Asset financing provides a practical avenue for businesses and individuals to secure necessary resources. Whether it’s funds, equipment, or even real estate, asset financing allows you to acquire them without having to use your own cash reserves. For real estate investors, asset-based lending offers a unique advantage by prioritizing the value of the asset itself rather than personal financial credentials like credit scores or capital reserves.

At Defy Mortgage, we specialize in streamlining the mortgage experience for all types of borrowers, from self-employed individuals looking for affordable home loans to real estate investors and business owners interested in DSCR loans. Whatever your needs, we can offer you an effortless mortgage experience with our competitive rates and seamless platform.

Although we do not offer asset financing at Defy, our extensive experience in the financial services space has made us very familiar with the ins and outs of this type of loan product. In this blog, we’ll go over what asset finance entails, the criteria you need to meet in order to qualify, and the best strategies to help you make the most of this loan type.

What Is Asset Financing and How Does It Work?

Asset financing is a type of loan in which physical or financial assets are used as collateral to secure funding. Unlike traditional financing, which heavily weighs the borrower’s credit history, asset financing focuses on the value of the assets being used as collateral.

This is particularly helpful for borrowers with imperfect credit or limited financial resources. It allows them to leverage any high-value assets that they may have and gain quick access to funds or assets without committing a large chunk of resources upfront. This can prove instrumental when a borrower needs immediate funds or asset access but faces challenges securing a traditional loan.

Asset Financing vs Asset Depletion Loans

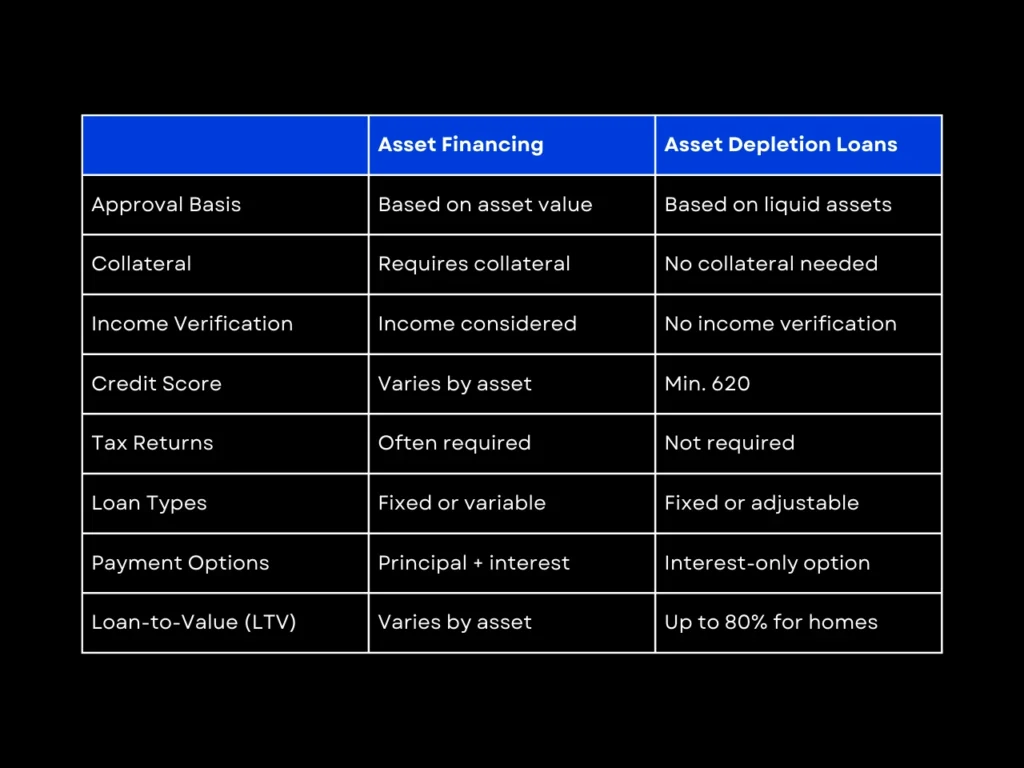

There are key differences between asset financing and asset depletion loans.

In asset financing, the value of the asset used as collateral is the primary factor in loan approval and terms. While income and creditworthiness are still considered (to a lesser extent), the focus is on the assets that you choose as collateral.

In contrast, asset depletion loans, which we offer here at Defy Mortgage, qualify borrowers based on their total liquid assets instead of income. To assess eligibility for these loans, lenders review your assets instead of your income, which is a form of alternative income verification.

No collateral is required. Instead, lenders assess your demonstrated ability to repay the loan using all of your liquid assets. This is particularly helpful for “high-net-worth” individuals who may not have regular W-2 income but hold significant liquid assets or retirees.

