Looking for a Colorado housing market guide in 2025? We’ve got you covered. Redfin recently declared metro Denver a “buyer’s market” – which is a significant change from the frenzy that occurred during the pandemic.

With median home prices reaching $561,462 and year-over-year depreciation (not appreciation) of -0.5%, there hasn’t been a better time to be a homebuyer in the last several years in Colorado.

From Denver’s urban appeal to Boulder’s premium pricing and emerging markets like Fort Collins, each region offers unique characteristics that influence investment potential and homeownership opportunities.

Current Colorado Housing Market Overview

As of 2025, the Colorado housing market is experiencing a significant transition that strongly favors homebuyers. The state continues to attract businesses and individuals seeking quality of life improvements, but market dynamics have shifted dramatically in buyers’ favor. The state’s unemployment rate remains below the national average, supporting sustained housing demand, while improved inventory conditions provide more choices than seen in years.

Recent market data reveals a median sale price of $561,462, representing a year-over-year depreciation of -0.5% – the first decline in several years and a welcome relief for buyers who faced relentless price increases during the pandemic era. Market dynamics show clear signs of balance favoring buyers, with days on market increasing to approximately 61 days and inventory levels reaching their highest point in recent memory. This shift creates exceptional opportunities for well-prepared purchasers while requiring sellers to adjust their pricing strategies accordingly.

The supply of available homes has reached unprecedented levels compared to recent years, addressing the severe inventory shortages that characterized the pandemic-era market. This dramatic improvement in housing supply, combined with moderate price declines, creates the most buyer-friendly conditions Colorado has seen since before the pandemic. New construction continues adding to inventory levels, while existing homeowners are increasingly motivated to list their properties, creating a robust selection for today’s buyers.

Regional Market Analysis Across Colorado

Denver Housing Market

According to NewsWeek, as of just a few weeks ago, Denver’s housing market has been inundated with an “unprecedented spike” in homes for sale.

Denver maintains its position as Colorado’s primary economic hub, with a current median home value around $561,462 reflecting the market’s recent shift toward buyer-friendly conditions. Recent reports indicate Denver has experienced an “unprecedented spike” in homes for sale, creating exceptional opportunities for buyers who faced limited inventory in previous years. The city’s vibrant economy and continued influx of technology companies maintain underlying demand, but the dramatic increase in available properties gives buyers significantly more negotiating power.

Boulder Real Estate Dynamics

Boulder represents the premium segment of the Colorado housing market, experiencing aggressive growth with annual appreciation rates reaching 26.7% in certain periods. This market benefits from the city’s scenic appeal, proximity to outdoor recreation, and the presence of the University of Colorado, creating demand from diverse buyer groups including students, professionals, and high-net-worth individuals.

The Boulder market typically commands premium pricing due to limited developable land and strict growth controls, making it attractive for investors seeking appreciation potential and buyers prioritizing lifestyle amenities.

Colorado Springs Market Conditions

Colorado Springs offers a more affordable alternative to Denver and Boulder while maintaining strong market fundamentals. The area benefits from military presence and growing technology sector influence, creating a stable economic foundation that supports consistent housing demand.

This market appeals particularly to families and first-time homebuyers seeking value compared to Front Range urban centers while maintaining access to employment opportunities and recreational amenities.

Northern Colorado: Fort Collins and Greeley

Fort Collins showcases balanced urban amenities and natural beauty, drawing consistent interest from buyers attracted to the presence of Colorado State University and the region’s growing energy sector. The area offers a compelling combination of educational institutions, outdoor recreation access, and business opportunities.

Greeley and the broader northern region are experiencing growth driven by energy sector development and educational institutions, creating opportunities for both residential buyers and real estate investors seeking emerging markets with growth potential.

