As someone who built up wealth through unconventional income paths, you might find it difficult to get a traditional mortgage, even though you have the financial capacity to support it. Non-traditional mortgage loans were designed precisely for those like you with unique financial situations. The effectiveness of these solutions is evident in their growing popularity; non-traditional mortgage loans are expected to jump from 5% of the mortgage market share in 2024 to up to 15% by the end of 2025.

Non-traditional mortgage loans are our bread and butter at Defy Mortgage. We’ve built our expertise around helping self-employed professionals, entrepreneurs, and investors like you turn complex income into borrowing power. Whether your earnings come from multiple businesses, fluctuating revenue streams, or high-value assets, our team specializes in structuring loans that let you leverage your full financial strength.

Inside this guide, you’ll find:

- An overview of what non-QM loans are and why they matter in 2025.

- A breakdown of the borrower profiles that non-QM lenders specialize in (including self-employed, asset-heavy, tax-shielded, investor types).

- Practical criteria and documentation requirements you’ll face with non-QM loans—and how to position yourself ahead.

TL;DR

- Non-traditional (non-QM) loans are built for self-employed professionals, real estate investors, and high-net-worth individuals whose income doesn’t fit conventional W2 standards.

- These loans can make use of alternative documentation like bank statements, CPA-prepared P&Ls, or asset-based income, instead of relying solely on traditional income verification.

- Common programs include bank statement, DSCR, and asset depletion loans, offering faster approvals and customized underwriting tailored to your financial reality.

- To make the best use of non-traditional mortgage loans, focus on aligning your documentation with your financial strengths. Use the income type that best represents your true earning power, whether that’s rental income, assets, or business cash flow.

- Defy Mortgage specializes in these flexible solutions, helping entrepreneurs and investors qualify based on their actual earning power and scale their portfolios with confidence.

What Is a Non-Traditional Mortgage Loan?

Non-traditional mortgage loans are mortgages that don’t meet the strict requirements of traditional loans, like steady W2 income or a low debt-to-income (DTI) ratio. Often referred to as non-qualified mortgages (non-QM loans), these are designed for individuals with unique income streams, such as self-employed borrowers, retirees, or real estate investors.

Non-traditional and unconventional mortgages are essentially the same, both focusing on flexible qualification requirements to accommodate a wide range of borrowers. In contrast to traditional loans that need to follow the strict lending guidelines set by the Consumer Financial Protection Bureau (CFPB), these loans allow borrowers to use alternative methods, like bank statements or asset-based income, to prove that they can repay the loan.

However, because these loans do not follow lending guidelines, they’re also not guaranteed by government-sponsored enterprises like Fannie Mae and Freddie Mac. This means that the lender takes on the full risk of lending out these products, and thus, they increase rates and impose their own requirements to compensate for this.

Who Can Benefit From Non-Traditional Mortgage Loans?

Non-traditional mortgage loans are designed to meet the needs of people who don’t fit the standard mold of conventional loans. For that reason, there are many flexible solutions for a wide range of individuals, including:

- Self-employed individuals and business owners with fluctuating or non-traditional income.

- Retirees who rely on assets rather than regular income.

- High-net-worth individuals (HNW) who may have significant wealth via liquid assets but limited taxable income.

- Real estate investors needing alternative qualification methods, like rental income.

- Foreign nationals without Social Security Numbers (SSNs) or a U.S. credit history.

- Borrowers with unique financial profiles, such as multiple income streams or non-traditional credit histories.

In other words, these loans are great for those whose income is not easily captured through W2s or pay stubs. Because they allow the use of alternative verification methods, non-traditional mortgage loans can map loan terms more accurately to a borrower’s financial reality.

Types of Non-Traditional Mortgage Loans

Non-traditional home loans and investment property loans come in all shapes and sizes, which means there are many options for people with unique financial situations. From serving self-employed individuals to real estate investors, there’s a loan tailored to your needs.

Here’s a quick overview of some of the most popular non-QM loan types:

- Bank Statement Loans: With bank statement loans, lenders use deposits from your bank statements to verify your income.

