If you’re a real estate investor looking to expand your portfolio in the Hawkeye State, a DSCR loan Iowa could be your key to unlocking new opportunities. With 19.3 million rental properties in the U.S. and a record 518,108 new apartment units set to hit the rental market in 2024, it’s a great time to be investing in real estate. Not to mention multi-family rents have increased 2.6% year-over-year as of July 2024 and the average investor’s home sold for $190,404 more than the purchase price as of June 2024.

But how can you take advantage of real estate investing when conventional loans are so tough to qualify for? This is where DSCR loans can be a game-changer.

This guide walks you through everything you need to know about DSCR loans Iowa, so you can simplify your investment property financing.

What Is a DSCR Loan?

DSCR loans are short for debt-service coverage ratio loans, which were designed with real estate investors in mind. These loans use a property’s cash flow as a basis for approval rather than your personal income, making it much easier to qualify as an investor. DSCR lenders compare the property’s net operating income to see if it’s sufficient to cover the mortgage payments.

DSCR loans fall under the category of non-QM (non-qualified mortgage) loans, meaning they don’t have to follow the strict lending standards set by the Consumer Financial Protection Bureau (CFPB). That way, DSCR lenders are free to set their own qualification requirements. Because these loans focus on the property’s cash flow, they provide more flexibility and easier qualification for investors who are looking to build their portfolios.

How Do I Calculate DSCR for an Investment Property?

When calculating DSCR for your investment property, you’ll need to gather a few important numbers first. Find out how much your property is making, the cost to operate your rental, and the mortgage payments.

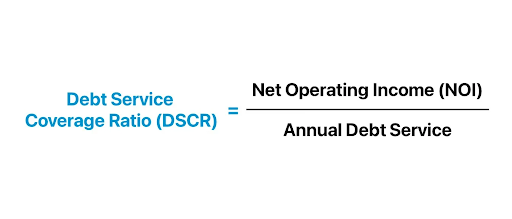

Then, you’ll first want to calculate your property’s net operating income (NOI) by subtracting your operating expenses from the property’s income. Next, take the NOI and divide it by the annual debt payments to arrive at the property’s DSCR.

Here is a simplified version of the formula:

What’s Considered a Good DSCR?

Now that you’ve calculated your property’s DSCR, you might be wondering whether you can qualify with it. If your DSCR is 1.0 or above, it means that the property is making enough in rental income to cover its monthly mortgage payments. On the other hand, if your DSCR is below 1.0, it means that the property isn’t making enough to cover the mortgage.

For most DSCR lenders, 1.25 is considered a strong DSCR. However, some lenders, like us at Defy Mortgage, accept a DSCR as low as 0.75. When shopping around for a lender, it’s important to ask them about their DSCR requirements, so you’re prepared for the application process. If your DSCR is too low, you can try to increase it by raising rent or reducing operating expenses before applying.

Using DSCR Loans to Scale Your Iowa Rental Portfolio

Real estate investors looking to grow their Iowa rental portfolios should consider DSCR loans as an option for easy, flexible financing. With the median Iowa rent at $1,175 per month, and a consistently growing population that peaked at 3.21 million in 2024 and projected to hit $3.3 million by 2030, demand for rental properties is expected to remain strong. On top of that, the median sale price of an Iowa home has jumped 45.5% between January 2020 and August 2024, providing potential for capital appreciation in addition to rental income.

With DSCR loans, you have the opportunity to qualify for more than one loan at a time, helping you achieve your Iowa investment property goals even faster.

DSCR Loan Iowa Requirements

The requirements for a DSCR loan vary since lenders set their own qualification criteria – just because one lender requires something, doesn’t necessarily mean all DSCR lenders will require the same thing. When shopping around for lenders, it’s important to ask about their specific requirements to make sure you’re prepared when it comes time to apply.

Although we can’t speak for other lenders and their requirements, here are our DSCR loan requirements at Defy:

- Minimum DSCR ratio of 0.75

- Minimum FICO score of 620+

- Maximum LTV of 85%

- 3 months cash reserve

- No maximum loan amount

- No income documents or tax returns

- Interest-only options available

DSCR Loan Iowa Lenders

A key to making the most out of your real estate investing journey is to partner with the right DSCR lender, especially in a state with growing demand and rising home values. Before jumping in, it’s smart to consider all your options before choosing a lender – committing to a mortgage is a big decision for anyone. Work with a lender who understands Iowa’s real estate market and can offer you flexible terms to help expand your rental portfolio.

At Defy Mortgage, we’re proud to offer customized DSCR loans that you can qualify for based on your property’s income instead of your personal income. Our team of experienced mortgage experts can help you secure the right financing to reap the benefits of your investment – book a free call with us today or give us a ring at (615) 622-1032 to learn more about what we can do for you.

DSCR Loan Iowa Interest Rates

Interest rates for a DSCR loan Iowa can vary depending on a few factors like your credit score, the lender, and the current market rates. While it’s possible to get competitive rates for DSCR loans, they usually tend to be slightly higher than conventional loan rates. Even though higher rates aren’t ideal, many real estate investors often find that it’s worth it for the opportunity for further exposure into the real estate market.

DSCR Loan Iowa Down Payment

Just like interest rates, down payments for DSCR loans can also vary based on factors like your credit score and the lender’s requirements. You’ll most likely need a down payment of anywhere between 15-30%. At Defy, our minimum down payment amount is 15%, but it could be higher depending on your credit score. A larger down payment is a larger investment upfront, but it makes it easier to meet the DSCR requirements and improves your chances of approval.

