Real estate investing is one of the best and safest ways to build long-term wealth and financial freedom, but getting financing for real estate ventures is often challenging, time-consuming, and full of red tape, especially if you’re an investor whose income doesn’t fit the traditional mold.

That’s why DSCR (Debt Service Coverage Ratio) loans have become a go-to financing solution for today’s real estate investors. They offer a faster, more flexible way to qualify based on property income potential. DSCR loans don’t care about the nature of your income. Instead, they focus on what really matters: your property’s cash flow.

At Defy Mortgage, creative financing solutions for real estate investors, like DSCR loans, are at the core of our DNA. Whether you want to create a steady passive cash flow out of long-term rentals, leverage self-employed income with a bank statement loan, or maximize short-term returns with an interest-only loan, we can give you the tools to realize your investment strategy.

In this guide, we’ll tell you all you need to know about DSCR loan down payment requirements, including:

- What DSCR loans are, what problems they solve, and how they function.

- The complete list of DSCR loan requirements.

- Advantages of leveraging DSCR loans for your investment strategy.

- How to apply for a DSCR loan.

- The best markets to take full advantage of this loan type.

Let’s get right into it.

What Are DSCR Loans?

DSCR loans are designed for real estate investors who qualify based on rental income rather than personal income. They focus on whether a property earns enough to cover its debts. DSCR loan down payment requirements typically range from 20–25%, depending on the lender and the property’s debt service coverage ratio.

What are the DSCR Loan Down Payment Requirements?

The “debt service” part of DSCR refers to how much money you owe, and the “coverage ratio” part refers to how much of that debt your property’s income can cover. DSCR is calculated by dividing your property’s NOI, which is income after operating expenses, by its TDS, or total debt service, which includes HOA fees and property taxes.

The standard down payment for a DSCR loan is 20%, but the following factors can contribute to an even lower down payment:

- Higher Credit Score

- Higher DSCR

- Desirable Property Location

- Working with a lender with High LTV

Choosing the right lender to work with matters. For example, even if you have a high credit score, DSCR, and an ideal property location, if a lender has a max LTV of 75%, your lowest down payment with them will be 25%.

At Defy Mortgage, we go as high as 85% LTV, allowing you to qualify for a DSCR loan with as low as 15% down (Note: this does not include cash-out DSCR options as our cash-out max LTV for DSCR loans is 80% LTV)

This LTV unlocks for borrowers with 740+ FICO and DSCR ≥ 1.000. The max LTV decreases based on your DSCR ratio and loan size:

- Up to 75% LTV if DSCR is between 0.750–0.999 (loan amounts ≤ $1.5M)

- Up to 75% LTV if DSCR is between 0.500–0.749 (loan amounts ≤ $1M)

- Foreign nationals: Up to 70% LTV for purchases with DSCR ≥ 1.000

If you’re shopping around for DSCR loans, be sure to discuss with your lender how much of a down payment you’re expected to make to avoid surprises. The percentage required depends on credit, loan size, property type, and income profile.

Complete DSCR Loan Requirements

Aside from down payment, DSCR loans have additional requirements that borrowers need to meet in order to get approved:

Credit Score Minimums

DSCR loans are considered higher-risk than conventional loans, so most lenders look for credit scores in the upper 600 range, usually 650-680. However, the best terms unlock for borrowers with FICO scores exceeding 700. At Defy Mortgage, our minimum credit score for DSCR loan approval is 640.

Property Types and Restrictions

You can only finance income-generating properties using DSCR loans. These properties also cannot be your primary residence. Most lenders also place restrictions on rural properties, mobile homes, manufactured homes, and vacant land.

At Defy Mortgage, we offer DSCR loans for single-family rentals (SFRs), multi-family rentals up to 9 units, PUDs, town homes, row homes, site-built condos, modular homes, warrantable and non-warrantable condos, co-ops, and condotels. We also have a dedicated program for Airbnb STRs.

Loan Limits and Documentation

Common loan limits go up to $3,000,000, but how much your lender is willing to lend you will depend on your financials and DSCR. At Defy Mortgage, we can go up to $6M depending on LTV, credit score, and DSCR. This decreases to $1.5M for DSCRs between 0.750-0.999, and $1M for DSCRs between 0.55-0.749.

