FHA loan Alabama offers an excellent opportunity for many individuals seeking homeownership in the United States. These loans, backed by the Federal Housing Administration (FHA), come with benefits such as lower credit score requirements and payment assistance programs. First-time homebuyers, individuals with lower credit scores, and those needing payment assistance can benefit significantly from this loan program.

At Defy Mortgage, we provide an all-inclusive mortgage solution to streamline the home-buying process. We provide FHA loans and other QM mortgages in Alabama, such as conforming, jumbo loans, VA, and HELOCs designed to meet your needs. We also offer non-QM loans, providing flexibility and opportunities for those who don’t fit the traditional requirements. With competitive rates and a seamless platform, we make managing your mortgage and application process effortless.

Informed by our years of experience in the field, we’ve created this guide to explore FHA loan Alabama. We’ll explore the application process, credit score requirements, and payment assistance programs. You will learn about FHA loan limits, closing costs, and the specifics of the FHA loan program. By the end of this blog, you will understand the eligibility criteria and how to navigate the process to secure an FHA loan with ease.

Let’s get started!

FHA Loan Alabama: What You Need to Know?

FHA loans are government-backed mortgages designed to help individuals achieve homeownership. Homebuyers can benefit from FHA loan Alabama with its low down payment and more lenient credit score requirements. These loans make purchasing a home more accessible for first-time homebuyers and those with less-than-perfect credit scores.

In 2024, FHA loans in Alabama saw changes affecting loan amounts and requirements. The Department of Housing and Urban Development (HUD) sets the loan amount limits, impacting home prices buyers can afford. Homebuyers must consider the upfront premium, monthly mortgage insurance, and total loan amount when planning their primary residence purchase.

Eligibility Criteria and Limitations for FHA Loans in Alabama

FHA loans in Alabama offer accessible financing options for homebuyers, especially those with limited financial resources. Assessing the eligibility criteria and limitations is crucial for anyone considering this financing option. It ensures you meet all requirements and understand any restrictions that could impact your loan approval.

Minimum Credit Score Requirements

Alabama FHA loans may be obtained with a credit score meeting the minimum required loan qualification threshold. Borrowers need a score of 580 or above to be eligible for the low payment of a 3.5% rate down. Credit scores of 500-579 require borrowers to make a 10% down payment to qualify for this loan option.

Timely payments and credit history are the keys to getting the best mortgage conditions. FHA lenders assess your debt-to-income ratio (DTI) to ensure it is no greater than 43%. By following all the prerequisites, borrowers ensure themselves the best loan rates and affordable mortgage insurance premiums (MIP).

Down Payment Guidelines for 2024

FHA loans in Alabama give you more choices about paying for a house in 2024. If your credit score is 580 or higher, you can only make a down payment of only 3.5%. This opens up homeownership for lots of people. But, those with scores from 500 to 579 need to put down 10%. You must also prove your income, like with past taxes and W-2 forms, as proof that you can afford these payments. A home appraisal sets your house’s worth and checks if it meets the property requirements FHA sets.

Impact on Buying Power

Understanding the impact of FHA loans on your buying power can influence your financial capabilities and decision-making when purchasing a home. Here are the key points to consider:

- Monthly Mortgage Payment: FHA loans often result in lower monthly mortgage payments than conventional mortgages in Alabama. Use a mortgage calculator to estimate payments and plan your budget accordingly.

- Home Equity: Building home equity can be slower with FHA loans in Alabama due to lower initial payments, but consistent mortgage payments will increase your home equity over time.

- Current Mortgage: Refinancing your current mortgage to an FHA loan can lower your interest rate and monthly payments, providing financial relief. FHA streamlined refinancing options are available for eligible homeowners.

- Foreclosure: FHA loans offer options for those who have experienced foreclosure. Meeting the qualifications can help rebuild credit and secure a new home loan.

- Upgrades: In Alabama, FHA loans include provisions for home upgrades through the FHA 203(k) loan, allowing borrowers to finance home improvements and renovations.

With lower monthly mortgage payments, FHA loans provide opportunities to build home equity and lending options for those with past financial challenges. Opting for this mortgage loan option can enhance your buying power and help secure a home that meets your needs.

Step-by-Step Guide to Applying for an FHA Loan

Applying for FHA loans in Alabama involves several steps to assist first-time homebuyers and those seeking mortgage assistance. Understanding and following these steps can simplify securing an FHA loan.