DSCR Loan Benefits and Drawbacks

Benefits:

- Personal income documentation not required

- Get approved based on the property’s rental income

- Easier to qualify for investors and individuals who have non-traditional income sources

- Opportunity to finance a variety of rental property types, including single-family, multi-family, and commercial properties

- Scale your rental portfolio faster with no hard limit on how many DSCR loans you can have

Drawbacks:

- Slightly higher interest rates in comparison to conventional loan rates

- Larger down payment requirements compared to conventional loans

- Primary residences are not eligible since properties need to be income-generating

Is an Iowa DSCR Loan Right for You?

Ultimately, deciding on whether an Iowa DSCR loan is right for you depends on your investment goals and financial situation. If you’re a real estate investor who’s focused on rental properties and prefers a loan that considers property income over personal income, then a DSCR loan could be a great fit for you. Assess the cash flow potential of the property you plan to buy, along with whether you can put down a larger down payment (15-30%). Also, consider if the flexibility to finance multiple properties aligns with your investment strategy for scaling your rental portfolio in Iowa’s growing market. If all of these factors match your investment strategy and goals, an Iowa DSCR loan might be an ideal choice.

Alternatives to an Iowa DSCR Loan

If you decide a DSCR loan Iowa isn’t for you, you’ve still got options. For those with non-traditional income, consider these loans instead:

- Bank Statement Loans: Qualify using your bank statements from the past 12-24 months. Ideal for self-employed individuals or those whose true income isn’t accurately reflected on their tax returns.

- P&L (Profit & Loss Statement) Loans: Qualify using your business’ CPA-prepared P&L statement. Ideal for business owners that can show a proven track record of steady cash flow.

- Fix-and-Flip Loans: Qualify based on historical experience for financing to buy, renovate, and sell a property for a profit. Ideal for real estate investors who are more interested in flipping homes quickly for a profit.

- Construction Loans: Qualify based on historical experience or construction plans to build a new property from the ground up or make major renovations on an existing property. Ideal for real estate investors who are looking to capitalize on new builds and high housing demand.

- Asset Depletion Loans: Qualify using your liquid investments, such as savings, investment, and retirement accounts. Ideal for those with little to no documented income, but have a large nest egg in liquid assets.

Ready to Start Your Real Estate Investing Journey?

Your real estate investing journey is unique, just like you. Don’t settle for an average DSCR loan, you deserve top-tier service and loan terms to get started on the right foot. Contact us at Defy Mortgage to see how we can help set you up for success.

DSCR Loan Iowa FAQs:

- What is a DSCR loan?

A DSCR loan, short for a debt-service coverage ratio loan, is a type of mortgage that bases your approval on the property’s cash flow rather than your personal income. It’s a great tool for real estate investors to scale their portfolios using rental income without their personal income limiting how much they qualify for.

- How do you calculate DSCR?

To calculate DSCR, you’ll need the property’s rental income, operating expenses, and mortgage payments. First, calculate the property’s net operating income (NOI) by subtracting the operating expenses from the rental income. Next, take this number and divide it by the annual mortgage payments to get your DSCR.

- What is the minimum DSCR needed to qualify for a DSCR loan in Iowa?

The minimum DSCR required to qualify depends on the lender, but 1.25 is generally seen as a strong DSCR. Some lenders, like us at Defy Mortgage, allow a DSCR as low as 0.75 to qualify.

- What types of properties can I finance with a DSCR loan in Iowa?

You can finance all different types of properties with a DSCR loan in Iowa, including single-family, multi-family, and commercial properties, as long as it generates enough rental income to cover its debt payments.

- Can I use a DSCR loan in Iowa to finance multiple properties?

Yes! The great thing about DSCR loans is that there’s no hard limit to how many of them you can have, meaning you can grow your portfolio faster without limits.

- Do I need to provide personal income verification for a DSCR loan in Iowa?

Nope! Personal income verification for a DSCR loan isn’t required.

- What are the credit score requirements for a DSCR loan in Iowa?

The exact credit score you’d need to qualify for a DSCR loan depends on the lender, but you can expect most lenders to have a minimum credit score requirement of around 620-680. At Defy Mortgage, you need a minimum FICO score of 620 or above to qualify.

- Can I refinance an existing investment property with a DSCR loan in Iowa?

Yes! You can refinance an existing investment property with a DSCR loan in Iowa.

- Are DSCR loans in Iowa available for short-term rentals like vacation homes or Airbnb properties?

Yes! DSCR loans in Iowa can be used for short-term rentals like vacation homes or Airbnb properties as long as they’re making enough income to meet the lender’s DSCR requirements.

- What is the down payment requirement for a DSCR loan in Iowa?

Down payments for a DSCR loan in Iowa depend on the lender’s requirements and your credit score, but generally you can expect to put down 15-30%. At Defy, we require a minimum down payment of 15% for our DSCR loans.

- How long does it take to close on a DSCR loan in Iowa?

It typically takes between 30-45 days to close on a DSCR loan in Iowa depending on the lender’s process and your application. While this is the industry average, at Defy, we strive to get your DSCR loan closed in as little as two weeks.

- Can I qualify for a DSCR loan in Iowa if my property is not currently generating rental income?

Yes, it’s possible to qualify for a DSCR loan Iowa based on projected rental income if your property’s not currently leased. Keep in mind that a rental appraisal or market analysis might be required in this case to calculate an accurate estimate of the property’s income.

- What are the benefits of using a DSCR loan for real estate investors in Iowa?

DSCR loans provide a flexible financing option for investors, as they focus on property income rather than personal income, making it easier to qualify. You can also finance multiple properties and often have fewer restrictions on property type, helping you quickly scale your portfolio.