DSCR loans have surged in popularity in recent years. Unlike conventional mortgages, these loans let borrowers skip traditional income verification and qualify with rental income instead. This has allowed borrowers from a much wider range of financial backgrounds to get started as real estate investors.

But how does a DSCR loan work, and how do you get one?

At Defy Mortgage, we specialize in DSCR loans and other non-QM products, such as bank statement loans and asset depletion loans. Our expertise puts us at the forefront of our field when it comes to providing personalized and creative mortgage solutions to the most complex lending situations. With competitive rates, dedicated 24/7 support, and a seamless platform, you can be sure that your mortgage experience with us will be stress-free and straightforward.

In this article, we’ll give you everything you need to know about DSCR loans, including:

- How they work.

- How you can calculate a property’s DSCR.

- The types of DSCR loans available.

We’ll also cover DSCR loan qualifications, how to get a DSCR loan, and how to maximize your debt service coverage ratio to get the most out of your DSCR mortgage loan.

Let’s jump in.

DSCR Loans: What Are They?

DSCR loans are mortgages for residential rentals that let borrowers qualify using the property’s income instead of their own. Terms like loan amount and rates are all based on the property’s cash flow potential. This makes them more flexible than conventional mortgages, which have stricter standards.

Debt Service Coverage Ratio loans fall under the category of non-qualified mortgages (non-QM), meaning that they do not follow the lending guidelines set by Fannie Mae and Freddie Mac. This is why lenders can set different standards that can let borrowers with imperfect credit take advantage of lucrative real estate opportunities.

Debt Service Coverage Ratio: How To Calculate + Example

Debt Service Coverage Ratio (DSCR) is a figure that’s used by lenders to determine whether an investment property is generating enough income to cover its debt payments. For DSCR loans, the DSCR figure is used in lieu of the borrower’s income, which is typically used for conventional loans.

3 Steps to Calculate the Debt Service Coverage Ratio

DSCR is calculated by dividing the property’s net operating income (NOI) by the total debt service (including interest and principal payments).

This ratio helps lenders determine whether the property is making sufficient income to “pay for itself.” A DSCR above 1 suggests that the property is generating enough to meet its debt obligations. Meanwhile, a DSCR below 1 would suggest that the property isn’t generating enough income to fully cover debt payments. To put this figure in perspective, see the two examples below of a strong DSCR vs. a weak DSCR.

- Find your net operating income (NOI): NOI is the income your property makes per year after deducting all operating expenses, such as repairs and maintenance. Since tenants pay for their own utilities in most rentals, the only operating expenses are maintenance expenses. For this, we can use the One Percent Rule of maintenance, which states that you should set aside at least 1% of the property’s market value at the time of purchase for maintenance each year. Subtract this from its yearly income, and you arrive at the NOI.

- Find your total debt service (TDS): Your annual total debt service includes all fixed periodic payments that need to be made over the course of a single year, including your mortgage’s principal and interest, as well as property taxes, insurance, and miscellaneous fees such as homeowners’ association dues.

- Divide your NOI by your TDS: Once you’ve determined both your NOI and your TDS, simply divide the two to arrive at your DSCR. A DSCR above 1.0 means the property makes more than or just enough to cover its annual debt obligations, while a number below 1.0 means that it only makes a percentage of that.

Examples of Debt Service Ratio Calculations

Example 1:

Property 1 is a duplex with a purchase price of $250,000. At a 7.5% interest rate, the total monthly payments are $1,748 for a 30-year fixed mortgage. Since this property is a duplex, each unit is renting out for $1,500 per month for a total of $3,000 per month for the entire property. Assuming the 1% rule that estimates annual maintenance expenses to be equal to 1% of the property’s value, $2,500 is spent yearly on maintaining the property.

