Recognized as one of the top 3 states to do business by CNBC, North Carolina is the perfect candidate for investors who want to tap into its ever-growing need for rental properties. This makes flexible financing options such as a DSCR loan NC an important part of your research.

At Defy Mortgage, we specialize in unconventional mortgage products for unique investment scenarios. From DSCR loans to bank statement loans, each of our non-QM solutions is completely customizable to fit your goals. Whether you’re an entrepreneur, freelancer, or real estate investor, we can give you expert support and guidance to navigate any financial situation.

In this blog, we’ll cover the various aspects of DSCR loans in North Carolina: how DSCR loans work, why they’re particularly advantageous for NC investors, and what you need to do in order to get approved for one.

Let’s get started!

What Is a DSCR Loan NC?

A DSCR loan NC is a type of mortgage that uses a property’s income potential as the primary qualifier and determiner of terms, instead of the borrower’s personal income and financials. DSCR loans are particularly advantageous in North Carolina, where the rental market is rapidly growing.

How DSCR Loans Work in North Carolina

DSCR loans are distinct from many other investment real estate loans in that they base loan eligibility and the terms offered on the property’s capacity to generate income. Let’s take a deeper look at how it works:

Understanding the Debt Service Coverage Ratio

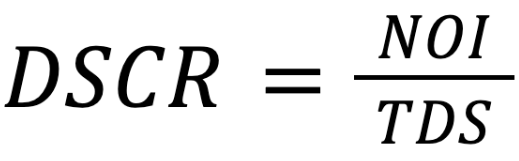

The debt service coverage ratio (DSCR) is simply the ratio between the property’s income after deducting expenses and its annual debt obligations, also known as its total debt service. Lenders use DSCR to determine whether a property generates enough profit to cover its debt. A DSCR of 1.0 means that the property essentially breaks even, making just enough money to pay for its mortgage and other debt obligations. The formula for calculating DSCR is as follows:

Where NOI (net operating income) is the property’s yearly income after subtracting yearly expenses, and TDS (total debt service) is the sum of the annual mortgage loan payments and any recurring fixed costs that must be paid regardless of whether or not the rental is operational, such as taxes and homeowner’s association dues.

As an example, let’s say you want to purchase a two-unit multi-family rental for $450,000 in North Carolina using a DSCR loan. Given that utilities are typically paid for by the tenant, your only operating expenses in most cases will be maintenance.

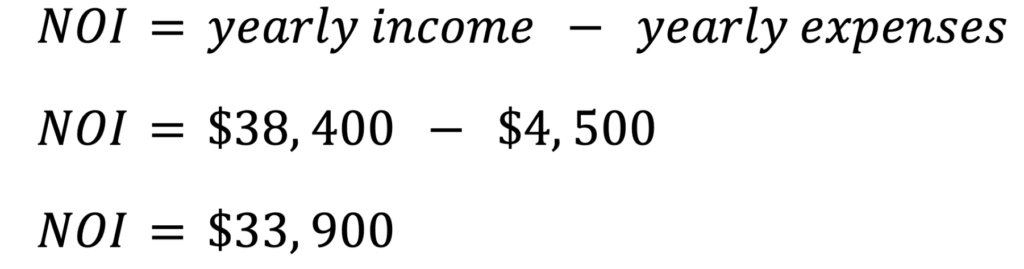

Following the one percent rule of property maintenance, which states that you should set aside 1% of the property’s purchase price for maintenance per year, this comes up to $4,500 in maintenance expenses each year. Given a monthly rental income of around $1,600 for a 2-bedroom unit, the property will earn $3,200 per month or $38,400 per year. Subtracting $4,500 from that gives us this NOI:

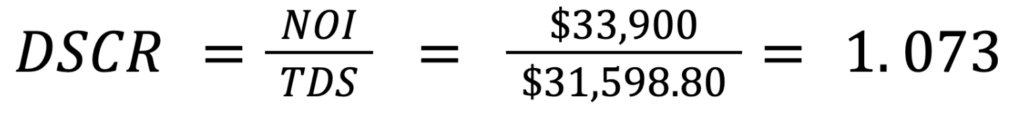

As for the total debt service (TDS), we add the annual mortgage debt payments and any recurring fixed costs such as homeowner’s association dues, property taxes, and insurance. Closing costs are not typically factored in unless they are rolled into the loan payments.

Assuming an interest rate of 6.125% and 20% down for a 30-year fixed-rate DSCR mortgage, the principal amount to be paid will be $360,000, resulting in monthly payments of $2,187.40 or an annual debt obligation of $26,248.80.