Step 1: Assess Your Financial Health

Evaluating your financial stability is the initial and essential step to getting approved for FHA loans in Alabama. Knowing your standing lets you evaluate your creditworthiness and set everything straight before entering the loan application process. First-time homebuyers must know the importance of this act to get the loan quickly and buy their first house in Alabama.

Here are the key factors to review:

- Credit Score: A higher credit score improves your eligibility for FHA loans in Alabama. Aim for a score of at least 580.

- Debt-to-Income Ratio: This ratio measures your monthly debt payments against your gross monthly income. For FHA loans, a lower ratio increases approval chances.

- Employment History: Lenders prefer applicants with stable employment. Ensure you have at least two years of steady employment.

- Savings: Having savings shows financial stability. Aim for enough to cover a down payment and closing costs.

- Financial Documentation: Gather all necessary documents, such as tax returns and bank statements. This preparation will speed up the application process.

With careful assessment and preparation, you can confidently approach lenders and meet Alabama FHA loan requirements. This proactive approach benefits first-time homebuyers, providing a clear path to securing FHA loans. If needed, seek mortgage assistance in Alabama to guide you through this process.

Step 2: Find an FHA-Approved Lender in Alabama

Finding the right FHA-approved lender in Alabama is essential for a smooth loan application process. Find a lender who understands your needs and can guide you through the FHA loan requirements.

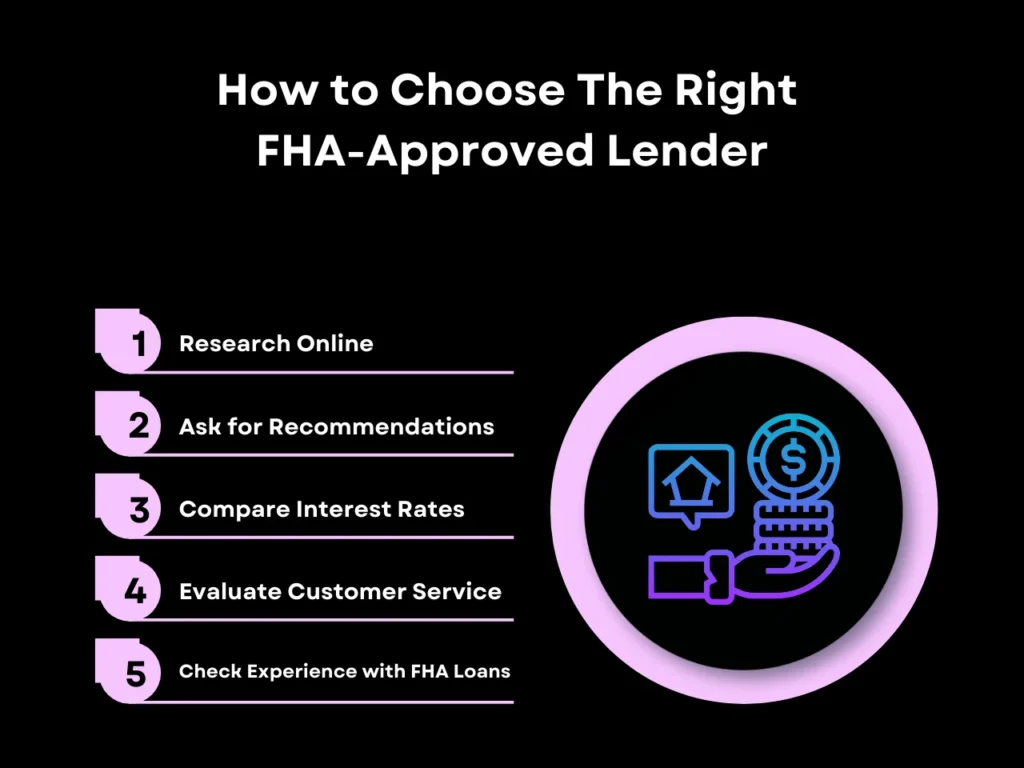

Here’s a guide on how to locate and choose the right FHA-approved lender:

- Research Online: Use online resources to identify FHA-approved lenders in Alabama. Check their websites for information on loan offerings and customer reviews.

- Ask for Recommendations: Consult friends, family, or real estate agents for lender recommendations. Personal experiences can provide valuable insights.

- Compare Interest Rates: Different lenders offer varying interest rate requirements. Comparing these rates can help you find the most affordable option.

- Evaluate Customer Service: Choose a lender known for excellent customer service. Good communication and support are crucial throughout the loan process.

