In recent years, New Hampshire’s rental market has experienced incredible growth with the 2023 statewide monthly median gross rent for two-bedroom units reaching $1,764, an 11.4% increase from last year. Paired with a vacancy rate of only 0.8% across all rentals, it’s clear that demand is outpacing supply across the Granite State. For real estate investors, this increased demand creates a lucrative opportunity and DSCR loans are a great way to take advantage.

This guide covers everything you need to know about getting a DSCR loan New Hampshire, so you can build your rental property portfolio and cash in on this opportunity.

What Is a DSCR Loan?

A DSCR loan is short for a Debt-Service Coverage Ratio loan, which is a type of real estate financing where the main qualification criteria is the income generated by the property itself instead of the borrower’s personal income. This loan is typically used by real estate investors who want to grow their rental property portfolio, making it easier to qualify for those whose tax returns don’t reflect their true income.

DSCR loans are also considered to be non-QM (non-qualified mortgage) loans, which means that they’re not subject to following the strict lending criteria set by the Consumer Financial Protection Bureau (CFPB). This allows lenders to set their own, more flexible qualification requirements, making DSCR loans even more accessible for real estate investors with non-traditional income sources.

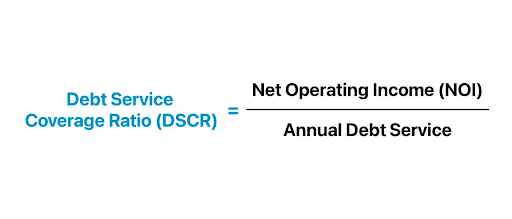

Calculating DSCR

Calculating DSCR isn’t difficult, but you’ll need to gather some information like the property’s income, your operating expenses, and the loan payments. To determine your property’s DSCR, take your annual net operating income (NOI), which is the property’s income minus operating expenses, and divide that by the annual required loan payments. Here is the simplified formula:

It’s important to ensure that these numbers are accurate, even if they’re projections. Inaccuracies can lead to underestimating or overestimating DSCR, which can affect how lenders evaluate your property.

What’s Considered a Strong DSCR Ratio?

Most lenders consider a strong DSCR to be 1.25 or higher, which means that the property’s rental income exceeds its debt obligations by 25%. This shows the lender that the property generates enough cash flow to comfortably cover its loan payments, while still providing a safety net for both the lender and borrower.

However, at Defy Mortgage, we offer more flexible options and allow for a DSCR as low as 0.75 to give investors the opportunity to secure financing even if their property is not yet fully cash-flowing or is in a transitional phase. We aim to support investors and the growth of their portfolios without being constrained by strict conventional financing requirements.

Benefits of DSCR Loans

DSCR loans come with many benefits for real estate investors, such as:

- No tax returns or personal income verification required

- Scalability without any personal income limitations

- Streamlined application process with typically faster approval times

- Can be used for various types of investment properties

Drawbacks of DSCR Loans

While DSCR loans have great benefits, there are some drawbacks to consider, such as:

- Limited availability compared to conventional loans

- Potentially higher interest rates

- Keeping up with loan payments could be difficult if unexpected vacancies or cash flow issues arise

DSCR Loan Interest Rates

DSCR loan interest rates typically depend on several factors, including the property’s cash flow, your credit score, and the loan-to-value (LTV) ratio. While these rates may be slightly higher than conventional loan rates, the flexibility they offer makes them a great tool for real estate investors looking to capitalize on a booming market. As of July 2024, the average home price in New Hampshire is $499,600, an increase of 8.6% from last year, making it an opportune time for investors to enter the market. The higher interest rates are often worth it for those seeking to tap into both passive rental income and capital appreciation.

How to Get a DSCR Loan in New Hampshire

Now that you know the basics of DSCR loans, let’s explore how you can get one in New Hampshire. In this section, we’ll cover what to expect during the application process, the requirements you’ll need, and how to find a DSCR lender.