- P&L Loans: P&L loans use a profit-and-loss statement prepared by a CPA to showcase your income and financial stability. They’re a practical solution for business owners whose income is best reflected through business documentation.

- DSCR Loans: DSCR (Debt-Service Coverage Ratio) loans are tailored for real estate investors, with qualification based on a property’s rental income rather than the borrower’s personal income. The focus is on whether the rental income can cover the property’s mortgage payments.

- Asset Depletion Loans: Asset depletion loans allow borrowers to qualify by converting their liquid assets, like savings, investments, or retirement funds, into a monthly “income.” This option works well for high-net-worth individuals or retirees without steady documented income.

- Fix-and-Flip Loans: Fix-and-flip loans provide short-term financing for investors buying and renovating properties to sell for profit. These loans offer quick approvals and funding, making them ideal for fast-paced property flipping.

- Construction Loans: Construction loans are designed to finance building or renovating properties, covering expenses like labor, materials, and permits. Funds are usually disbursed in stages as the project progresses, which requires detailed plans and budgets.

- Interest-Only Mortgages: Interest-only mortgages let borrowers pay just the interest portion of their loan for an initial period, usually 5-10 years. They’re great for those who expect increased income or property value over time.

Non-Traditional Mortgage Loans vs Traditional Loans

Application and Approval Process

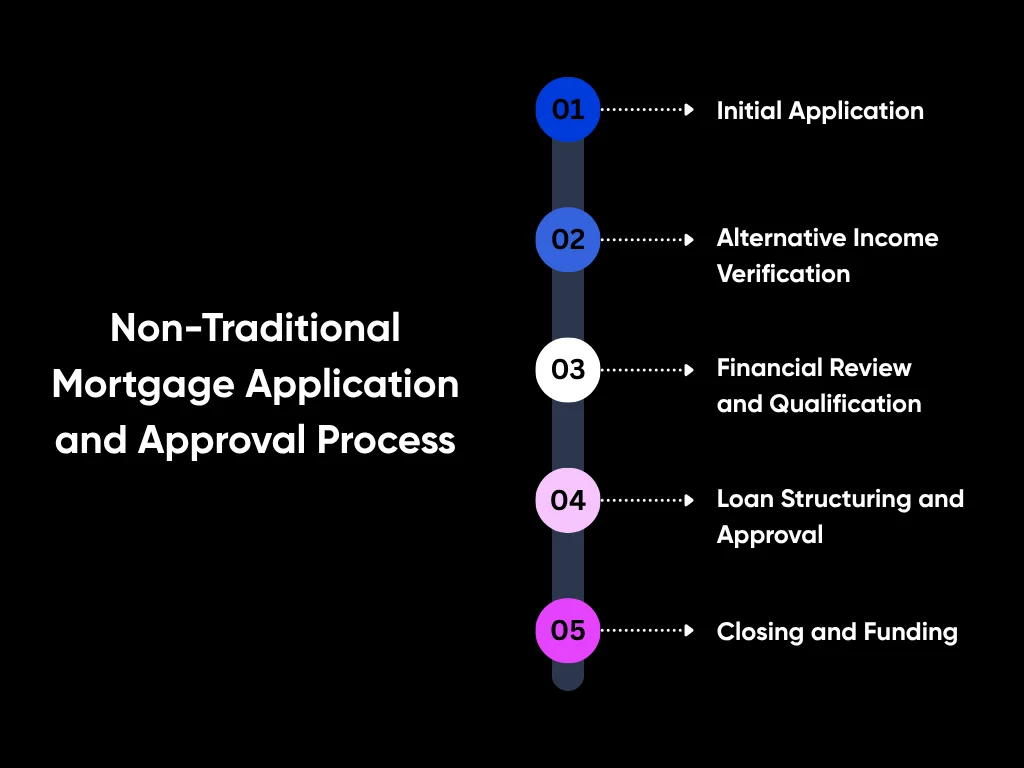

The application and approval process for a non-traditional mortgage is usually much faster and more streamlined than that of traditional loans, especially when working with private mortgage lenders. These lenders specialize in customizing loans to unique financial situations, which often makes their qualification requirements more flexible. The application and approval process for non-traditional mortgages typically follows these general steps:

- Initial application: Borrowers submit an application that outlines their financial profile, property details, and loan goals. Unlike conventional loans that rely primarily on tax returns and W-2s, non-traditional loan programs may use alternative forms of income verification aligned with self-employed and asset-based borrowers, whether rental income from an investment property or liquid assets.

