The Kansas housing market is heating up, becoming increasingly more attractive for investors as home prices in the Sunflower State continue to rise. As of August 2024, home prices in Kansas were up 3.7% from last year, selling for a median price of $279,400. Along with consistently declining vacancy rates, it makes a great time for real estate investors to jump in. A DSCR loan Kansas can help you do just that – imagine growing your rental portfolio without worrying about your personal income limiting your loan approval.

In this guide, we’ll be covering what you need to know before getting a DSCR loan Kansas. Whether you’re a new investor buying your first property or an experienced one looking to scale your portfolio, DSCR loans can be a valuable tool to building your real estate empire.

What Is a DSCR Loan?

A DSCR loan, or debt-service coverage ratio loan, is a real estate financing option that allows you to qualify for a loan based on your property’s cash flow instead of your own personal income. It was designed specifically for real estate investors with income-generating properties, providing an easier way to grow your portfolio without the limitations of your personal income.

Since DSCR loans use an alternative way to verify income, it’s considered to be a non-QM (non-qualified mortgage) loan. This simply means that they’re not subject to the strict lending requirements set by the Consumer Financial Protection Bureau (CFPB).

How Does a DSCR Loan Work?

When evaluating someone for a DSCR loan, lenders take a look at the property’s income to see if it will cover the mortgage payments and essentially pay for itself. This is where the DSCR metric comes in – an easy way for lenders to determine how strong the property’s cash flow is. Next, we’ll go over how to calculate your property’s DSCR to see if you might be able to qualify.

How to Calculate DSCR

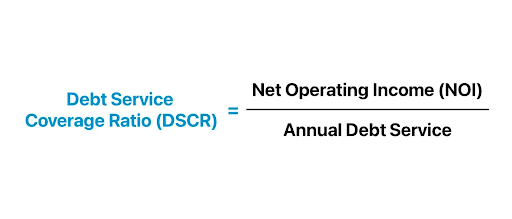

To calculate DSCR, start by subtracting your operating expenses from the property’s rental income to give you its net operating income (NOI). Then, divide the NOI by the annual mortgage payments to get your property’s DSCR. Here is the simplified formula:

What DSCR Do I Need to Qualify?

Now that you have your property’s DSCR, you might be wondering if you can qualify with it. A DSCR of 1.0 or higher means that the property is generating enough income to cover its mortgage payments. Most DSCR lenders require a minimum DSCR of 1.0-1.25, however some lenders can have lower requirements. For example, at Defy, we only require a minimum DSCR of 0.75.

Building Your Kansas Real Estate Portfolio with DSCR Loans

With the population of Kansas reaching 2.94 million in 2023 after a 0.13% increase from 2022, demand for housing is on the rise. The state’s population is projected to grow by about 468,000 residents by 2071 – a nearly 16% increase from 2021. Beyond population growth, rental vacancy rates have seen a significant drop from 12.1% in 2020 to 8.3% just three years later in 2023. Considering that the median rent in Kansas City is already at $1,250 as of October 2024, it’s only expected to get higher from here with a tightening market.

Pros and Cons of DSCR Loans

Pros:

- No personal income verification required

- Qualify for a mortgage using your property’s rental income

- No hard limit on how many DSCR loans you can have

- More flexible qualification requirements

Cons:

- Slightly higher interest rates

- Limited availability

- Potential to be overleveraged with too many DSCR loans at once

DSCR Loan Kansas Requirements

Since a DSCR loan is a non-QM loan, each lender sets their own qualification requirements. To give you an idea of what you can expect in terms of lender requirements, here is what we need at Defy for our DSCR loans:

- Minimum DSCR ratio of 0.75

- Minimum FICO score of 620+

- Maximum LTV of 85%

- 3 months cash reserve

- No maximum loan amount

- No income documents or tax returns

- Interest-only options available

Remember to do your research and reach out to lenders directly to make sure you can qualify prior to applying.

