In the world of real estate, the difference between pending vs contingent may not be readily apparent to inexperienced buyers and sellers. After all, both mean that the sale is on its way to being closed, but not yet, so you can often see the two terms used in overlapping contexts when browsing real estate listings. Their primary distinction lies in what phase of the process the transaction is in prior to closing.

At Defy Mortgage, we specialize in helping various types of borrowers realize their financial goals, from real estate investors, freelancers, business owners, and more to former service members and homeowners who have built up substantial home equity. With competitive rates and fast, reliable pre-approvals, we can provide simplified solutions for even the most complex loan situations.

In this guide, we’ll break down the key differences between pending vs contingent. We’ll highlight the pros and cons of each type of offer and go over the factors that can help you determine which type of offer might be the best fit for your situation.

Let’s begin!

Understanding the Difference Between Pending and Contingent

The distinction between pending vs contingent carries different implications depending on whether you’re a buyer or seller. Both terms mean that the property is already under contract, meaning the seller has accepted the buyer’s offer. However, the key difference lies in the status of the conditions attached to the sale.

What Does Contingent Mean in Real Estate?

A contingent offer is one where closing depends on specific conditions being met. These conditions are known as sale contingencies. They protect both buyers and sellers by ensuring certain milestones are achieved before the deal can be closed and the ownership of the property can be officially transferred to the buyer.

This protection is provided by the earnest money deposit that the buyer is required to put into an escrow account to demonstrate their commitment to the purchase, and the subsequent legal processes both sides can pursue if the contract is breached. If the contingencies outlined in the contract are not met, the buyer can usually back out of the deal and reclaim their earnest money. Common types of contingencies include:

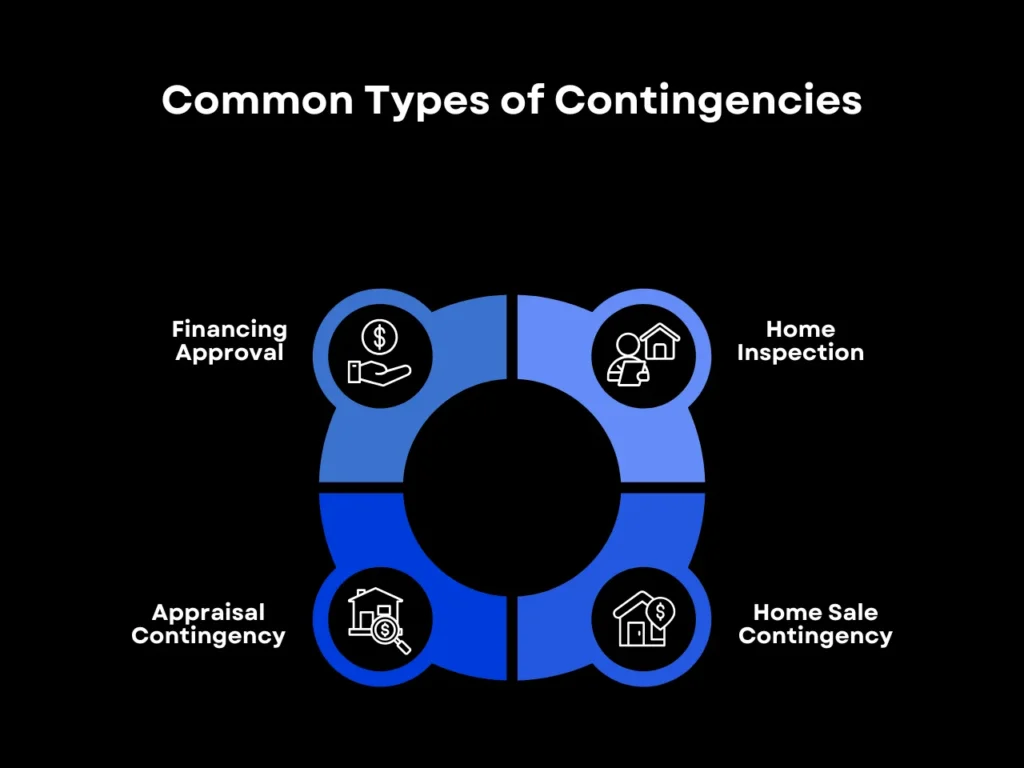

- Financing Approval: This is one of the most common contingencies. In order for the majority of real estate deals to proceed, the buyer must secure financing from a mortgage lender before a set date. If they fail to do so, they can withdraw from the deal without penalty, and the home is put back up on the market.

- Home Inspection: An inspection contingency means that the buyer’s offer is conditional on a satisfactory home inspection. If the inspection reveals significant defects or issues that the seller is unwilling to repair or address, then the buyer can back out of the agreement without losing their earnest money deposit.

