The Hawaii housing market is one of the most active and competitive real estate landscapes in the U.S. It has historically been competitive, especially in popular areas like Honolulu, Maui, and the Big Island. Over the last few years, the market has shifted due to rising interest rates and strong demand for rental properties, making loans like DSCR a highly attractive option for buyers.

At Defy Mortgage, we streamline the mortgage process with non-traditional mortgage solutions like DSCR loans. Whether you’re a real estate investor, freelancer, business owner, or self-employed individual, we can fast-track you to investment property ownership with quick preapprovals on our seamless platform.

In this blog, we’ll discuss the main reasons why DSCR loans are becoming such powerful financing tools in the Hawaii real estate market. We’ll examine the market’s performance, expert predictions, and how DSCR loans fit into the market outlook.

Let’s jump in.

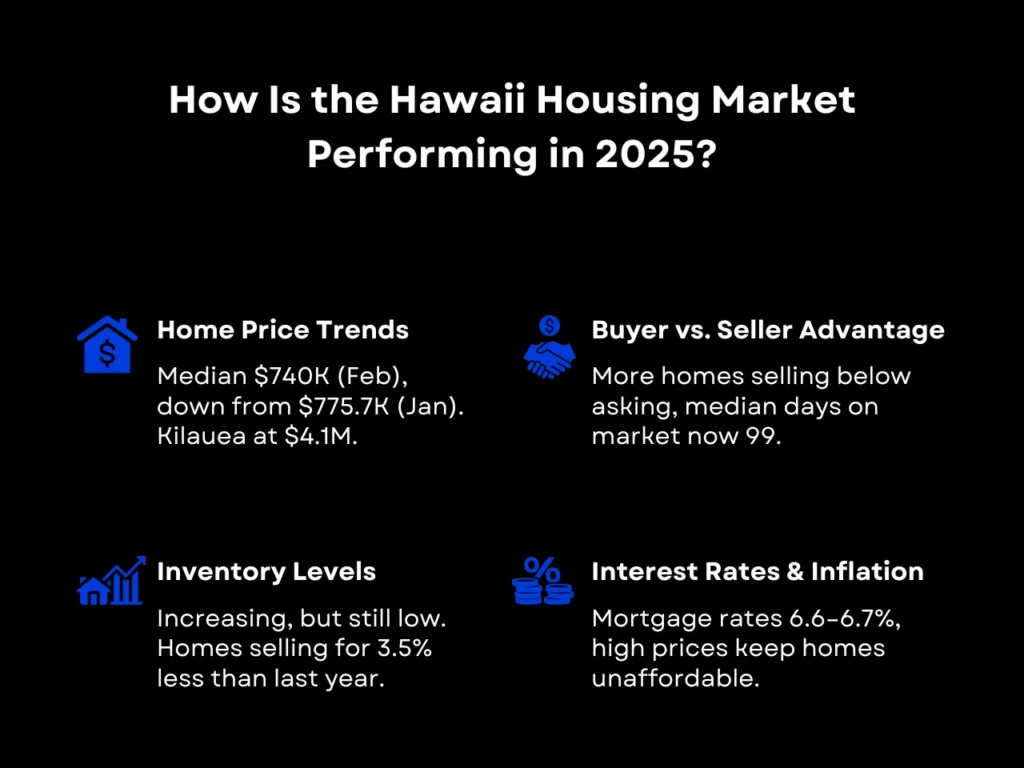

How Is the Hawaii Housing Market Performing in 2025?

In 2025, the Hawaii housing market is expected to remain competitive due to its limited land supply and high demand from both local and international investors. Rental investments have become highly profitable, with Hawaii’s tourism rebound elevating short-term rentals and luxury real estate, and new developments increasing the supply of multi-family homes.

Home Price Trends

As of February 2025, the median home price across Hawaii is approximately $740,000, up 0.04% year over year, according to Redfin. Areas such as Kilauea on Kauai’s North Shore have emerged as premium markets, with median listing prices reaching $4.1 million as of December 2024.

Other regions, such as the Kahului-Wailuku-Lahaina area, are experiencing remarkable appreciation. The average home value in this locale has risen to $1,050,949 as of March 2025, up 2.7% year over year. Despite inventory increases in late 2024, demand is still strong enough to support continued price growth, making strategic property acquisitions potentially more lucrative in the long term.

