Louisiana is celebrated for its rich cultural heritage, but what you may not know is that it has an equally vibrant real estate market. DSCR loan Louisiana is fast becoming a popular financing option for investors in the state seeking flexibility and growth, particularly those with non-traditional income sources.

At Defy Mortgage, we have approved scores of DSCR loans that have kick-started successful investments. With our streamlined platform and competitive rates, we have supported entrepreneurs, self-employed individuals, real estate investors, and homebuyers alike by providing everything from bank statement loans to profit & loss statement loans. We are committed to providing an exceptional, transparent, and stress-free experience, no matter your loan needs.

With our long-standing expertise, we’ve created this blog to help investors looking to tap into Louisiana’s thriving real estate market. We’ll help you understand how DSCR loans operate within the context of Louisiana, as well as other nuances and advantages specific to the state. We’ll also discuss how you can maximize your chances of getting approved for a DSCR loan in the Pelican State.

Dive in to discover the insights you need to thrive in Louisiana’s unique real estate market.

Understanding DSCR Loans in Louisiana

A DSCR loan Louisiana can be one of the most effective financing tools for a real estate investor interested in buying property in the state. DSCR loans offer financial flexibility that helps solve challenges like high insurance premiums, fluctuating property values, and costs involved in following local property laws.

A Debt Service Coverage Ratio loan is a type of investment property loan specifically designed to assist individuals and businesses in securing funding based on the income generated by a property rather than the borrower’s income sources. Approval and terms for this type of loan are based on the Debt Service Coverage Ratio, which is the ratio between a property’s net income and its total debt service.

This type of loan is particularly advantageous in Louisiana, where the real estate market offers diverse investment opportunities that may only be accessible if one were to take their personal finances out of the calculation.

How DSCR Loans Work in Louisiana

DSCR loans in Louisiana operate slightly differently compared to many other states in the U.S. For example, Louisiana is more vulnerable to natural disasters like hurricanes and flooding, so some DSCR lenders in Louisiana might have more scrutiny towards properties in disaster-prone areas. However, the various benefits of DSCR loans, like financial flexibility and higher returns, can easily let you overcome these challenges.

Legal and Financial Nuances

The real estate you purchase with Louisiana DSCR loans can be affected by the state’s unique property laws, such as Forced Heirship, which forcibly bestows up to 50% of a property to the owner’s children upon the original owner’s death. This can be problematic if you have a business partner or co-borrower. There are also strict zoning laws in coastal areas and historical districts that could limit property development. However, with some legal counsel and strategic property choices, you can sidestep these issues and maximize cash flow.

The financial nuances of Louisiana DSCR loans stem mostly from environmental factors specific to Louisiana. Elevated building codes in flood-prone areas can increase property expenses, while high insurance premiums–driven by the state’s hurricane and flooding risks–affect the overall cost of property ownership and operation. However, DSCR loans offer innate financial flexibility and benefit greatly from the state’s tax credits, allowing you to offset these extra expenses and enjoy more profits from your investment as long as you choose a property that performs well.

Eligibility Criteria for DSCR Loans in Louisiana

Securing a DSCR loan in Louisiana involves meeting specific eligibility criteria. Understanding these requirements can help you determine if this financing option is suitable for your needs.

Credit Scores

While DSCR loans are generally more flexible than traditional mortgages, a solid credit score can improve your chances of approval and may secure higher loan amounts and better loan terms.

Lenders may still consider your credit history to assess financial responsibility, often seeking a minimum credit score to ensure reliability. At Defy, we offer DSCR loans for investors in several states with FICO scores as low as 620, and we even provide options for foreign nationals who have no U.S. credit score or social security number.

While some lenders like us may consider lower credit scores, it’s worth noting that scores of 700 or higher typically secure more favorable interest rates and terms. Credit score, though important, is not the sole determining factor. The property’s financial performance and the borrower’s overall financial health also carry significant weight in loan approval decisions. For precise, current information on DSCR loan requirements from specific lenders, it’s advisable to contact them directly before submitting an application.

