Building equity is helpful, but you usually only benefit from it once you sell. Fortunately, cash-out refinancing offers an alternative way to unlock the equity you’ve already earned. Instead of letting the value of your home sit idle, you can turn it into cash that can be put toward new purchases, renovations, or better-return investments.

At Defy Mortgage, we prioritize real estate investors with complex income structures. Whether you’re increasing the profitability of your assets or simply scaling your portfolio, our cash-out refinance options can adapt to your unique needs and resources. With our flexible non-QM cash-out refinance terms, you can act quickly without going through traditional underwriting hurdles.

In this guide, you’ll learn:

- How cash-out refinancing works for property investors.

- Real-world examples that illustrate how much equity you may be able to access.

- The types of cash-out refinancing options available in 2025 (including non-QM options built for investors).

- Cash-out refinance requirements and alternative income verification methods.

- The strategic advantages and risks involved in using a cash-out refinance for investment growth.

TL;DR

- A cash-out refinance allows investors to withdraw some of the equity they’ve built in cash by refinancing into a new mortgage.

- Investors often use cash-out refinancing to scale portfolios, fund renovations, consolidate higher-interest debt, or free up capital for time-sensitive investment opportunities.

- The amount you can borrow depends on your home’s value, existing mortgage balance, type of mortgage, and lender guidelines.

- Non-QM cash-out refinance options allow investors to qualify using alternative income documentation methods as well as traditional W-2s or tax returns.

- Cash-out refinance rates are typically lower than rates for HELOCs or home equity loans, making it an efficient way to create liquidity.

- Most lenders allow refinancing up to 70%–80% LTV for investment properties, depending on credit profile and loan type.

- To apply for a cash-out refinance, borrowers must meet key requirements including 20–30% equity in the property, a strong credit score (typically 640+), and proof of income or alternative verification methods.

- Lenders will also assess your property value, debt-to-income ratio, and overall financial stability to ensure the new loan is manageable.

What Is a Cash-Out Refinance?

Cash-out refinancing lets you convert your equity into usable cash by replacing your current mortgage with a larger one. The difference between your old mortgage and the new one will be given to you as a lump sum of cash, which can be used for any purpose.

As opposed to other forms of home equity financing, like home equity loans (HELoans) and home equity lines of credit (HELOCs), cash-out refinances replace your original mortgage instead of being a second mortgage.

This leads to the following advantages over those financing options:

- Convenience and simplicity: With a cash-out refinance, you only have to manage a single mortgage. With a HELoan or HELOC (home equity line of credit), you’re potentially beholden to two creditors; with a cash-out refinance, you only owe one.

- Longer loan term: HELoan and HELOC terms typically range from 5 to 15 years, giving you a higher monthly debt obligation for the life of the loan. On the other hand, most cash-out refinances are available in standard 30-year fixed rate terms, leading to more manageable monthly debt payments.

- Lower interest: Cash-out refinances typically have lower interest rates than HELoans and HELOCs.

