Alongside home equity loans and home equity line of credit, cash out refinance Texas is an effective option to leverage home equity in the state. It allows homeowners to replace their existing mortgage with a new, larger one, receiving the difference as cash. However, Texas cash out refinance is regulated by specific laws that borrowers and lenders must follow.

At Defy Mortgage, we provide streamlined custom mortgage solutions for virtually every type of borrower. Our loan options range from home equity financing like cash out refinance to non-QM loans like bank statement and P&L loans. Whether consolidating debt, expanding your real estate portfolio, or purchasing your first home, our tailored loans can help you reach your goals with minimum hassle and maximum efficiency.

With our long-standing industry experience, we’ve written this blog to familiarize you with the rules and regulations surrounding cash out refinancing in Texas. We’ll also go over how cash out refinancing works, the qualifications needed, as well as the benefits and risks of choosing this financing option.

Let’s dive in.

What Is Cash Out Refinancing?

Cash out refinancing allows homeowners to replace their current mortgage loan with a new one for more than they still owe, using the difference in cash. Like home equity loans and HELOCs, cash out refinance Texas is particularly advantageous because of the state’s steadily climbing property values.

Like a home equity loan, cash out refinancing gives borrowers a one-time lump sum of cash, depending on how much they intend to borrow minus the remaining balance on the first mortgage. However, unlike home equity loans and HELOCs, cash out refinancing replaces your primary mortgage, resulting in a single mortgage rate instead of having to pay off two separate monthly mortgage payments.

The cash provided in cash out refinancing can be used for any purpose. If you’ve accumulated a large amount of home equity, you can tap into this stored value to cover large expenses, from home improvements and debt consolidation to buying investment properties.

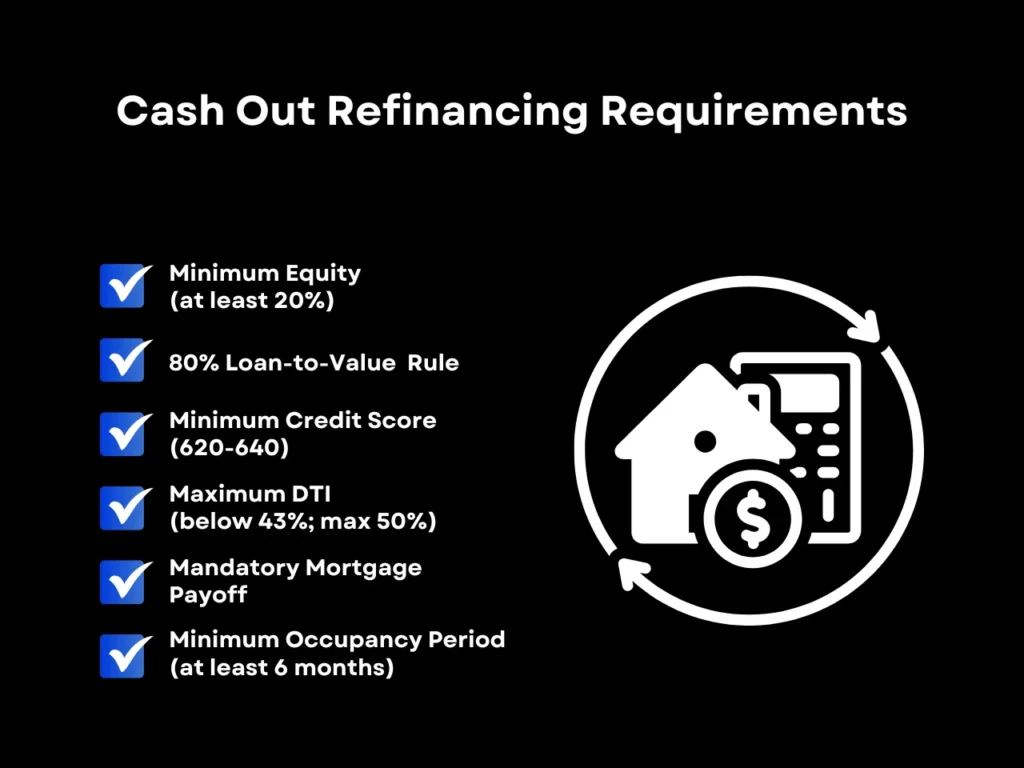

Cash Out Refinancing Requirements

Eligibility for cash out refinancing involves requirements similar to those of other types of home equity financing. The primary ones are:

- Minimum Equity: Borrowers must have at least 20% equity in their homes. Equity is the percentage of your mortgage that you have already paid off, and thus, it’s also the percentage of ownership you have over your home.

