As of 2024, Oregon is the 8th most expensive state to purchase a home in, with median home prices reaching $511,434. Given these prices, even fairly modest homes can sometimes be priced above the limits allowed by conventional mortgages in expensive areas. In these cases, a jumbo loan Oregon can be vital to buying a home in the state.

At Defy Mortgage, we make home buying easier for borrowers of all financial backgrounds, including those with unconventional incomes, such as freelancers, real estate investors, and self-employed individuals. We offer both traditional mortgages like FHA loans and VA loans as well as non-traditional lending options like jumbo loans and bank statement loans in several states other than Oregon. With competitive rates, fast pre-approvals, and end-to-end support, we can simplify even the most complex of loan situations.

Using our long-standing expertise in providing various types of home loans, we’ve written this blog to guide you on everything you need to know to successfully navigate the Oregon jumbo loan application process. We’ll discuss the requirements and conforming loan thresholds for Oregon, and we’ll go over best practices to get ideal loan terms and the highest chances of approval.

Let’s get right into it.

Please note that we do not currently offer loan options in the state of Oregon at this time.

What Is a Jumbo Loan Oregon?

A jumbo loan Oregon is a mortgage that allows you to purchase Oregon properties priced beyond the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans are often geared towards high-net-worth individuals, but anyone with sufficient income and an ideal financial background can apply.

How Conforming Loan Limits Work

Conforming loan limits are the maximum amounts Fannie Mae and Freddie Mac will back for standard mortgages. Like FHA limits, conforming loan limits tend to vary by county to ensure that prospective homeowners have sufficient buying power in their particular region. The FHFA sets the conforming loan limits according to the median home prices in a county. If 115% of the median home price in a county exceeds the baseline conforming loan limit, they’re designated a high-cost area and are given a higher conforming loan limit.

When a property’s cost surpasses the conforming loan limit, it can no longer be covered with a conventional home loan. At this point, a jumbo loan becomes necessary. Since these loans are not insured by the government, they typically come with stricter qualification criteria to mitigate lender risks.

Current Thresholds for Oregon

The baseline conforming loan limit for most U.S. counties in 2024 is $766,550 for a single-family home. Although Oregon is one of the most expensive states to purchase real estate in, with FHA loan limits that reflect that, the base limit of $766,550 applies throughout all of Oregon’s 36 counties, even in high-demand areas like Portland and Eugene.

This is because the Q4 2023 median home price in Oregon remained at around $500,000-$600,000 when conforming loan limits for 2024 were set. 115% of $600,000 is $690,000, which is below the conforming loan limit of $766,550.

Thus, the FHFA saw no need to raise the limit, even in Oregon’s more expensive counties. This means that any home purchase requiring a loan more than $766,550 can no longer be financed by a conventional loan and instead will have to rely on a jumbo loan.