How a Cash-Out Refinance Works

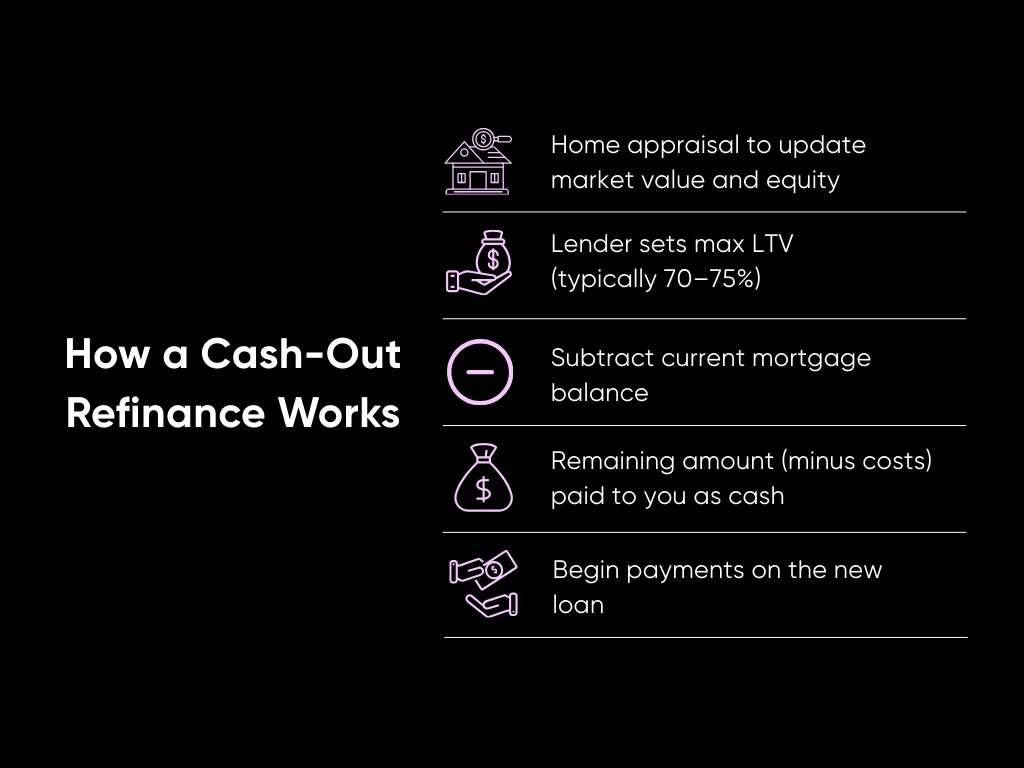

Here’s the basic process:

- Your property is appraised to determine its current market value. This creates an updated valuation, establishing how much equity you’ve gained from paying off your principal and home appreciation since purchasing the property.

- The lender calculates your maximum allowable loan-to-value (LTV). This typically ranges between 70-75% of the property’s current market value. At Defy Mortgage, our maximum LTV depends on what kind of cash-out refinance you choose, but we can usually go up to 80% LTV with most loan types pending FICO and DSCR criteria.

- Your existing loan balance is subtracted from the allowed loan amount.

- The remaining amount, minus closing costs and other fees, becomes cash paid out to you at closing. You’re free to use these funds however you want.

- You begin making payments on the new mortgage with the updated loan amount and terms.

An Example of Cash-Out Refinancing

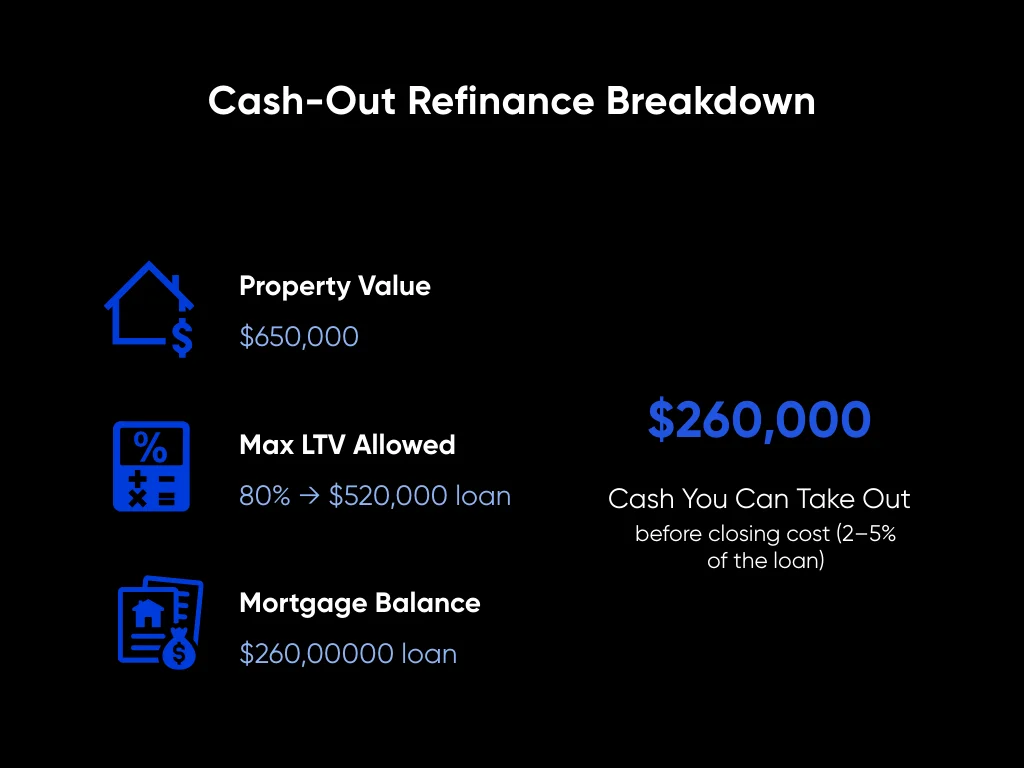

To understand how cash-out refinancing works in practice, let’s look at a real-world example for a property investor:

Let’s say you purchased an investment property several years ago for $400,000. After appreciation and improvements, the property is now worth $650,000. Your remaining mortgage balance is $260,000.