DSCR Ratio Requirements

The minimum DSCR for most lenders is 1.0, indicating that your property breaks even on all of its expenses and debt obligations. However, some may have a stricter requirement of 1.25.

If you have a negative ratio (lower than 1.0), you will have to find a lender that permits that. Defy Mortgage is one such lender. We allow DSCR loans for properties with as low as 0.55 DSCR with at least 3 months cash reserve. Defy Mortgage’s DSCR loans allow you to qualify entirely using rental income.

Advantages of Making Down Payments on a DSCR Loan

Although putting money down might not be ideal if you’re low on capital, it comes with significant benefits:

- More equity: A larger down payment directly increases your ownership stake in the property. Higher equity protects you from market downturns, improves your creditworthiness, and unlocks financing options like HELOCs and home equity loans.

- Lower monthly payments: The total amount you have to pay in interest depends on your principal. Since down payments reduce your principal, the larger the down payment, the less you have to pay in interest.

- Better chance of approval: A substantial down payment signals to lenders that you’re financially stable and committed to the property’s success. This makes you less likely to default, and thus a much safer investment for them.

DSCR Loan Application Process

Applying for a DSCR loan is much more straightforward than most traditional mortgage products. While every lender’s process may differ slightly, the core steps are similar across most DSCR programs:

Pre-qualification Steps

Before applying, make sure your investment property and finances are ready. Taking a few simple steps up front will help you streamline the process, secure stronger terms, and move confidently toward closing:

- Find a DSCR-experienced lender: Start by selecting a lender that has experience in offering a dedicated DSCR program and understands real estate investment financing. At Defy Mortgage, our Mortgage Consultants have over a century’s worth of collective experience in diverse markets across the United States, allowing us to apply deep, market-informed nuance to every scenario.

- Calculate your DSCR: Before sending in your application, calculate your DSCR. This will determine what terms to expect, including minimum down payment, loan amount, and rate. If your DSCR is lower than ideal, it may be best to wait until your credit score has recovered or choose a different property to get favorable terms once you apply.

- Get pre-qualified: This quick review helps confirm your eligibility, potential loan amount, and rate range before you make an offer, and it also gives you an edge over competing buyers who aren’t pre-qualified. At Defy Mortgage, you can get pre-qualified in a matter of days.

Documentation Checklist

Before and during underwriting, you’ll need to provide several key documents. While DSCR loans are simpler than traditional loans, complete and accurate documentation still helps accelerate approval. Typical documentation includes:

- Property details: Purchase contract, address, and appraised value.

- Rental income documentation: Lease agreement or market rent estimate

- Credit report: Your lender will ask for your permission to pull your credit report, usually a full pull of a tri-merge report that shows your credit history, open accounts, balances, and scores from all three major bureaus (Equifax, Experian, and TransUnion).

- Entity documentation: If you’re borrowing under an LLC or other business entity, you’ll need to provide formation documents, operating agreements, and proof of ownership.

- Proof of funds: Recent bank statements or verified investment account balances proving sufficient funds for the down payment, closing costs, and cash reserves.

