When buying a home, you’ll likely hear the terms “deed of trust” and “mortgage” thrown around, often interchangeably. But what do these terms actually mean? These two legal documents aren’t quite the same, and understanding the difference can help you stay informed during the home financing process.

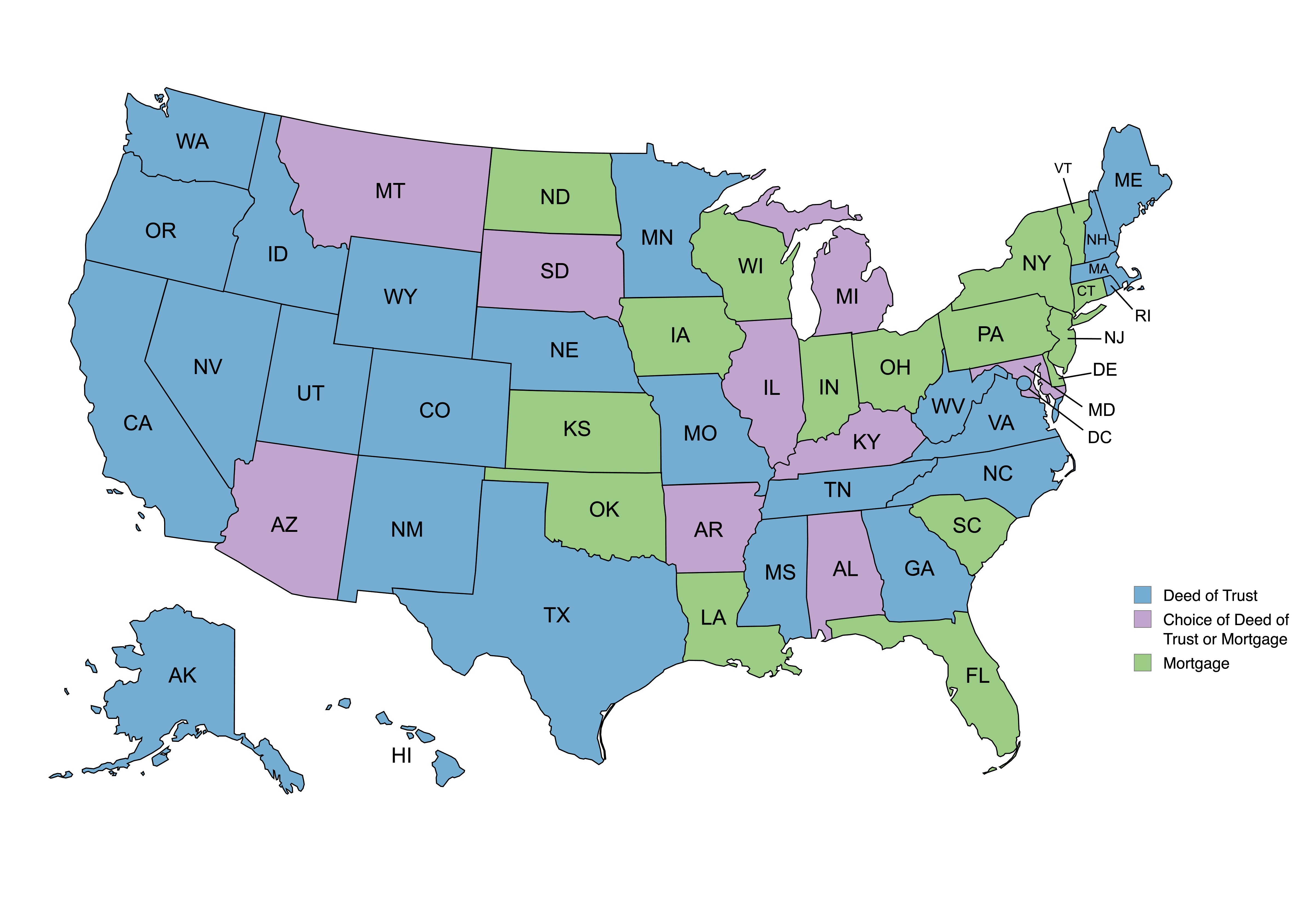

Interestingly, 26 states use a deed of trust exclusively, while an additional nine states give lenders the option to choose between a deed of trust or a mortgage. Knowing which type of document applies to your home loan is important, especially if you’re buying in a state where the rules might affect your rights as a borrower.