Property Types

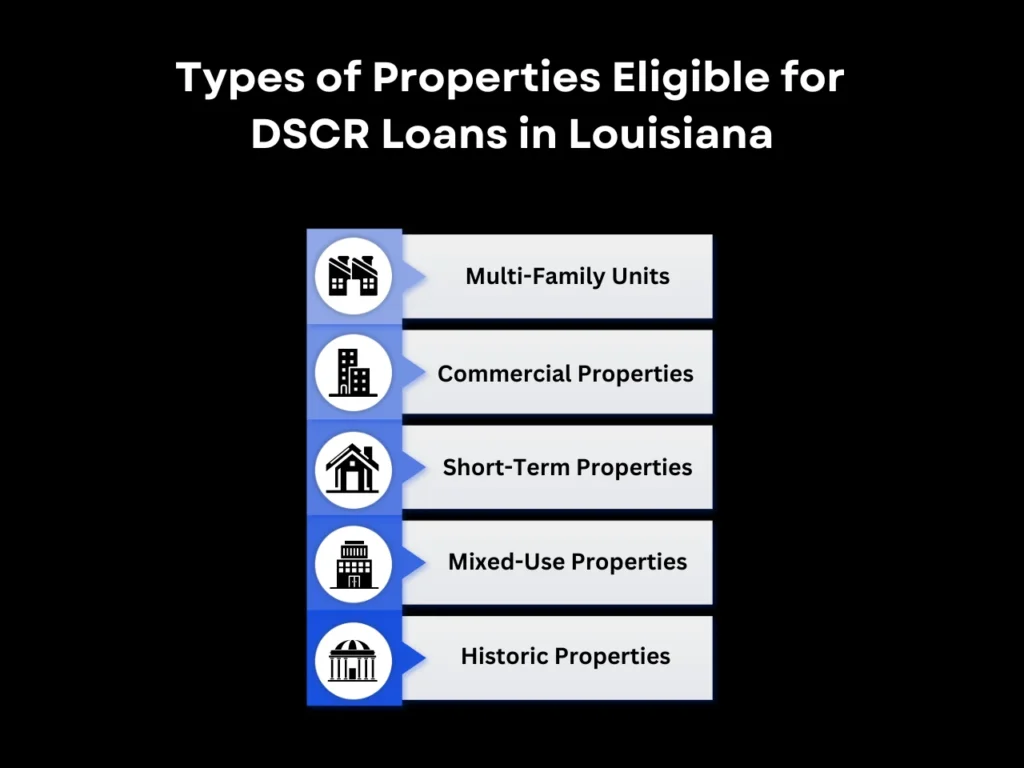

Properties that generate enough income to cover mortgage payments are potentially eligible for a DSCR loan, and in Louisiana, certain property types align perfectly with the state’s unique market conditions:

- Multi-Family Units: With high demand from locals and transient populations like students and seasonal workers in the state’s large oil and gas industry, multi-family units are a prime candidate for DSCR loans in Louisiana. These properties offer stable, consistent income streams.

- Single-Family Units: Louisiana’s strong rental market also has a high demand for single-family units, particularly in the suburbs around major cities like Baton Rouge and Lafayette. Although multi-family units have higher demand, single-families attract more long-term tenants, providing more reliable income.

- Commercial Properties: Commercial real estate is also feasible for DSCR loans as long as you choose one that is situated in a high-demand area, like New Orleans’ Central Business District.

- Short-Term Properties: Louisiana has a high rate of tourism, making strategically placed vacation rentals and other short-term properties viable, particularly during peak seasons like Mardi Gras and Jazz Fest. Make sure that the property’s seasonal income is high enough to score high on the DSCR metric and that you adhere to local regulations.

- Mixed-Use Properties: With diverse income streams from residential and commercial spaces, mixed-use properties present lucrative opportunities. However, navigate zoning laws and historic preservation regulations carefully, especially in cities like New Orleans.

- Historic Properties: Louisiana has a wealth of historic buildings, particularly in New Orleans. Despite higher maintenance costs, historic properties can still qualify for DSCR loans with strong management and potential tax incentives.

While multi-family and single-family units are the best bet, commercial properties provide viable options in areas with high demand and stable income potential. Mixed-use properties offer similar benefits but are subject to even stricter regulations and zoning laws. If you’re new to real estate investing, it may be best to start with a multi-family or single-family unit due to its simpler management and steady demand. At Defy, we offer DSCR loans in a variety of states for 1-4 unit properties.

Income Documentation

Unlike traditional loans that require detailed personal income documentation, DSCR loans prioritize the property’s cash flow. This means you’ll need to provide documentation of the property’s rental income as opposed to tax returns.

