types of Properties Eligible for DSCR Loans

Different types of properties may qualify for a DSCR loan in Maryland. Lenders focus on different eligibility criteria for each type. They may examine certain details about the borrower’s finances to ensure that they can manage the property well enough to service the debt — these are factors such as the property’s rental income, the borrower’s experience as a landlord, and their overall credit profile and financial standing.

Residential Investment Properties

Ordinarily, you wouldn’t be able to use a DSCR loan to purchase a residence for your own personal use. But if you demonstrate that the property will be used for rental purposes and can generate enough income to cover loan payments, you can get approved for a DSCR loan for residential properties, from small single-family homes to multi-unit buildings. As long as the lender finds the property’s occupancy rate, rental income stability, overall market conditions, and your own property management skills suitable, you are likely to get approved for a DSCR loan to purchase a residential property.

Obtaining a DSCR loan can be a good option for purchasing a residential real estate property due to the potential for steady rental income. As long as the property is strategically located and fairly well-maintained, you can enjoy lucrative rental potential and long-term value. However, getting a DSCR loan in Maryland for a residential property may require a higher DSCR, better credit score, and better personal finances due to the continuously rising purchase price of housing in the state.

Commercial Real Estate and Mixed-Use Properties

Commercial properties are the ideal type of investment property for DSCR loans, but mixed-use properties can be found very preferable by DSCR lenders as well. Both of these properties typically generate income from multiple sources, like retail space, office units, or residential components. Lenders assess the income streams from each of these sources to arrive at the DSCR ratio, which can include analyzing lease agreements, tenant quality, and the property’s overall market position.

However, compared to residential properties, this complex assessment may come with extra fees. Lenders must consider the mix of tenant types and lease structures, the investor’s ability to manage them, the property’s location, and the rental income stability. Regardless, the diversity of income can be advantageous, as the investor is less reliant on a single tenant or market segment.

Specialty Property Considerations

Special-purpose properties include industrial facilities and unique real estate assets, and they may qualify for DSCR loans under certain conditions. Lenders assess DSCRs based on their specialized use or location and how attractive that makes them to niche markets or specific types of tenants. This includes examining income potential, tenant demand, lease terms, and how many different uses a property can be adapted for (a beer brewery can be converted into a soda bottling plant, for example).

Specialty real estate investing comes with significant advantages but also unique challenges. Both the lender and borrower will have to look at maintenance requirements, potential for redevelopment, and overarching market trends to assess the property’s potential for long-term income generation. Securing a DSCR loan for this type of property may require more due diligence and a detailed demonstration of the property’s positive cash flow and future prospects.

DSCR Loan Maryland FAQs

1. What is the minimum DSCR to qualify for a loan in Maryland?

The minimum Debt Service Coverage Ratio (DSCR) required to qualify for a DSCR loan anywhere in the US is 1.0. However, in Maryland, you’re advised to keep a DSCR above 1.25. Keep in mind that lenders can have different preferred minimum ratios, and the type of property being financed can also affect the DSCR they’re looking for. At Defy Mortgage, however, we allow for negative DSCR ratio downs to .75.

2. Can I use a DSCR loan for a property outside of Maryland?

Yes, DSCR loans for real estate purchases are available across the United States and many other countries. However, the specific requirements and interest rates for DSCR loans may differ by location. It’s important to consult with your lender to understand the conditions applicable to your desired property location. Likewise, make sure you ask every lender which states they are licensed in as most lenders are not licensed in all states for all different loan types.

3. Are there specific lenders that specialize in DSCR loans in Maryland?

Yes, there are lenders specializing in DSCR loans in Maryland who have in-depth knowledge of the state’s real estate market. They can offer tailored solutions that align with the property’s unique requirements and your financial situation. Since they specialize in real estate, they can give you valuable insights and loan terms that are more considerate of the property’s specific circumstances.

4. How does rental income affect my eligibility for a DSCR loan?

Rental income is one of the primary sources of income for an investment property. Since DSCR is equal to the annual net operating income divided by the total debt service per year, a higher rental income can directly lead to a higher DSCR. Thus, higher rental income can lead to better loan terms, such as lower interest rates and higher loan amounts.

5. Can I Refinance a DSCR Loan in Maryland?

Yes, you can refinance using DSCR loans in Maryland. Real estate investors often employ this strategy, using the BRRRR (buy, rehab, rent, refinance, and repeat) method to maximize returns when selling a property. A DSCR cash-out refinance allows you to withdraw equity from the project, providing funds for future acquisitions.

However, be aware that prepayment penalties may apply if you pay off a 30-year DSCR loan early. Many lenders require a seasoning period of at least six months before refinancing is permitted.

Key Takeaway

Securing the best loan terms for a DSCR loan Maryland requires a clear understanding of eligibility criteria and accurate DSCR calculation. Beyond a property’s income potential, lenders can look at your credit score, financial history, and net worth, among other factors, so make sure your financial affairs are in order before applying for a DSCR loan.

Remember that each property type may have its own eligibility criteria. With the housing market in Maryland getting more expensive, you may need a good credit score, a healthy financial history, and a DSCR higher than 2 for residential properties. You may also need to display a good track record of property management, especially for specialty and mixed-use properties.

Looking for a DSCR loan with great rates and repayment terms in Maryland or a different state? Feel free to contact Defy and start a discussion about the real estate investment ventures you’re planning. We accept a minimum DSCR ratio of 0.75 – much lower than the industry standard of 1.0-1.25 – and offer a streamlined loan application without the excessive paperwork and long application process of traditional loans.