Adding nominal yearly HOA fees of $1,200 and using the NC property tax rate of 0.7% of the value of the property, as well as an additional $1,000 in insurance premiums, we arrive at the following total debt service (TDS):

Given that, we can calculate the property’s DSCR using the basic formula above

The above DSCR means that the property can make just a little more than what it needs to cover its debt obligations. This is often just enough for the average DSCR lender to consider approving a DSCR loan, but at Defy, this exceeds our minimum expectation of 0.75 DSCR, meaning that you can potentially get better rates with a DSCR of 1.0 and above.

Why NC Real Estate Investors Choose DSCR Loans

North Carolina’s real estate market has become increasingly attractive to investors. Factors like its high-growth metropolitan areas and favorable market conditions make debt service coverage ratio loans an appealing financing option for those looking to invest. We’ll break down these factors more in detail:

High-Growth Metropolitan Areas

North Carolina’s metro areas are experiencing astonishing growth. Between 2003 and 2023, North Carolina’s population grew 28.6% and is projected to become the 7th most populated state by 2030s. Here are some of the best metropolitan areas in NC to invest in:

- Charlotte: According to the 2024 U.S. Census Bureau estimates, Charlotte gained over 61,000 people in 2024 alone, a 2% increase from 2023. This places it just outside the top ten booming metro areas in the country. Housing prices continue to rise at a sustainable pace in Charlotte, and inventory is down 3% between January 2025 and January 2024. Housing experts note that there is not enough construction to meet demand–a perfect environment for residential rentals.

- Raleigh-Durham: The Raleigh-Durham area is experiencing significant job growth, adding 27,400 jobs between 2023 and 2024–an increase of 2.6% and well above the national average at the time. The area also exhibits some of the highest demand for rentals in the US, particularly for multifamily units. The latest report from Avison Young shows a significant surge in demand, ballooning to 15,812 multifamily units by Q4 2024, the highest ever recorded in the area.

- Asheville and the Outer Banks: With several popular tourist destinations, Asheville and the Outer Banks present a promising market for short-term rentals (STRs). Asheville is particularly popular among beer enthusiasts, having earned the name “Beer City USA” thanks to its large number of breweries. In 2023, a record 14 million international and domestic tourists visited Asheville, with 5 million of them being overnight guests seeking accommodations such as hotels and STRs.

Favorable Market Conditions

Housing market conditions across North Carolina are creating attractive opportunities for investors. Let’s take a look at some of the most impactful ones:

- Increasing property values: While the NC housing market has had its ups and downs in recent years, home market values show a general trend of increasing, with median sale prices reaching $367,500 in February 2025, up from $245,200 in February 2020. This indicates positive returns from both rent and resale.

- Strong rental income potential: Demand for rental properties in major cities like Raleigh and Charlotte is sky-high and shows no sign of slowing down. In Q3 2024, the quarterly absorption for multifamily properties in the Raleigh-Durham area reached a 20-year high at 2,300 units.

- High market resilience: North Carolina’s housing market, particularly in major metros like Charlotte, displays a high amount of resilience through economic shocks and interest rate fluctuations. Despite these challenges, growth continues at an accelerating pace, attracting more and more investors.

DSCR Loan Requirements in North Carolina

DSCR loan requirements in NC are pretty similar to those in most other states. Here’s what you’ll need to qualify:

Minimum DSCR Ratio

Lenders typically look for a DSCR of at least 1.25. A DSCR requirement of 1.25 means that the property needs to make 25% more than it needs to meet its total debt service, to leave room for any interruptions in its income stream. Some lenders may go as low as 1.0. At Defy, however, we provide DSCR loans for properties with DSCR ratios as low as 0.75.

Down Payment & Credit Score

Down payment is usually defined by the loan-to-value ratio (LTV), which is the percentage of the property’s purchase price that the lender is willing to finance. The remainder is left to the borrower to cover as the down payment. Common LTV ratios for DSCR loans can range between 75%-80%, but at Defy, our DSCR loan LTVs go up to 85%, meaning you only have to put 15% down to close on a new investment property.

Credit scores are much less of a concern with DSCR loans, with most lenders offering them to borrowers with FICO scores of at least 620-650. At Defy, the minimum credit score we look for is 620.

Property Eligibility

The basic requirements for a property to be eligible for a DSCR loan are that it be purely an investment property–meaning it cannot be owner-occupied–and that it generates income. However, most lenders primarily focus on DSCR loans for residential real estate, but sometimes consider commercial properties as well.