Annual debt service: $1,748 x 12 = $20,976

Annual operating income: $3,000 x 12 = $36,000

Annual operating expenses: $250,000 x 1% = $2,500

Annual net operating income: $36,000 – $2,500 = $33,500

Using the DSCR formula:

Net Operating Income / Annual Debt Service

= $33,500 / $20,976

= 1.60

In this example, Property 1’s annual net operating income is enough to cover the debt obligation by 1.6 times, which means it has a fairly strong DSCR.

Example 2:

Property 2 is a single-family home with a purchase price of $250,000. At a 7.5% interest rate, the total monthly payments are $1,748 for a 30-year fixed mortgage, and the property rents out for $1,800 per month. Assuming the 1% rule that estimates annual maintenance expenses to be equal to 1% of the property’s value, $2,500 is spent yearly on maintaining the property.

Annual operating income: $1,800 x 12 = $21,600

Annual net operating income: $21,600 – $2,500 = $19,100

= $19,100 / $20,976

= 0.91

In this example, Property 2’s annual net operating income isn’t enough to fully cover the debt obligation. Even though the monthly rent exceeds the monthly mortgage payment by $52 per month, after taking into account annual maintenance, it’s insufficient to cover it.

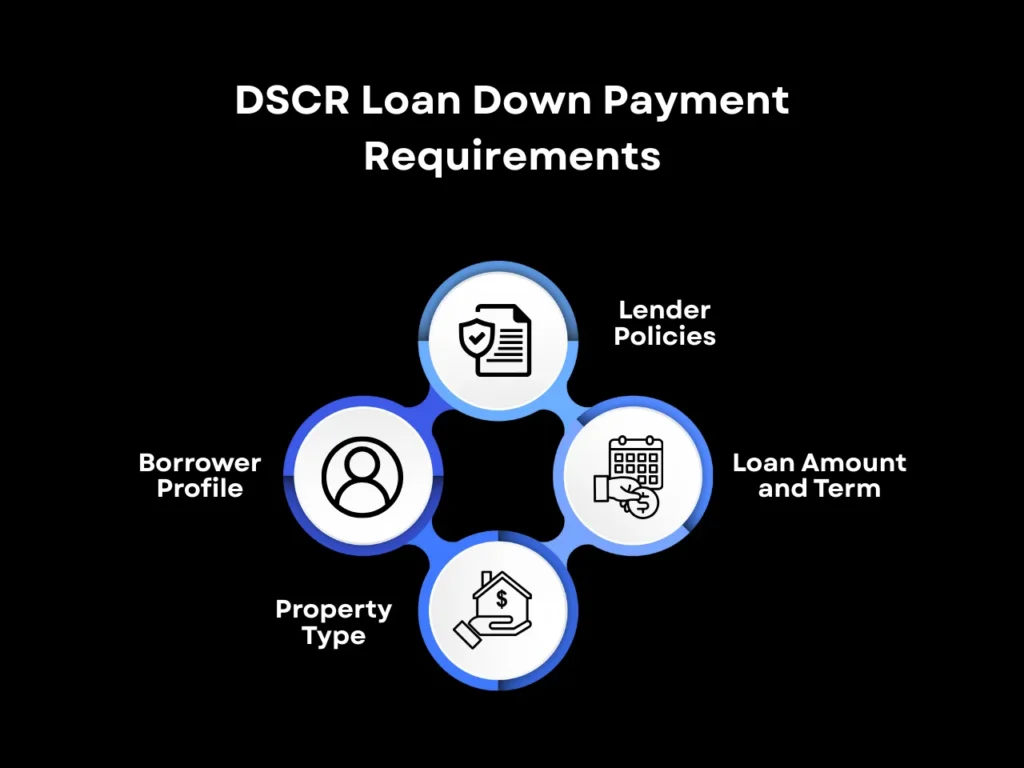

DSCR Loan Down Payment Requirements

For DSCR loans, the down payment requirements can vary depending on the lender. Generally, the down payment requirement ranges between 10% to 30% of the property’s purchase price. Several factors can also impact the down payment requirements for a DSCR loan, such as:

- Lender policies: Different lenders have their own risk tolerance and minimum down payment requirements for DSCR loans.