- Home Sale Contingency: This makes the purchase of a property dependent on the buyer selling their current home. If the buyer’s home doesn’t sell, they can back out of the deal or renegotiate terms.

- Appraisal Contingency: A common contingency is that the property’s value must meet or exceed the agreed price.

If the buyer fails to meet their obligations or backs out of the deal without valid reasons tied to a contingency, the seller may be entitled to keep the earnest money as compensation for the time the property was off the market. Earnest money ensures that both parties take the contract seriously while providing a safety net for either side if the deal falls through for valid reasons.

Backup Offers

To avoid the lengthy process of finding another buyer in case the deal falls through, sellers may choose to keep showing the home to prospective buyers while the property is under contract. Sellers can then receive backup offers that they can accept if the original agreement is broken or if the buyer withdraws. However, please note that this option can be prohibited by the terms of the agreement.

What Does Pending Mean in Real Estate?

In real estate, if a home is marked as “pending,” that means all contingencies have been met and the deal is moving towards closing but has not yet closed. If an offer is made without contingencies, it goes straight to pending.

A pending offer has less uncertainty of closing compared to a contingent offer. For buyers, this means limited opportunity to negotiate further, and both parties are focused on completing the sale.

Can Buyers Still Make an Offer on a Pending Property?

While rare, buyers can sometimes still make an offer on a house that is already pending or simply let the listing agent know that there is an interested party should the sale fall through. There is a slight chance that something goes wrong with the current transaction which leads to the agreement falling through, and the home could be put back up on the market.

Prospective buyers can make either a contingent or contingent-free backup offer, but those with fewer or no contingencies will be much more attractive to the sellers.

Key Differences Between Pending and Contingent

| Factor | Contingent | Pending |

| Flexibility | Allows renegotiation if contingencies fail | Little to no room for renegotiation |

| Risk | Higher risk of deal falling through for the seller | Lower risk as there’s no contingencies or contingencies are resolved |

| Timeline | May extend the process | Typically short and predictable |

| Buyer Opportunities | Allows backup offers | Rarely open to new offers |

This table underscores the key differences between pending and contingent properties and what it means for you.

Pros and Cons of Pending and Contingent Offers

As a buyer, you have a choice between putting forward a contingent or a non-contingent offer on the property. Similarly, as a seller, you can choose to go through with a contingent offer or a non-contingent offer. Here are the pros and cons of each choice:

For Buyers

Contingent offers provide protections mainly for the buyer. An offer can have multiple contingencies. For example, it is common for an offer to have both an inspection contingency and a mortgage contingency. If the home inspection report comes back with a long list of repairs, the buyer can request the seller to make repairs, negotiate the offer, or back out of the deal. Similarly, if the buyer is not able to secure financing from a mortgage lender before a set date, the buyer could also back out of the transaction.

While contingencies offer protection, a home may be getting multiple offers in a competitive seller’s market and buyers with contingent offers may find that their offers aren’t as competitive and therefore aren’t being accepted by sellers. Sellers often prefer offers with as few contingencies as possible as that usually signifies a clearer and quicker path to closing. This means contingent offers may need to compensate in other ways, such as increasing the purchase price.

If a buyer chooses to submit an offer with no contingencies, this could make their offer a lot more attractive to the seller as there are fewer barriers to closing. The buyer could offer a slightly lower purchase price and still be able to outcompete other offers that may be contingent.

| Type | Pros | Cons |

| Contingent | Buyers are protected and are able to back out of the deal if contingencies are not met. | Deal may fall through if contingencies are unmet. Other buyers may submit a better offer and yours is not accepted. |

| Pending | Fewer obstacles to close and higher likelihood of a smooth transaction. | Limited room for renegotiation or additional contingencies. Often indicates it was competitive. |

For Sellers

Most offers that sellers receive will be contingent ones. Depending on how many offers the seller receives and what each offer looks like, the seller must evaluate which offer they want to move forward with. Each seller will have their own preferences. Generally speaking, sellers prefer offers that have as few contingencies as possible as this typically indicates a smoother and quicker close process as well as a higher likelihood of the transaction going through. Contingent offers with a preapproval letter from a mortgage lender could indicate that the buyer is more serious as they have gone through the initial steps of exploring their financing options. Similarly, a buyer typically pays for a home inspection which could indicate that they are diligent and committed to the transaction.

| Type | Pros | Cons |

| Contingent | Visibility into buyer’s circumstances and financial readiness. | Longer timelines with uncertainty about meeting conditions. Increased risk of the deal falling through. |

| Pending | Indicates strong buyer commitment with contingencies resolved. Allows focus on closing the sale without handling additional offers. | Limits the ability to entertain backup offers. Some risk still remains until the final closure. |