- Alternative income verification: Lenders may accept the following forms of alternative income proof:

- Bank statements: Typically from the last 12-24 months to verify deposits and cash flow.

- CPA-prepared profit & loss (P&L) statements: To demonstrate business income.

- Proof of liquid assets: This can include savings, investment, or retirement accounts, but some near-liquid assets may be considered, such as stocks or bonds, especially for asset depletion loans.

- Rental income documentation: For purchasing or refinancing investment properties, particularly for DSCR loans.

- Financial review and qualification: The lender reviews your overall financial picture, from credit behavior to available assets and income consistency.

- Loan structuring and approval: Once your documents are verified, the lender structures the loan terms depending on how well you meet the qualification criteria. At Defy Mortgage, our loan terms are fine-tuned to your specific financial scenario. Our loan structuring can involve setting custom loan-to-value ratios, interest-only options, or alternative amortization schedules. The approval stage is generally faster than with traditional mortgages.

- Closing and funding: After final approval, the lender prepares closing documents and disburses funds to the seller. This step is also often faster compared to closing and funding for conventional mortgages, often taking only weeks rather than months, depending on documentation readiness and property type.

Pros and Cons of Non-Traditional Mortgage Loans

Pros:

- Flexible qualification requirements: Non-traditional lenders often accept alternative forms of income verification, such as bank statements, CPA-prepared P&L statements, or proof of liquid assets. This lets you get more mileage out of your complete income picture, allowing you to factor in income that may not be reflected in your tax returns or W-2s.

- Expanded access to credit: Because of their flexibility, these loans open the door for individuals who may not fit traditional lending criteria, such as business owners, real estate investors, or retirees relying on assets instead of active income.

- Diverse loan options: Borrowers can choose from a wide range of loan programs, like bank statement loans, DSCR loans, asset depletion loans, and interest-only loans. Each of these loans is designed to meet different financial needs and property goals.

- Personalized underwriting: Rather than following rigid underwriting standards, non-QM lenders like Defy Mortgage take a full 360-degree view at a borrower’s finances. This allows us to create fairer and more customized loan structures.

- Faster approval times: Non-traditional loans can be processed and approved faster than conventional loans, ideal for buyers needing quick funding. This is especially the case with non-QM specialists like Defy Mortgage. With decades of experience with complex income profiles, our Mortgage Consultants avoid redundancies and miscommunications that slow traditional underwriting.

Cons:

- Higher interest rates: Because these loans carry greater risk for lenders, borrowers usually face slightly higher interest rates compared to conforming or conventional mortgage products.

- Larger down payments: Non-traditional loans often require higher down payments, often 20% or more, to offset the additional risk that lenders take on. However, depending on the loan type, non-traditional loan options can have down payments as low as 10%. Conventional loan down payments, on the other hand, can be as low as 3%.

- Limited availability: Not every lender offers non-traditional or non-QM loan products, meaning borrowers may have fewer options and less competitive pricing to choose from. Fortunately, however, many of Defy Mortgage’s non-QM loans are available in most US states.

- More sensitive to market volatility: Certain non-traditional products, like interest-only or adjustable-rate loans, may lead to increased payments in the future if market conditions or income levels change.

Choosing a Non-Traditional Mortgage Lender

When you’re looking for a non-traditional mortgage lender, it’s important to find someone who understands your unique situation and can offer flexible options to match.

Start by considering their experience with non-QM loans like bank statement or DSCR loans, and make sure they’re upfront about terms, rates, and fees. Checking reviews and their track record with other borrowers like you can also give you a good sense of what to expect.

Top 5 Non-Traditional Mortgage Lenders

Note: This list is in no particular order.

1. Defy Mortgage

Since being founded in 2022, Defy Mortgage has built a reputation for ultra-flexible underwriting and tailored programs for complex borrower profiles. Whether you earn income through multiple businesses, rental properties, or investments, Defy Mortgage specializes in structuring non-QM loans that reflect your true financial picture rather than just your tax returns.