- Loan amount and term: Larger loan amounts or shorter terms might involve stricter down payment requirements.

- Property type: Loans for certain property types, like multi-unit buildings, might require higher down payments compared to single-family homes.

- Borrower profile: Strong creditworthiness and experience with investment properties can potentially secure lower down payment options.

It’s important for borrowers to discuss specific down payment requirements with potential lenders during the loan application process.

DSCR Loan Credit Score Requirements

While specific credit score requirements depend on the lender, DSCR loan credit score requirements can typically range between 620 and 700. Though most lenders require a minimum credit score of 680, some may be willing to accept lower scores as low as 620, depending on other factors like your DSCR ratio and down payment amount.

Having a strong DSCR figure can potentially offset lender concerns about a slightly lower credit score. Additionally, a larger down payment would result in a lower loan-to-value ratio (LTV), which would also reduce the lender’s risk. Even though some lenders might be open to allowing lower credit scores, keep in mind that higher credit scores, like 700 or above, generally unlock better interest rates and loan terms.

Despite credit score being an important element, other factors like the financial performance of the property and the borrower’s financial stability can also play a significant role in the loan approval process. For the most accurate and up-to-date information on specific lender requirements for DSCR loans, it’s recommended to contact them directly prior to applying.

DSCR Loan Pros and Cons: Explained

If you’re still evaluating whether a DSCR loan is right for you, it’s essential to consider the pros and cons to make an informed decision. For your convenience, we’ve explained the main pros and cons of DSCR loans below.

Pros:

- Flexibility and Accessibility: DSCR loans have more flexible borrower criteria. Since they don’t require income or work history, they’re more accessible to self-employed individuals or people with non-traditional sources of income.

- Options for Foreign Nationals: Depending on the lender, foreign national real estate investors can qualify for a DSCR loan for their investment property.

- Faster Approval: Using the property’s income as a qualifying factor rather than personal income streamlines the approval process compared to traditional mortgages.

- No Income Documents Required: A DSCR loan does not require income documents like W2s, pay stubs, or tax returns, making it ideal for self-employed individuals and those with non-traditional income sources.

- Flexibility With Rental Income: Use the rental income generated from your existing real estate investment properties toward loan qualification

- LLC Ownership: Property can be purchased under an LLC, which can be used as an asset protection strategy.

- Potential for Higher Returns: If the property generates more rental income than the mortgage payments, it can lead to higher returns with additional positive cash flow.

- Potential for Lower Interest Rates: Since a DSCR loan is secured by the property and its cash flow, borrowers might be able to secure a lower interest rate compared to other types of commercial real estate loans.

- Allows Borrowing for Multiple Properties: There’s no hard limit on how many properties you can buy using DSCR loans, unlike traditional mortgages.

Cons:

- Potential for Higher Down Payments: Most lenders require a minimum of 20-25% down, which may limit the access of DSCR loans to investors with less capital.

- More Stringent Requirements: Depending on the property, it may be difficult to meet the DSCR or credit score thresholds required by some lenders.

- Limited Lenders: Since DSCR loans are specialized loan products, the selection of lenders may be limited.

- Non-Standardized: DSCR loans don’t have standardized guidelines, so, unlike traditional mortgages, terms and conditions can vary significantly among lenders.

- Market Volatility: Fluctuations in the economy can potentially impact DSCR negatively. Negative impacts can come from lower income generation, higher debt obligation, or both.

The DSCR Loan Application Process

Specific loan application processes for DSCR loans may vary among lenders, but here is a general overview:

- Preparation and Gathering of Documents

- Prepare information such as rental income and operating expenses to analyze the property’s financial performance and calculate the estimated DSCR.

- Gather financial documents like bank statements, credit reports, and property information to have them ready for the lender’s review.

