If you’re self-employed, a business owner, or otherwise have a non-traditional income, qualifying for a traditional mortgage in Texas can be challenging, even with the state’s healthy real estate market. Fortunately, bank statement loan Texas offers a flexible alternative, especially if you have a track record of good financial decisions. This loan type allows borrowers to qualify based on bank statement deposits instead of traditional income documentation, making them ideal for individuals with fluctuating incomes.

At Defy Mortgage, we specialize in non-traditional lending solutions geared towards individuals with unconventional incomes, from bank statement loans and P&L loans to DSCR loans and jumbo loans. Whatever your financial goals are, our 75+ loan options can be fully customized to fulfill your needs.

Building off of our experience in simplifying the loan process for freelancers, contractors, and entrepreneurs, we’ve written this guide to walk you through everything you need to know about bank statement programs in Texas. We’ll go over all of the essential requirements and steps you can take to secure a bank statement loan in Texas with the best possible loan terms.

Let’s get right to it.

What is a Bank Statement Loan Texas?

A bank statement loan Texas is a mortgage option that uses bank statements instead of pay stubs or tax returns to verify income. It’s designed for borrowers with inconsistent revenue, like self-employed individuals and contractors. Texas bank statement loans are particularly advantageous because the state has no income taxes.

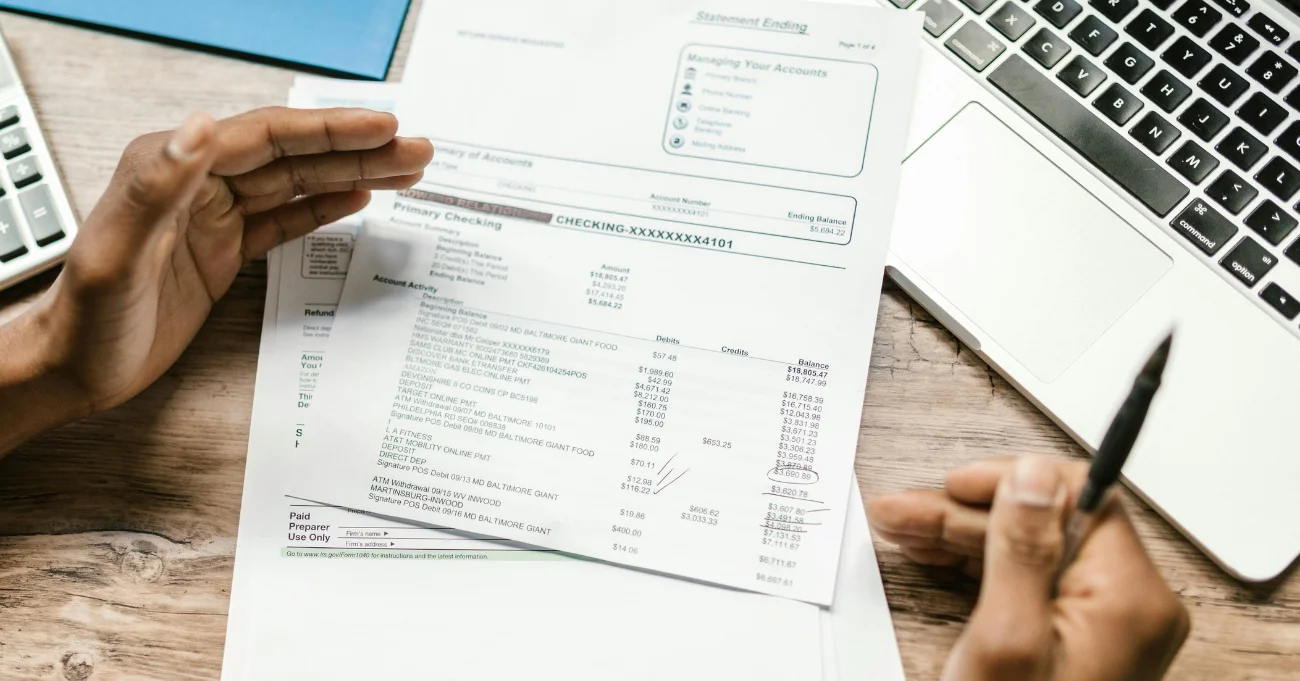

Bank statements are commonly requested by lenders during applications for conventional loans to supplement the financial profile of a borrower. But with bank statement loans, they’re the central criteria used to determine whether a borrower can be approved, and with what loan amount and terms. Lenders consider the average amount deposited into the borrower’s personal and/or business accounts over the past 1 to 2 years to assess whether a borrower has sufficient income to cover the loan.