Inventory Levels

In 2024, inventory recovered from the various constraints that limited it in previous years, with supply up year-over-year throughout 2024. Between December 2024 and January 2025, the number of home listings increased by 25% to around 7,000 homes for sale. The available months of supply are now at 6.7 months, an increase of 110%, tipping the balance in favor of buyers.

Buyer vs. Seller Advantage

As of March 2025, Hawaii’s housing market is generally considered a buyer’s market, except in highly priced areas like Maui and Kilauea. This is consistent with the general trends in the US real estate market, where homes tend to be on the market longer, giving buyers more time to negotiate. An increasing number of homes are starting to sell under asking price in historically expensive markets like Honolulu, although plenty still sell at or above list price.

Hawaii Housing Market Predictions for 2025

Hawaii housing market predictions for the next 5 years will likely see continuous price growth headed for an eventual slowdown. This is in line with expert predictions for the general predictions for the US housing market as a whole. Let’s break it down in detail:

Will prices continue to rise?

The leading predictions say that house prices in Hawaii are likely to stabilize overall but will remain high due to land scarcity.

Depending on local market conditions, they may even dip in some areas, which we are already beginning to see in places such as Honolulu, where a growing number of homes are selling below list price. Honolulu and Maui are also experiencing a new development boom, which can create a more noticeable price drop as more supply becomes available to meet demand. For investors, this can mean more affordable acquisitions.

Meanwhile, places like Kilauea and Kahului-Wailuku-Lahaina are not experiencing the same level of development, and thus space remains more of a premium.

Economic Factors

The Hawaii Department of Business, Economic Development and Tourism (DBEDT) maintains its previous prediction of a 2% growth rate for 2025. Tourism, the state’s cornerstone industry, is bouncing back from 2023 lows, having generated a revenue of $20.68 billion in 2024.

Supporting tourism are industries such as construction and real estate. Hawaii’s construction sector, which experts have said has been on a “healthy upcycle” over the last decade, is expected to generate over $10 billion for the state through the next three years. This is thanks in large part to the state’s high housing demand, as well as government projects such as the Honolulu Rail Transit Project.

Tourism’s Impact

Despite economic difficulties such as the 2023 Maui wildfires, Hawaii’s tourism industry is expected to rebound. Visitor spending has already exceeded pre-2020 levels, with strong demand from U.S. mainland travelers, though international markets like Japan are still recovering.

According to the Hawaii Tourism Authority (HTA), the state is investing $2.5 billion in airport modernization and infrastructure improvements, with about 20% funded by federal grants. Hospitality businesses are also adapting by catering more to local residents to maintain revenue.

Long-Term Investment Outlook

Hawaii remains a strong long-term bet due to its unique appeal and limited housing supply. Although housing demand is beginning to dampen in certain areas, prices remain high and continue to show growth potential.

If you’re evaluating if Hawaii is the right place for your next investment, be sure to take home insurance into consideration. Certain parts of Hawaii, such as Puna on the Big Island, may show relatively lower prices. However, many insurance providers are in the process of withdrawing coverage in such areas or have increased costs because of environmental hazards like lava zones. This could add to the long-term cost of your investment.

The Best Investment Property Types in Hawaii Real Estate Market

Within Hawaii’s unique real estate market, certain property types emerge as the best options for investors. With its tourism-centric economy, vacation rentals are one of the most lucrative investments, but recent housing reforms are also making multi-family and mixed-use properties more viable.

1. Short-Term Vacation Rentals

Demand for short-term rentals (STRs) is as strong as ever in Hawaii, the 2nd most visited state in the US behind New York. High-tourism areas such as Waikiki in Oahu and Lahaina in Maui present highly profitable opportunities with their high occupancy levels and nightly rates. Airbtics reports that the average daily rate (ADR) in Hawaii ranges from $200 to over $400, often reaching upwards of $500 during peak season. These rates are much more affordable than that of hotels, and offering more space to boot. In 2024, Hawaii welcomed over 9,689,113 visitors. According to the State of Hawaii’s Department of Land and Natural Resources, 71 percent of Hawaii visitors prefer STRs to traditional hotels.