- Choose a Lender and Get a Pre-Approval

- Research lender options and speak to several of them to discuss your potential eligibility. Check out the top DSCR lender articles to assist you.

- Evaluate your options by considering each lender’s terms, interest rates, and requirements.

- Choose a lender that fits your needs and specializes in non-QM loans, primarily DSCR loans. We happen to be one of them!

- Get a pre-approval from your chosen lender.

- Submit Formal Loan Application

- Complete and submit the lender’s formal loan application.

- You may be required to provide additional detailed information about the property, financial documents, and anything else they ask for.

- Property Appraisal

- The lender will order an appraisal and rent schedule to verify the property’s value and market rent.

- Underwriting Process

- The lender’s underwriting team will review your application and take all eligibility criteria into consideration. Additional documentation might be requested by the lender during this step.

- This step is done by the lender to assess the loan’s feasibility and risk.

- Loan Approval

- If the underwriting process is successful, your loan will be approved and the lender will specify the terms and conditions of the loan.

- Closing

- Submit any remaining documents and finalize the loan terms with the lender.

- Schedule a closing date to sign documents and complete the closing process.

- Once everything is finalized, the funds are disbursed and the property title is transferred.

- Post-Closing

- After closing, be sure to stick to the agreed-upon loan terms and make regular payments.

- Some lenders might continue monitoring the property’s financial performance throughout the lifespan of the loan.

- Put together information such as rental income and operating expenses to analyze the property’s financial performance and calculate estimated DSCR.

- Gather financial documents like bank statements, credit reports, and property information for the lender’s review.

- Research lender options and speak to several of them to discuss your potential eligibility. Check out the top DSCR lender articles to assist you.

- Evaluate your options by considering each lender’s terms, interest rates, and requirements.

When applying for a DSCR loan, it’s important to have the necessary documents ready and be prepared for any negotiations during the underwriting process. Remember that specific requirements and application processes may vary depending on the lender. If you’re still unsure how to navigate the complexities of the DSCR loan application process, don’t be afraid to reach out to professionals like your realtor or loan officer.

The DSCR Loan Closing Process

The closing process for a DSCR loan is the final stage in securing financing for your investment property. While the process might be different depending on your lender, here’s a general overview of what you should expect:

- Title Search and Insurance

- A title search is completed to confirm that the property has no liens that could interfere with the lender’s rights.

- Typically, the borrower has to purchase title insurance to protect themselves from any potential title issues.

- Document Review

- Review documents from the lenders, such as a loan agreement, promissory note, mortgage or deed of trust, etc.

- Legal Consultation

- A legal consultation can help you determine whether the documents align with your interests and protect your rights.

- Legal professionals can help you thoroughly understand the terms and conditions outlined in the loan documents.

- Coordinating the Closing Date

- Coordinate with the lender to schedule a closing date.

- The closing date is the day when the necessary documents are signed and the transaction is completed.

- Funding Preparation

- Confirm that the funds required for the transaction, such as the down payment, closing costs, and reserves, are ready.

- Closing Statement Review

- The closing statement outlines the details of the transaction, such as the loan amount, interest rate, closing costs, and any adjustments.

- Review the closing statement carefully to ensure that all of the information is agreed upon and accurate.

- Document Signing

- Sign all required documents at the closing meeting.

- All involved parties, including borrowers and guarantors, need to be present.

- Funding

- After the document signing, the lender transfers the loan amount to either the seller’s account or the escrow agent.

- Document Recording

- Legal documents are filed with the proper authorities to officially transfer the property title to your name.

- Post-Closing

- Complete any post-closing requirements specified by the lender, which could include submitting additional documentation, providing proof of homeowners’ insurance, and making your first loan payment according to the schedule.

Keep in mind that each lender’s closing process may vary. During the DSCR loan closing process, it’s essential to be prompt with your communication and be ready with any required documents to ensure a smooth transaction. If you’re having trouble navigating the closing process, it’s recommended to reach out to your loan officer or a legal professional for assistance.

