With the average residential property generating around 10.6% in annual returns according to Forbes, there’s no doubt that rental property investing can be a profitable business to be in. But how can you get started if you don’t qualify for conventional loans and can’t buy properties in cash? For real estate investors who have dreams of high returns in the Pacific Northwest, a DSCR loan Washington can help make that a reality.

This guide will go over what you need to know before jumping into the Washington state real estate market with a DSCR loan. Keep reading to learn more!

Understanding DSCR Loans

What Is a DSCR Loan?

A DSCR loan, or Debt Service Coverage Ratio loan, is a type of financing designed specifically for investment properties, where the focus is on the property’s income rather than the borrower’s personal income. Essentially, a DSCR loan looks at whether the rental income from the property can cover the mortgage and other debts, which is a helpful approach for investors with multiple properties or non-traditional income.

DSCR loans fall under the category of non-QM loans (non-qualified mortgages), which means they don’t follow the strict guidelines of traditional loans, like verifying personal income or tax returns. Instead, non-QM loans allow for more flexibility, making DSCR loans a popular option for investors who want to finance properties based on cash flow rather than traditional credit or income standards.

How DSCR Loans Work

DSCR loans are a fantastic financing option for real estate investors, whether you’re just starting out or have a growing portfolio. Compared to traditional loans that rely heavily on your personal income and credit, a DSCR loan is based on your property’s cash flow potential. Simply put, lenders calculate your property’s DSCR to see if the rental income from the property will cover the loan payments, making it easier to qualify for properties expected to generate steady rental income.

All in all, this method allows both new and experienced investors to qualify for financing without extensive income verification, so you can focus on building your portfolio rather than jumping through income-related hoops. With DSCR loans, if your property’s income stacks up, you’re in a great position to secure financing that helps you grow your investment goals.

Calculating Your Property’s DSCR

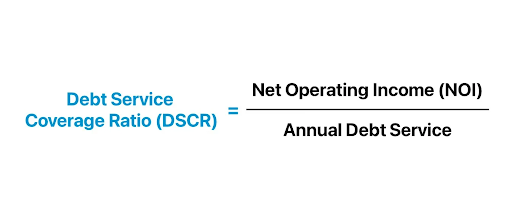

Calculating your property’s DSCR isn’t too difficult and gives you a high-level overview of its cash flow. To find the DSCR, simply divide the property’s Net Operating Income (NOI), which is your rental income minus any operating expenses, by the total debt service (usually the annual mortgage payments).

Here’s the formula:

What DSCR Do I Need to Qualify?

To qualify for a DSCR loan, most lenders like to see a DSCR of at least 1.0, which means the property is generating enough income to cover its own expenses. A DSCR of 1.25 or higher is considered strong since it shows that the property has extra income to handle unexpected costs or dips in rent.

However, some lenders offer even more flexibility – Defy Mortgage allows for DSCRs as low as 0.75. So, whether your DSCR is just at 1.0 or a solid 1.25 and above, there are options available, especially with lenders like Defy Mortgage who are open to a wider range of cash flow situations.

Maximizing Your Returns With a DSCR Loan Washington

If you’re thinking about financing an investment property in Washington state, a DSCR loan could be your perfect match. Washington’s rental market is booming, with a low vacancy rate of 4.2% and an average monthly rent of $1,791, which is the 7th highest in the country, making it an ideal place to generate reliable rental income. Plus, the state’s population continues to grow, reaching just over 8 million in 2024 with a 1.1% growth rate, which only boosts demand for housing. Home values are also on the rise, with an average price of $591,095, up 3.1% over the past year, so you’re not just looking at strong rental returns but also solid appreciation potential.

With a DSCR loan, you get to leverage Washington’s growing market without the hassle of extensive income documentation – a win-win for your real estate portfolio.

DSCR Loan Washington Pros and Cons

Pros:

- No traditional income documents required (e.g. W2s, pay stubs, tax returns)

- Qualify using your property’s rental income

- Personal income doesn’t limit loan amount you can qualify for

- Easier to expand your portfolio with no hard limit on how many DSCR loans you can have

- Makes investment property financing more accessible for both new and experienced investors

Cons:

- Limited availability

- Potential to be over-leveraged

- Cash flow fluctuations can make it difficult at times to make monthly debt payments

What You Need to Qualify for a DSCR Loan Washington

Each lender sets their own DSCR loan requirements, so they tend to vary. At Defy Mortgage, these are our requirements for a DSCR loan Washington:

- Minimum DSCR ratio of 0.75

- Minimum FICO score of 620+

- Maximum LTV of 85%

- 3 months cash reserve

- No maximum loan amount

- No income documents or tax returns

- Interest-only options available

When shopping around for lenders, be sure to ask them for their qualification requirements, so you can determine whether you can qualify or not before applying.