In this guide, we’ll be simplifying the “deed of trust vs mortgage” debate by going through what each of them are, how they work, and the key differences between the two.

Understanding the Fundamentals

What Is a Mortgage?

A mortgage is a loan specifically designed to help you buy a home. When you get a mortgage, you’re borrowing money from a lender to cover the cost of the property, and in return, you agree to pay it back over time with interest.

But until you pay off the loan, the lender has a legal claim on your home, which means they can foreclose on the property if you stop making payments. Essentially, a mortgage is a collateral arrangement where the house itself backs up the loan. With a mortgage, you own the property, but the lender has a lien on it, giving them the right to take it if you can no longer make the payments.

Pros and Cons of a Mortgage

Pros:

- More borrower protection with a judicial foreclosure process

- Longer foreclosure process gives you the opportunity to catch up on payments, contest the foreclosure, or negotiate a solution

- In some states, you have a redemption period after foreclosure

- Less third-party involvement

- Reduces complexities with a more straightforward relationship with the lender

Cons:

- Lengthy foreclosure process that may take months or even years to finalize

- Potentially higher legal fees and more stress with longer foreclosure process

- Less flexibility for a quick resolution if you decide to move on from the property

Parties Involved in Getting a Mortgage

When getting a mortgage, there are two main parties involved:

- Borrower: The borrower is you – the person looking to buy the property and repay the mortgage loan over time.

- Lender: The lender provides the funds for the mortgage, which allows you to buy the property. To protect the lender, they hold a lien on the property, giving them legal claim on it if payments aren’t made.

What Is a Deed of Trust?

A deed of trust is a legal agreement that works a bit differently from a traditional mortgage but ultimately serves the same purpose: to secure a home loan.

When you use a deed of trust, three parties are involved: you (the borrower, or “trustor”), the lender (the “beneficiary”), and a neutral third party known as the “trustee.” Here’s how it works: when you take out the loan, you transfer the legal title of the property to the trustee, who holds it on behalf of the lender until the loan is paid off. Think of the trustee as a middleman who can step in if you stop making payments.

Other than the deed of trust, another important part of the trust arrangement is a promissory note, which is the actual contract that outlines the loan amount, interest rate, payment schedule, and repayment terms. Simply put, the deed of trust connects the loan to the property, whereas the promissory note sets out your obligation to repay it.

Compared to a traditional mortgage, a deed of trust often allows for a quicker, non-judicial foreclosure if you stop making payments. So, while it’s still a path to homeownership, a deed of trust shifts more of the control to a third party, which can benefit the lender.

Pros and Cons of a Deed of Trust

Pros:

- Avoid long, drawn-out legal battles and potentially work out alternative solutions if you default on the loan

- Less court involvement during the foreclosure process

- Simpler loan process

- Keeping more control within the borrower-lender relationship rather than involving a court

Cons:

- Risk of faster foreclosure, meaning less time to catch up on missed payments

- Less borrower protection (e.g. fewer opportunities to dispute or delay foreclosure)

- Limited or unavailable redemption rights

Parties Involved in Getting a Deed of Trust

A deed of trust involves an additional party compared to a traditional mortgage. This arrangement is common in states that use a deed of trust instead. The key players involved are:

- Trustor: You, the homebuyer, are the trustor in this arrangement. Similar to a borrower in a mortgage, you secure financing from a lender to purchase the property and agree to repay the loan over time. As the trustor, you transfer legal title to the property to a neutral third party (the trustee) as security for the loan.

- Beneficiary: The beneficiary is the lender providing the funds for the home purchase. They benefit from the deed of trust because it allows them to foreclose more quickly through a non-judicial process if the borrower defaults. The lender’s interest is secured through the deed of trust rather than directly holding a lien on the property.

- Trustee: The trustee is an independent third party who holds the legal title to the property until the loan is paid off. The trustee’s role is crucial because they act as a neutral party who can facilitate foreclosure if the borrower defaults or transfer the title to the borrower once the loan is fully repaid. Trustees are often title companies, attorneys, or other legal entities.