Types of DSCR Loans

Interest-Only DSCR Loans

While not all DSCR loans are interest-only, many of them offer an interest-only option. This option allows the borrower to make only interest payments during the loan’s introductory period, typically between three and ten years. Paying only the interest during this period means that your monthly payments are significantly lower compared to a traditional loan that would incorporate both principal and interest in the monthly payments according to an amortization schedule.

Not only are your monthly payments smaller, but you may be able to reap additional tax benefits by deducting interest expenses. The extra cash can then be used for other investments or expenses, like renovations or repairs. Interest-only DSCR loans can be a valuable tool for real estate investors who are looking to maximize their cash flow during the beginning stages of owning the property.

Even though interest-only DSCRs can sound enticing due to lower payments for the first few years, borrowers usually have to transition to monthly payments that incorporate both interest and principal after the specified interest-only period. This means that their monthly payments can be expected to jump in comparison to their initial interest-only payments. On top of that, interest-only DSCR loans increase the overall cost of the loan when you factor in the total interest paid over time.

Keep in mind that not all DSCR lenders offer interest-only options, so if this is a non-negotiable loan feature for you, it’s important to shop around for lenders and evaluate your options carefully.

DSCR Construction Loans

When it comes to construction loans, DSCR construction loans are different from traditional ones. Traditional construction loans typically focus on the project’s costs, along with the borrower’s income and credit score, which is more in line with a conventional loan in terms of eligibility requirements. Meanwhile, DSCR construction loans have a strong focus on the property’s income potential in the future.

Lenders use the DSCR metric to determine the property’s ability to generate enough income to cover the construction loan interest on top of future mortgage payments. Using this figure, lenders can also evaluate how viable the project is and whether the borrower has the capacity to manage the debt effectively.

In the commercial real estate world, DSCR construction loans can be beneficial for real estate developers who are looking for financing during the construction phase since the income-generating potential of the future property plays such a large factor in eligibility.

DSCR Cash-Out Refinance Options

For real estate investors looking to unlock equity in their properties, DSCR cash-out refinance options can be a great option. These involve refinancing an existing mortgage to help investors cash out equity from their property while still maintaining its income-generating potential.

A DSCR cash-out refinance differs from a traditional cash-out refinance due to the way that the lender assesses borrower eligibility. Instead of using the borrower’s income and personal credit score, the lender uses the property’s DSCR figure to determine whether the income generated by the property can cover both the existing mortgage and the additional borrowed amount.

Leveraging the property’s strong income performance allows the borrower to access cash for a variety of purposes, like renovations and repairs, debt consolidation, or other investment opportunities.

DSCR Loans for Airbnb and Short-Term Rentals

Since DSCR loans are designed for investment properties, using a DSCR loan to fund an Airbnb or short-term rental is common. Instead of using the borrower’s income as a main factor to be eligible, lenders use the property’s income from short-term rentals to determine the property’s DSCR. If the property has a strong DSCR, meaning it generates enough income to cover its debt obligation, lenders will heavily take that into account for DSCR loans. However, since income from short-term rentals can fluctuate, lenders will typically consider historical rental performance, occupancy rates, and the location of the property. A DSCR loan recognizes the unique revenue stream of Airbnbs and short-term rentals and offers a tailored financial solution for real estate investors looking for their next venture.

30-Year Fixed-Rate DSCR Loans

While 30-year fixed-rate DSCR loans exist, they’re generally less common compared to traditional mortgages. Considering that DSCR loans are typically associated with commercial real estate and real estate investing, they’re structured differently than a standard residential mortgage. Usually, DSCR loans come with shorter terms, such as five, seven, or 10 years. Although the loan term is shorter, the total loan amount may be amortized over a more extended period. At the end of the term, borrowers can either refinance the loan or pay off the remaining balance.