Eligible property types include:

- Single-family rentals

- Multi-family properties

- Short-term rentals

- Mixed-use properties

- Commercial properties

Pros and Cons of DSCR Loans in NC

A DSCR loan North Carolina offers a range of benefits for real estate investors. Here’s a breakdown of the biggest advantages (and a few challenges to keep in mind):

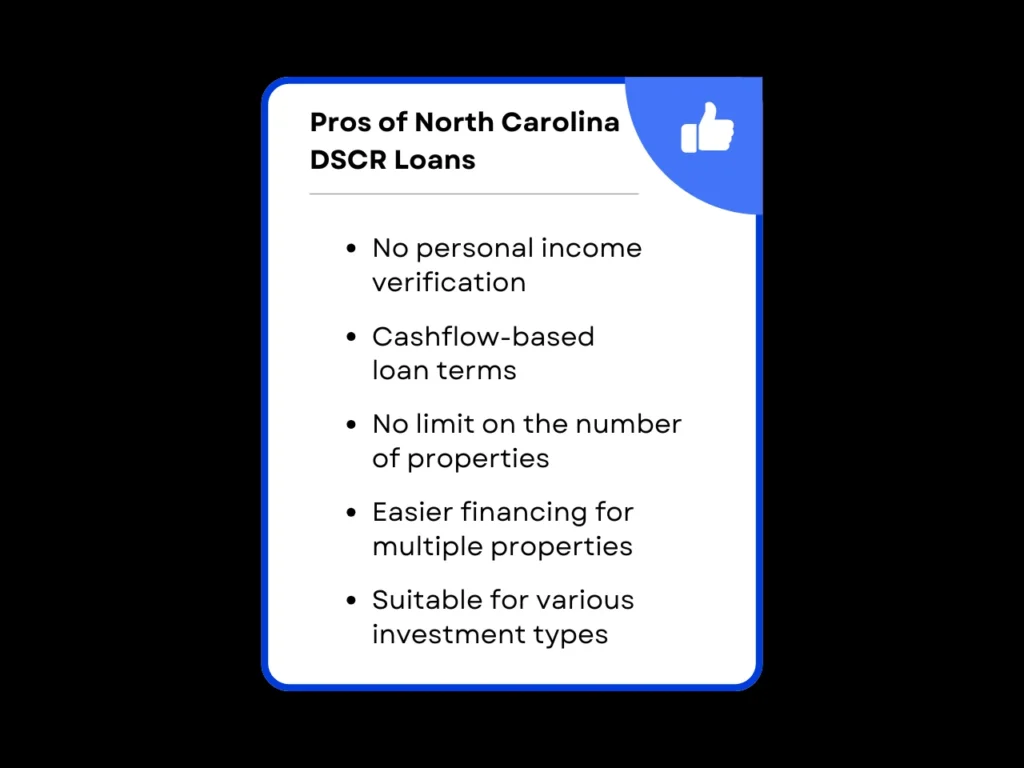

Pros of North Carolina DSCR Loans

- No personal income verification: DSCR loans don’t require you to verify your income with W-2 income, pay stubs, tax returns, or bank statements. This makes for a much smoother and faster underwriting process.

- Cashflow-based loan terms: DSCR loan terms are based primarily on your property’s income potential, not your personal credit or income. This means that even with a modest income or less-than-perfect credit, you can get competitive rates and high loan amounts as long as the property you want to purchase has a high DSCR.

- No limit on the number of properties: There is no hard cap on how many DSCR loans you can have active at any one time. You can add several properties to your portfolio simultaneously, as long as your lender is confident in the ability of each of those properties to meet their mortgage debt obligations. This allows you to quickly scale your portfolio and your rental income.

- Easier financing for multiple properties: DSCR loans are completely self-contained, meaning they are primarily concerned with the potential performance of the property, with minimal attention to outside factors. This means you can get a DSCR loan with favorable terms for a specific property regardless of how the other properties in your portfolio are performing.

- Suitable for various investment types: DSCR loans are highly suited to both long-term and short-term rentals, making them ideal for hybrid real estate investment strategies that capitalize on both high-traffic tourist destinations like Asheville and high-demand rental markets such as Charlotte and Raleigh.

