Debt Service Coverage Ratio (DSCR) loans offer an attractive financing option for real estate investors. These loans leverage rental income potential to grow investment properties or real estate portfolios. DSCR loan interest rates play a crucial role in determining the affordability and feasibility of such investments. Understanding how to calculate this interest rate can be beneficial for investors looking to optimize their financial strategy and cash flow management.

At Defy Mortgage, we provide a comprehensive mortgage solution to simplify the home-buying process. We cater to entrepreneurs, freelancers, and real estate investors with nontraditional lending options tailored to individual needs. Our offerings include DSCR loans, bank statement loans, and foreign national loans. We ensure competitive rates and a seamless platform, making mortgage management effortless. Our commitment to transparency and excellence ensures a stress-free experience for all homeowners.

Based on our years of experience in the mortgage industry, we’ve created this guide to explore DSCR loan interest rates, how to calculate them, and tips for finding the best rates. Eventually, you will understand how DSCR loans can benefit your real estate investments and how to secure the best terms.

Let’s dive in!

What are DSCR Loan Interest Rates?

DSCR loan interest rates refer to the percentage applied to mortgages where the Debt Service Coverage Ratio (DSCR) determines the borrower’s eligibility. These rates differ from conventional loans as they assess the property’s income rather than personal income. Due to their flexibility, real estate investors often prefer DSCR mortgage loans.

Private mortgage lenders and mortgage brokers often use the DSCR calculator to determine the right mortgage rates for rental properties. This calculator helps assess whether a property’s income can adequately cover loan payments for various types of loans. Understanding the current DSCR mortgage rates and the benefits of DSCR loans can guide rental property investors in making informed decisions about their mortgage loan options.

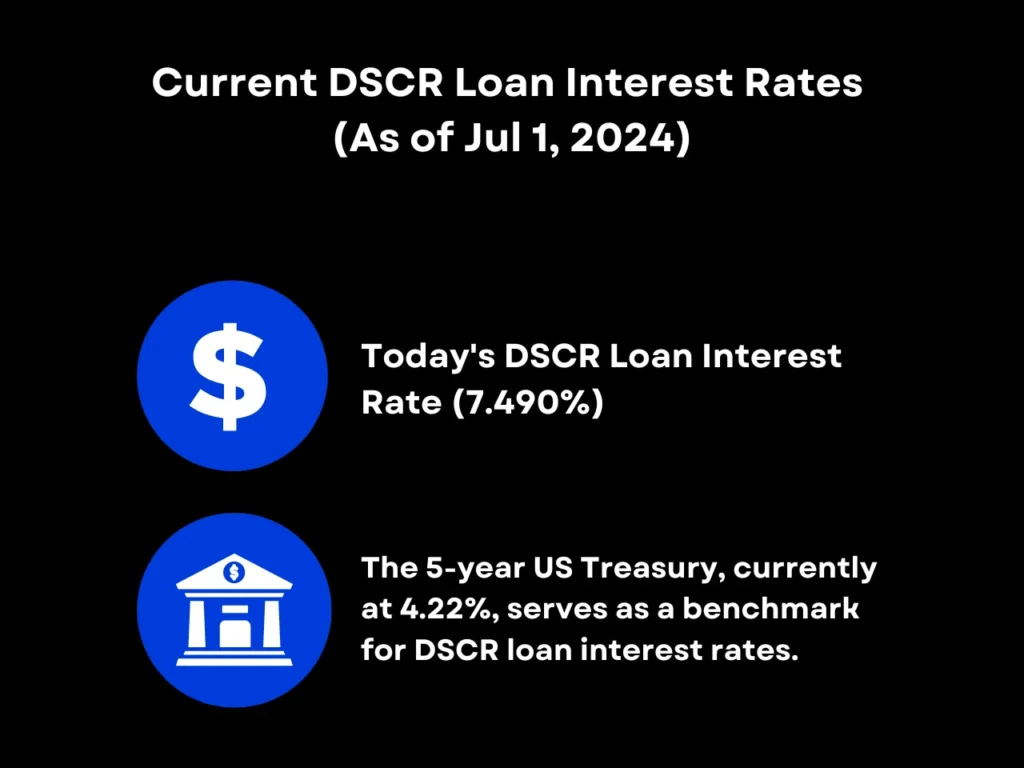

Current DSCR Loan Interest Rates (As of July 1, 2024)