You’ve chosen a DSCR cash-out refinance, which at Defy Mortgage goes up to 80% loan-to-value (LTV). Because you have excellent credit and DSCR (740+ FICO, ≥1.000 DSCR), you’re able to max out the allowable loan-to-value.

Let’s break that down step-by-step:

- Current property value: $650,000

- Maximum loan amount at 80% LTV: $520,000

- Existing mortgage balance: $260,000

- Available cash-out amount: $260,000 (minus closing costs)

In this example, you could access roughly $260,000 in equity without selling the property, before closing costs, which are typically 2%-5% of the loan amount. If you decide to take out the entire $260,000, then your closing costs would range from $5,200 to $13,000, meaning your actual cash-in-hand would be $247,000-$254,800.

Why Should You Get a Cash-Out Refinance?

Property investors often use cash-out refinancing as a strategic way to unlock the equity they’ve built and put that capital to work. Instead of letting equity remain tied up in a property, a cash-out refi allows you to convert it into liquidity that can support portfolio growth, major improvements, or other high-return ventures.

Common reasons investors choose this option include:

- Freeing up funds for reinvestment: Many investors use the cash-out capital as a down payment for their next maintenance, renovation, fix-and-flip, or rental acquisition.

- Consolidating high-interest debt: Using home equity to refinance expensive business or personal debt can reduce monthly obligations and free up cash flow.

- Funding business growth or expansion: Entrepreneurs often reinvest cash-out proceeds into their companies—purchasing equipment, hiring staff, or scaling operations.

- Covering major expenses or liquidity needs: Cash-out refinancing provides access to large sums of capital when timing matters, without selling an asset. Fund everything from college tuition and medical bills to home improvement projects.

Because investors tend to have long-term strategies built around leverage, a cash-out refinance can be an efficient way to access low-cost capital and strengthen your financial position.

Cash-out Refinancing Investment Properties

Cash-out refinances open up a variety of possibilities for property investment, including:

- Purchasing additional investment properties: Many investors use the cash-out capital as a down payment for their next rental, fix-and-flip, or short-term rental acquisition.

- Renovating or improving existing properties: Updates can increase rental income, boost property value, or help reposition a unit for higher-earning tenants. The increased rental revenue you can get from this can even potentially offset the costs of the cash-out refinance.

- Holding cash in reserve for business purposes: Cash-out refinances can be an easy way to generate emergency or discretionary funds so you can quickly address issues or capitalize on opportunities as they arise.

Cash-out refinances tend to have lower borrowing costs compared to personal loans or credit cards, making them more cost-effective for these investment pathways.