How to Decide Which Offer Is Best for You

Pending vs Contingent Offers: Key Considerations for Buyers

For buyers, deciding between making a contingent or pending offer involves assessing factors like:

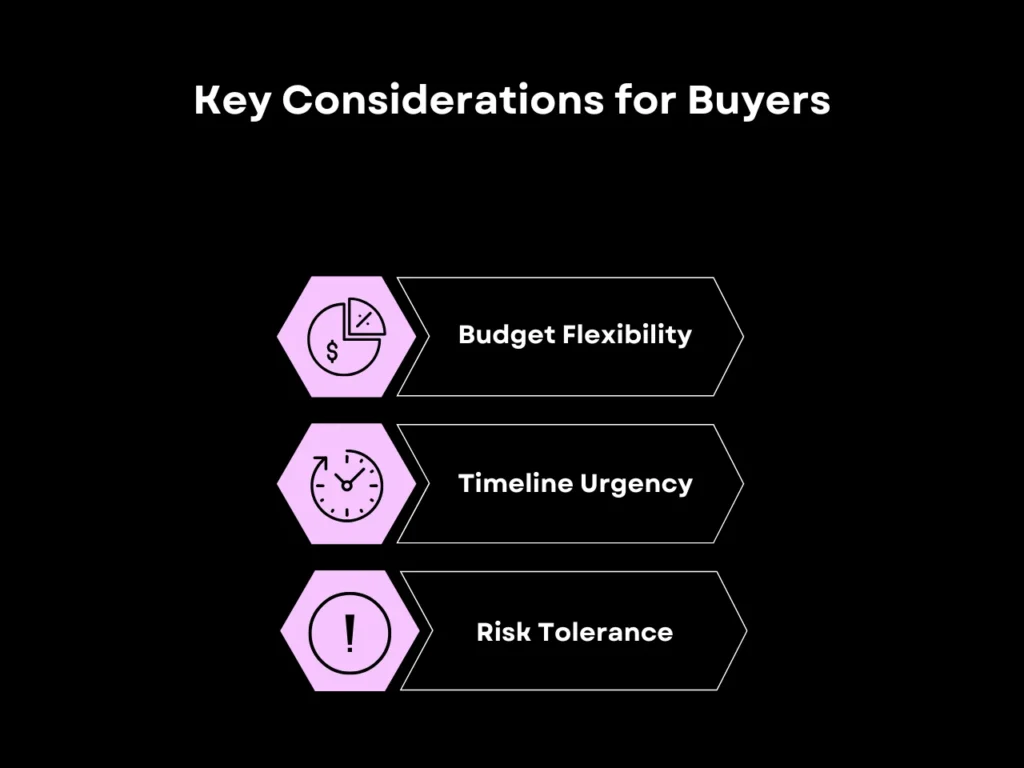

- Budget Flexibility: Consider whether you can meet potential costs for contingencies. While inspection repairs and appraisal adjustments often serve to protect buyers, sellers may impose additional terms—such as repair caps or as-is agreements—to ensure the deal remains viable. This means that the buyer will then have to shoulder the cost of future repairs or renovations. Buyers must budget for these potential costs before making a contingent offer.

- Timeline Urgency: Are you prepared for possible delays with contingent offers? Satisfying the many conditions of a contingent offer can take an extended amount of time, and oftentimes the delays are out of your control.

- Risk Tolerance: How comfortable are you with the deal falling through? With a contingent offer, if the contingencies aren’t met or if the buyer and seller aren’t able to come to an agreement following negotiations, the deal could fall through. The seller would need to find another buyer and the buyer will need to find another home to not only make an offer on but also have your offer accepted.

To improve competitiveness, consider strengthening your offer by reducing contingencies, if you’re comfortable and able to, or providing a larger earnest money deposit.

Pending vs Contingent Offers: Key Considerations for Sellers

For sellers, the choice between contingent and pending often hinges on:

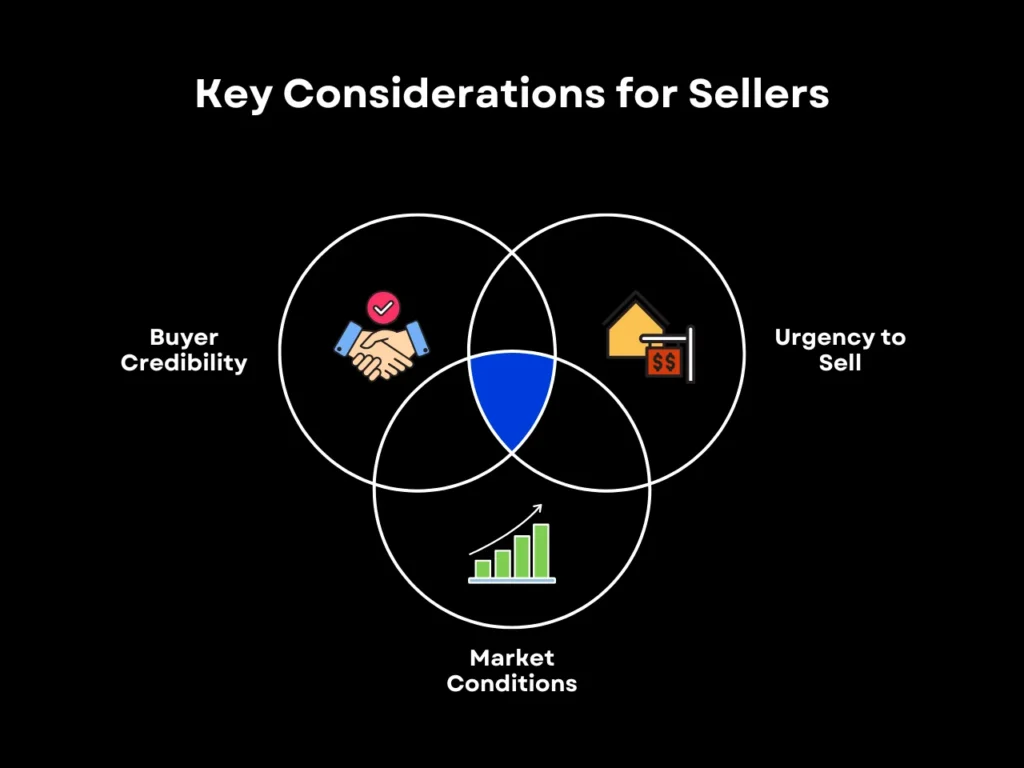

- Buyer Credibility: Is the buyer financially stable and likely to meet contingencies? A credible buyer increases the likelihood of successfully navigating a contingent offer. Conversely, if their financial stability or commitment is uncertain, an offer from a more reliable buyer with fewer contingencies may be the safer choice.

- Urgency to Sell: Do you have time to entertain contingencies, or is a quick closure preferable? If you need to sell immediately, it may be better to favor non-contingent offers that go straight to pending. However, non-contingent offers may be at a lower price as the buyer is aware their offer with no contingencies is more attractive and is using it to negotiate.

- Market Conditions: A hot market may allow you to impose stricter terms on the buyer, and in a seller’s market, buyers are more likely to agree to these terms. Cool markets, however, favor the buyer, which would necessitate flexibility on the seller’s part.

Accepting backup offers, if the contract allows, can safeguard your interests while ensuring a smooth transaction.

Pending vs Contingent FAQ

What happens if contingencies aren’t met in a contingent offer?

If contingencies aren’t met, the buyer can withdraw from the contract without penalties, or the seller may renegotiate terms.

Can a seller accept another offer if a sale is pending?

Typically, no. Pending status indicates a binding agreement, but backup offers may be tentatively accepted as a safeguard, depending on the language in the contract. Backup offers can usually only be considered if the pending sale agreement breaks down for whatever reason.

Are pending sales more likely to close than contingent sales?

Yes, pending sales are more likely to close because they are closer to being finalized. However, even after a sale is marked as pending, many reasons can still lead to the home being put back on the market. Interested buyers can still make backup offers on a pending property and become next in line if the original deal falls through.

How long do properties typically stay in contingent or pending status?

Contingent status can last anywhere from a few weeks to up to 60 days, depending on how quickly both sides of the agreement can satisfy the contingencies. Without contingencies, pending homes typically close within 60 days.

Can a buyer back out of a pending or contingent deal?

Buyers can legally back out of a contingent deal without incurring penalties if contingencies aren’t met, even after signing the contract. A buyer typically cannot back out of the deal if the contingencies have been resolved and it’s in pending status. Without a valid reason, backing out would be a breach of contract and can result in lost funds and legal action taken against the buyer.

Key Takeaway

Understanding the difference between pending vs contingent offers can help prepare you for your home buying or selling experience. For buyers, contingent offers can give more protection. However, offers with no contingencies are often viewed as more favorable to sellers as they increase the likelihood of being able to close.

Buyers should consider their financial and personal situations when crafting their offer and make an attractive offer that also protects them. On the other hand, sellers should choose if they value a quicker closing timeline or a higher offer, before selecting the best offer available.

Ready to learn more about your real estate options? Get started with Defy today and let our mortgage experts help you make informed financial decisions. Our offerings range from traditional loan products like FHA loans to non-QM mortgages such as DSCR loans and jumbo loans. All of these are fully customizable to fit your unique financial needs.