Today’s DSCR loan interest rate is 7.490%, with the 5-year US Treasury yield of 4.22% serving as a key benchmark. Recent fluctuations in Treasury yields have directly impacted DSCR interest rates, primarily driven by inflation and Federal Reserve policies.

Despite this volatility, DSCR mortgage rates remain competitive, currently ranging between 7.25% and 8.5%. Borrowers considering these loans should note that if interest rates drop, opting for a lower prepayment penalty can facilitate effective refinancing. DSCR loans continue to offer attractive financing options for rental properties compared to traditional loans.

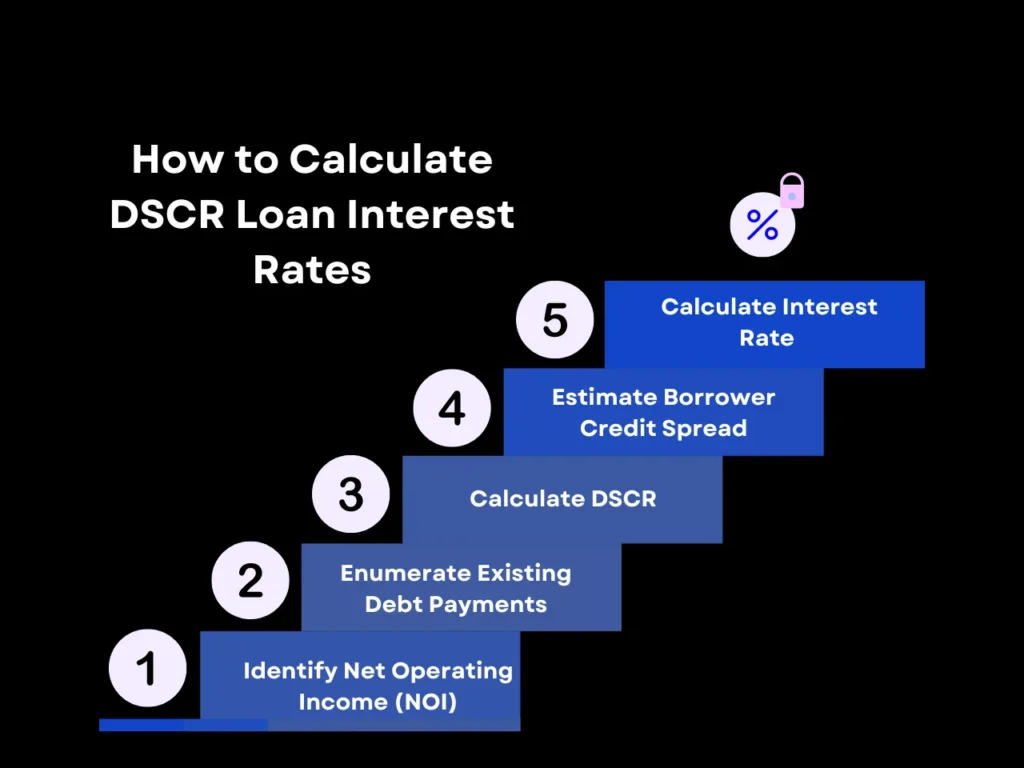

How to Calculate DSCR Loan Interest Rates

Calculating DSCR loan interest rates is crucial for real estate investors. It helps them understand the cost of borrowing and evaluate a property’s financial feasibility. The DSCR determines the loan’s interest rate. Here’s how to calculate DSCR mortgage rates:

Step 1: Identify Net Operating Income (NOI)

Begin with identifying the property’s net operating income (NOI). This figure represents the total income generated from the property after deducting all operational expenses. Accurately calculating NOI is crucial as it forms the basis of the DSCR interest rates.