DSCR Loan Application Process

The DSCR loan application process is designed to be more streamlined compared to traditional loans since it focuses on the income generated by the property rather than the borrower’s personal income. To start off, you’ll need to provide details about the property, including its current or projected rental income and operating expenses. Lenders will also review the property’s DSCR to confirm if the income covers the loan payments. While tax returns and W-2s are typically not required, you may still need to submit basic financial documentation like credit reports and property appraisals. On average, DSCR loans take anywhere between 30 to 45 days to close depending on the lender.

DSCR Loan Requirements

When it comes to DSCR loan requirements, each lender can set their own specific requirements. To give you an idea of what to expect, here are our requirements at Defy:

- Minimum DSCR ratio of 0.75

- Minimum FICO score of 620+

- Maximum LTV of 85%

- 3 months cash reserve

- No maximum loan amount

- No income documents or tax returns

- Interest-only options available

DSCR Lenders in New Hampshire

Finding the right DSCR lender in New Hampshire is key to maximizing your real estate investment opportunities, especially in a competitive market with rising home prices. Getting a mortgage is a big financial decision and you should consider all of your options before choosing a lender. When looking for a lender, it’s important to choose one that understands the unique dynamics of the state’s real estate market and offers flexible terms to help you grow your portfolio.

At Defy Mortgage, we specialize in providing tailored DSCR loans that allow investors to qualify based on property cash flow, not personal income. Our experienced team is dedicated to helping you navigate the market and secure the financing you need to take advantage of New Hampshire’s booming real estate market. If you’re ready to kickstart your real estate investing journey, book a call with us for a free consultation with one of our mortgage experts.

DSCR Loan New Hampshire FAQs:

- What is a DSCR loan?

A DSCR loan is short for a Debt-Service Coverage Ratio loan, which is a type of financing where the loan approval is based on the income generated by the property rather than the borrower’s personal income. These loans make it easier for real estate investors to qualify and grow their rental property portfolio without the limitations of their personal income.

- How do DSCR loans work?

For DSCR loans, lenders evaluate the property’s rental income to see if it can cover the loan payments. Lenders use the DSCR ratio calculation, which we’ll explain in next, to determine if the property’s cash flow can support the loan.

- How can I calculate my property’s DSCR?

Calculating DSCR is simple – divide the property’s net operating income (NOI) by the annual debt service (loan payments). Be sure to take into account all potential operating expenses when calculating the property’s NOI to get an accurate DSCR.

- What’s considered a good DSCR ratio?

A DSCR above 1 indicates the property makes enough income to cover its loan payments. Lenders typically consider a DSCR of 1.25 or higher to be considered good since it shows the property generates 25% more income than needed to cover its debt.

- What are the pros and cons of DSCR loans in New Hampshire?

Pros:

- No tax returns or other personal income documents needed

- Qualify mainly using property’s rental income

- Opportunity to invest in real estate and grow your portfolio

- More flexible qualification criteria

Cons:

- Limited availability

- Potentially higher interest rates

- Unexpected vacancies or cash flow issues could make it difficult to meet loan payments

- What credit score do I need to qualify for a DSCR loan?

Most lenders require a minimum credit score of 620-680 to qualify for a DSCR loan, but a higher score may help you secure better loan terms. At Defy, we require a minimum credit score of 620 or higher for our DSCR loans.

- Do I need tax returns to qualify for a DSCR loan?

No, you don’t need tax returns to qualify for a DSCR loan since the qualification is based on the property’s income rather than the borrower’s income. This makes it easier for real estate investors to qualify, especially if their tax returns don’t properly reflect their true income.

- Can you get a DSCR loan in New Hampshire with no down payment?

No, typically lenders will require a down payment for DSCR loans. Keep in mind that no down payment DSCR loans are quite rare and it’s unlikely that the lender won’t ask for anything down.

- What’s the minimum down payment required for a DSCR loan in New Hampshire?

The minimum down payment required for a DSCR loan in New Hampshire will vary by lender, but on average, it’s 15-25% of the property’s value. At Defy, we require a minimum down payment of 15%.