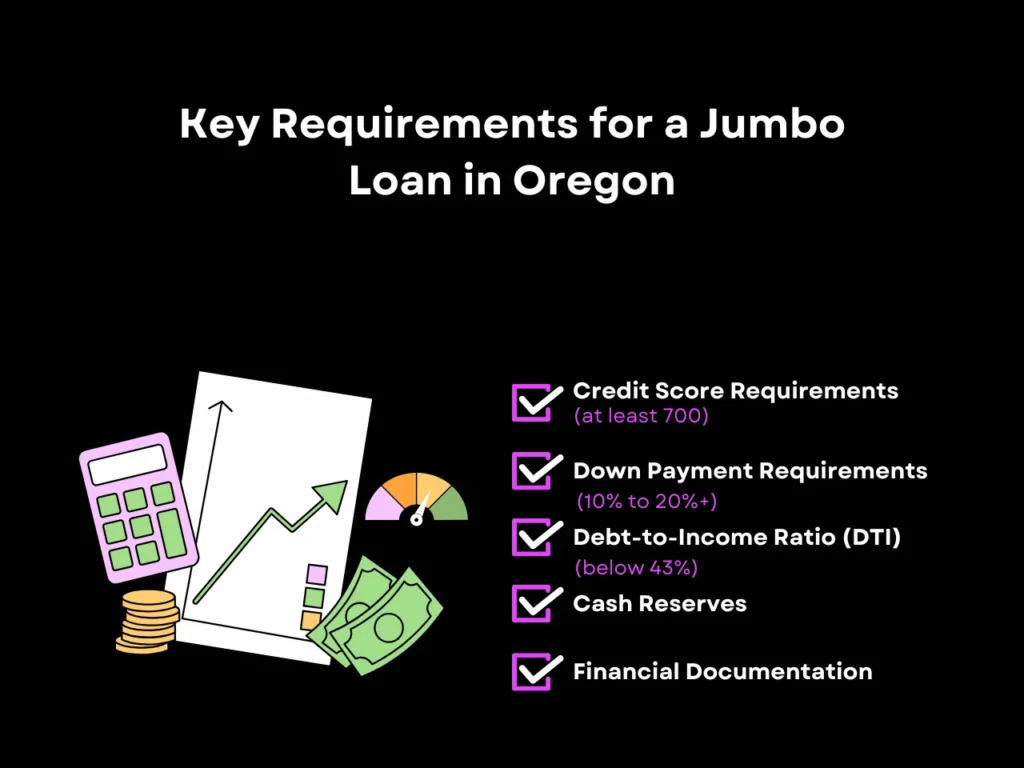

Key Requirements for a Jumbo Loan in Oregon

Jumbo loans have more stringent requirements than conventional loans due to their larger loan amounts. Here’s what you need to secure a jumbo loan in Oregon. Please note that we do not currently offer loan options in the state of Oregon at this time.

Credit Score

Jumbo loan lenders tend to prefer credit scores around 720-760. At Defy, the minimum FICO score we look for is 700 for Jumbo loans in other states. Higher scores improve the odds of approval and the chances of getting better jumbo mortgage rates, as well as unlock higher loan amounts. Please note that we do not currently offer loan options in the state of Oregon at this time.

Down Payment

Unlike conventional loan down payments, where down payments can be as low as 3%, the minimum down payment you can expect to pay for a jumbo loan is 10%. However, the average jumbo loan requires a down payment of 20% or more depending on how well you meet the other requirements. If you have a particularly high DTI ratio or lower credit score, it’s possible to increase the odds of approval and getting good loan terms by raising your down payment.

Debt-to-Income (DTI) Ratio

Your debt-to-income ratio, or DTI, is the ratio between your monthly income and your monthly debt payments. Most jumbo lenders look for a DTI ratio below 43%, although some lenders may allow you to get approved with a slightly higher DTI ratio if you have a good credit score.

Many lenders recommend keeping your DTI below 36% to maximize your chances of approval. Jumbo loans are high-risk loans, given their large amounts, so lenders prefer borrowers with low debt burdens, as this makes them less likely to miss payments if their income is disrupted.

Cash Reserves

Jumbo loan lenders often require that borrowers show liquid assets covering up to a year of mortgage payments. This serves as proof that a borrower will have enough funds to make mortgage payments even if their regular income stream is interrupted. At Defy, we require borrowers to have at least 6 months’ worth of debt payments in reserve.

Financial Documentation

Lenders will ask to see documentation of your income and assets to gain a clear picture of your cash flow and potential sources of liquid funds. This typically includes tax returns and W2 or 1099 income, as well as asset statements, bank statements, and investment statements. If you intend to use gift funds for your down payment or mortgage payments, you may be asked to provide gift letters as well to verify that your benefactor did intend for the funds to be used for payment assistance.