Personal income statements are less critical, but some lenders may still ask to review documents such as credit reports, bank statements, tax returns, and others for additional context. At Defy, however, we don’t ask our clients for tax returns at all for DSCR loans. No tax returns are required with our DSCR loans, helping to speed up the process and providing borrowers with another lending option that has more flexibility.

Minimum DSCR Ratio

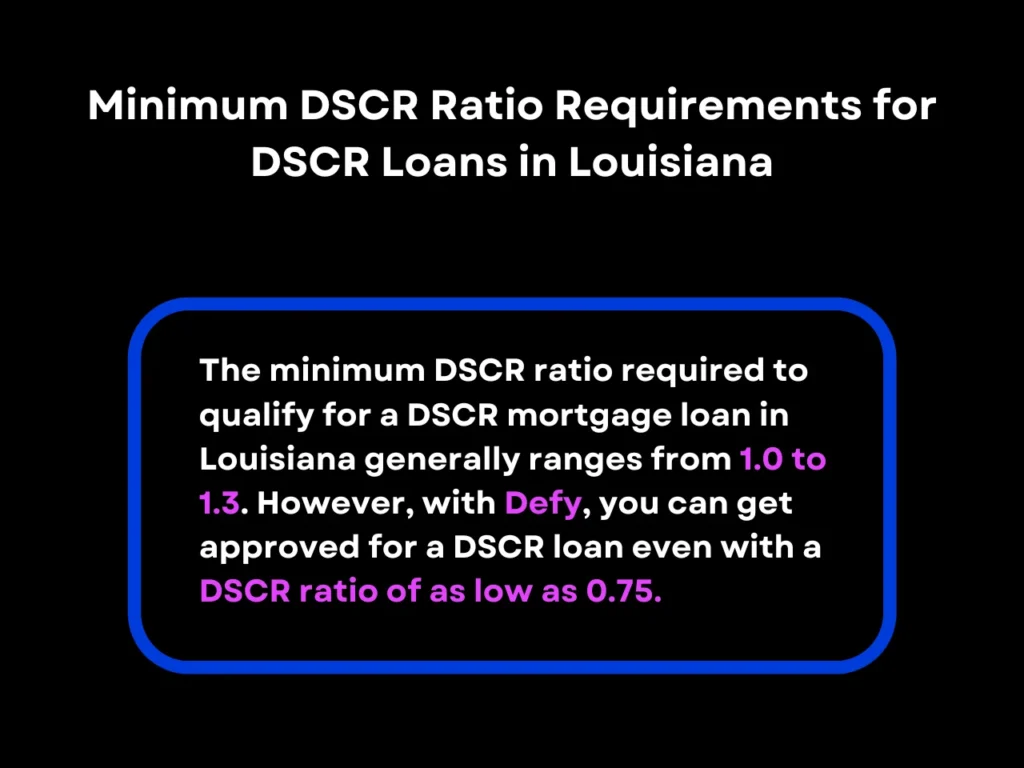

The minimum DSCR ratio required to qualify for a DSCR mortgage loan in Louisiana generally ranges from 1.0 to 1.3. This ratio indicates how comfortably the property’s income covers its debt obligations. For example, if a property’s net operating income is $3,500 per month and the debt service is $2,500, the DSCR ratio is 1.4, suggesting a comfortable margin for covering the debt.

However, with Defy, we offer DSCR loans with a DSCR ratio of as low as 0.75. Our expert team will work with you to tailor loan terms and a repayment plan that suits you, even if your property’s income isn’t at its full potential yet.

Advantages of DSCR Loans for Louisiana Investors

DSCR loans in Louisiana are particularly advantageous because of the unique real estate conditions and challenges in the state. Here’s how DSCR loans can supercharge your real estate investment in Louisiana:

Flexibility in Financing

Rising insurance premiums in Louisiana have tightened underwriting standards for real estate loans. This is a large part of why Louisiana DSCR loans have accelerated in popularity. Unlike conventional loans that factor insurance premiums into your debt-to-income ratio, DSCR loans treat insurance as an operating expense, subtracted from the property’s income rather than the borrower’s.

Potential Tax Advantages

Louisiana allows property owners to deduct mortgage interest payments, property taxes, and certain maintenance expenses from their taxable income. The state’s Restoration Tax Abatement program provides up to 10 years of property tax relief for improvements in qualifying areas. Lower taxes lead to higher DSCR, so these tax credits can offset the increased insurance premiums in Louisiana and lead to better loan terms.