Even though 30-year fixed DSCR loans might not be common at this time, lending products can evolve and new products can become available through specialized lenders. By doing research and reaching out to specific lenders, you might be able to find a lending product that’s right for you.

DSCR Home Equity Loans and HELOCs

For property owners who are looking to leverage the equity in their properties, DSCR home equity loans and HELOCs offer a unique solution. DSCR home equity loans and HELOCs use the DSCR metric to evaluate the property’s income-generating potential rather than the borrower’s credit score and income. Using this metric allows property owners to access funds based on the property’s ability to cover both the existing mortgage payments and the additional debt.

Unlocking the equity in a property using a DSCR home equity loan or HELOC can help secure funding for other purposes like renovations and repairs, education, other investments, or debt consolidation. For real estate investors, these specialized financing options can be beneficial since the property’s cash flow potential plays a big role in eligibility.

4 Tips to Improve Your DSCR

DSCR loan approval and terms depend on your property’s Debt Service Coverage Ratio, so increasing it is beneficial for any investor interested in using this mortgage option. Here are some of the most effective ways you can do that:

1. Raise Rental Income

Selecting a property with better rental income potential is one of the surest ways to maximize your DSCR and get the best terms. If you already own a rental property and want to take out a DSCR refinance on it, you can improve your DSCR beforehand by conducting improvements. Things that increase rental income include amenities and services that are attractive to tenants, such as parking spaces, modern appliances, more storage, and other curb appeal enhancements such as fresh paint and landscaping.

2. Decrease Your Overhead

A major limiting factor to DSCR is the cost of operating your property. This directly impacts your NOI (net operating income) because NOI is the difference between your gross annual income and annual operating expenses. You can minimize operating costs by investing in improvements such as energy-efficient fixtures and preventative maintenance that lets you save on repairs over the long term.

3. Choose a Longer Amortization

A longer amortization structure means lower loan payments per year, reducing the total debt service (TDS) per year. A lower TDS leads to a higher DSCR.

Note that while this can yield a lower mortgage rate, a longer amortization period also leads to more interest paid over time. Remember to consult with your lender to determine whether a longer amortization would lead to more cost savings in the long term.

4. Take Advantage of Additional Revenue Potential

You can further add to your property’s NOI by tapping into additional revenue sources, such as offering advertising space to companies. Note that not all lenders consider non-rent income when calculating your DSCR.

How Defy Can Help You With a DSCR Loan

Founded in 2022, Defy Mortgage was created with the simple goal of empowering dreams, enriching lives, and elevating the mortgage experience for non-traditional borrowers. We specialize in non-QM loans after recognizing that the number of self-employed individuals, real estate investors, and gig workers is at an all-time high.

As part of our product offerings, Defy has DSCR loans catered to real estate investors with a minimum DSCR requirement of 0.75, up to 85% LTV (about 5% higher than the industry average), no tax returns needed, no maximum loan amount, and options for foreign nationals. We break down barriers for both buying and refinancing short-term-rental and long-term-rental properties, making the process smoother and more secure for real estate investors in 25+ states.

Since its establishment, Defy’s CEO has been Todd Orlando, an experienced banker who has continually disrupted the financial services industry with a history of challenging the status quo. And the best part? We close fast and make it easy. No application fees or obligations EVER when you apply. Let your investment property’s rental income do the talking.

Top States Where Defy Can Help You With DSCR Loans in 2025

Since DSCR loans are typically classified as commercial real estate loans and are catered towards real estate investors, states with growth in the real estate sector and large metropolitan areas often attract more investors. These states include:

- California

- New York

- Texas

- Florida

- Illinois

- Georgia

- Massachusetts

- Washington

- Colorado

- North Carolina

Frequently Asked Questions

DSCR Loans vs. Conventional Loans

In terms of their lending approaches, DSCR loans and conventional loans are vastly different. More commonly used in commercial real estate, DSCR loans determine eligibility mainly based on how much income the property is generating. By using the DSCR figure, lenders can assess whether the property’s income can cover its debt obligations. For real estate investors who purchase properties under an LLC, using a DSCR loan can allow them to secure financing for properties with strong cash flows even if they have poor personal credit.