For those considering an asset depletion loan, here are our qualification requirements at Defy Mortgage:

- We accept applications with credit scores starting at 620 and offer both fixed-rate and adjustable-rate mortgages.

- Our loans feature interest-only payment options and can fund up to 80% of the property’s value for primary residences and second homes.

- Only available for primary residences and second homes.

- You’ll need to demonstrate sufficient liquid assets.

- Tax returns aren’t required for qualification.

Please note that your specific loan-to-value ratio will be determined by various factors including your credit score and debt-to-income ratio, and terms are subject to change. For personalized information about rates, fees, and terms based on your financial situation, schedule a consultation with us!

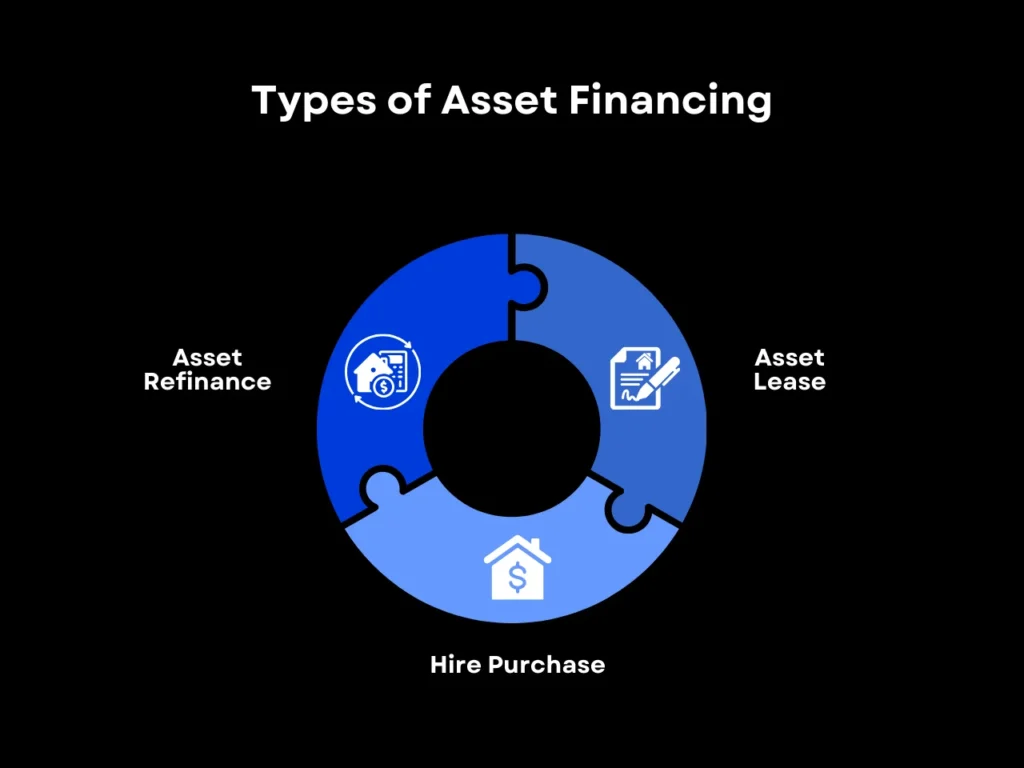

Types of Asset Financing

Asset financing takes on many different forms. While not all lenders offer all of these asset financing options, here are the most common types of asset financing:

Asset Refinance

This essentially involves pledging an asset that you own to be used as collateral for a loan, similar to pawning or (in some ways) a real estate cash out refinance. Assets that can be refinanced include everything from real estate to vehicles, business equipment, and accounts receivables. Loan terms will be based on the resale value of the asset, so depreciating assets like vehicles and equipment may yield a smaller loan size than the initial purchasing price.

Asset Lease

Asset leases allow borrowers to use an asset for a period of time. Assets can be leased under an operating lease, which gives the borrower a license to use the asset for a period of time, during which the lender retains full ownership of the asset; or a capital lease, also known as a finance lease, in which the borrower assumes greater ownership of the asset. An operating lease does not expose the borrower to the risks involved in owning the asset.

Hire Purchase

In a hire purchase, the borrower requests the lender who offers this to purchase an asset for them and pay it off over time, during which the lender retains full ownership of the asset. Once the asset is fully paid off, the borrower usually has the option to purchase the asset for a fee.

Benefits of Asset Financing

Asset financing allows businesses to access essential assets or funds without significant upfront costs. Here are some of its top benefits:

Faster Approval

In a fast-paced competitive market, quick access to funding can be essential for business growth. Traditional loans usually involve extensive credit and financial background checks, which can be a barrier to businesses that are on a tight timeline. With less stringent underwriting requirements, asset financing provides a faster and more accessible alternative.