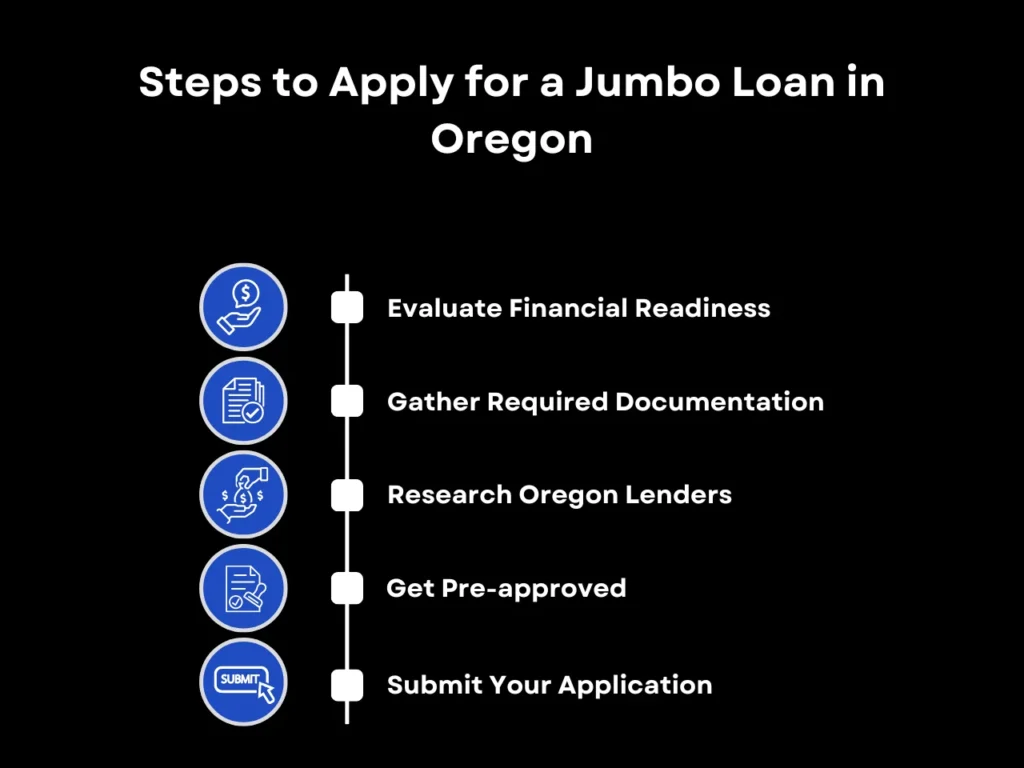

Steps to Apply for a Jumbo Loan in Oregon

Applying for an Oregon jumbo mortgage follows similar steps as applying for a conventional loan. However, there are certain key steps borrowers should follow to ensure that the process goes smoothly and secure the best loan terms possible.

Step 1: Evaluate Financial Readiness

Check your credit reports and report any inaccuracies to ensure that your FICO score is as high as possible before applying for a jumbo home loan to get the best terms and chances of approval. Calculate your DTI ratio as well to verify that you fall below the maximum threshold allowed by your lender. If your DTI is too high or your credit score is too low, it may be worth considering consolidating your debts or improving your credit score before applying for a jumbo loan in Oregon.

Income stability is another major deciding factor in approval. Lenders will closely review your employment history or business earnings to confirm steady and sufficient income over the past two years. If you’re self-employed or a freelancer, be prepared to provide detailed documentation, such as tax returns and profit-and-loss statements, to demonstrate your financial reliability.

Step 2: Gather Required Documentation

Prepare all necessary financial documents beforehand, including bank statements, proof of income, tax returns, and asset verifications. Having all of these ready right away can significantly streamline and fast-track your loan process.

Step 3: Research Oregon Lenders

Once you’ve got your finances in order, it’s time to shop around to find the best jumbo loan rates in Oregon for your particular purchase. It’s usually a good idea to prioritize local lenders that have experience in jumbo financing. Local lenders often have better insight into the state’s property market. Coupled with jumbo loan expertise, a local lender can be more likely to approve your loan and offer you competitive terms for your unique situation.

However, this isn’t the case all the time. Sometimes out-of-state lenders can offer you a better deal, so it’s best to create a shortlist of both in-state and out-of-state lenders so you can compare and contrast which ones best meet your particular needs.

Step 4: Get Pre-Approved

Pre-approval isn’t a mandatory step, but it comes with several benefits, like helping you grasp your borrowing potential. Providing a lender with your financial information allows them to give you an initial estimate of the maximum amount they are willing to lend you in a jumbo loan. It also strengthens your position as a buyer, as sellers will prefer bidders who are already pre-approved as they present the clearest path to closing on the sale.

Step 5: Submit Your Application

Once you’ve chosen a lender, you can submit a formal application for a jumbo loan. During this phase, the lender will examine all of the documents you’ve gathered. This will also be the part where the lender will schedule appraisals to verify that the property’s value is aligned with the loan amount you’re requesting.

If everything is in order, your application will be approved and you can then close on the property with the seller, upon which the lender will disburse the funds to them.

Jumbo Loan Oregon FAQ

What credit score is needed to qualify for a jumbo loan in Oregon?

A minimum credit score of around 720-760 is typical, though higher scores are preferred for better rates. At Defy, the minimum FICO score we look for is 700.

Can I refinance my jumbo loan in the future?

Yes, refinancing is an option and may lower interest rates or adjust loan terms depending on market conditions.

Are interest rates on jumbo loans in Oregon higher than conventional loans?

Generally, yes. Jumbo mortgage rates in Oregon are higher due to the larger amounts and increased lender risk.

How long does it take to get approved for a jumbo loan in Oregon?

Approval can take 30-45 days, depending on the lender and the complexity of the application. Please note that we do not currently offer loan options in the state of Oregon at this time.

What is the typical down payment required for a jumbo loan in Oregon?

A down payment of 10-20% is common for jumbo loans, although some lenders may require a larger amount based on the loan size or borrower profile.

Key Takeaways

Whether you’re looking to purchase a luxury property, finance a large real estate investment, or buy a mid-to-high range home in an expensive neighborhood, a jumbo loan Oregon is one of the most effective tools for financing a large real estate purchase in the state.

If you’re interested in a jumbo loan in Oregon, make sure to keep your credit score, DTI ratio, and cash reserves at ideal levels. Lenders can be very strict when it comes to jumbo loan approval, so it can pay to take time to improve these criteria to maximize your chances of getting approved with good loan terms.

Would you like to learn more about your mortgage options in other states? Don’t hesitate to start a conversation with Defy to gain expert advice on your unique mortgage needs.