Step 2: Enumerate Existing Debt Payments

Once NOI is determined, list all current debt payments on the property. These may include mortgages, lines of credit, and other financial obligations tied to the property. Be sure to determine the property’s PITIA (Principal, Interest, Taxes, Insurance, and Association Fees) to account for all financial commitments when calculating DSCR mortgage rates.

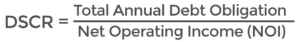

Step 3: Calculate the DSCR

To calculate the Debt Service Coverage Ratio (DSCR), divide the NOI by the total annual debt obligation. The DSCR indicates that a property is generating enough income to cover its debt obligations. A higher DSCR is generally seen as a positive sign for lenders, as it suggests a lower risk of default, thereby leading to better loan terms and lower DSCR loan interest rates.

Formula:

Step 4: Estimate Borrower Credit Spread

The Borrower Credit Spread is the difference between the interest rate offered to a borrower and the yield on a comparable risk-free asset. It reflects the additional interest rate lenders charge to compensate for the perceived risk of the borrower defaulting on the loan.

To estimate this spread, use the borrower’s credit score and down payment percentage:

- Credit Score: A higher credit score indicates lower risk, which generally results in a lower credit spread. Obtain the credit score from a reliable credit reporting agency. You may also verify the employment and income stability to gauge the borrower’s creditworthiness. Stable employment and reliable income suggest a lower risk of default.

- Down Payment Percentage: Calculate the down payment percentage based on the loan amount (principal) and property value. A higher down payment indicates that the borrower has more equity in the property, potentially leading to a lower credit spread.

Estimating the credit spread helps mitigate the impact of potential defaults and determine whether to approve or reject a loan application. A lower credit spread means the borrower will pay less interest on the loan, reflecting their lower risk. Conversely, a higher credit spread indicates higher perceived risk. This means the borrower will be paying more interest.

Step 5: Calculate Interest Rate

Once all set, add the Borrower Credit Spread to the 5-year US Treasury rate to determine the DSCR loan interest rate. Calculating the interest rate applicable to a DSCR loan helps you understand the cost of borrowing. Here’s a guide to help you out:

Formula:

DSCR Loan Interest Rate = 5-Year US Treasury Rate + Borrower Credit Spread

Sample Calculation

If a 5-year US Treasury rate is 4.22% and a Borrower Credit Spread ranges from 2.65% to 4.5%, with the average Borrower Credit Spread of 3%, then:

DSCR Loan Interest Rate = 4.22% + 3% = 7.22%

Factors Influencing DSCR Loan Interest Rates

Understanding the factors influencing DSCR loan interest rates helps borrowers secure favorable terms. DSCR, short for Debt Service Coverage Ratio loans, involves several key elements that lenders should consider. Here, we explore the top 5 factors to consider, helping you determine the interest rate and loan conditions.

1. Credit Score and Loan Amount

Your credit rating impacts the interest amount you pay on a DSCR mortgage. Lenders typically look at your credit score to see if you can repay loans on time. A good credit score usually means a lower interest rate. Conversely, a low credit score suggests a higher risk, leading to a proportionate higher interest rate. The loan size also affects the interest rate. Bigger loans often have higher interest rates because they are riskier for lenders.

2. DSCR Ratio and Borrower’s Profile

The DSCR ratio is used to evaluate a property’s cash flow to cover its mortgage payment. A high DSCR, typically above 1.25, indicates lower risk, allowing lenders to offer favorable interest rates. Alternatively, a low DSCR, usually below 1.0, could mean higher interest rates or even loan rejection. The borrower’s ability to generate good cash flow from the property impacts DSCR loan interest rates. Lenders prefer properties with a steady, strong income stream.