- 80% Loan-to-Value (LTV) Rule: You can only borrow up to 80% of your home’s market value. Although some states allow exceptions, this rule is enforced by law in Texas under Section 50(a)(6) of the Texas Constitution.

- Minimum Credit Score: A cash out refinance typically requires a credit score between 620 and 640.

- Maximum DTI: Your DTI or debt-to-income ratio is the percentage of your income that goes to debt payments. Lenders prefer that your DTI stays below 43%, but they may allow up to 50% DTI if you have a large amount of liquid funds or a particularly high credit score.

- Mandatory Mortgage Payoff: Once approved, your cash out refinance must be used to pay off your first mortgage and all of your liens or second mortgages.

- Minimum Occupancy Period: You must have owned your home for at least six months to be eligible for a cash out refinance.

Lenders will evaluate your financial situation to determine your ability to afford a larger loan than your current one. Depending on your circumstances, you may need to exceed the minimum requirements to be approved for a cash out refinance. Additionally, a home appraisal will be necessary to ascertain the amount you can borrow against your home’s equity.

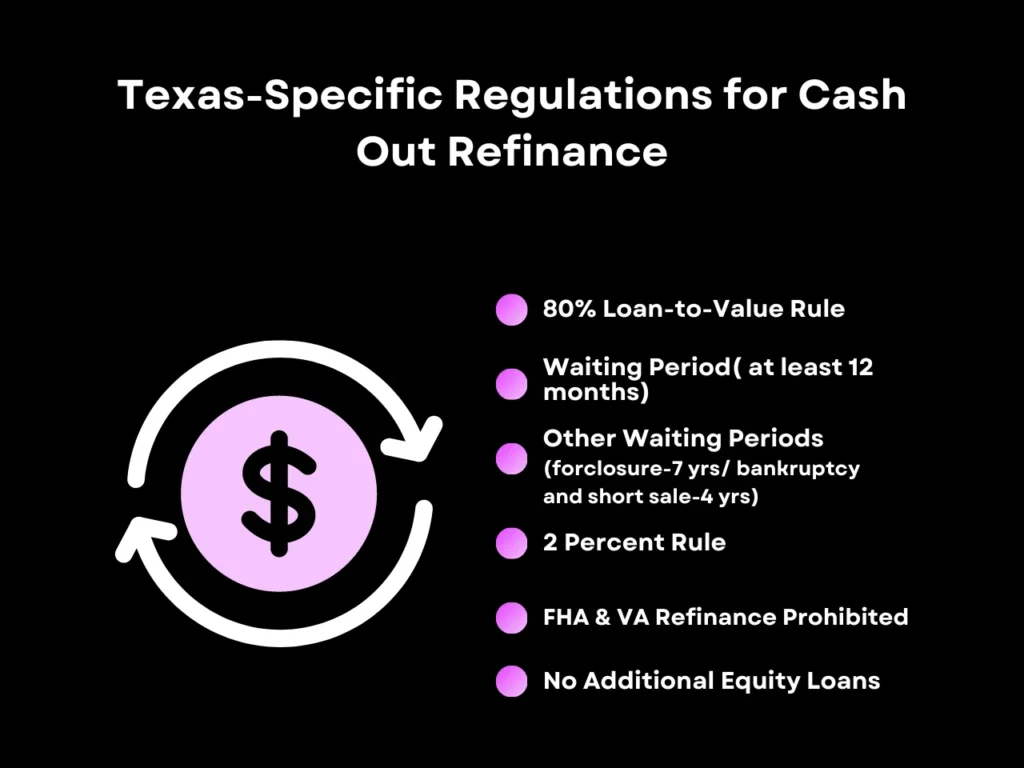

Texas-Specific Regulations for Cash Out Refinance

Texas cash out refinance is subject to the same regulations as HELOCs and home equity loans in the state. Keep these regulations in mind if you’re looking to cash out refinance your home:

- 80% Loan-to-Value Rule: Texas law enforces a hard borrowing limit of 80% of your home’s market value. Some states allow up to 90% LTV, but Texas prevents homeowners from borrowing against the last 20% of their stake in the home so it can serve as a safety net.

- Waiting Period Between Refinances: According to Section 50(a)(6)(M)(iii) of the Texas Constitution, homeowners must wait at least 12 months after closing a cash out refinance before they can refinance their properties again, whether through another cash out refinance or another type of refinance.

- Other Waiting Periods: Those who have experienced foreclosure, bankruptcy, or a short sale must wait a certain number of years before qualifying for a cash out refinance in Texas. The waiting period for foreclosure is seven years, while it’s four years for bankruptcy and short sale.

- 2 Percent Rule: Lenders can only charge up to 2% of the loan’s amount in closing fees. However, this does not include external fees like attorney costs, appraisal, and title insurance.