Eligible DSCR Loan Property Types

With a DSCR loan, you can get a wide variety of property types depending on what your investment goals are. Exact property types vary by lender, but you can often finance:

- Single-family properties

- Multi-family properties

- Vacation rentals

- Short-term rentals (like Airbnb and Vrbo)

- Some commercial properties

Before getting a DSCR loan, confirm with your lender that they’re willing to accept the property type you plan to purchase.

DSCR Loan Kansas Interest Rates

Interest rates for DSCR loans in Kansas depend on several factors like your credit score, the lender, and the current market rates. However, you can expect DSCR interest rates to be slightly higher than conventional rates. Despite the higher rates, many real estate investors find it worth it for a chance to grow their portfolio.

DSCR Loan Kansas Down Payment Requirements

DSCR loan down payments depend on the lender’s requirements and your credit score, but you can expect to put down anywhere between 15-25% of the purchase price. At Defy, we require a minimum of 15% down for our DSCR loans.

DSCR Loan Kansas Lenders

Partnering with the right lender for your next real estate purchase can make or break your investment decision. When searching for a lender, make sure to do your research and weigh all of your options before committing to one. A lender with DSCR loan experience, personalized advice, and an understanding of Kansas’ real estate market would be a solid choice.

If you’re looking for a lender with tailored lending solutions for individuals with unique income streams, look no further. At Defy, our experienced team can help you from end to end with your Kansas DSCR loan. Schedule a free consultation or give us a ring at (615) 622-1032 to speak with one of our mortgage experts.

DSCR Loan Kansas FAQs:

- What is a DSCR loan?

A DSCR loan, or a debt-service coverage ratio loan, is a type of real estate financing that bases approval on a property’s income rather than your personal income. DSCR lenders evaluate whether the property’s income covers its mortgage payments. These loans were designed with real estate investors in mind to make it easier to qualify for loans and scale portfolios.

- How can I calculate my property’s DSCR?

First, take your property’s rental income and subtract your operating expenses from it to arrive at your net operating income (NOI). Then, take your NOI and divide it by your annual mortgage payments. That final number is your property’s DSCR.

- What are the benefits of using a DSCR loan for real estate investing in Kansas?

Getting a DSCR loan for real estate investing in Kansas has several benefits, such as:

- More flexible qualification criteria

- No personal income documents required (e.g. W2s, tax returns, pay stubs)

- Loan amount is based on property’s cash flow, not your personal income

- No hard limit to how many DSCR loans you can have, making it easier to scale your portfolio

- What is the minimum DSCR ratio required to qualify for a DSCR loan Kansas?

Most DSCR lenders require a minimum DSCR of 1.0-1.25 to qualify, but keep in mind that this requirement varies by lender. At Defy, we require a minimum of DSCR of 0.75.

- How do DSCR loan interest rates in Kansas compare to traditional loans?

You can expect DSCR loan interest rates in Kansas to be slightly higher than traditional loan rates, but depending on your credit score and down payment, they can still be quite competitive. These higher rates are often worth it for real estate investors who are looking for a way to grow their rental portfolio.

- What are the credit score requirements for a DSCR loan Kansas?

Exact credit score requirements vary by lender, but at Defy, we require a minimum FICO score of 620 or higher to qualify for our DSCR loans.

- Is personal income verification required for a DSCR loan Kansas?

No, personal income verification isn’t required for a DSCR loan Kansas. This means you don’t have to provide documents like W2s, pay stubs, or tax returns.

- Can I refinance my existing investment property in Kansas with a DSCR loan?

Yes! You can refinance your existing Kansas investment property with a DSCR loan, as long as it meets the lender’s requirements.

- What are the down payment requirements for a DSCR loan Kansas?

The minimum down payment required for a DSCR loan Kansas depends on the lender’s requirements and your credit score, but you can expect to put down between 15-25%. At Defy, we require a minimum 15% down for our DSCR loans.

- How long does it take to close on a DSCR loan Kansas?

On average, closing on a DSCR loan can take anywhere from 3 to 6 weeks. We put our clients first at Defy, working hard to help you close your DSCR loan in as little as 2 weeks.