- Check Experience with FHA Loans: Ensure the lender has experience handling FHA loans in Alabama. Familiarity with the process can lead to a smoother experience.

Considering these factors when selecting a lender impacts your overall experience and success in securing an FHA loan. Ensure your lender meets Alabama FHA loan requirements and can guide you through each step. Choosing the right lender sets the foundation for a successful home-buying journey in Alabama.

At Defy Mortgage, we understand the importance of choosing the right lender. We specialize in providing FHA loans in Alabama with personalized assistance to meet your needs. Our team will work closely with you to assess your financial situation and determine the best loan products available. Get a quote today to learn more about our FHA loan programs and get pre-approved for your dream home!

Step 3: Complete the Application with Your Lender

Completing the application for FHA loans in Alabama involves gathering various documents and providing detailed information to your lender. Ensuring everything is in order will streamline the process and increase your chances of approval.

Here are the key documents and information you will need:

- W-2 Statements and Tax Returns: These documents provide proof of income. Have your W-2s and tax returns from the past two years ready.

- Bank Account and Credit Card Statements: Gather account numbers and recent statements for all your bank accounts and credit cards. This information shows your financial activity and balances.

- Personal Loans, Auto Loans, and Student Loans: Provide account information for any personal, auto, or student loans. This helps the lender understand your existing debt obligations.

- Investment and Retirement Account Statements: Collect statements for investment and retirement accounts. These can show your additional assets and financial stability.

- Business Tax Returns: If you’re self-employed looking for a mortgage, include business tax returns from the past two years, demonstrating your business income and financial health.

- Documentation of Other Income: Include additional income sources, such as alimony or child support. This ensures the lender has a complete picture of your financial situation.

Thoroughly preparing these documents ensures a smooth application process for FHA loans in Alabama. This preparation benefits new homeowners and meets Alabama FHA loan requirements. Mortgage assistance in Alabama can provide additional support and guidance, helping you navigate the application process efficiently.

Step 4: Conduct the FHA Loan Appraisal and Approval Process

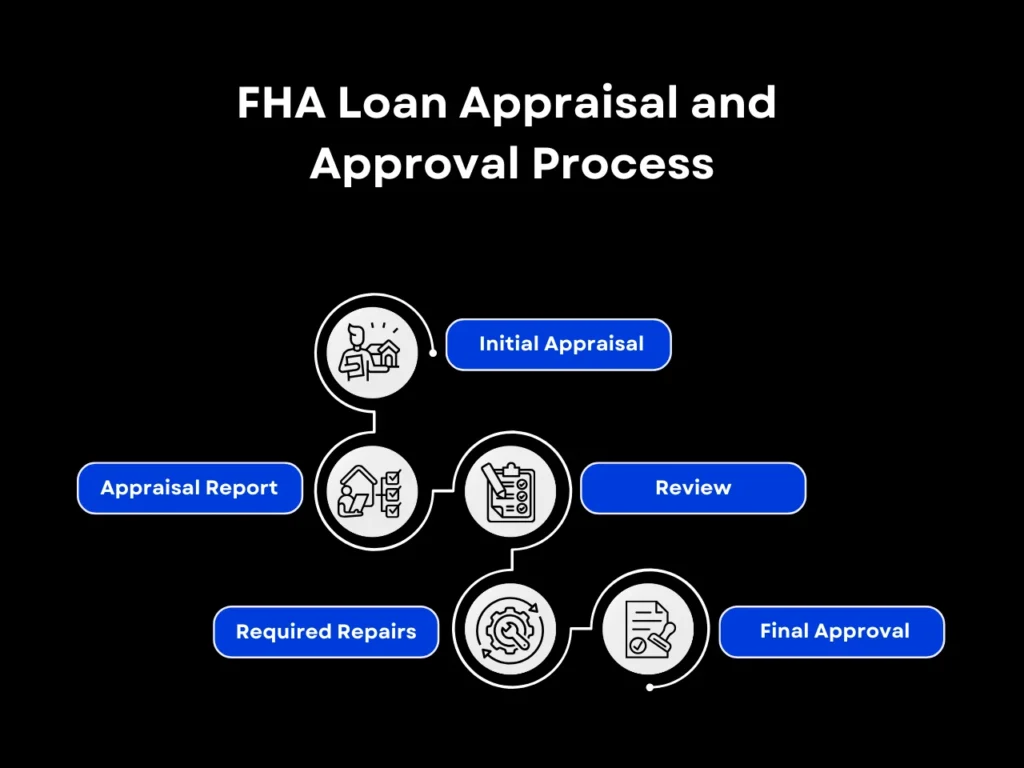

The FHA loan appraisal process ensures that the property you intend to purchase meets specific standards for FHA loans in Alabama. An FHA-approved appraiser will assess the home’s market value and check its physical condition. This appraisal ensures the home is safe, secure, and a sound investment.