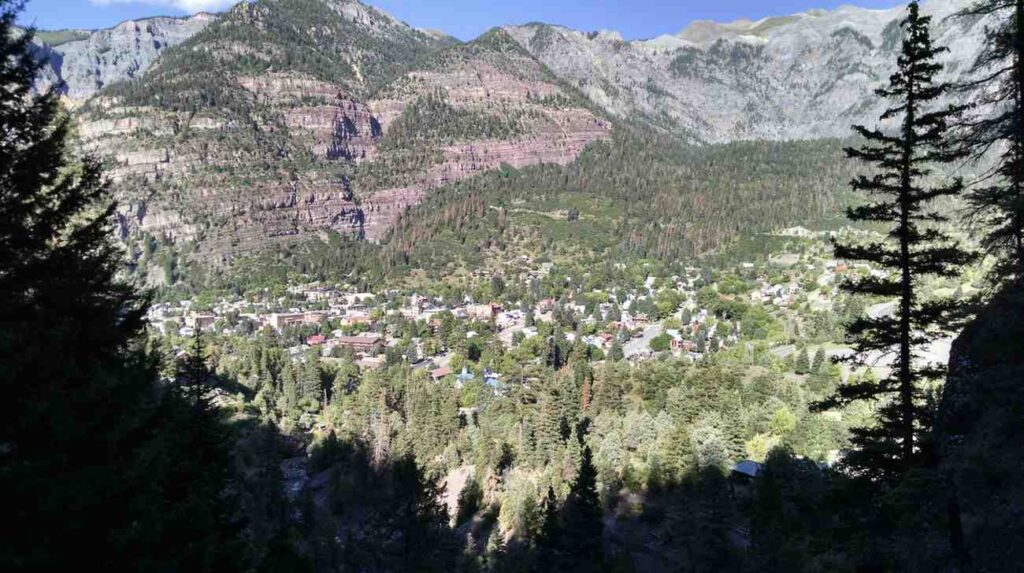

Western Colorado: Grand Junction and Mountain Communities

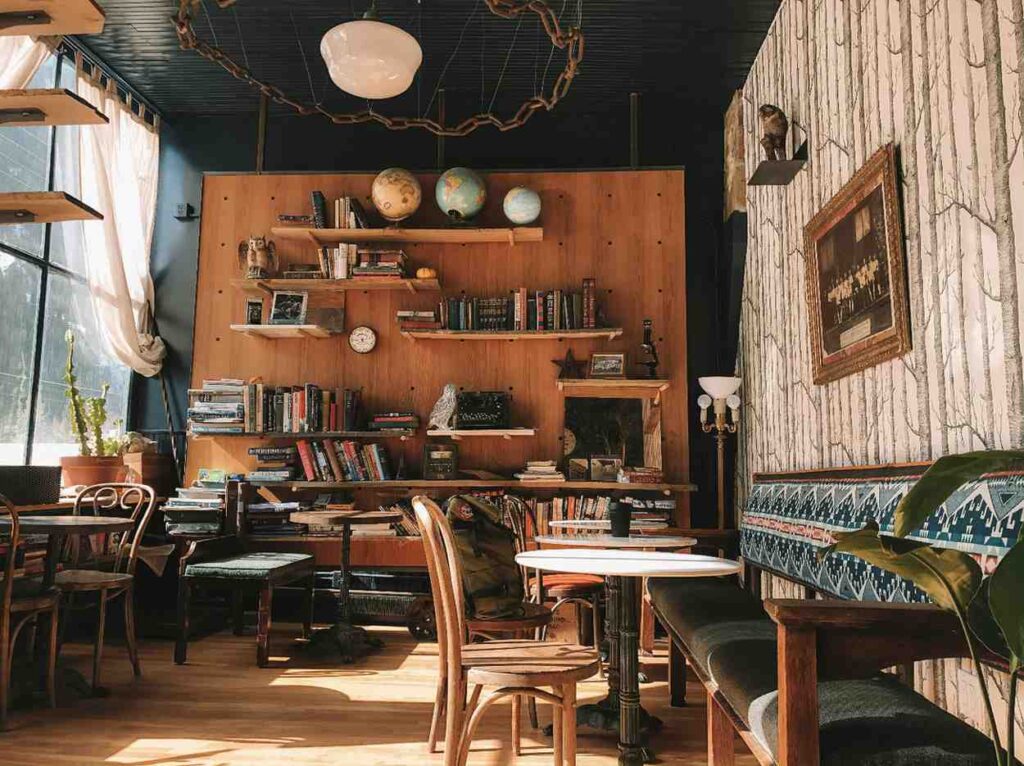

Grand Junction and western Colorado markets cater primarily to buyers seeking proximity to outdoor recreation and quieter lifestyles. These markets show steady growth reflecting appeal to retirees, outdoor enthusiasts, and remote workers seeking lower-cost alternatives to Front Range metros.