Eligible Property Types

DSCR loans are known for their flexibility, and eligible property types are no exception to that. Acceptable property types can vary by lender, but generally, you can finance:

- Single-family properties

- Multi-family properties

- Vacation rentals

- Short-term rentals (like Airbnb and Vrbo)

- Some commercial properties

It’s important to check with lenders that they accept your property type prior to getting a DSCR loan.

DSCR Loan Washington Down Payment Requirements

Down payment requirements for DSCR loans depend on the lender and your credit score, but you can generally expect to put down 15-25% of the purchase price. We at Defy require a minimum of 15% down for our DSCR loans.

DSCR Loan Washington Interest Rates

The interest rate you’ll be offered for a DSCR loan Washington will depend on a few factors like the lender, your credit score, your down payment amount, and the current mortgage rates. Generally, DSCR loan rates are slightly higher in comparison to conventional loan rates since they use alternative income verification. However, these rates are often worth it for real estate investors looking to take advantage of the growing housing market.

DSCR Lenders in Washington

When shopping around for a DSCR lender in Washington, look for a lender that has experience with both DSCR loans and the Washington real estate market. Beyond that, check online reviews and make sure they offer an above-and-beyond customer experience.

At Defy Mortgage, we know that choosing a lender to partner with for your next real estate investment can be a big choice. If you’re looking for a lender with custom loan solutions and flexible qualification requirements, we might be the lender for you. Schedule a free consultation or give us a ring at (615) 622-1032 to see how we can elevate your next home buying experience.

DSCR Loan Washington Alternatives

If a DSCR loan isn’t the right fit for you, don’t worry – there are plenty of other options that might fit your unique circumstances. Here are some other non-QM loans to consider if you’re a non-traditional buyer or investor:

- Bank Statement Loans: Qualify using your bank statements rather than traditional income documents. Ideal for self-employed individuals or anyone who has a unique income stream.

- P&L Loans: Short for “Profit & Loss Statement Loans,” which allow you to qualify using your business’ CPA-prepared P&L statements. Ideal for business owners with access to P&L statements.

- Asset Depletion Loans: Qualify using your liquid asset portfolio, such as savings, stocks, and retirement funds. Ideal for high-net-worth individuals who have limited documented income.

- Construction Loans: Finance a ground-up construction project based on historical experience and/or building plans. Ideal for those who want a custom-built home or plan to sell the new construction for a profit.

- Fix-and-Flip Loans: Finance the purchase and renovation of a distressed home and sell it for a profit. Ideal for home flippers with past experience.

DSCR Loan Washington FAQs:

- What is a DSCR loan?

A DSCR (Debt-Service Coverage Ratio) loan is a type of financing that focuses on a property’s income rather than the borrower’s personal income. It measures whether the property’s income can cover its debt obligations, making it easier to qualify for investment properties.

- Who can apply for a DSCR loan Washington?

Real estate investors, both U.S. citizens and foreign nationals, can apply for a DSCR loan Washington if they have income-generating properties. It’s especially suited for investors with non-traditional or multiple income sources.

- How can I calculate a property’s DSCR?

To calculate DSCR, divide the property’s net operating income (NOI) by its total debt service (monthly mortgage payment). A DSCR above 1.0 indicates the property generates enough income to cover its debt.

- What is the minimum DSCR required for a loan in Washington?

Most lenders in Washington require a minimum DSCR of 1.25, meaning the property’s income should be at least 1.25 times its debt service. However, some lenders, like us at Defy, allow a DSCR as low as 0.75.

- What type of property can I finance with a DSCR loan Washington?

DSCR loans can finance several different property types, including single-family rentals, multi-family properties, and even commercial buildings sometimes. When shopping for lenders, be sure to ask if your investment property type is accepted.

- How do Washington state property investors benefit from a DSCR loan?

DSCR loans provide Washington investors with a streamlined approval process by focusing on the property’s income, which typically results in quicker approvals. Investors can scale their portfolios without having to provide extensive personal financial documentation.

- What credit score is required to apply for a DSCR loan Washington?

The minimum credit score required depends on each lender’s qualification criteria, but at Defy, we require a FICO score of 620 or above to qualify for a DSCR loan Washington.

- How does the DSCR loan process differ from traditional mortgage loans in Washington?

DSCR loans don’t require personal income verification, whereas traditional loans ask for income documentation like W2s, tax returns, and pay stubs. Instead, DSCR loans focus on the property’s rental income.

- What are the typical interest rates and terms for a DSCR loan Washington?

Interest rates for DSCR loans are usually slightly higher than traditional loans, but the exact rate you’ll be offered depends on market conditions and borrower qualifications. Terms typically range from 5-30 years, with flexible payment options for investors.

- Can I qualify for a DSCR loan in Washington without personal income verification?

Yes! DSCR loans are designed to rely on the property’s cash flow, so personal income verification isn’t required.