Best Cash-out Refinance Lenders for Investors in 2025

Types of Cash-Out Refinance Loans

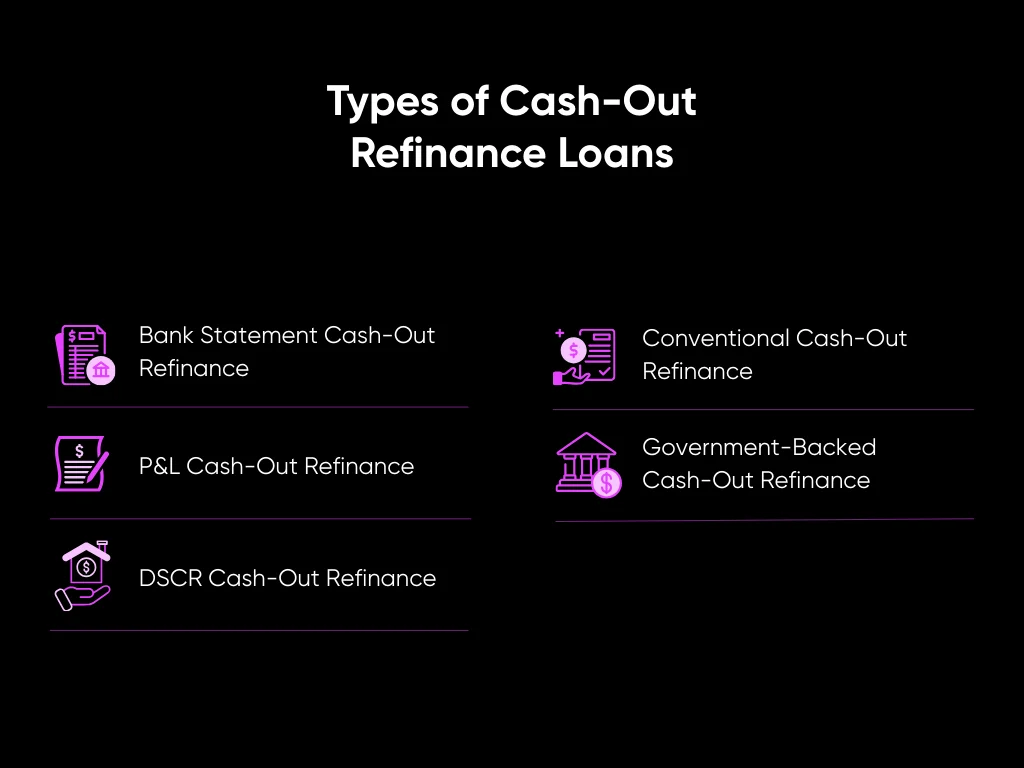

Property investors have several loan options when pursuing a cash-out mortgage refinance. The best choice depends on your credit profile, property type, income structure, and long-term investment goals. Here are the main loan types available in 2025:

- Bank statement cash-out refinance: These allow borrowers to use bank statements as alternative income documentation. The advantage of using bank statements is that they provide a more direct representation of your full income picture. Instead of checking your taxable income via your tax returns or W-2s, you can simply show the lender how much money goes into your bank account on a regular basis.

- P&L cash-out refinance: Similar to bank statement cash-out refinance, except they use profit-and-loss statements to prove income instead of bank statements.

- DSCR cash-out refinance: These let you prove income using the debt service coverage ratio (DSCR). DSCR is the net operating income (NOI) of a property divided by its total debt service (TDS), which includes annual taxes and fees.

- Conventional cash-out refinance: Similar to conventional loans, with stricter credit standards and tighter income documentation requirements.

- Government-backed cash-out refinance: This can come in the form of either an FHA cash-out refinance or a VA cash-out refinance.

Requirements for a Cash-Out Refinance

To qualify for a cash-out refinance, you’ll need to meet several requirements.

- Generally, you need to have at least 20-30% equity in your property

- A good credit score (often 640 or higher)

- A stable income to show the lender you can repay the new loan.

- Afterwards, lenders will order a property appraisal to confirm its current market value and ensure it supports the new loan amount. Lastly, your debt-to-income ratio and overall financial stability will likely be assessed to ensure you meet the lender’s criteria.

Defy Mortgage Cash-out Refinancing LTVs

Defy Mortgage offers lax LTVs for our cash-out refinancing options, opening up greater flexibility for investors to unlock equity to be redeployed into further investments:

| Loan Type | Max Cash-Out Refi LTV |

| DSCR | 80% |

| Bank statement | 80% |

| P&L | 80% |

| Foreign national | 65% |

These LTVs unlock for borrowers with 740+ FICO (and >=1.000 DSCR for DSCR loans). We currently have no C/O option for asset depletion loans.