Mountain communities and areas like Clear Creek County and Park offer unique investment opportunities in recreational and second-home markets, though these segments can be more volatile and seasonal in nature.

Market Segmentation and Property Types

Single-Family Homes vs. Condominiums and Townhomes

Single-family homes dominate the Colorado housing market, appealing to families and individuals seeking traditional homeownership experiences with larger lot sizes and privacy. These properties typically command premium pricing and show strong appreciation potential, particularly in desirable school districts and established neighborhoods.

Condominiums and townhomes serve buyers seeking lower-maintenance lifestyles and more accessible price points. These property types are especially popular in urban areas and cater to first-time homebuyers, downsizers, and investors seeking rental income opportunities.

Luxury Market vs. Affordable Housing Segments

Colorado’s luxury market continues to show strong performance, particularly in markets like Boulder, Aspen, and premium Denver neighborhoods. These properties attract affluent buyers seeking high-end amenities, larger estates, and exclusive locations with scenic views and recreational access.

The affordable housing segment remains challenging due to overall price appreciation, though opportunities exist in emerging markets and for buyers utilizing specialized financing programs. The gap between luxury and affordable segments highlights the importance of targeted strategies for different buyer profiles.

Financing Options for Colorado Real Estate

Alternative Lending Solutions for Colorado Buyers

Colorado’s diverse economy, which includes many entrepreneurs, self-employed professionals, and business owners, creates significant demand for alternative financing options beyond traditional mortgages.

Bank statement loans provide excellent opportunities for self-employed buyers whose tax returns may not reflect their true earning capacity. These loans evaluate income based on bank deposits rather than traditional documentation, making them particularly valuable for Colorado’s entrepreneurial population.

P&L loans serve established business owners who maintain detailed financial records and want to showcase their business profitability for mortgage qualification. This option works well for Colorado’s many small business owners and professional service providers.

For real estate investors, DSCR loans focus on property cash flow rather than personal income, making them ideal for building rental portfolios in Colorado’s strong rental markets.

Investment Property Financing

Colorado’s rental markets, particularly in college towns like Boulder and Fort Collins, and growing metros like Denver and Colorado Springs, offer strong cash flow potential for real estate investors. Investment property financing through DSCR loans allows investors to qualify based on rental income potential rather than personal income, enabling portfolio expansion.

Interest-only loan options can enhance cash flow for investment properties, allowing investors to maximize their purchasing power and optimize their real estate portfolios in Colorado’s appreciating markets.

Economic Factors Influencing the Colorado Housing Market

Population Growth and Employment Trends

Colorado continues experiencing consistent population growth driven by both natural increase and migration from other states. This influx contributes to sustained housing demand across multiple markets and price points. The state’s positive job growth across various sectors demonstrates economic stability and attractiveness to potential residents.

New job creation in technology, energy, aerospace, and other sectors bolsters economic stability and supports housing demand. Colorado’s diversified economy provides resilience against economic downturns and supports long-term real estate market stability.

Interest Rate Impact and Federal Reserve Policy

Current mortgage rate environments significantly influence buyer affordability and market activity in Colorado. Despite rate fluctuations influenced by Federal Reserve decisions and broader economic conditions, Colorado’s strong fundamentals continue supporting market activity.

Buyers utilizing alternative financing options like bank statement and P&L loans may find competitive rates that enable them to participate in Colorado’s markets despite income documentation challenges.

Buying and Selling Strategies in Colorado

Guidance for Sellers

Colorado maintains characteristics of a seller’s market, with homes continuing to sell at reasonable pace despite recent cooling. Sellers should focus on competitive pricing strategies based on recent comparable sales and current market conditions rather than peak pricing from previous years.

Understanding days on market trends, which have increased to approximately 61 days, helps sellers set realistic expectations and pricing strategies. Professional staging, quality photography, and strategic marketing remain important for achieving optimal results.

Tips for Buyers

Home buyers in the current Colorado market have more negotiating power than during peak seller’s market conditions, though competition remains significant in desirable areas and price ranges. Securing pre-approval for financing, including alternative loan programs for self-employed buyers, streamlines the purchasing process.

Buyers should consider multiple markets and property types to maximize opportunities, as some segments offer better value than others. Working with knowledgeable local agents who understand current market dynamics provides significant advantages.