3. Market Conditions and Federal Reserve Policies

Market conditions and Federal Reserve policies significantly influence DSCR loan interest rates. The real estate market’s status, such as property values and purchase prices, affects interest rates. During market downturns, rates may rise due to a perceived higher risk of default. Federal Reserve policies, including rate cuts or hikes, directly impact the average interest rate on DSCR loans. Lenders adjust rates based on these policies to manage their lending risk.

An increase in interest rates also increases the cost of borrowing money across the board. This includes the rates on Treasury bonds, which serve as a benchmark for DSCR loan rates. As a result, DSCR loan interest rates also tend to increase following Fed rate hikes. Lenders adjust rates based on these policies to manage their lending risk.

4. Type of Loan and Lender

The type of DSCR loan and the lender also determine the interest rates. Hard money loans, often used for short-term rentals and property investments, typically have higher interest rates due to their higher risk. In contrast, traditional mortgages and private lending options might offer lower interest rates. DSCR loan requirements and the specific DSCR lenders’ criteria can also vary, influencing the final interest rate. Different lenders have varying risk tolerances and pricing structures, so comparing rates from multiple lenders is crucial.

5. Property’s Cash Flow and LTV Ratio

A property’s cash flow and Loan-to-Value (LTV) ratio play vital roles in determining DSCR loan interest rates. Properties are generating cash flow and posing lower risks tend to secure more advantageous interest rates. The LTV ratio compares the loan amount to the property’s value, significantly impacting the interest rate. A lower LTV ratio signifies reduced risk, leading to more favorable interest rates, whereas a higher LTV ratio could result in elevated interest rates.

How to Find the Best DSCR Loan Interest Rates

Finding the best DSCR loan interest rates can significantly impact your investment returns. Following a strategic approach, you can secure favorable terms that enhance your investment’s profitability. Here are five essential steps to help you navigate the process and find the most competitive DSCR mortgage rates for your real estate ventures:

Step 1: Research and Compare Lenders

Finding the best DSCR loan interest rates requires thorough research and comparison of lenders. Start by identifying reputable lenders specializing in DSCR loans. Evaluate their offerings, interest rate policy, loan terms, and customer reviews. This approach ensures a comprehensive understanding of each lender’s strengths and weaknesses, helping you make an informed decision.

Here are the top five factors to consider:

- Interest Rates: Compare the DSCR interest rates offered. Lower rates can save substantial amounts over the loan term.

- Loan Terms: Examine the flexibility of loan terms. Longer terms may reduce monthly payments but could increase the total interest paid.

- Lender Reputation: Research the lender’s reputation. Check reviews and ratings to ensure reliability and customer satisfaction.

- Customer Service: Assess the quality of customer service. Prompt and clear communication is crucial during the loan process.

- Fees and Costs: Investigate any additional fees or costs. Hidden fees can impact the overall cost of the loan.

You can effectively compare and identify the most favorable DSCR loan interest rates for your needs. At Defy Mortgage, we deliver a comprehensive mortgage solution. Our expertise in DSCR loans ensures you receive competitive interest rates tailored to your financial needs. We prioritize transparency and customer satisfaction, helping you secure the best DSCR mortgage rates for your investment properties.

Step 2: Check Your Credit Score

Lenders use credit scores to determine interest rates for DSCR loans. A higher credit score often results in better interest rates, saving money over the loan’s term. Lenders assess your creditworthiness based on this score, making it a pivotal factor in their decision-making process. Regularly reviewing your credit report lets you identify and rectify any inaccuracies, ensuring your score remains optimal.

Here are the key considerations when evaluating the interest rate for DSCR loans:

- Credit History: A clean credit history can lower DSCR mortgage rates. Lenders favor applicants with consistent, on-time payments.

- Debt-to-Income Ratio: A lower ratio indicates better financial health, which can help secure competitive DSCR mortgage rates.