Bank statement mortgage programs are classified as “non-QM” or non-qualifying mortgages, meaning they do not conform to the guidelines imposed by institutions like Fannie Mae and Freddie Mac. This allows their qualification standards to be more flexible than those of conventional mortgages.

Bank statement mortgage programs can also be ideal for individuals who have regular incomes but whose tax returns or pay stubs don’t accurately represent their income and assets, such as if they run a business alongside having a salary or claim tax write-offs.

Requirements for Bank Statement Loans in Texas

Bank statement mortgage loans have similar requirements to other loans, but bank statement history is the chief requirement that makes them stand out. This type of mortgage is well-suited to 1099 contract workers, entrepreneurs, small business owners, real estate investors, and other individuals with unconventional incomes. However, they may also have to provide proof of their self-employment in lieu of tax returns or pay stubs.

Credit Score

Typically, a minimum credit score of 650 is required for a bank statement loan in Texas, although some lenders may have stricter requirements. At Defy, we offer bank statement loans in Texas to borrowers with FICO scores as low as 620. However, a FICO score of 700 and up will unlock better rates and loan terms.

Bank Statement History

Lenders generally require 12 to 24 months of bank statements to verify the borrower’s income. The statements must show consistent deposits to indicate a steady income stream. The monthly deposits and balances from these statements will be taken to estimate your average net income, which will be one of the chief determiners of loan terms.

Down Payment

Bank statement loan down payments range between 10-20% of the home’s purchase price. This amount can vary depending on the lender, the loan amount, and the borrower’s financial profile.

Debt-to-Income (DTI) Ratio

Your debt-to-income ratio is the ratio between your monthly debt payments and monthly income. This ratio should be 43% or lower, although some lenders permit higher ratios for borrowers who have a good credit score or make a larger down payment.

Self-Employment Verification

If you’re self-employed or otherwise do not have a traditional income, lenders may also ask for documentation of your main income source, such as proof of self-employment, a business license, or articles of incorporation.

In addition, some private lenders may require borrowers to have enough cash reserves to cover mortgage payments for several months, typically up to a year. This can include documentation of savings and other liquid accounts that were not included in your submitted bank statements. It can also be helpful to provide documentation of any investments you may have.

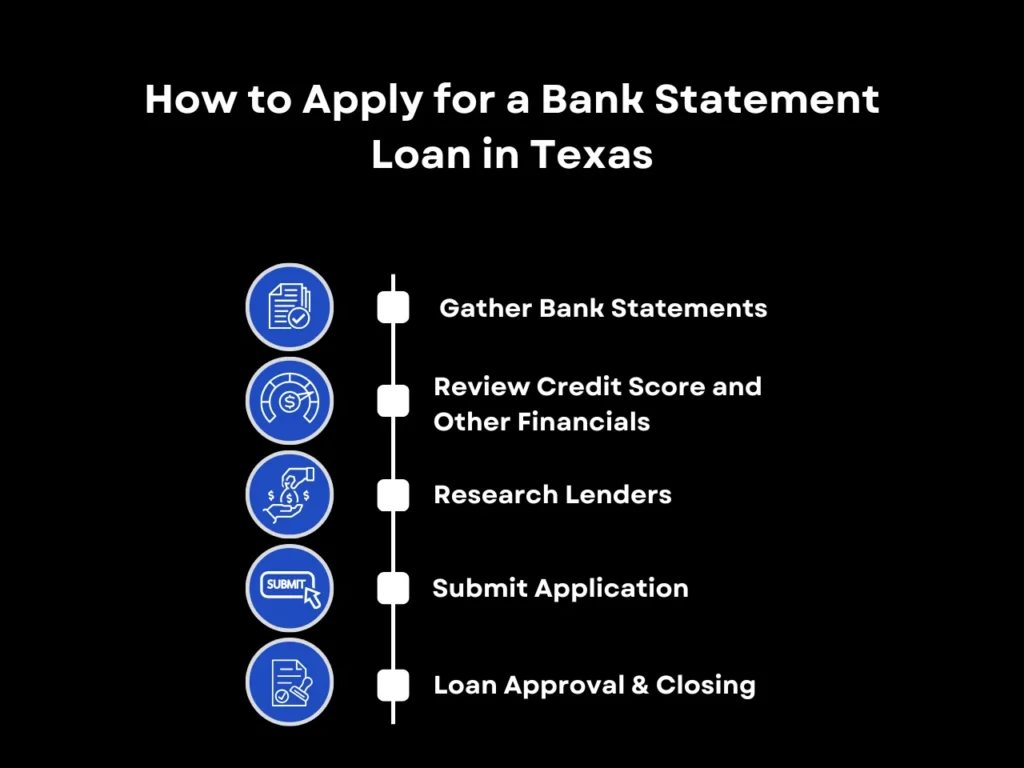

How to Apply for a Bank Statement Loan in Texas

Applying for a bank statement loan in Texas follows many of the same steps that you would for any other type of loan. However, a core component of your loan application would be preparing your bank statements and ensuring that all information in them is factual.

