With 19.3 million rental properties in the U.S. and 36% of Americans naming real estate as their top investment choice according to a Gallup poll, it’s clear that real estate is still one of the top investments for building wealth. While buying properties and collecting rental income seems simple in theory, it can be tricky to get started or grow your portfolio without the right financing. This is where a DSCR loan Nebraska comes in as a handy tool for investors looking to capitalize on the booming real estate market.

In this guide, we’ll be covering how this option can help you secure financing using rental property income, providing a simple path to expanding your portfolio. Let’s get started!

Understanding DSCR Loans

A DSCR loan, or Debt-Service Coverage Ratio loan, is a type of financing designed specifically for real estate investors. Instead of relying on your personal income or work history, lenders determine if you qualify based on the property’s rental income. DSCR loans tend to capture the attention of investors looking to scale their portfolios without the usual limitations of traditional income verification.

Another thing to note is that DSCR loans fall under the category of non-QM (non-qualified mortgage) loans. Traditional loans are required to follow strict guidelines set by the Consumer Financial Protection Bureau (CFPB), but non-QM loans are more flexible and allow lenders to use alternative criteria for qualification.

How Do DSCR Loans Work?

DSCR loans work by shifting the focus from your personal income to the income potential of the investment property itself. Lenders mainly look at the DSCR of the property, which is a simple calculation lenders use to determine if the property generates enough cash flow to cover its loan payments. This makes DSCR loans a much easier way to get financing for real estate investors because lenders are less concerned with your paycheck and more focused on whether the property can stand on its own financially.

How to Calculate DSCR

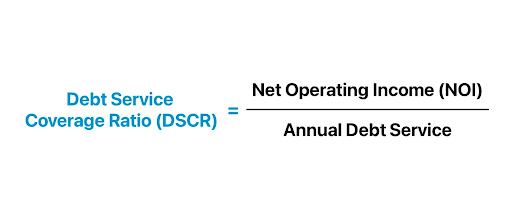

Calculating the Debt Service Coverage Ratio (DSCR) is straightforward and involves dividing the property’s net operating income (NOI) by its total debt obligations. Here’s the formula:

Net operating income includes all the income the property generates (like rent) minus operating expenses such as property management fees, maintenance, and utilities. Total debt service refers to all the costs associated with the loan, including principal and interest payments, taxes, and insurance.

For example, if a property generates $120,000 in NOI annually and the total debt service is $100,000, the DSCR would be 1.2. This means the property earns 20% more income than it needs to cover its debt.

What DSCR Do I Need to Qualify?

Generally, a DSCR above 1.0 indicates positive cash flow, while anything below 1.0 signals that the property isn’t earning enough to cover its loan obligations. Most lenders consider a DSCR of 1.25 to be a strong ratio, but some lenders, like us at Defy, accept a DSCR as low as 0.75. Each lender is different in terms of what DSCR they’ll accept, so it’s important to ask lenders directly to confirm your property meets their qualification criteria.

Building Your Real Estate Empire With a DSCR Loan Nebraska

If you’re a real estate investor eyeing Nebraska, there’s no better time to leverage a DSCR loan to secure a rental property. The Cornhusker State’s rental market is thriving, with a rental vacancy rate of just 4.9% as of January 2023, according to the U.S. Federal Reserve. The state’s capital, Omaha, is one of the most competitive rental markets in the U.S. with rental units averaging only 32 days on the market and 13 applicants per unit. This creates opportunity for investors who can provide quality rental properties to meet the high demand.

Nebraska’s population growth is another reason to invest. The state’s population recently hit 2 million and steady annual growth of 0.88%, ranking it the 17th fastest-growing state. The growing population creates consistent demand for housing. With the average Nebraska home value at $258,011 – up 3.3% in the past year – investing now puts you in a better position to benefit from both rising property values and steady rental income. A DSCR loan is your ticket to tapping into this hot market by focusing on the property’s income potential, making it easier to secure financing and start growing your portfolio in a state full of opportunity.

Pros and Cons of a DSCR Loan Nebraska

Pros:

- No hard limit on how many DSCR loans you can have

- No personal income documentation required

- Qualify using your property’s rental income

- Expand your real estate portfolio quickly and easily

Cons:

- Limited availability

- Potential to be over-leveraged

- Disruptions to cash flow (e.g. vacancies, expensive repairs, etc.) may make it difficult to meet loan payments

DSCR Loan Nebraska Requirements

When applying for a DSCR loan Nebraska, qualification requirements vary between lenders. Each lender can set their own criteria since there’s no strict standard for the industry.