2. Long-Term Rental Properties

With the cost of homeownership likely to remain high for years to come, experts anticipate that Hawaii’s renting population, which accounts for 38.2% percent of the state’s residents, will stay in the rental market for the foreseeable future. This means stable rental demand, especially in places with a strong job market such as Urban Honolulu. Honolulu’s metro areas, which are 49% renter-occupied, have been experiencing a 2.43% increase in employment and a 6.2% growth in median household income. Median rents in Honolulu hover around $2,300, making this growth highly beneficial to its local rental market.

3. Multifamily Homes & Condos

Under long-term rentals, multifamily homes and condos are of particular interest compared to single-family rentals. With the average price per square foot across Hawaii staying around $691–over three times the national average–renting a unit in a multifamily property instead of a single-family home makes more economic sense for most Hawaiians.

With housing reforms such as Honolulu’s Bill 7, Senate Bill 3202, and House Bill 2090 already underway, the supply of multifamily homes is increasing, potentially providing an entry point for would-be investors. Given the state’s unwavering rental demand, building a portfolio of multifamily rentals in Hawaii can result in a relatively low-risk, consistent, and lucrative income stream.

4. Luxury & Resort Properties

Alongside vacation rentals, Hawaii’s luxury and resort property market remains strong thanks to its continued popularity among tourists. As one of the premier holiday destinations in the United States and the world as a whole, luxury properties in Hawaii have immense appreciation potential. 2024 saw a rebound to 20 ultra-luxury (over $10 million) sales compared to last year’s 13, reflecting healthy demand in the state’s luxury real estate market.

Affluent buyers, particularly entrepreneurs, executives, and celebrities from the US, as well as Japan and Canada, frequently purchase vacation homes and second homes in the state, fuelling this demand. Investment in the state’s luxury amenities is thriving, with new resorts such as Kona Village, a Rosewood Resort opening a series of signature suites across Hawaii. Markets close to these attractions are set up for accelerating growth and demand, making them ideal for investment with a jumbo loan to target high-net-worth buyers.

Why DSCR Loans Are the Best Financing Option for Hawaii Investors

Various investment property loans can be used effectively in Hawaii’s unique real estate ecosystem, but out of all of them, debt service coverage ratio (DSCR) loans are the safest bet. Let’s look into why that is:

- No income verification: DSCR loans qualify borrowers based on the rental income potential of their chosen properties rather than their personal finances. This makes them ideal for borrowers who don’t have the required credit scores to get good terms for conventional loans.

- Terms are based on the property, not the borrower: DSCR loan terms are determined based on the debt service coverage ratio, which is the ratio between the property’s cash flow and its debt obligations. As long as your property exceeds the minimum DSCR (0.75 at Defy!), you can get approved for a DSCR loan.

- Fast approval process: No complex background checks or underwriting procedures required. As soon as the lender can verify that the property can perform well once operational, you can expect approval between 2-4 weeks.

- Works for multiple property types: Whether you’re targeting the short-term rental market or long-term rentals such as multi-family units, DSCR loans employ the same income potential criteria to determine your eligibility and loan terms.

- Easier portfolio expansion: DSCR loans don’t account for your personal debt-to-income ratio, and there’s no hard limit on how many DSCR loans you can have active. This means you can keep getting approved as long as your chosen properties have a positive cash flow, allowing you to rapidly scale your portfolio and rental income stream.

How to Leverage DSCR Loans for Maximum ROI

Return on investment or ROI is a direct metric for how profitable an investment is. It’s calculated by subtracting the cost of purchasing a property from its final value, dividing the result by that same cost, and multiplying it by 100 to get a percentage.

Maximizing ROI is a matter of market research, property management, and strategic financing. Here’s how you can do that:

Choose the Right Property

Rental income potential is the primary factor in how quickly you get a return on your investment. As with most things in real estate, this is mainly decided by the property’s geographical location. Areas closer to amenities, schools, infrastructure developments, and jobs are often worth more than comparable properties located farther away.

Some factors can be more impactful than others when it comes to driving up rental demand; for example, since Hawaii’s economy is highly reliant on tourism, homes closer to tourist spots are likely to be more desirable to locals working in the hospitality industry. Make sure to do thorough research on rental demand trends in order to zero in on the best neighborhoods and properties to purchase.