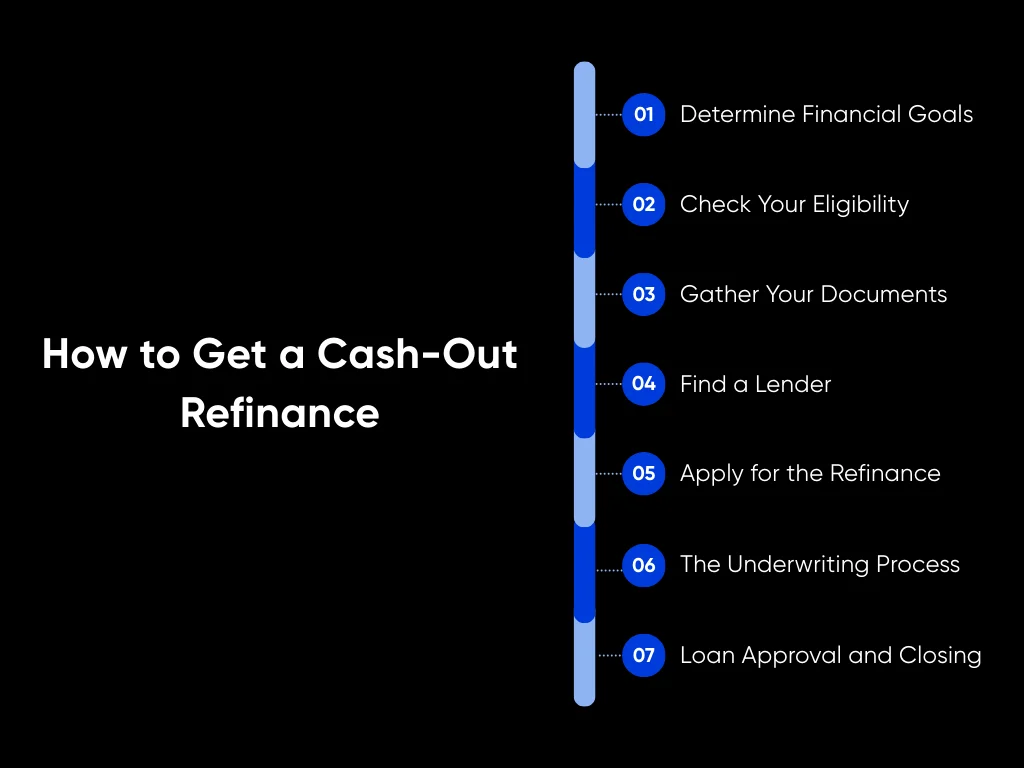

How to Get a Cash-Out Refinance

1. Determine Your Financial Goals

Before initiating a cash-out refinance for your investment property, clarify how much cash you need and its intended use. Consider goals such as upgrading the property to enhance value, buying another property to grow your portfolio, paying off personal debt to lower interest rates and improve credit, or setting up an emergency fund. Having a defined purpose for the cash ensures the refinance aligns with your financial strategy and maximizes your property’s equity.

2. Check Your Eligibility

To qualify for a cash-out refinance, you generally need 20-30% equity in your property, with the new loan amount being 70-75% of the home’s appraised value (LTV ratio). Additionally, you should have a credit score of 640 or higher, depending on the lender’s specific requirements.

3. Gather Your Documents

When applying for a cash-out refinance, collect essential documents including: proof of income (W-2s, 1099s, or tax returns), personal or business tax returns from the past two years, current homeowner’s insurance, statements of existing debts, and a copy of your title insurance. Note that specific documentation requirements may vary by lender.

4. Find a Lender

Compare quotes from multiple lenders to secure the best terms, including interest rates, closing costs, and loan conditions. For competitive rates and personalized service, consider Defy Mortgage, where we can guide you through the refinancing process – contact us for a free consultation.

5. Apply for the Refinance

After evaluating your options, choose the lender that offers the best terms and aligns with your financial objectives. Submit your application along with the required documents, noting that some lenders might request additional information based on their process.

6. The Underwriting Process

Once your application is submitted, the lender will start underwriting to verify all details. They will order an appraisal to assess the property’s market value and your equity, and review all submitted documents to ensure they meet lending criteria.

7. Loan Approval and Closing

After underwriting, you’ll receive the lender’s final decision. If approved, you’ll get a loan disclosure detailing the terms, interest rate, and closing costs. Review these documents carefully, ask any questions, and sign them on closing day to finalize the refinance. You’ll then receive your cash proceeds, minus closing costs.

Cash-Out Refinance Closing Process

The closing process for a cash-out refinance isn’t too different from closing on a new property purchase. After your loan application is approved, you’ll typically enter a waiting period to review loan documents and ensure everything is accurate. Then comes closing day, where you’ll meet with various parties involved in the refinance.

