In 2025, qualifying for an FHA loan in Georgia requires meeting specific criteria. Understanding FHA loan requirements Georgia ensures a smoother application process and increases your chances of approval. With credit score requirements as low as 580 for a 3.5% down payment, these loans can open doors to homeownership for many Georgians who might struggle with conventional financing. FHA loan limits vary by county, affecting the maximum loan amount you can obtain, especially if you have lower credit scores.

At Defy Mortgage, we specialize in non-traditional lending solutions that cater to the unique needs of entrepreneurs, business owners, freelancers, creatives, and more. Our expertise in FHA loans ensures you receive the best guidance and support. We aim to make the mortgage process simple and straightforward, helping you from initial consultation to closing deals. With our help, FHA borrowers can quickly and confidently achieve their dream of homeownership.

Informed by our industry expertise, we’ve created this guide to delve into FHA loan requirements Georgia. As you navigate through, you’ll learn about the loan eligibility criteria, loan limits, and property requirements for FHA loans. Following that, you’ll gain insights into FHA appraisal guidelines to ensure that the property meets certain standards for safety, livability, and structural integrity.

Let’s get started!

FHA Loan Requirements Georgia and Eligibility Criteria

Understanding the FHA loan requirements Georgia is essential for anyone aiming to secure a home mortgage in 2025. The Federal Housing Administration sets these requirements to ensure potential homebuyers meet specific criteria. Let’s explore the key aspects of FHA loan requirements in Georgia in detail.

Minimum Credit Score Requirements

To qualify for an FHA loan in Georgia, borrowers need a minimum credit score. Generally, a FICO credit score of 580 or higher allows for a down payment as low as 3.5% of the purchase price. Individuals with a FICO score between 500 and 579 may still qualify for a loan, but a higher down payment of 10% is required. Credit scores below 500 are considered “subprime,” potentially causing disqualification due to perceived higher risk to lenders. However, exceptions exist depending on lender policies, especially for borrowers with extenuating circumstances that can be documented.

Maintaining a higher credit score increases the likelihood of loan approval and can result in better interest rates. Borrowers must also have at least two established credit accounts and no history of delinquency on federal government debts, such as previous FHA loans or student loans.

Down Payment Requirements and Options

The down payment for an FHA loan is another critical factor. The standard requirement is 3.5% for those with a credit score of 580 or higher. For lower credit scores (500-579), the down payment requirement increases to 10%. Various payment assistance programs in Georgia can help with down payments. For instance, the Georgia Dream Homeownership Program offers aid to eligible first-time homebuyers and those buying in specific properties.

Additionally, gift funds from family members or close friends can cover the down payment. This option provides flexibility for buyers needing help to save the required amount. It’s important to note that all gift funds must be documented appropriately to adhere to FHA guidelines.

Debt-to-Income Ratio Standards

The debt-to-income ratio (DTI) is a crucial metric to assess a borrower’s ability to manage monthly and new mortgage payments. Your DTI should be less than 57% to qualify for an FHA loan. This ratio represents the percentage of a person’s gross monthly income used to pay off debts, including student loans, credit cards, and federal debts. While there are exceptions, most lenders in Georgia prefer a debt-to-income ratio of no more than 43%.

This ratio includes all forms of debt, such as credit cards, student loans, car payments, and other monthly obligations. Maintaining a lower DTI ratio helps meet the FHA loan requirements in Georgia and ensures manageable monthly mortgage payments. Borrowers should reduce existing debts to improve their DTI ratio, enhancing their eligibility for an FHA loan.

Mortgage Insurance and Additional Requirements

Mortgage Insurance Premium (MIP) is required upfront and annually to protect lenders against potential losses from borrower default. MIP ensures more people can access FHA loans by mitigating lender risk. Additionally, applicants must provide a valid ID, title insurance policy, homeowner’s insurance policy, and closing funds from FHA-approved sources to meet all FHA loan requirements, ensuring legal and financial safeguards are in place for both parties.

FHA loans are primarily intended for buyers planning to use the purchased home as their primary residence. Therefore, FHA loans cannot be used to finance a second home, rental, vacation, or investment property. However, there are some exceptions and a few ways to navigate this general rule.

Property Requirements for FHA Loans in Georgia

FHA loans offer a path to homeownership, particularly for those with less-than-perfect credit and limited funds for a down payment. However, properties must meet specific criteria to qualify for an FHA loan in Georgia.

Here’s a detailed overview of the primary residence requirement and FHA appraisal guidelines.

Primary Residence Requirement

The property must be the borrower’s primary residence. This rule ensures that FHA loans support homeownership for those intending to live in the home rather than for investment purposes. Borrowers cannot use FHA loans for vacation homes or rental properties. Some nuances exist:

- The borrower must occupy the home within 60 days of the closing process.