If you intend to purchase a historical property, you can also benefit from the Historic Preservation Tax Credit, offering up to 25% credit for qualifying preservation expenses. With nearly 1,500 properties considered historical places in the state of Louisiana, the potential for positive cash flow and DSCR loan qualification is substantial.

Potential for Higher Returns

Since DSCR loans focus on a property’s financial health, you can get a much higher loan amount than the purchase price of the property if you can find one that has a high DSCR. You can then reinvest the extra amount into property improvements to raise property value and increase rental income. If you can generate more rental income than the mortgage payments, you’ll be able to enjoy higher returns with additional positive cash flow.

Flexible Qualification Criteria

DSCR loans often have more flexible qualification criteria, allowing for easier approval for real estate investors and self-employed individuals. This is especially advantageous for borrowers based in Louisiana itself, where economic fluctuations can make it harder for some investors to meet traditional mortgage requirements.

With DSCR loans, there’s no need for a traditional employment history or tax returns, making them ideal for self-employed professionals with irregular income streams — such as real estate investors.

Allows Borrowing for Multiple Properties

There’s no hard limit on how many properties you can buy using DSCR loans, unlike traditional mortgages that look at how many outstanding debts you have and your DTI (Debt-To-Income) ratio. Each DSCR assessment only cares about the property’s ability to service its debt, so long as you choose properties with DSCRs that lenders find acceptable, you can buy as many as you want with DSCR loans. This allows you to maximize your investment potential and grow your real estate holdings efficiently.

DSCR Loan Louisiana FAQ

What is the minimum DSCR ratio acceptable in Louisiana?

The minimum DSCR ratio in Louisiana typically ranges from 1.0 to 1.3, but different lenders and loan programs can have different requirements. Defy, for example, offers DSCR loans for properties with ratios as low as 0.75.

Can I use DSCR loans for properties outside of Louisiana?

Absolutely! DSCR loans can be used for properties outside of Louisiana. While DSCR loans are available nationwide, terms and eligibility criteria may vary depending on the location and lender’s policies. It’s important to consult with lenders familiar with the real estate market in those areas to understand how local conditions might impact your loan application process.

How does property type affect DSCR loan eligibility?

The type of property significantly impacts DSCR loan eligibility. DSCR loans can be used for single-family homes, multi-family units, and commercial properties, each with different income requirements and risk factors. For example, commercial properties may face stricter underwriting standards due to potentially volatile income streams compared to residential properties. This is not to say that commercial properties are a bad investment by any means, but for the sake of the question, it’s important to note.

Are there specific lenders in Louisiana that specialize in DSCR loans?

Yes, several lenders in Louisiana specialize in DSCR loans and understand the unique requirements of the local market. These lenders can provide tailored solutions and advice for investors and self-employed individuals seeking DSCR loans. Researching lenders with a strong track record in handling DSCR loans is beneficial — lenders like us a Defy.

How do interest rates for DSCR loans compare to traditional mortgage rates?

DSCR loan interest rates can be higher than traditional mortgage rates due to lenders perceiving higher risk in non-traditional income sources. However, a strong DSCR ratio can lead to more favorable rates, higher returns, faster approval processes and many more positives. It’s important to compare rates from multiple lenders and consult with a mortgage advisor to find the best terms.

What documentation is required for a DSCR loan application?

Applying for a DSCR loan requires documentation to verify the property’s income and its ability to cover the debt service. Essential documents include proof of rental income, net operating income statements, a property appraisal, and potentially personal or business tax returns depending on the lender. Some lenders might not tax returns for DSCR loans in Louisiana — lenders like us at Defy.

Key Takeaway

A DSCR loan Louisiana can offer valuable flexibility for investors with non-traditional incomes or those seeking diverse property types in the state’s variable real estate market. Multi-family and single-family rental units often provide the most straightforward path to approval, but commercial and mixed-use properties can also be viable with careful selection and adherence to local regulations.

To maximize your chances of securing a DSCR loan, ensure your property generates strong rental income, maintain accurate financial documentation, and consult with local experts to navigate the state’s unique market conditions.

Ready to explore DSCR loans whether in Louisiana or another state? Contact Defy Mortgage for a smooth and efficient loan process. Our team is dedicated to providing customized mortgage solutions tailored to your investment goals. Whether you’re buying your first home, seeking a VA loan for your post-military business ventures, or exploring other financing options under the non-QM loan space, we’re here to serve you.