Flexibility

Asset financing provides significant flexibility compared to traditional loan types. With asset refinancing, borrowers can customize the repayment schedule and adapt it to their needs. It’s an excellent option for covering unforeseen business expenses in the short run.

Conserves Cash Flow

Asset financing allows borrowers to access funding without draining their cash reserves, which is the biggest gain for businesses that need to preserve their runway and mitigate the risks of their investment. Preserving cash flow for other essential expenses or investments helps businesses maintain financial stability during growth.

Assets Eligible for Financing

Eligible collateral for asset financing can include both tangible property, such as real estate and equipment, and financial assets such as accounts receivable, stocks, and cash reserves. Here are some of the most common types of assets you can pledge to receive financing:

- Financial Assets: Accounts that hold liquid funds such as bank accounts, certificates of deposit (CDs) and retirement funds, as well as securities like stocks and bonds, can be used as collateral for an asset financing loan.

- Equipment: Physical assets such as machinery and vehicles can be pledged as collateral, leased, or hire-purchased.

- Current Assets: Accounts receivable financing is a common way for businesses to gain liquidity from outstanding bills and invoices. Some lenders even offer inventory financing, where you can simply put up your business’ spare inventory as collateral.

- Real Estate: Although using real estate as collateral usually falls under the domain of hard money loans, asset financing lenders may also allow you to tap into the equity of properties you currently own to gain funding. Similar to home equity loans, asset financing with real estate bases terms on the projected market value of the property to determine the loan amount, with some lenders also factoring in rental income.

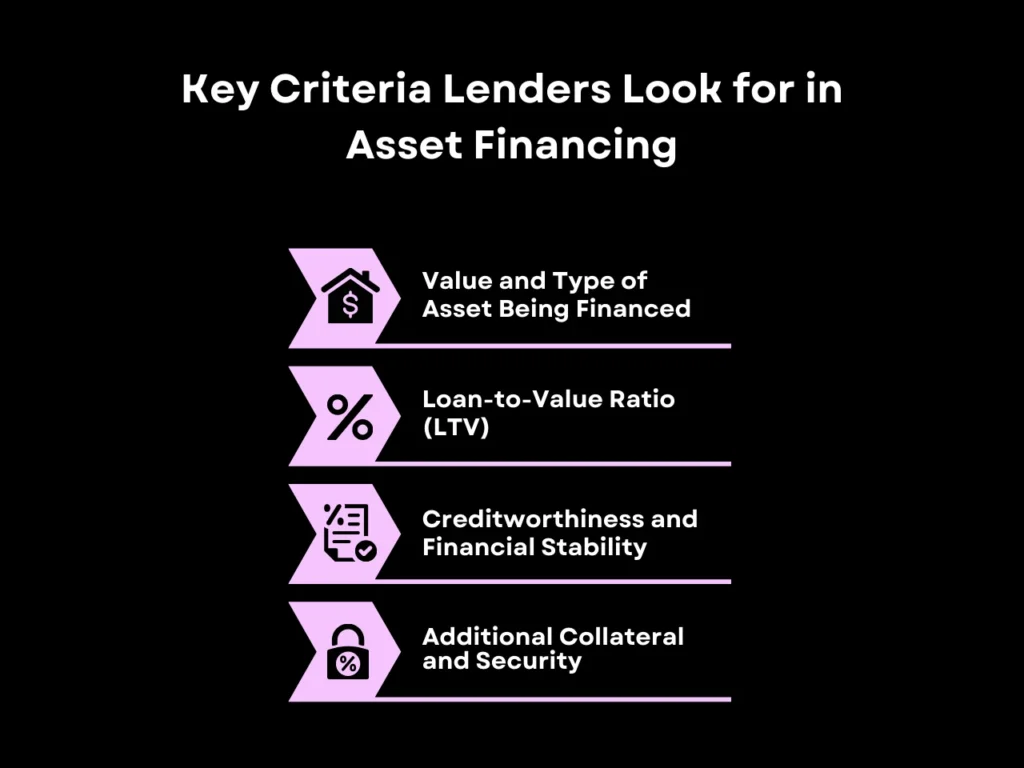

Key Criteria Lenders Look for When Approving Asset Financing

Lenders who offer asset financing primarily evaluate the value, condition, and resale potential of the asset being used as collateral. They may also consider the borrower’s business history, repayment ability, and the asset’s relevance to the borrower’s business operations.