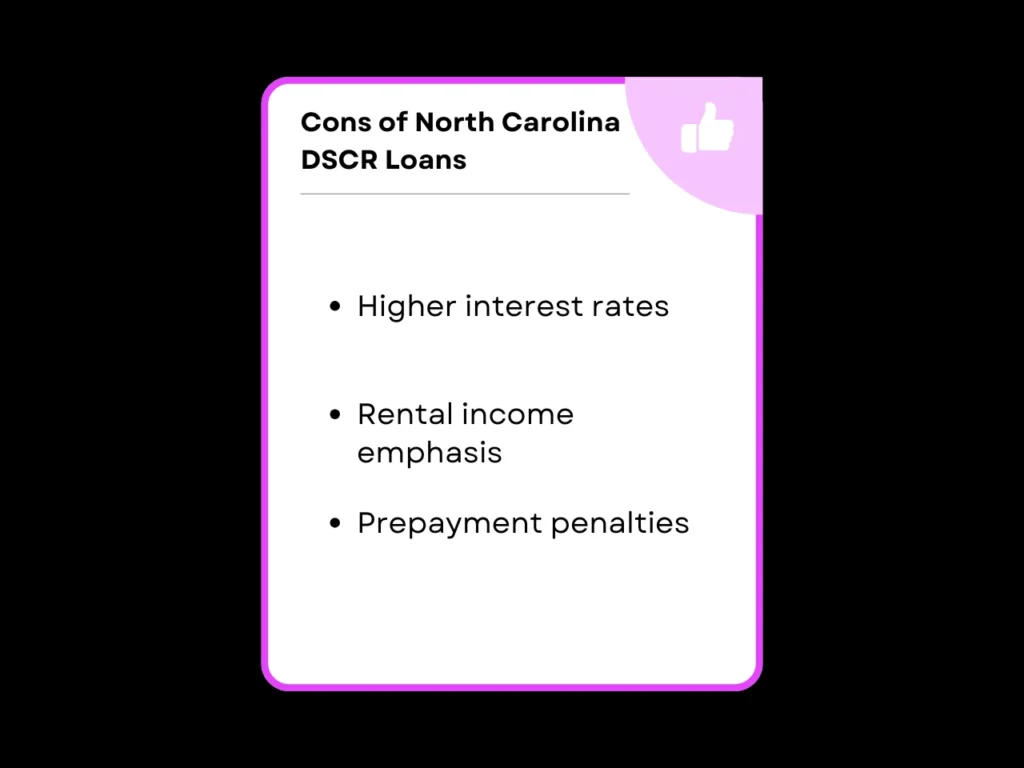

Cons of North Carolina DSCR Loans

- Higher interest rates: DSCR loan rates typically start higher than that of conventional loans. However, properties with high income potential can significantly offset this, leading to a rate that can compete with conventional mortgages at high FICO scores.

- Rental income emphasis: DSCR loans rely on the property generating rental income, making them generally incompatible with buy-and-hold strategies where the holder is uninterested in renting out the property.

- Prepayment penalties: Some DSCR loans include prepayment penalties, most often following the “5-4-3-2-1” structure, where the penalty decreases each year over a five-year period—starting at 5% of the outstanding loan balance in the first year, then reducing by 1% annually until it reaches 1% in the fifth year. Make sure to review loan terms carefully to fully understand what penalties your lender imposes.