Investment Opportunities

Real estate investors can find opportunities across Colorado’s diverse markets, from cash flow-focused rental properties in college towns to appreciation-focused investments in emerging suburban markets. Understanding local rental markets, growth patterns, and financing options helps investors identify the best opportunities.

DSCR financing enables investors to expand portfolios based on property performance rather than personal income limitations, particularly valuable in Colorado’s strong rental markets.

Market Predictions and Future Outlook

Short-Term Market Projections

Colorado housing market forecasts suggest continued price growth at more moderate rates than recent years, reflecting market maturation and improved supply-demand balance. Days on market may continue increasing slightly, providing more balanced conditions for both buyers and sellers.

Inventory levels are expected to improve gradually as new construction increases and some sellers become more motivated due to changing market conditions. This should create more opportunities for buyers while maintaining reasonable conditions for sellers.

Long-Term Growth Potential

Colorado’s long-term real estate outlook remains positive due to fundamental factors including population growth, economic diversification, lifestyle appeal, and limited developable land in desirable areas. The state’s appeal to businesses and individuals seeking quality of life improvements supports sustained demand.

Climate considerations and outdoor recreation access continue making Colorado attractive to both residents and investors, supporting long-term value appreciation across multiple markets and property types.

Frequently Asked Questions

Q: What are the predictions for the Colorado housing market in 2025? A: Analysts forecast continued but moderate price growth for Colorado’s housing market in 2025, with a more balanced environment between buyers and sellers compared to recent peak conditions.

Q: How have housing prices changed in Colorado recently? A: Colorado has experienced a significant market shift, with median sale prices declining to $561,462 and year-over-year depreciation of -0.5%, marking the first price decline in several years and creating exceptional opportunities for buyers.

Q: What factors contribute to Colorado’s current market conditions? A: The current buyer-friendly market results from significantly increased housing inventory, improved supply-demand balance, and slight price depreciation, combined with Colorado’s continued appeal for its natural beauty, strong job market, and lifestyle amenities.

Q: Is it a good time to buy a house in Colorado? A: With median prices declining to $561,462, year-over-year depreciation of -0.5%, and inventory at its highest levels in recent memory, current conditions represent the best buying opportunity Colorado has seen in several years.

Q: What financing options work best for Colorado real estate purchases? A: Beyond conventional loans, bank statement loans, P&L loans, and DSCR loans serve Colorado’s many self-employed residents and real estate investors effectively.

Q: How does Denver’s market compare to other Colorado regions? A: Denver typically shows higher prices and faster appreciation than most other Colorado markets, reflecting its status as the state’s economic and cultural center.

Q: What areas of Colorado offer the best investment opportunities? A: Investment opportunities vary by strategy, with rental markets strong in college towns and growing metros, while appreciation potential exists in emerging suburban markets and mountain communities.

Q: How do Colorado’s alternative lending options benefit buyers? A: Alternative lending serves Colorado’s large population of entrepreneurs, business owners, and self-employed professionals who may not qualify for traditional financing despite strong earning capacity.

The Bottom Line: Colorado Housing Market

The Colorado housing market in 2025 presents exceptional opportunities for homebuyers, with the most favorable conditions seen in several years. With median prices declining to $561,462, year-over-year depreciation of -0.5%, and inventory at unprecedented levels, the market has shifted decisively in favor of buyers while still offering reasonable opportunities for properly positioned sellers and strategic investors.

Success in Colorado’s real estate market requires understanding regional variations, current financing options, and market timing considerations. The state’s continued population growth, economic strength, and lifestyle appeal support long-term real estate value appreciation across multiple markets and property types.

At Defy Mortgage, we specialize in helping clients navigate Colorado’s real estate market with financing solutions tailored to their unique situations. Our expertise in bank statement loans, P&L loans, DSCR financing, and other alternative lending programs enables us to serve Colorado’s diverse population of entrepreneurs, business owners, and real estate investors.

Whether you’re a first-time homebuyer, seasoned investor, or self-employed professional seeking financing solutions, our team understands Colorado’s market dynamics and can help you achieve your real estate goals with competitive financing options.

Ready to explore your Colorado real estate opportunities? Schedule an appointment with our experienced lending team today to discuss how we can help you succeed in Colorado’s dynamic housing market with financing solutions designed for your specific needs.