The lender will present the final loan agreement outlining the terms, interest rate, and closing costs. Be sure to ask any questions before signing. Once everything is finalized, the old mortgage will be paid off, and you’ll receive the difference between the new loan amount and your old mortgage balance (minus closing costs) in cash. This can take a few business days to appear in your account.

Key Takeaways

Cash-out refinancing is a powerful tool for property investors looking to put their stored-up equity to work, without giving up ownership of their investment. And just like home equity loans and HELOCs, you’re completely free to use the funds however you wish, whether it’s reinvesting into acquisitions or renovations or even non-investment purposes like savings and debt consolidation. Cash-out refinances are one of the most versatile financing tools available to real estate investors, letting you take full advantage of each and every investment asset.

If you’re gearing up to apply for a cash-out refinance, remember the basic requirements, mainly 20-30% equity and good credit (740+ to unlock the best LTVs). It would also be worth assessing the pros and cons of a cash-out refinance over a home equity loan or HELOC. Cash-out refinances offer the convenience of a single mortgage, but HELoans tend to have lower credit requirements, and HELOCs let you tailor your debt obligation as-needed by borrowing only as much as you need when you need it.

Ready to leverage equity across your entire portfolio? Defy Mortgage specializes in investor-focused solutions such as cash-out refinances. Each solution is custom-built to work in sync with your needs, resources, and investment strategy, maximizing the convenience and benefit you get out of them. Contact us today at (615) 622-1032 or schedule an appointment on our site for a free consultation and see how your equity can work harder for you.

If you’re a mortgage broker, Defy TPO can allow you to offer that same strategic advantage to your borrowers. With our ultra-flexible cash-out refinances, along with 75+ other customizable non-traditional products, you can tap into the extensive sector of underserved real estate investors and position your brokerage as the go-to resource for complex, investor-focused financing. Curious how that would work? Send us your hardest pricing scenarios, and we’ll show you how Defy Mortgage solves problems.

Frequently Asked Questions

What is a cash-out refinance?

A cash-out refinance is a mortgage refinance where the new loan amount is larger than your existing mortgage, and you receive the difference in cash. Investors use this to unlock equity from their properties to fund renovations, acquire new investment properties, consolidate high-interest debt, or finance business opportunities.

Who should get a cash-out refinance?

Property investors and self-employed borrowers who have built substantial equity in their homes and need capital for growth or improvements are ideal candidates. You should have at least 20% equity and a plan for how to deploy the cash strategically.

Is it hard to get a cash-out refinance?

Not necessarily. While conventional loans require standard income documentation, many investors qualify through alternative income verification methods, including bank statements, DSCR loans, or profit-and-loss documentation. These options make it easier for entrepreneurial borrowers with complex income streams to access cash.

How long does it take to close on a cash-out refinance?

The exact timeline will depend on the lender, how long the appraisal takes, and how complete your documentation is. At Defy Mortgage, we typically close cash-out refinances in 30-45 days.

How Much Money Can You Get From a Cash-Out Refinance?

The cash you can access depends on your property’s loan-to-value (LTV) ratio. Most lenders allow up to 70–75% of the appraised value minus your existing mortgage balance. For example, if your property is worth $500,000 and you owe $300,000, a 75% LTV allows a new mortgage loan of $375,000, giving you $75,000 in cash (before closing costs).

What’s the max LTV I can get with Defy Mortgage’s Cash-Out Refinances?

Defy Mortgage cash-out refis for DSCR, bank statement, and P&L loans go up to 80% LTV for borrowers with 740+ FICO (65% for foreign nationals). DSCR >= 1.000 is also necessary to unlock 80% LTV for DSCR cash-out.

What are the Pros and Cons of Getting a Cash-Out Refinance?

Pros:

- Unlocks home equity without selling property.

- Provides capital for renovations or portfolio expansion.

- Can consolidate high-interest debt at lower rates.

- Investor-focused options like DSCR allow alternative income qualification.

Cons:

- Increases mortgage balance and monthly mortgage payment.

- If property values declined instead of appreciating since purchase, you may have less equity available to cash out.

- Closing costs apply.

What are the potential risks associated with a cash-out refinance?

These are the main risks investors should consider:

- Risk of foreclosure: As with any mortgage, cash-out refinances use your home as the collateral. That means that if rental income drops, vacancies rise, or cash flow otherwise tightens and you can’t make payments, the lender has the right to sell your home.