Step 1: Gather Bank Statements

Bank statements are the primary deciding factor in bank statement loan approval and terms. Make sure that your personal or business bank statements for the past 12-24 months accurately reflect your cash flow. If there are any discrepancies, it’s best to dispute them early so as to not affect your application.

Bank statement loans require borrowers to show a history of steady income deposits, so if you experienced an income disruption within the last 12-24 months, it may be best to wait until that mark on your record is farther behind so your financial records reflect greater stability.

Step 2: Review Credit Score and Other Financials

Ensure your FICO score meets the minimum requirements and that your DTI ratio does not exceed the maximum threshold. It may be worth working to improve your credit score or consolidating debt to lower your DTI ratio in order to get the best chances of getting approved with ideal loan terms.

Step 3: Research Lenders

After you’ve taken inventory of your bank statements and financial profile, you can begin researching bank statement mortgage lenders in Texas. This can take a while, as not all lenders offer bank statement loans. It’s often best to go with lenders that specialize in non-QM loans (which Defy happens to be one of) as they tend to have more experience with non-traditional financing solutions like bank statement loans.

Optionally, you can also get pre-approved for each of the lenders you’ve shortlisted. This will tell you the maximum loan amount each lender is willing to lend to you, and at what rate. Home sellers also prefer buyers who are pre-approved, as they’re more likely to go through with the purchase.

Step 4: Submit Application

Once you’ve decided on a lender, you can provide them with all the required documents, including proof of self-employment, to complete your application. The lender will then consider all of the information and documents you have provided to assess your credit risk. They may also order an appraisal of the property to ensure that the amount you’re asking for is accurate to the property’s market value.

Step 5: Loan Approval & Closing

After the lenders have conducted their assessment and completed underwriting, you will then receive a letter notifying you of approval. Once approved, you will be asked to pay the closing fees and sign the closing documents. Upon doing so, the lender will send the purchase funds to the seller, who will then hand over the keys to the home to you.

Bank Statement Loan Texas FAQ

What types of income are eligible for bank statement loans in Texas?

All types of income can qualify for a bank statement loan, as long as the bank statements exhibit sufficient average income to cover loan payments. Bank statement loan borrowers typically source their income from freelance work, gig work, business ownership, and investments, which is becoming increasingly common in the Texas’ rapidly growing workforce. However, those with traditional salaried jobs can still apply for a bank statement loan.

Can I qualify for a bank statement loan program if I have a low credit score in Texas?

Bank statement loans are often considered higher risk because they rely on non-traditional income verification methods. Hence, the lowest credit score most lenders will consider is 650. At Defy, we offer bank statement loans for borrowers with credit scores as low as 620. Higher scores can help offset the higher interest rates that bank statement loans usually have due to their risky nature.

How much of a down payment is required for a bank statement loan in Texas?

Down payments range from 10-20%, depending on the lender and the borrower’s financial profile. Borrowers with good credit may qualify for a down payment as low as 10%, but those with high DTI ratios might have to put down 20% or more.

Are there any fees associated with bank statement loans in Texas?

Yes, the most common charges associated with bank statement loans are origination fees, closing costs, or other administrative fees, similar to traditional loans. Like many other loans, they can also have prepayment penalties, so be sure to check with your lender to be able to prepare your finances ahead of time.

How quickly can I get approved for a bank statement loan in Texas?

Approval timelines can vary, especially given the extra time needed to check through several months’ worth of bank statements. You can typically expect to be updated on the approval status of your loan application within 14 to 45 days.

Key Takeaway

For Texans with non-traditional income, a bank statement loan Texas can provide an excellent opportunity to secure home financing. With eligibility criteria tailored for self-employed individuals, independent contractors, and entrepreneurs, this loan type enables such individuals to skip the waiting and difficulties associated with securing a conventional home loan.

If you’re interested in a bank statement loan in Texas, remember to review your financial profile, research experienced lenders, and prepare your bank statements to maximize your chances of approval and secure the best terms available.

Ready to learn more about your mortgage options in Texas? Start a conversation with Defy today and let our mortgage experts guide you through the next steps on your journey. We also offer Texas foreign national loans for individuals who do not have a US-based credit score and home equity loans for existing homeowners who are looking to take advantage of their property value.