Here are the critical steps in the timeline following the appraisal to final loan approval:

- Initial Appraisal: The appraiser inspects the property to assess its value and condition, focusing on factors like the roof, foundation, and overall safety.

- Appraisal Report: The appraiser completes the Uniform Residential Appraisal Report, detailing the property’s condition, value, and any safety concerns or needed repairs.

- Review: The lender reviews the appraisal report to ensure the property meets FHA requirements. Any identified issues must be addressed.

- Required Repairs: If the appraisal highlights necessary repairs, they must be completed. The seller or buyer must arrange and confirm the repairs before proceeding.

- Final Approval: Once the property meets all requirements, the lender grants final approval, and you can close the FHA loan.

Understanding the FHA appraisal process is crucial for new homebuyers in Alabama. Proper preparation and attention to detail can facilitate a smooth approval process for FHA loans in Alabama.

Key Takeaway

FHA loan Alabama offers a practical solution for those seeking homeownership with lower down payments and flexible credit requirements. Understanding the interest rates and terms of FHA loans in Alabama helps buyers make informed decisions. Buyers should consider how these rates compare to other loan options, such as portfolio loans.

Preparing financially before applying for an FHA loan in Alabama ensures a smoother application process. Seeking advice from the best FHA mortgage lenders for 2024 provides guidance tailored to individual financial situations. Lenders can offer insight into improving credit scores and securing favorable loan terms. This preparation helps applicants meet the Alabama FHA loan requirements and enhances their eligibility.

Are you ready to take the next step towards homeownership with FHA loan Alabama? At Defy Mortgage, we simplify the process, offering support and expertise throughout your journey. Contact us to learn more and begin your application today. Let us help you achieve your homeownership dreams with ease and confidence.

Frequently Asked Questions

1. What are the benefits of an Alabama FHA Loan?

FHA loans offer several benefits, including:

- Low down payment options (as low as 3.5%).

- Acceptance of financial gifts for down payments.

- Higher debt-to-income ratio allowances (up to 57%).

- No minimum income requirement.

- Various loan types, including streamlined refinance and 203(k) loans for renovations.

- The possibility for the seller to cover closing costs.

- Assumable loans, where the buyer can take over the seller’s existing mortgage.

- Availability for different properties, including single-family homes, condos, and manufactured homes.

2. What are the basic requirements for an Alabama FHA Loan?

To qualify for an FHA loan in Alabama, you generally need:

- A credit score of at least 580 (lower scores may require a larger down payment).

- A down payment of 3.5%-10%, depending on your credit score.

- Verifiable, steady employment for the past two years.

- The ability to pay mortgage insurance premiums (both upfront and monthly).

- A property that meets FHA appraisal standards and will be your primary residence.

- A debt-to-income ratio of less than 57%.

3. How do FHA loans compare to conventional loans?

FHA loans are often easier to qualify for than conventional loans. They have lower credit score requirements and down payment options. With options allowing borrowers a higher debt-to-income ratio, this loan program is even more accessible to borrowers who may not meet the stricter requirements of conventional loans.

4. What types of FHA loans are available in Alabama?

There are several FHA loan options available, including:

- Standard FHA loans: Traditional loans with lower down payment requirements.

- FHA Streamline Refinance: Simplifies refinancing for existing FHA loan holders, with less documentation and no appraisal required.

- FHA 203(k) Loans: These cover the purchase of a home and the cost of its repairs and renovations, with options for minor and major repairs.

5. What is the maximum loan limit for FHA loans in Alabama?

The FHA loan limits in Alabama vary by county but are generally set at $498,257 for a single-family home. Depending on the county, this limit can increase to $958,350 for four-unit properties.

6. Can I use an Alabama FHA loan for a rental or investment property?

No, FHA loans are intended for primary residences only. You cannot use an FHA loan for rental properties, investment properties, or vacation homes. The property must be your main home.

7. What is the FHA Streamline Refinance program?

The FHA Streamline Refinance program allows homeowners with existing FHA loans to refinance with minimal paperwork and no appraisal requirement. This program aims to lower monthly mortgage payments by switching to a new interest rate based on current market conditions.