- Higher debt obligations: Because you’re replacing your existing mortgage with a larger one, your monthly payment may increase. Even if the interest rate is competitive, taking on a higher principal balance means carrying more long-term debt, which can affect your cash flow and overall borrowing capacity.

- Extends your mortgage term: Since it replaces your first mortgage, it will essentially “reset the clock” on your mortgage, meaning it will take 30 more years to pay off instead of however much time was remaining. You can mitigate this by opting for a 15-year term, but this leads to higher monthly payments.

- Risk of higher interest rate: If mortgage rates rose since you purchased your home, a cash-out refi might be more expensive overall compared to your original loan.

Can I qualify for a cash-out refinance with bad credit?

Yes, but options may be limited. Non-QM loans and alternative income verification methods allow borrowers with lower credit scores or complex financials to qualify. Lenders will consider property value, cash flow, and other compensating factors alongside credit history.

Can a cash-out refinance be used for investment purposes?

Absolutely. Many property investors use cash-out refinancing to:

- Acquire additional rental or investment properties.

- Fund renovations or improvements that increase rental income or resale value.

- Consolidate high-interest debt to improve cash flow.

- Reinvest in business ventures or entrepreneurial opportunities.

Why is Defy Mortgage is one of the best cash-out refinance lenders for investors?

- Max LTV up to 80% (higher than many conventional lenders)

- A full suite of non-QM options (DSCR, bank statement, P&L)

- Flexibility for DSCR loan qualification – great option if you are a real estate investor

- Great for real estate investors, self-employed borrowers, portfolio owners

- Specializes in complex-income borrowers

- Fast closings (30–45 days) tailored for investor timelines

- Works with portfolio investors and foreign nationals

- Choose Defy Mortgage if you want flexible cash-out refinance underwriting designed for investor cash flow, not just W-2 income and maximum LTVs

Where can I get a cash-out refinance?

Cash-out refinance mortgages are available from a wide variety of lenders, including banks, credit unions, and private mortgage lenders. If you’re looking for cash-out refinance options that are flexible and more customizable, consider a non-QM lender like Defy Mortgage. We aim to make home financing more accessible to a wider range of borrowers – contact us today for a free consultation.

What LTV can I get with a Defy Mortgage cash-out refinance?

Defy Mortgage offers lax LTVs for our cash-out refinancing options up to 80% LTV, opening up greater flexibility for real estate investors to unlock equity to be redeployed into further investments. These LTVs unlock for borrowers with 740+ FICO (and >=1.000 DSCR for DSCR loans). We currently have no C/O option for asset depletion loans. And yes, we do offer bank statement options for real estate investors as well.

| Loan Type | Max Cash-Out Refi LTV |

| DSCR | 80% LTV |

| Bank statement | 80% LTV |

| P&L | 80% LTV |

| Foreign national | 65% LTV |

About the Author: Meet Todd Orlando, co-founder and CEO of Defy Mortgage and Defy TPO. With over 20 years of experience in banking and financial services at institutions like First Republic and Morgan Stanley, Todd has dedicated his career to broadening access to lending and revolutionizing the mortgage industry, particularly in the non-QM space.

In 2022, Todd launched Defy Mortgage to provide real estate investors, entrepreneurs, and self-employed individuals with a secure, streamlined, and personalized lending experience tailored to meet their specific needs. He knows firsthand how access to the right mortgage can make or break a project and how today’s borrowers need flexible financial partners and creative lending options designed for their unique needs and lifestyles. Traditional banks are rigid, and their one-size-fits-all approach is outdated. That’s why he created Defy Mortgage — to stay ahead of the curve, set new standards in lending, and deliver personalized, non-traditional solutions for those looking to purchase or refinance.

For the third year running, Todd has been recognized by Inman News for excellence in the mortgage and lending industry, landing on their prestigious Best of Finance list for 2025. He was also honored as a mortgage finance leader in 2023 and 2024 for the same award. His visionary leadership has earned him endorsements from esteemed former colleagues at prestigious institutions across the financial services spectrum.

Beyond his work in finance, Todd is also a co-founder of two software companies in commercial lending and healthcare tech, an active real estate investor, and a husband and father of three. An industry disruptor, Todd is here to redefine what’s possible in mortgage lending.

Mortgage broker itching to elevate client offerings? Check out our TPO business, Defy TPO: https://defytpo.com/