Optimize Rental Income

Beyond choosing a property with great potential, you can fine-tune property performance by adding desirable features that allow you to charge more of a premium. Urban areas like Urban Honolulu and Waikiki, for example, are experiencing a severe parking shortage, making parking space an excellent selling point for your property. If your property doesn’t have dedicated parking, you can still make an agreement with parking facilities in your area, or even build one if there’s enough free space on your property.

Other ways to optimize rental income include thoroughly vetting your tenants to minimize costly incidents. When increasing rent, avoid sudden increases and instead closely monitor economic shifts such as inflation. Timing gradual, incremental price hikes with inflation is fairer, avoiding costly vacancy periods from tenants leaving to look for better prices.

Understand Loan Terms

Make sure you thoroughly understand the terms your DSCR loan comes with. Some terms, like interest rate, have a more straightforward impact on your ROI. Others, like repayment terms, have a more complex relationship with ROI. Longer terms decrease monthly payments, leading to better cash flow, while shorter terms decrease the amount of interest payments you have to make over time. Which one you should lean into would depend on your property’s performance and the other specifics of your investment.

Loan-to-value (LTV) and loan amounts also factor into ROI. High LTV means you can make a lower down payment to close. At Defy, our LTV for DSCR loans is 85%, meaning you can put as low as 15% down. Loan amounts determine the maximum amount you can get for a purchase, which can be used to afford higher-end investments or place a higher bid on a desirable property.

Work with the Right Lender

Thorough market research, rental income optimization, and being mortgage-savvy work best when paired with a lender that understands your goals and the Hawaii real estate market. Defy Mortgage has worked with scores of borrowers throughout the United States, including Hawaii investors. We’re deeply intimate with the nuances of each local market, such as Hawaii zoning regulations and STR restrictions. With our guidance, you can get maximum mileage out of your DSCR loan.

Hawaii Housing Market FAQ

What is a DSCR loan, and why is it popular in Hawaii?

A DSCR loan allows investors to qualify for an investment property mortgage based on the income potential of the property they’re interested in purchasing, rather than their personal income and financials. Terms such as mortgage rate, loan-to-value (LTV), and loan amount are all based on how well the property could perform. This makes it a great fit for Hawaii due to its tourism-driven economy.

Are DSCR loans available for Airbnb and vacation rentals in Hawaii?

Absolutely! DSCR loans are great for Airbnb and vacation rentals in Hawaii that generate enough income to meet their yearly debt obligations. Unlike many other vacation spots, Hawaii is popular year-round, so you can expect consistent rental income throughout the year, with even greater income potential during the high period around December to March.

Will the Hawaii housing market crash or correct in 2025?

While a major crash is unlikely, price growth may decrease due to rising mortgage rates tempering demand. The median sale price movement is beginning to slow down and even trend downward in some markets. Although there’s currently no indication that this will continue long-term, it can be a sign that price hikes are beginning to lose steam.

How do DSCR loan interest rates compare to traditional mortgages?

DSCR loan rates start higher than that of conventional loans, but they don’t have the disadvantage of getting a potentially higher rate if you don’t have a good credit score. If you choose a property with excellent income potential, lenders may offer you an even more competitive rate.

What are the best locations in Hawaii for real estate investors in 2025?

The best locations will ultimately depend on your goals, risk tolerance, and financial resources. Consult your local realtors for the most up-to-date information. As of March 2025, Oahu and Maui are currently undergoing widespread development and unveiling new attractions. These tend to lead to higher rental income and appreciation rates.

Key Takeaway

Despite affordability challenges, the Hawaii housing market remains a lucrative space for real estate investors, particularly those interested in short-term vacation rentals and multi-family units. With the advantages of DSCR loans at your disposal, you can gain the flexibility necessary to make the right investments in this resilient and dynamic market.

DSCR loans provide quick approvals, rapid scaling, and flexible terms, allowing you to seize opportunities that other loan types may not. Although the housing market is experiencing a general downward trend in competitiveness among homebuyers, competition for multi-family and short-term rentals remains fierce, especially as Hawaii is beginning to cut down the number of vacation rentals in favor of affordable housing. The fast approvals and rental income-based loan amounts can be the ace in your sleeve in bidding wars, allowing you to quickly expand your Hawaii investment portfolio.

Ready to take the next step? Reach out to Defy today and let’s get started planning your entry into the Hawaii real estate market. Schedule an appointment on our website, email us at team@defymortgage.com, or call us at (615) 622-1032.