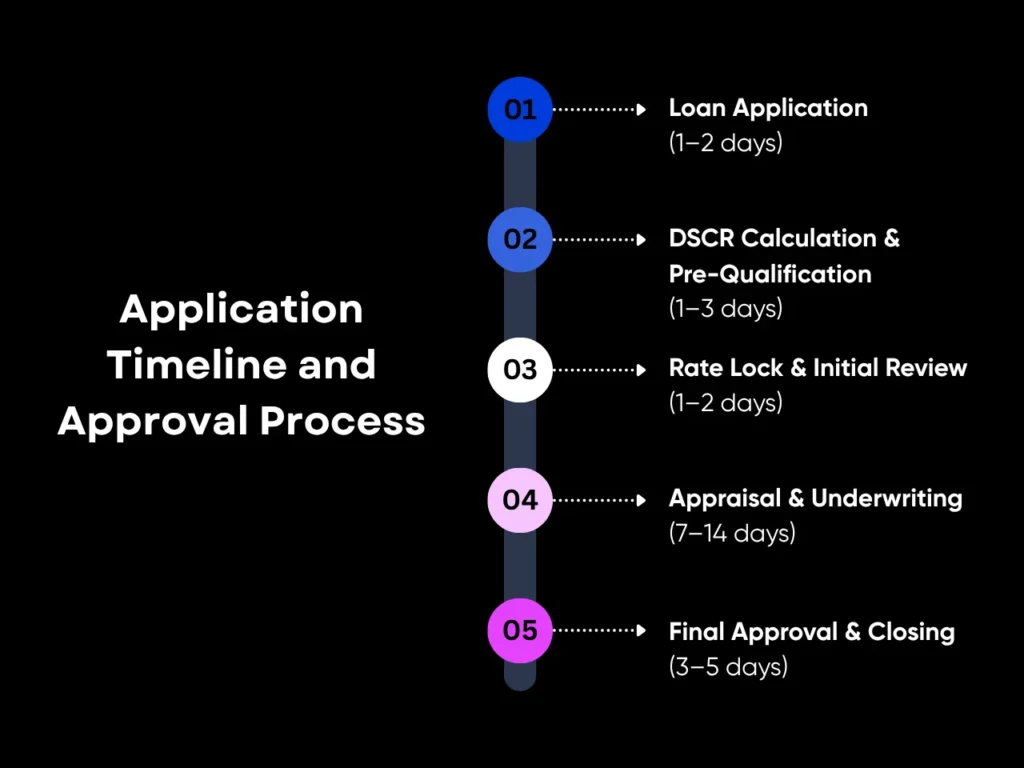

Application Timeline and Approval Process

While every borrower’s timeline may vary, most DSCR loans follow a predictable flow from start to funding. Here’s how long each stage typically takes:

- Loan Application (1–2 days): Complete your initial DSCR loan application online or with the help of a loan specialist. They’ll gather basic details about your property and investment goals.

- DSCR Calculation & Pre-Qualification (1–3 days): The lender will calculate your property’s Debt Service Coverage Ratio and verify that there’s enough income potential to cover the loan amount.

- Rate Lock & Initial Review (1–2 days): Once your DSCR and property profile are confirmed, you can lock in an interest rate while the lender’s team begins preliminary underwriting.

- Appraisal & Underwriting (7–14 days): The property will be appraised to confirm value and rental potential. During underwriting, the lender will review your credit, title, and property documentation to finalize approval.

- Final Approval & Closing (3–5 days): Once underwriting clears, you’ll receive final loan terms and closing documents. After signing, funds are quickly released to your escrow account.

At Defy Mortgage, most borrowers close their DSCR loans in as little as 2–4 weeks, depending on property type and documentation speed.

What to Expect During Underwriting

Before your DSCR loan is finalized, your lender will complete a standard underwriting review to confirm that both you and the property meet lending requirements. Underwriting generally includes:

- Credit report review: Lenders can make either a soft or full pull of your credit info to confirm creditworthiness.

- Appraisal: Independent valuation to verify property market value and rent comparables.

- Rental income verification: Validation of lease agreements or estimated market rent to confirm debt coverage.

- Title search: Ensures the property has clear ownership and no outstanding liens.

- Final underwriting decision: The lender issues a final approval and prepares closing documents.

Best Markets for DSCR Loan Investments

While DSCR loans were designed to allow rental portfolios to flourish, they perform best in certain environments. Market conditions that maximize the benefit of DSCR loans include:

- High rental demand: This includes markets like California, Texas, New York, and Tennessee.

- Strong job growth: Areas with high job availability typically have low unemployment. This means that buyers here have more purchasing power and are less likely to default.

- Population growth: Cities experiencing consistent migration often sustain stable rent appreciation and long-term investment viability.

Additional indicators include:

- High rental yields: Areas where rent rates are higher are more likely to have DSCR ratios above minimum thresholds.

- Economic diversity: Similar to job growth, economic diversity ensures that even if one sector experiences a downturn, others will not necessarily be affected. This makes it much more likely for rental demand to stay up even if certain industries are experiencing low periods.

- Appreciation potential: Markets with consistent property value growth offer long-term wealth-building opportunities, allowing investors to gain both from rental income and rising equity over time.

If qualifying for a DSCR loan or meeting its down payment requirements is challenging, investors may consider alternative non-QM options. These include bank statement loans, which allow you to qualify using bank statements instead of tax returns or pay stubs, or asset-based options which let you use your liquid assets, such as mutual funds to stand in for income.