Here are some examples of what Defy Mortgage offers:

- Bank statement loans: Qualify with 12-24 months of personal or business bank statements. Up to 90% LTV, minimum 620 FICO, loan amounts up to $6M.

- DSCR loans: Qualify using rental income. Minimum 640 FICO, 85% LTV, DSCR as low as 0.500 accepted and no ratio DSCR options, loan amounts up to $6M.

- Asset depletion loans: Qualify based on liquid assets. Minimum 640 FICO, 80% LTV, loan amounts up to $6M.

- Jumbo loans: Minimum 700 FICO, up to 90% LTV, and 6-12 months of cash reserves.

No matter how complex your documentation, our Mortgage Consultants have the experience to ensure minimal friction, prevent unnecessary conditions, and speed approvals.

2. Rocket Mortgage

Rocket Mortgage remains one of the largest mortgage lenders in the country and provides a highly digital, mobile-friendly application process. However, Rocket’s programs can be less customizable than the ones offered by boutique lenders for complex financial profiles, and with higher origination fees. They also do not offer certain non-traditional financing options, such as HELOCs.

3. Guaranteed Rate

Now known as Rate, this lender is known for fast and flexible underwriting, as well as a large selection of mortgages. However, their loan programs themselves can be inflexible, with income limits, HELOCs requiring the immediate withdrawal of all funds, and other restrictions. Some loans’ details are also not readily available on their site.

4. New American Funding

New American Funding focuses on inclusivity and borrower diversity, with speciality programs for first-time and self-employed home buyers. However, their rates aren’t advertised online. Origination fees are also on the high side, and they may also charge application fees.

5. PennyMac

PennyMac combines traditional stability with modern tech, offering both conventional and non-traditional mortgage options with a user-friendly online platform. However, their main focus is on government-backed loans such as FHA loans and VA loans, not non-QM loans. They also don’t offer certain non-QM loans, such as HELOCs, construction loans, and renovation loans. Their fees are also on the higher end.

Key Takeaways

The market for non-traditional mortgage loans continues to accelerate in 2025, with more entrepreneurs, self-employed professionals, and real estate investors taking advantage of these flexible solutions to access funding that they may not get from conventional lenders. With these programs, borrowers don’t have to be bound by rigid agency formulas, allowing even those with the most irregular incomes to scale their wealth through real estate.

To take advantage of these opportunities, remember to align your financing approach with your real financial strengths. Use bank statements, CPA-prepared P&Ls, or asset-based documentation to qualify based on your actual earning power. Real estate investors can benefit most from DSCR loans for income-based qualification, while high-net-worth borrowers may prefer asset depletion or interest-only structures to preserve liquidity and maximize returns.

Building your portfolio with Defy Mortgage makes traditional underwriting obstacles a thing of the past. Our team designs customized loan structures using flexible income documentation, asset-based underwriting, and DSCR programs built for serious investors. We move fast, underwrite smarter, and structure deals that match your financial strategy so you can close confidently and keep scaling.

And if you’re a mortgage broker, Defy TPO gives you access to the same platform. With our suite of ultra-flexible loans, you can deliver faster approvals, custom structuring, and better results for your clients. Let us solve some of your trickiest pricing scenarios, and we’ll show you how Defy Mortgage can help you dominate the market. Alternatively, you can try our AI Pricer for a quick quote.

Non-Traditional Mortgage Lender and Loan FAQs:

Are nontraditional mortgages a good idea?

Whether or not a non-traditional mortgage is right for you ultimately depends on your needs. They can be a good idea if you have strong income or assets, but don’t meet conventional underwriting standards. For example:

- You’re self-employed and you deduct a lot of business expenses from your taxes. Because of this, your tax returns don’t reflect your full income.

- You rely on investment income, savings, or your built-up assets.

- You’re an investor who regularly needs to meet tight investment windows. With fewer documentation requirements, non-traditional loan underwriting can be much faster than conventional, allowing you to close on properties much more quickly.

Are nontraditional mortgages the same as non-QM mortgages?