On the other end of the spectrum, conventional loans use a broader range of eligibility criteria. The main criteria used for determining eligibility for a conventional loan are the borrower’s credit history, income, and debt-to-income (DTI) ratio. Although the property’s income can also be used as an additional factor for conventional loan eligibility, it’s not the sole determining factor. Because of this, conventional loans provide a wider variety of options to cater to lending needs that are outside of commercial real estate.

Are DSCR loans allowed for primary residences?

DSCR loans are typically available to real estate investors who want to acquire income-generating properties. The main metric used to determine eligibility is DSCR, which calculates whether an investment property’s income can pay off its debt obligation.

Since primary residences are usually owner-occupied, they don’t generate any rental income. If the property isn’t generating any income, the DSCR figure would automatically be zero. For primary residences, lenders offering traditional mortgages would judge eligibility by the borrower’s income, credit score, DTI, and other factors that indicate financial stability.

If you’re looking for financing options for your primary residence, it’s recommended to explore the traditional mortgage options that are offered by lenders.

What Is a good DSCR ratio?

Most lenders look for a DSCR ratio of at least 1.25, with some going as low as 1.0. DSCR is the ratio of a property’s income compared to its debt obligations after deducting operational expenses. 1.0 means it breaks even, while 1.25 means it makes 25% more than it needs to cover its mortgage payments and other obligations, so a DSCR of 1.25 or more is generally considered good.

How does a DSCR loan work?

DSCR loan programs work by assessing how a property’s net income compares to its annual mortgage payments, taxes, insurance, and other fees, such as HOA fees. This yields the Debt Service Coverage Ratio, which tells the lender whether its income can support a loan of a specified amount. The DSCR is the basis upon which approval and terms are determined, with higher DSCRs unlocking higher loan amounts and better rates.

Is a DSCR loan hard to get?

DSCR loans can actually be much easier to get than conventional mortgages, but this depends on the specifics of your investment. If you have less-than-perfect credit, but your selected property can make more in profits than its debt payments, it can be much easier for you to get a DSCR loan than other types of investment property loans.

However, if your property has a low DSCR (lower even than our minimum of 0.75 at Defy), you may have to seek alternatives, such as a P&L loan to qualify with business income instead, or an interest-only DSCR loan to minimize your monthly payment for up to 10 years, giving your investment breathing room to build up profitability.

What are the current DSCR rates?

Current DSCR rates tend to vary depending on location, but the average across the USA is currently around 7.65% for a 30-year fixed-rate mortgage with 25% down and over 1.1 DSCR. Note that while this is higher than that of conventional home loans, it is entirely possible to get a DSCR loan with a rate that can compete with that of traditional mortgages if your DSCR is high enough. You can estimate your DSCR loan rate by accounting for various factors, such as DSCR, credit spread, loan amount, and LTV ratio.

Key Takeaway

DSCR loans take the burden away from your personal finances and place it solely on the cash flow potential of the property. This makes them the best bet for individuals who have complicated financial histories but still possess the business savvy and dedication needed to make a rental property reach its fullest income potential.

If DSCR loans sound like the right move for you, make sure to do thorough research on properties and the local market, and calculate your property’s DSCR beforehand. Neglecting to check your DSCR ratio and do market research are two of the top 10 mistakes to avoid when applying for a DSCR loan. It’s also advisable to get pre-approval from a lender before committing to a purchase, so that you have a clear idea of your borrowing capacity and a strong negotiating position when bidding.

Ready to jump into the world of real estate investing with a DSCR loan? Schedule an appointment with Defy today and start your journey with our mortgage experts at your side. We’re always standing by to answer your questions and help you build your winning investment strategy.