- The property must remain the primary residence for at least one year.

FHA loans do not support purchasing a home solely for investment purposes. Still, if circumstances change (like a job relocation), the borrower may rent the property after meeting the occupancy requirement.

FHA Appraisal Guidelines

The appraisal process for an FHA loan involves a detailed inspection to ensure the property meets the standards set by the Federal Housing Administration. Key elements appraisers look for include:

- Safety: The home must be free of hazards and ensure the safety of its occupants. For example, no exposed wiring, unstable staircases, or broken windows should exist.

- Security: The property should provide a secure environment. This includes functioning locks on all doors and windows.

- Structural Soundness: The home must be structurally sound and in livable condition. Issues like significant foundation problems, roof damage, or major structural deficiencies can disqualify a property.

- Value Assessment: The appraisal determines the property’s market value, ensuring it aligns with the loan amount requested.

Appraisers check these aspects to ensure the home is habitable and complies with FHA standards. Properties not meeting these criteria must undergo necessary repairs before loan approval. Ensuring compliance with these guidelines is crucial for a smooth and successful FHA loan process.

FHA Loan Limits in Georgia for 2024

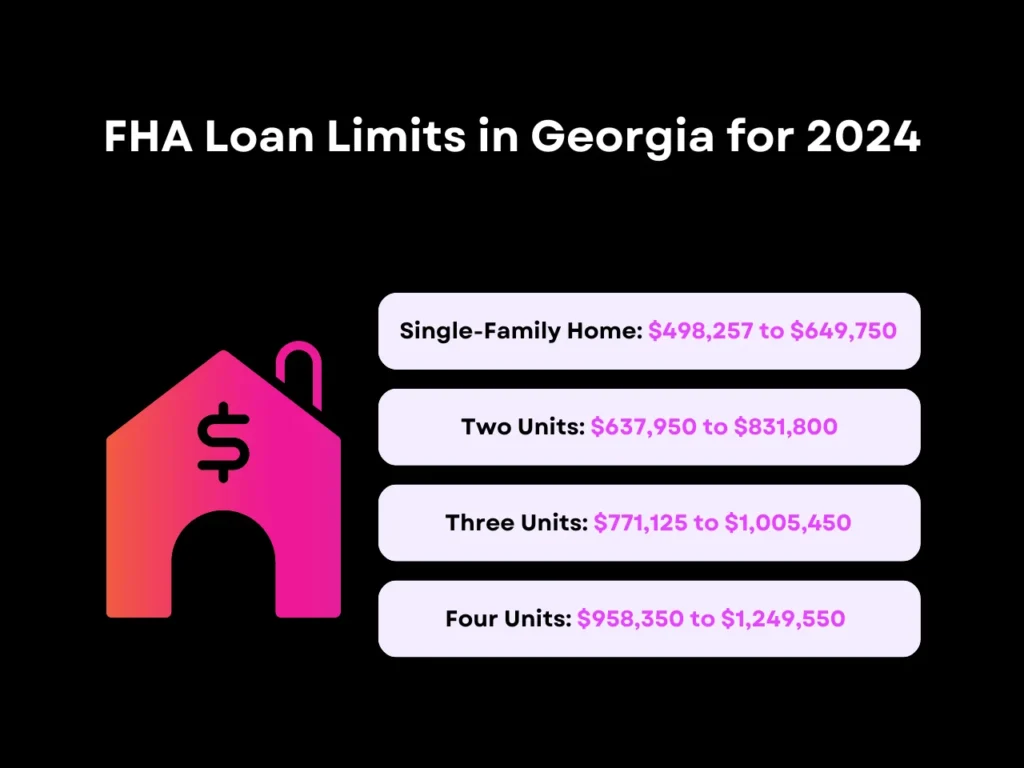

Assessing FHA loan limits is essential for prospective homebuyers. These limits, set annually, dictate the maximum loan amounts that FHA will insure. This ensures that borrowers can secure affordable home financing without excessive financial strain. FHA loan requirements in Georgia play a crucial role in determining these limits, ensuring they align with market conditions and housing costs.

Loan Limits

For 2024, FHA loan limits in Georgia vary based on property type and county. The base limit for single-family homes in most counties is set at $498,257. However, this limit rises in higher-cost areas, reflecting the diverse real estate market across the state.

- Single-Family Home: $498,257 to $649,750

- Two Units: $637,950 to $831,800

- Three Units: $771,125 to $1,005,450

- Four Units: $958,350 to $1,249,550

These limits are calculated as a percentage of the national conforming loan limit of $766,550 for a single-family home in 2024. The FHA sets the floor limit at 65% of this figure and the ceiling limit at 150%, adjusting for local housing market conditions. FHA loan limits and requirements can change annually, reflecting shifts in housing market trends and economic factors. Please note as well that loan limits vary by state and lender.