- Loan-to-Value Ratio: A lower ratio often results in more favorable DSCR loan interest rates. Lenders view it as a lower risk.

- Market Conditions: Interest rates fluctuate based on economic conditions. Monitoring market trends can help you lock in the best DSCR interest rates.

- Lender Relationship: Establishing a strong relationship with your lender can lead to personalized DSCR mortgage rates and terms. Regular communication and a history of previous loans can be beneficial.

Understanding these factors can significantly impact the DSCR interest rates for which you qualify. Conduct thorough research and maintain a strong credit profile to secure the most favorable rates.

Step 3: Assess Loan Amount and Term

When assessing the best DSCR loan interest rates, understand the loan amount and term. Lenders offer varying interest rates based on these factors. A larger loan amount often secures better rates, but it’s crucial to balance this with the term length. Shorter terms typically mean higher monthly payments but lower interest costs overall.

Choose a term that balances monthly payments with overall interest costs. Shorter terms save money in the long run. Different lenders have varying criteria. Compare multiple offers to find the best rates. You can secure the most favorable DSCR mortgage rates by carefully assessing these factors. Review each lender’s terms and conditions to make an informed decision. Taking these steps will help you achieve the best possible financial outcome.

Step 4: Consider Property Type

Property types, such as residential, commercial, or mixed-use, can impact the interest rates offered. Lenders assess risk based on the property’s use and potential income generation, influencing the available DSCR mortgage rates. Understanding each property type’s requirements and benefits can help you secure favorable rates.

Here are the considerations for evaluating property type:

- Residential Properties: Typically, these properties offer lower DSCR mortgage rates due to their stable rental income and high demand.

- Commercial Properties: These properties may have higher DSCR loan interest rates because of their variable income streams and market fluctuations.

- Mixed-Use Properties: Interest rates for mixed-use properties depend on the proportion of residential and commercial spaces, affecting the overall risk assessment.

- Multi-Family Units: These properties often attract favorable DSCR interest rates due to their multiple income streams from various tenants.

- Special Purpose Properties: Lenders may consider these properties riskier due to their limited market appeal and specialized use, leading to higher DSCR mortgage rates.

Considering these factors ensures a comprehensive understanding of how property type influences the interest rate, enabling better decision-making in the loan process. Evaluate each property type’s characteristics and risks to find the most advantageous DSCR loan interest rates for your investment.

Step 5: Negotiate with Lenders

Negotiating with lenders is crucial to securing favorable loan terms. Start by comparing offers from multiple lenders. Each lender evaluates DSCR loans differently, impacting the interest rates. Present your case confidently, showcasing strong debt service coverage ratios. Highlight your ability to generate sufficient cash flow to cover debt obligations. This can persuade lenders to offer competitive rates.

You can even request rate reductions based on market conditions and your financial stability. Consider locking in a fixed rate to avoid future fluctuations. Discuss potential rate discounts for longer loan terms or larger loan amounts. Strong negotiation skills can significantly impact the final interest rate, saving you money over the loan period.

Key Takeaway

DSCR loan interest rates significantly impact real estate investments and business financing. Understanding these rates helps in making informed decisions. Real estate investors, freelancers, and self-employed individuals benefit from knowing the current DSCR loan rates and how they fluctuate based on economic conditions and market demand. Accurate calculation and comparison of these rates with traditional loans provide a clearer financial picture, which is crucial for successful investments.

Finding the best rates involves thorough research and comparison of lenders. Factors such as credit score, loan amount, and property type play a significant role. Negotiating better rates requires a strong financial profile and a strategic approach. For self-employed individuals, bank statement loans are a valuable option, offering flexibility in verifying income to expedite the mortgage approval process.

Ready to explore DSCR Loans? At Defy Mortgage, we assist you in navigating the complexities of finding the best solutions tailored to your needs. Our expertise in DSCR Loans ensures a transparent and stress-free experience. Visit Defy Mortgage to learn more about your options and start securing the best DSCR loan interest rates for your investment.