Key Similarities Between Deed of Trust vs Mortgage

While deeds of trust and mortgages have some distinct differences, they share several key similarities that make them easy to confuse.

Both are tools that help you secure a home loan by using the property itself as collateral, which means your home backs the loan until it’s fully repaid. In both cases, you’re agreeing to make regular payments to the lender, and if those payments stop, the lender has the right to initiate foreclosure and take the property. Additionally, deeds of trust and mortgages are recorded with the local government to make the agreement official, creating a public record of the lender’s interest in the property.

So, whether you’re dealing with a deed of trust or a mortgage, you’re following a similar path toward homeownership, with a lender’s interest in your home as security until the loan is paid in full.

Key Differences Between Deed of Trust vs Mortgage

The main differences between a deed of trust and a mortgage come down to who’s involved and how foreclosure works. In a mortgage, there are just two parties (the borrower and lender), while a deed of trust adds a third party, called the trustee, who holds the title until the loan is paid off.

This structure has a big impact on foreclosure: with a deed of trust, foreclosure can usually happen outside of court through a quicker, non-judicial process led by the trustee. On the other hand, a mortgage requires judicial foreclosure, meaning the lender has to go through the court system, which can be a longer process but tends to offer more protections for the borrower.

State Laws and Regulations on Deeds of Trust and Mortgages

Depending on where you buy your property, you may need to use one option over the other. Here is a list of the 26 states that use a deed of trust instead of a mortgage:

- Alaska

- California

- Colorado

- District of Columbia

- Georgia

- Hawaii

- Idaho

- Maine

- Massachusetts

- Minnesota

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Hampshire

- New Mexico

- North Carolina

- Oregon

- Rhode Island

- Tennessee

- Texas

- Utah

- Virginia

- Washington

- West Virginia

- Wyoming

Beyond this list, there are nine states that let the lender to have a choice of either using a deed of trust or a mortgage:

- Alabama

- Arizona

- Arkansas

- Illinois

- Kentucky

- Maryland

- Michigan

- Montana

- South Dakota

If your state isn’t listed on either of these lists, then you’d be required to get a mortgage.

Which is Right for You: Deed of Trust vs Mortgage?

Choosing between a deed of trust and a mortgage comes down to a few key factors: your state of residence, personal preferences, and even the type of property loan you’re taking out.

Depending on where you live, you might not have much choice, as some states primarily use one over the other. If you’re in a state that offers both, consider how each option’s foreclosure process affects your security – the faster, non-judicial path of a deed of trust versus the longer, court-involved route of a mortgage. Different types of property loans might also steer you toward one option over another based on how quickly the lender can reclaim the property if needed.

Curious about which is best for your situation? Book a call with us at Defy Mortgage today to get personalized guidance from one of our mortgage experts and choose the right path to homeownership.

Deed of Trust vs Mortgage FAQs:

- What is the difference between a deed of trust vs mortgage?

A deed of trust involves three parties – the borrower, lender, and trustee – whereas a mortgage involves only the borrower and lender. In a deed of trust, the trustee holds the title until the loan is paid off, whereas in a mortgage, the borrower holds the title directly.

- How many parties are involved in a deed of trust vs mortgage?

A deed of trust involves three parties: the borrower (trustor), lender (beneficiary), and trustee. A mortgage involves two parties: the borrower and the lender.

- Which states use a deed of trust instead of a mortgage?

Twenty-six states use deeds of trust exclusively, while nine additional states allow lenders to choose between a deed of trust and a mortgage. For an exact list, refer to the State Laws and Regulations on Deeds of Trust and Mortgages of this article.

- What is a trustee in a deed of trust, and what do they do?

The trustee in a deed of trust is a neutral third party who holds the legal title to the property until the loan is paid off. If you default, the trustee can initiate foreclosure on behalf of the lender.

- How does the foreclosure process differ between a deed of trust vs mortgage?

With a deed of trust, foreclosure typically occurs through a faster, non-judicial process managed by the trustee. A mortgage generally requires judicial foreclosure, involving the court system and resulting in a longer process.

- What’s the most significant difference between a deed of trust vs mortgage from a practical standpoint?

The biggest practical difference is the foreclosure process: a deed of trust allows for quicker, non-judicial foreclosure, while a mortgage typically requires judicial foreclosure, which is longer but provides more borrower protections.