- FHA and VA Refinance Prohibited: Cash out refinancing isn’t backed by federal programs, so you can’t use the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA) for cash out refinances. Although FHA and VA loans offer other refinancing options, such as Streamline Refinance, they are inaccessible in Texas.

- No Additional Equity Loans Allowed: A cash out refinance disqualifies you from taking out a traditional home equity loan or a HELOC until it is fully paid off.

Note that these rules only apply to your primary residence. Cash out refinancing an investment property or second home will not be subject to these regulations.

The Benefits and Risks of Cash Out Refinancing

Cash out refinancing is rapidly gaining popularity amongst borrowers because of several key benefits, but it also has several critical risks you need to plan around. Remember to weigh each of these when incorporating cash out refinancing into your mortgage strategy:

Benefits

- Access to Lower Interest Rates: Refinancing offers much lower interest rates, often ranging from 4% to 6%, as opposed to the double-digit rates of personal loans or credit cards. This makes it particularly effective at consolidating debt or making large purchases.

- Tax Deductions: Interest on a refinanced mortgage is often tax-deductible, further driving down overall borrowing costs.

- Credit Score Improvement: Consolidating debt with cash out refinancing can raise your credit score by decreasing your credit utilization ratio and the number of outstanding debts.

Risks

- Extended Mortgage Term: Depending on how much you borrow, a Texas home refinance can extend your mortgage term, potentially leading to higher total interest payments over time despite the lower interest rate and tax deductions.

- Consequences of Overborrowing: Borrowing too much through refinancing can harm financial stability, especially if housing prices decline. Though this is unlikely, given the recent trends in Texas real estate, it’s prudent to plan for that eventuality and avoid borrowing up to your maximum limit.

- Best for Single-Family Homes: Cash out refinancing tends to yield the most cash when refinancing a single-family home. Multi-family homes, condos, and manufactured homes may have lower LTV ratio limits and could incur extra fees or higher rates.

Cash out refinances offer more simplicity by consolidating mortgage and loan payments into one. However, they also entail risks that require a careful evaluation of your financial situation and future housing market trends to maximize their benefits.

Cash Out Refinance Texas FAQs

What Is the Maximum Amount I Can Borrow With a Cash Out Refinance in Texas?

Cash out refinancing in Texas is limited by Section 50(a)(6) of the Texas Constitution, which states that Texas homeowners can only borrow up to 80% of their home’s appraised value.

How Often Can I Complete a Cash Out Refinance in Texas?

Under Texas law, specifically Section 50(a)(6)(M)(iii), homeowners can only complete any type of home equity financing, including cash out refinance, once every 12 months.

Can I Use a Cash Out Refinance in Texas to Pay off High-Interest Debt?

Yes, you can use cash out refinance funds for any purpose.

Many use them to consolidate high-interest debt, such as credit card balances or personal loans, into their mortgages, resulting in a lower overall interest rate. However, increasing your mortgage balance could have long-term impacts, so plan accordingly if you decide to consolidate debt with a cash out refinance.

Are There Any Tax Benefits Associated With Cash Out Refinancing in Texas?

Yes, mortgage interest from a cash out refinance can often be tax-deductible, provided that you use the funds for qualifying expenses. These can include capital home improvements, purchasing property, and home repairs. The IRS allows homeowners to deduct mortgage interest on the loan up to a certain limit set by tax laws, and the total deductible amount can vary depending on how much you borrowed and how the funds were utilized.

What Are the Costs and Fees Involved in a Cash Out Refinance in Texas?

The costs involved in Texas cash out refinance, such as refinancing expenses, origination fees, and closing costs, are not allowed to exceed 2% of the loan amount. However, this does not include external costs, such as appraisal, title search, and insurance fees. If these are included, the total fees can reach up to 5% of the loan amount, depending on your circumstances.

Key Takeaway

Cash out refinance Texas is a versatile financing tool that requires careful planning like any other loan. Fortunately, it offers tax deductibility, limited lender fees, and lower interest rates. Opting for a cash out refinance to lower your overall mortgage payments is a viable strategy as long as you avoid overborrowing.

If you intend to cash out refinance in Texas, remember to carefully assess your financial situation to ensure the numbers work in your favor. It may be prudent to raise your credit score and lower your debt-to-income ratio before closing on a cash out refinance to secure better terms, especially if your goal is to make your mortgage more manageable.

Looking for cash out refinance options at competitive rates? Reach out to Defy for a free consultation on the best option for your particular situation. We offer over 75 non-traditional and conventional mortgages for all types of borrowers. Whether you’re a new homeowner, a self-employed individual, a real estate investor, or anything else in between, we can customize a financing solution that fits your needs.