Not exactly. In many contexts, lenders use those two terms interchangeably, but a non-traditional mortgage technically refers to any mortgage that does not follow conventional loan structures. Examples include balloon loans, interest-only loans, and hybrid ARMs. Whereas a non-QM mortgage is any loan that can have:

- Risky payment structures such as interest-only, negative amortization, and balloon payments.

- Loan terms longer than 30 years.

- No lending cost limit.

- No limit on upfront points and fees.

- Flexible income verification requirements.

Therefore, a loan can technically be non-QM while still having a traditional payment structure (such as 30-year fixed or adjustable-rate) if it allows alternative income documentation or upfront points above standard limits. However, since QM loans cannot be interest-only or have any other risky payment structures, a non-traditional loan by definition cannot be QM.

What are unconventional loans?

Unconventional loans are home loan programs that don’t follow the standard rules used by big banks or government-backed lenders. They are designed for borrowers with income, employment, or asset circumstances that fall outside typical underwriting norms.

Why would someone need an unconventional mortgage?

Traditional loans typically require specific income sources, while unconventional mortgages accept alternative proofs of income. This usually works better for those who get their income from:

- Self-employment

- 1099 contract work

- Their built-up assets

- A business or businesses they own

- Investment income

- Rental income

In short: when your income is irregular, multi-sourced, or asset-rich but not W2-rich, unconventional loans can let you make better use of your complete financial profile compared to conventional loans.

What makes Defy Mortgage different from traditional mortgage lenders?

At Defy Mortgage, we specialize in non-traditional or complex borrower profiles. We offer a wide array of non-QM (non-qualified mortgage) and unconventional loan program options, including DSCR (debt service coverage ratio) loans, bank-statement loans, and asset-qualifying solutions for self-employed/1099/foreign nationals.

Our Mortgage Consultants have over a century of collective experience handling complex income profiles. This makes our team highly skilled at structuring and presenting non-traditional documentation to underwriting to speed approval and avoid unnecessary delays. Since we also specialize in investment property loans, we place extra emphasis on agility and speed, letting you close faster.

Does Defy Mortgage offer home-loan solutions for people with non-traditional financial backgrounds?

Yes. We offer a variety of solutions for borrowers with non-traditional financial backgrounds, including:

- Bank-statement loans: For borrowers whose tax returns and W-2s may not reflect true cash flow

- Asset depletion loans: Qualify based on the value of your liquid and near-liquid assets rather than traditional income.

- Foreign national programs: Allow non-US residents without a US credit score or Social Security Number to access financing.

DSCR loans: Let you qualify based on property income rather than personal W2 income.

About the Author: Meet Todd Orlando, co-founder and CEO of Defy Mortgage and Defy TPO. With over 20 years of experience in banking and financial services at institutions like First Republic and Morgan Stanley, Todd has dedicated his career to broadening access to lending and revolutionizing the mortgage industry, particularly in the non-QM space.

In 2022, Todd launched Defy Mortgage to provide real estate investors, entrepreneurs, and self-employed individuals with a secure, streamlined, and personalized lending experience tailored to meet their specific needs. He knows firsthand how access to the right mortgage can make or break a project and how today’s borrowers need flexible financial partners and creative lending options designed for their unique needs and lifestyles. Traditional banks are rigid, and their one-size-fits-all approach is outdated. That’s why he created Defy Mortgage — to stay ahead of the curve, set new standards in lending, and deliver personalized, non-traditional solutions for those looking to purchase or refinance.

For the third year running, Todd has been recognized by Inman News for excellence in the mortgage and lending industry, landing on their prestigious Best of Finance list for 2025. He was also honored as a mortgage finance leader in 2023 and 2024 for the same award. His visionary leadership has earned him endorsements from esteemed former colleagues at prestigious institutions across the financial services spectrum.

Beyond his work in finance, Todd is also a co-founder of two software companies in commercial lending and healthcare tech, an active real estate investor, and a husband and father of three. An industry disruptor, Todd is here to redefine what’s possible in mortgage lending.

Mortgage broker itching to elevate client offerings? Check out our TPO business, Defy TPO: https://defytpo.com/