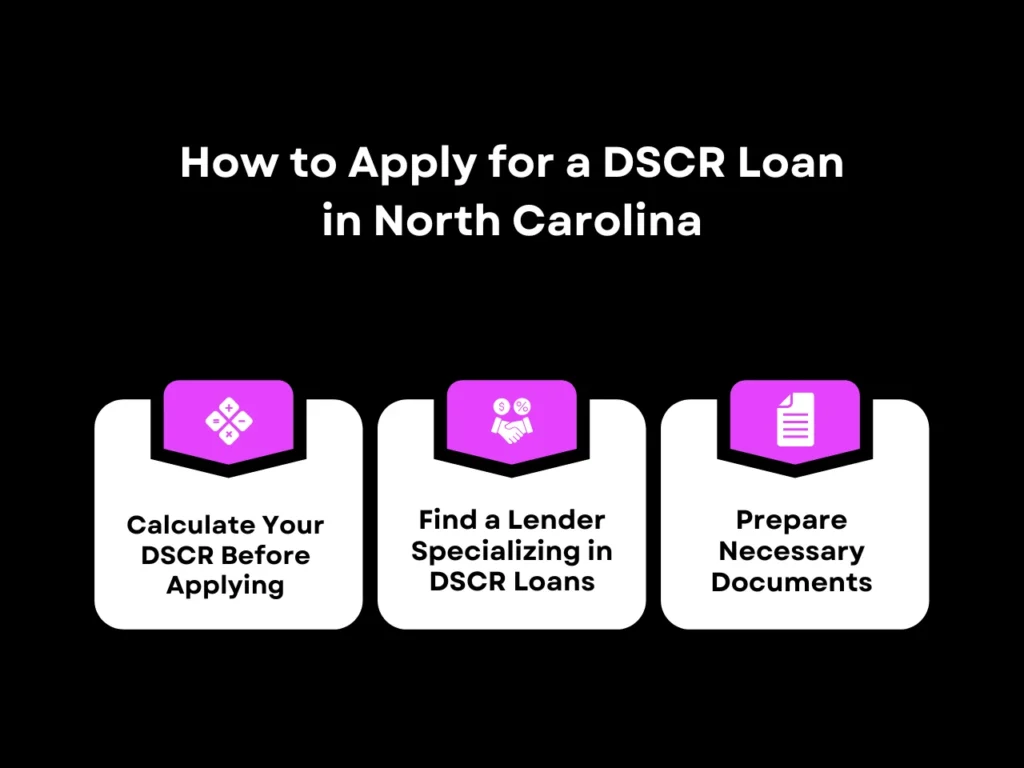

How to Apply for a DSCR Loan in NC

Applying for a DSCR loan in North Carolina is similar to applying for a traditional loan but with more emphasis on the property’s income potential. Here’s a step-by-step approach for investors to use to maximize their approval odds:

Calculate Your DSCR Before Applying

Calculating the debt service coverage ratio (DSCR) for your chosen property should be your first step, as it helps determine how likely you are to get approved and secure favorable rates. If the property’s DSCR is less than ideal, it may be better to shortlist a few other properties with higher income potential to see if you can further increase your ROI.

Find a Lender Specializing in DSCR Loans

Once you’ve confirmed the property you’d like to purchase, be sure to work with a lender who knows the local market well and specializes in providing DSCR loans. Lenders who focus on non-QM loans and have in-depth knowledge of regional trends are more likely to offer favorable terms tailored to your goals.

Defy has been offering personalized support to real estate investors since day one. With deep expertise in North Carolina’s real estate landscape, we provide flexible non-QM solutions such as DSCR to align with your property’s cash flow and long-term strategy.

Prepare Necessary Documents

DSCR loans focus primarily on rental income, so it’s important to gather lease agreements and property cash flow analysis documents. If you’re purchasing a short-term rental, you should also provide the last 12 months of receipts to demonstrate consistent income. If borrowing through an LLC, documents such as the Certificate of Formation and Operating Agreement may be necessary. Any renovation documentation will also be helpful to support the findings made by the lender’s appraisal.

DSCR Loan NC FAQ

What DSCR ratio do I need to qualify for a loan in NC?

Lenders’ preferred DSCR ratio can vary, but they typically require a DSCR between 1.0 and 1.25. At Defy Mortgage, we offer DSCR loans with ratios as low as 0.75, giving investors more flexibility.

Does Defy Mortgage offer DSCR loans for short-term rentals in North Carolina?

Yes! Defy specializes in DSCR loans for both long-term and short-term rental properties across North Carolina. Whether you’re investing in vacation rentals in Asheville or multifamily properties in Charlotte, we can help you secure the right financing.

Can I refinance my investment property with a DSCR loan through Defy Mortgage?

Absolutely. Defy Mortgage offers refinancing options such as DSCR cash-out refinance, which lets investors tap into the equity stored in their rental properties. DSCR rate-and-term refinance also allows investors to take advantage of their property’s cash flow for improved loan terms.

Do DSCR loans impact my personal credit report?

Typically, DSCR loans are not reported to personal credit bureaus, especially if it’s been taken out under a business entity such as an LLC. However, this can vary from lender to lender. Be sure to review the loan terms carefully and consult your lender to fully understand the extent of the credit impact.

What types of properties are eligible for a DSCR loan in NC?

Eligible properties for DSCR loans in North Carolina include single-family rentals, multifamily units, short-term rentals, and mixed-use properties. Depending on the cash flow potential, this can also include commercial real estate as well.

How fast can I close on a DSCR loan with Defy Mortgage?

With our streamlined approval process, you can typically expect to close between 30 and 45 days. Please note that the exact timeline will heavily depend on document preparation and other factors.

Key Takeaway

North Carolina’s flourishing, diverse economy is attracting jobs, investment, and new residents alike, creating an ideal environment for various investments. A DSCR loan NC provides a flexible financing solution for real estate investors interested in collecting rental income while the property appreciates over the long run.

This is a great strategy for single-family rentals in high-income locales such as Charlotte, or short-term rentals in popular tourist attractions like Asheville. Paired with its low tax rate and affordable property values, NC’s rental market is not to be missed in 2025.

If you’re interested in learning more about your investment mortgage options in NC, don’t hesitate to reach out to Defy. Our mortgage experts are always available to answer your questions and provide guidance. Simply schedule an appointment on our website, or alternatively, call us at (615) 622-1032, or email us at team@defymortgage.com.