Value and Type of Asset Being Financed

Lenders who offer these loans prefer assets with high resale value and minimal depreciation. For instance, machinery with a stable market demand or properties in prime locations are more attractive.

Loan-to-Value Ratio (LTV)

The LTV ratio indicates the percentage of the asset’s value that lenders are willing to finance. Typical ranges are between 70%-90%. The remainder of the 100% needs to be met by the borrower, so the lower the LTV, the higher the down payment that the borrower needs to make.

Lenders often impose different LTVs for different types of assets, so be sure to check with your lender to determine which of your assets would best serve you as collateral for an asset-based loan.

Creditworthiness and Financial Stability

Although these factors are less emphasized, asset financing lenders may still assess your credit history and financial stability. Strong personal and business credit scores signal reliability. Presenting clear financial statements, such as profit and loss or cash flow reports, strengthens your case. They may also require a minimum level of liquidity to ensure that you can still meet debt obligations in the event of income disruption.

If you’re borrowing under an LLC, your business’s track record is another factor. Established companies with consistent revenue streams will likely find it easier to qualify. Startups may face stricter scrutiny but can still succeed by presenting a solid business plan.

Additional Collateral and Security

The financed asset itself usually serves as collateral, but lenders may also request additional guarantees, such as personal assets or third-party backing, to further mitigate risks. This can often come if their risk assessments based on the asset’s resale value and your financial stability raise concerns.

How to Increase Your Chances of Qualifying for Asset Financing

To increase your chances of qualifying for asset financing, ensure the asset you offer is high-value, in good condition, and relevant to your business operations. Here are several things you can do to maximize the chances of getting approved for an asset financing loan with ideal terms:

- Strengthen Your Credit Profile

Pay off existing debts and ensure timely payments on current obligations to boost your credit score. Demonstrating financial responsibility makes you a more appealing candidate to asset financing lenders.

- Prepare Comprehensive Documentation

In terms of preparing comprehensive documentation for qualifying for asset financing, you may organize the following:

- Detailed financial statements.

- Asset valuation and maintenance records.

- A business plan illustrating how the asset will generate revenue.

- Choose the Right Lender

Research asset financing lenders who specialize in your industry or desired asset type. Once you’ve narrowed down your search to such lenders, you can start comparing terms, interest rates, and eligibility requirements. Not every lender offers these options so please keep that in mind when you are exploring your options. IF you are interested in a lender who doesn’t offer asset financing, ask them about asset depletion options or other non-QM lending solutions.

Asset Financing FAQ

Can startups qualify for asset financing, or is it only for established businesses?

Yes, startups can qualify, but they may face stricter requirements. Asset financing lenders look at a business’ history to determine borrower eligibility. To maximize your chances, present a strong business plan and high-value collateral.

What happens if I default on an asset financing loan?

If the borrower defaults on an asset financing loan, the lender is usually entitled to seize the financed asset to recover losses. Depending on the lender, additional penalties may apply.

Is it possible to finance used assets, or do lenders only approve new ones?

Both new and used assets can be financed, though used assets must meet the lender’s valuation criteria.

How long does the asset financing approval process typically take?

Approval timelines vary but usually range from a few days to a few weeks, depending on the lender and documentation completeness.

What industries benefit the most from asset financing?

Industries such as construction, transportation, IT, and manufacturing often leverage asset-based loans to fund equipment and infrastructure.

What is the difference between asset depletion loans and asset financing or asset based mortgages?

The key difference lies in how your assets are used: asset depletion mortgages transform your liquid assets into a calculated income stream, while asset-based mortgages use the assets directly as security for the loan. Asset depletion mortgages and asset-based mortgages serve borrowers with substantial assets, but they function quite differently in the qualification process.

With an asset depletion mortgage, your liquid assets are converted into a theoretical monthly income by dividing them by the number of months in your loan term. This approach demonstrates your ability to sustain monthly payments over time, even without traditional employment income and are tailored tailored for borrowers wanting to qualify based on liquid wealth or “liquid assets”.

Key Takeaway

The versatility offered by asset financing can be a powerful tool for acquiring critical resources when time or cash reserves are limited. Asset refinancing enables you to tap into the inherent value of your own assets to gain quick access to cash or rapidly fill in any gaps in your operations.

The first step in improving your chances of approval is to understand what lenders care about for this specific type of loan. If asset financing is of interest to you, start by researching specialized asset financing lenders, strengthening your credit profile, and preparing comprehensive documentation. Just keep in mind that not all lenders offer asset financing, Defy included.

Interested in other loan products such as asset depletion loans, bank statement loans or P&L loans? Reach out to Defy today, and we’ll talk about how we can help you reach your financial goals. With 75+ fully customizable loan products, we can tailor solutions for every situation.