How County Limits Affect Borrowing

FHA loan limits vary significantly across counties in Georgia, affecting borrowing capacity. In high-cost counties like Barrow and Bartow, the single-family loan limit reaches $649,750. Conversely, in lower-cost counties such as Appling and Atkinson, the limit remains at $498,257. This disparity ensures that FHA loan requirements in Georgia are responsive to local market conditions, providing equitable access to home financing.

For example, a borrower in Fulton County can access up to $649,750 for a single-family home, whereas a borrower in Berrien County is capped at $498,257. These limits reflect the median home prices and the cost of living in each area, ensuring borrowers can find suitable housing within their financial means.

Key Takeaway

Potential homeowners looking to qualify for an FHA loan must understand the minimum credit score, down payment options, and debt-to-income ratio standards. Preparing these FHA loan requirements Georgia helps determine a borrower’s eligibility and aids in securing favorable loan terms, ultimately increasing their chances of approval.

When applying for an FHA loan, consider your financial situation and eligibility. Review your credit score, calculate your DTI ratio, and prepare for the down payment. Research available grants and programs in Georgia that can assist with down payments. Staying informed about FHA loan requirements Georgia can simplify the application process and help you achieve your homeownership.

Do you meet the FHA loan requirements in Georgia? At Defy Mortgage, we guide you through every step, ensuring a smooth process. Whether you seek an FHA loan in Alabama or an FHA loan in Texas, we provide expert guidance to help you qualify. Visit our homepage to learn more about how we can help you navigate FHA loan requirements and secure your dream home.

Frequently Asked Questions

1. What are the FHA loan requirements in Georgia for 2024?

FHA loan requirements in Georgia for 2024 include several key criteria:

- Credit Score: Minimum of 580 for a 3.5% down payment. Scores between 500-579 require a 10% down payment.

- Down Payment: 3.5% for credit scores of 580 or higher, 10% for lower scores. Gift funds are allowed for down payments but must be documented.

- Employment History: Steady employment for at least two years, supported by tax returns and pay stubs.

- Debt-to-Income Ratio (DTI): Maximum of 57%, though lenders prefer 43%.

- Property Use: Must be a primary residence.

- Mortgage Insurance Premium (MIP): For most FHA loans, MIP is required for the life of the loan. However, if the initial down payment was 10% or more, the MIP can be removed after 11 years. An upfront MIP of 1.75% of the loan amount is required at closing.

- Home Inspection: The property must pass an appraisal specific to FHA requirements.

2. What minimum credit score is required for an FHA loan in Georgia?

To qualify for an FHA loan in Georgia, borrowers need a minimum credit score of 580 for a 3.5% down payment. If your score ranges between 500-579, a 10% down payment is necessary. FHA lenders also review your credit and income history to ensure you can manage the monthly debt payments and mortgage loans.

3. Are there any exceptions to the minimum credit score requirements for FHA loans in Georgia?

Exceptions to the minimum credit score requirements are possible. If your credit score is below 580, FHA lenders may still approve your application with a higher down payment. Additionally, a strong income history and low monthly debt payments can improve your chances. Discuss your specific situation with a top FHA mortgage lender to explore all available options.

4. How are FHA loan limits calculated and updated?

FHA loan limits are determined annually based on changes in the median home prices in each county. In Georgia, these limits vary by county. The Department of Housing and Urban Development (HUD) sets the limits to reflect current market conditions. These limits are updated to accommodate fluctuations in home values, making homeownership accessible for more borrowers.

5. How do FHA loan limits vary across different counties in Georgia?

FHA loan limits in Georgia vary significantly by county. For instance, more expensive areas like Barrow and Bartow have higher loan limits, while other regions follow the standard limit. These variations account for differences in property values and help ensure borrowers can secure a mortgage that fits the local housing market. Prospective buyers should check the specific loan limits for their county with FHA lenders to understand their borrowing capacity.

6. Who would benefit from an FHA loan in Georgia?

An FHA loan is great for first-time homebuyers and homeowners, those with lower credit scores, those with a good credit history, and those with limited savings for a down payment. FHA loan qualifications are different from traditional loan qualifications, so many groups of people would benefit from an FHA mortgage.

7. Can I refinance my FHA loan in Georgia?

Yes, you can refinance your FHA loan in Georgia. Borrowers can refinance their properties through various FHA refinance programs.

8. Where can I get an FHA loan in Georgia?

If you are interested, Defy Mortgage is a certified FHA lender licensed in the state of Georgia. Our team is well-versed in FHA loan qualifications and works swiftly with borrowers to secure their FHA mortgage in a timely, professional manner.

If you aren’t sure if an FHA loan in Georgia is right for you, we have 75+ creative home loan options to meet your unique needs – this ain’t rocket science and we’ve got your back if you’d like to discuss your options.