To give you an idea of what requirements to expect, here is a list of what we would need for our DSCR loans at Defy Mortgage:

- Minimum DSCR ratio of 0.75

- Minimum FICO score of 620+

- Maximum LTV of 85%

- 3 months cash reserve

- No maximum loan amount

- No income documents or tax returns

- Interest-only options available

For exact qualification requirements from other lenders, be sure to reach out to them directly.

Eligible DSCR Loan Property Types

Since each lender sets their own qualification requirements for DSCR loans, this also extends to the types of eligible properties. Depending on the lender, these types of properties may be eligible:

- Single-family properties

- Multi-family properties

- Vacation rentals

- Short-term rentals (like Airbnb and Vrbo)

- Long-term rental properties

- Some commercial properties

It’s important to double-check with your lender to ensure your property type is eligible before applying.

DSCR Loan Nebraska Down Payment Requirements

For a DSCR loan Nebraska, you can typically expect to make a down payment ranging from 15-25%. The exact percentage will depend on factors like your credit score and the specific requirements of your lender. At Defy Mortgage, we require a minimum of 15% down for our DSCR loans, offering flexibility to help investors secure the financing they need.

DSCR Loan Nebraska Interest Rates

Interest rates for a DSCR loan Nebraska are influenced by several factors, including your credit score, the lender’s policies, and current market rates. Generally, DSCR loan interest rates are slightly higher than conventional loan rates. While this may not seem ideal at first glance, real estate investors often find the benefits, like streamlined qualification and access to Nebraska’s booming rental market, well worth the trade-off.

DSCR Loan Nebraska Lenders

Choosing the right lender can make or break your DSCR loan journey. Look for a lender with experience working specifically with DSCR loans and real estate investors. A knowledgeable partner will guide you through the process, answer your questions, and ensure a smooth experience from start to finish. On top of expertise, prioritize lenders with exceptional customer support. A responsive team can provide peace of mind and reliable assistance, even after closing.

At Defy Mortgage, we specialize in working with non-traditional borrowers, offering tailored solutions and flexible qualification criteria. If you’re ready to explore your options, book a call with us or reach out at (615) 622-1032 to speak with one of our mortgage experts today!

DSCR Loan Nebraska Alternatives

If a DSCR loan doesn’t feel like the right fit for your needs, consider these non-QM loan alternatives instead:

- Bank Statement Loans: Qualify based on your bank statements.

- P&L (Profit & Loss Statement) Loans: Use your business’ CPA-prepared P&L statements to qualify.

- Asset Depletion Loans: Secure a loan based on your liquid asset portfolio.

- Fix-and-Flip Loans: Qualify using your past renovation experience or planned projects.

- Construction Loans: Fund your build based on your historical experience or project plans.

DSCR Loan Nebraska FAQs:

- What is a DSCR loan, and how does it work in Nebraska?

A DSCR loan in Nebraska is a type of financing that focuses on the rental income of the property rather than the borrower’s personal income, making it ideal for real estate investors.

- Who is eligible for a DSCR loan in Nebraska?

Anyone with the minimum credit score and above, along with a qualifying investment property can apply for a DSCR loan, including self-employed individuals and investors with unique streams of income.

- How is DSCR calculated?

DSCR is calculated by dividing a property’s net operating income by its total debt obligations, with a ratio above 1.0 meaning positive cash flow.

- What DSCR is required to qualify for a loan in Nebraska?

Most lenders in Nebraska require a DSCR of at least 1.0 to 1.25, depending on the property and loan terms.

- What types of properties can be financed with a DSCR loan in Nebraska?

DSCR loans can be used to finance various property types, including:

- Single-family properties

- Multi-family properties

- Vacation rentals

- Short-term rentals (like Airbnb and Vrbo)

- Long-term rental properties

- Some commercial properties

- Can DSCR loans be used for short-term rental properties in Nebraska?

Yes! DSCR loans can be used for short-term rental properties in Nebraska, as long as the property generates enough income to meet the lender’s requirements.

- Are there specific lenders offering DSCR loans in Nebraska?

Yes! Several lenders, including specialized non-QM lenders like Defy Mortgage, offer DSCR loans tailored for Nebraska real estate investors.

- Can I refinance an existing property with a DSCR loan in Nebraska?

Yes! DSCR loans can be used to refinance existing properties, allowing you to tap into equity or secure better loan terms.

- Are DSCR loans a good option for first-time real estate investors in Nebraska?

Yes! DSCR loans can be a great option for both first-time and experienced real estate investors in Nebraska.