If you have significant equity in your investment properties, you can leverage it with a DSCR cash-out refinance to secure a substantial amount of capital. Defy Mortgage offers DSCR cash-out refinances with the following terms:

- Minimum credit score: 640 FICO

- Max LTV: 80%

- Minimum DSCR: 0.55

- Loan amounts: Up to $3M at 65% LTV/ up to $2M at 75% LTV

- Cash-in-hand limits: Unlimited pending LTV

Open to foreign nationals and investors, with interest-only options available.

Key Takeaways

DSCR loan down payment requirements can be as low as 15% for strong borrowers and flexible terms designed around cash flow. This is one of the reasons it can open doors to faster growth and smarter investing. The best investment opportunities tend to be in high-demand markets like California, Texas, New York, and Tennessee, where job growth, rental stability, and appreciation potential work together to build long-term wealth.

To get the most out of your investment, focus on boosting your credit score, improving your property’s DSCR ratio, and targeting markets with steady rental yields. A little preparation goes a long way. More than just unlocking a low down payment, a stronger DSCR ratio and credit score also unlock lower rates, higher leverage, and better cash flow over time.

At Defy Mortgage, we make it simple to put these strategies into action. Whether you’re expanding your rental portfolio, financing another long-term rental property, or scaling your short-term rental business, our team knows how to match your goals with the right loan. We’ll help you find the flexibility, speed, and leverage you need to grow your investments on your own terms.

And if you’re a mortgage broker, Defy TPO gives you access to all 75+ of Defy Mortgage’s flexible loan products, including DSCR, bank statement, and asset-based programs. With DefyTPO, you can serve more investors, tap into the booming non-QM market, and bring your clients the creative financing solutions most lenders simply can’t offer. Want to know more about how you can dominate the market with DefyTPO? Send us the scenarios you’re having trouble with, and we’ll show you how we build solutions that work over the long term. Alternatively, we also have a handy AI Pricer for quick quotations.

Frequently Asked Questions

Do You Have to Have a Down Payment for a DSCR Loan?

Yes. You always need to put money down. No standard DSCR program allows for 0% down.

DSCR Loans With No Down Payment: Do They Exist?

Practically never. Only in extremely rare, custom deals might a lender offer a DSCR loan with no down payment, but that’s not something typical borrowers should plan for.

How Much of a Down Payment Is Required for a DSCR Loan?

Usually 15% to 25%, with 20% being the most common starting point.

Can You Get a DSCR Loan With 10% Down?

Generally no, but experienced investors may be able to find options that offer down payments as low as 10%. However, these options may have higher interest rates and/or lower loan amounts.

Can You Get a DSCR Loan With 15% Down?

Yes, some lenders (like Defy Mortgage!) offer as low as 15% down for borrowers with strong credit and DSCR.

How Do You Calculate the Down Payment for a DSCR Loan?

Your DSCR loan down payment is a percentage of the property’s purchase price. With most lenders, this is 20%. That means if you want to buy a $500,000 apartment building, you’ll have to pay $100,000 upfront. With Defy Mortgage, however, your down payment can be as low as 15%, in which case you’ll only have to pay $75,000 upfront.

What Factors Affect DSCR Down Payment?

- LTV (how much the lender is willing to finance).

- The property’s DSCR ratio (higher DSCR unlocks lower down).

- Borrower credit score / financial strength.

- Property type, location, and market risk.

- Lender policy/program flexibility.

How Can You Reduce Your DSCR Down Payment Amount?

- Improve your credit score.

- Select a property with stronger income, or raise your rental property’s income if refinancing into a DSCR loan.

- Negotiate with a lender who specializes in DSCR loans, like Defy Mortgage.

- Increase your cash reserves.

How Do You Calculate DSCR on a Loan?

DSCR = Net Operating Income (NOI)Debt Service ( principal + interest + taxes + insurance + HOA fees)

Where Can You Get a DSCR Loan?

Non-QM lenders, private lenders, niche real estate financing firms, and some banks that offer investment-property or DSCR programs. You’ll get the best results from non-QM specialists that have years of experience providing DSCR loans. With Defy Mortgage, you also get a team of consultants who have decades of experience in real estate markets that you’re interested in.