With interest rates on the rise, borrowing behavior is shifting. In this article, we’ll be looking at how rising rates impact home equity loans and cash-out refinancing.

Homeowners are increasingly wary of refinancing their mortgages for three primary reasons:

1) They would sacrifice their historically low interest rates.

2) They would have to pay closing costs again.

3) They’d end up with a higher monthly payment.

Instead, many are turning to home equity lines of credit (HELOCs) and home equity loans, which allow them to tap into their home’s equity without altering their primary mortgage terms.

However, with interest rates likely to come down over the coming few years, more and more homeowners might find it to be a wise decision to do a cash-out refinance instead (particularly those with lower credit scores).

This article will explore the choices homeowners are making in response to the high-rate environment. If you’re wondering, “Should I take out a HELOC, home equity loan, or do a cash-out refinance?” this article can provide some much-needed guidance.

The Impact of Higher Interest Rates on Home Equity Loans

It seems that home prices are hitting all-time-highs every month or so.

To many, this would indicate that Americans have a lot of home equity they aren’t tapping into – and data from the Federal Reserve seems to bear this out. Homeowners have more equity today than they have at any point in the past fifty years.

In fact, Pew Research Center has gathered that 45% of Americans’ net worth is tied up in their primary residence.

While many people are millionaires on paper, since there isn’t much that they can do with that money, they certainly don’t feel like it.

Homeowners are afraid to tap into this home equity for the reasons cited above: they don’t want to spend money originating another loan just to end up with a higher monthly burden. Even if you have $200,000 in home equity, it doesn’t mean much if refinancing your mortgage would make it impossible for you to afford the monthly payment on the home that you’re currently living in.

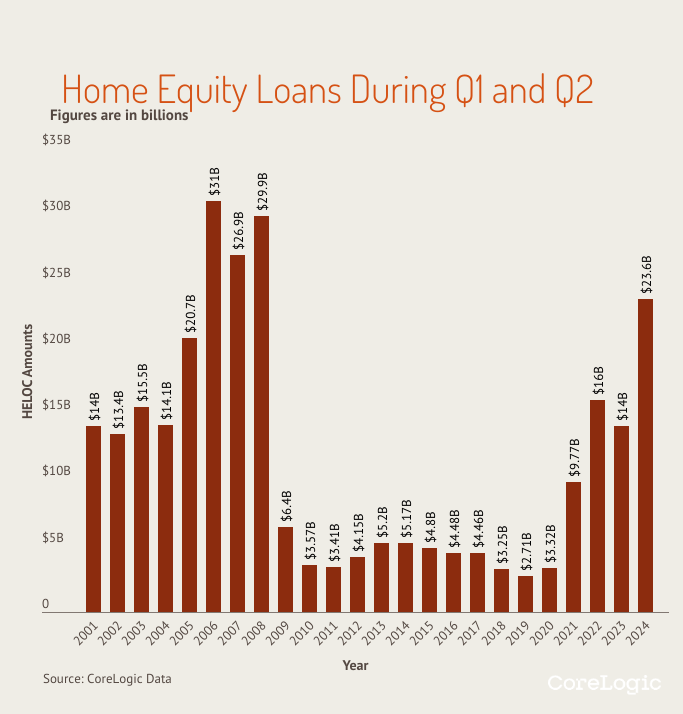

So, home equity loans are an increasingly desirable option to leverage their assets for projects, debt consolidation, or investments, which is why – by and large – home equity loan activity is up:

How Do Home Equity Loans and HELOCs Work?

How Home Equity Loans Work

A home equity loan is a straightforward borrowing option where the lender provides a single lump sum based on the equity in your home — typically up to 85% of the equity you’ve built.

This loan comes with a fixed interest rate and a set repayment period, often ranging from 5 to 30 years. Since the rate is fixed, the monthly payment remains the same over the life of the loan, making it a predictable choice that’s easier to budget for.

Home equity loans are often used for significant one-time expenses, such as major renovations, debt consolidation, or education costs, since you receive the entire amount upfront. However, it’s important to remember that because the loan is secured by your home, falling behind on payments could lead to foreclosure. It usually sits in the second lien position, so you get to keep your original mortgage.

How HELOCs Work

A HELOC, on the other hand, functions more like a revolving line of credit, similar to a credit card. Instead of receiving a fixed amount, the lender approves a credit limit based on your home’s equity, giving you the flexibility to draw from it as needed. This flexibility is especially useful for ongoing projects or expenses, such as repairs or medical bills, where costs may not be as predictable. HELOCs often have a variable interest rate, so monthly payments can fluctuate, although some lenders may offer fixed-rate options for portions of the balance.

The structure of a HELOC includes a “draw period” (often lasting 5-10 years) when you can access funds and typically only need to pay interest on what you borrow. After the draw period, the HELOC enters a repayment phase, usually lasting 10-20 years, where you must pay back both the principal and interest. This setup allows for short-term borrowing and repayment flexibility, but because payments can vary with interest rate changes, it may be less predictable than a home equity loan.

Shifting Borrowing Trends: Homeowners Are Staying Put

The sustained rise in interest rates has dramatically impacted housing market mobility. For homeowners with mortgages locked in at historically low rates — some as low as 2-3% — the idea of taking on a new loan at today’s elevated rates, which may exceed 7%, is a financial burden most are unwilling to consider.

This creates what many experts call the “lock-in effect,” where homeowners feel compelled to stay put rather than sell their homes and face new financing terms.

And, while some borrowers can opt for HELOCs or home equity loans to tap into that equity, other borrowers face difficulties that prevent them from doing so, leaving them with few other options besides a cash-out refinance.

Cash-Out Refinancing: The Best Option for Those With Low Credit

For homeowners with credit scores below 680, qualifying for a traditional HELOC or home equity loan can be challenging. Lenders typically offer less favorable terms or require higher interest rates for borrowers with subprime credit. As a result, cash-out refinancing often becomes a more viable alternative – particularly as the Fed prepares to lower interest rates.

Cash-out refinancing provides a path for homeowners with lower credit scores to access funds by leveraging the equity they’ve built in their homes.

This option allows borrowers to consolidate debt, cover emergency expenses, or fund home improvements without needing additional qualifications for new loan products.

Understanding Cash-Out Refinancing in a High-Rate Environment

Cash-out refinancing involves replacing an existing mortgage with a new, larger loan, allowing homeowners to pocket the difference in cash. Although this option has historically been popular, current high rates make it less attractive. Still, for some, it remains the best option for securing large amounts of cash.

Pros and Cons in the Current Market

For homeowners with significant equity but limited cash reserves, cash-out refinancing can provide essential funds, even if it means accepting a higher interest rate on the new loan. However, the new loan will come with potentially steep interest charges and reset the mortgage term, leading to a longer repayment period.

For instance, a homeowner with a $200,000 mortgage at 3% might refinance into a $250,000 loan at 6%, increasing both their debt and their monthly payments. While this can provide cash for urgent needs, it often results in higher costs over time.

However, within the next year, a borrower with $150,000 mortgage at 4.5% might find it to be a wise decision to do a cash-out refinance on their home to a new 5.5% rate in order to pay for renovations or other major expenses.

Long-Term Implications of Tapping Home Equity During High-Rate Periods

While using home equity through HELOCs or loans can provide critical access to cash, doing so during a high-interest rate period has potential long-term repercussions.

Rising rates can limit future refinancing options, locking homeowners into high-rate debt that may restrict their financial flexibility.

With a cash-out refinance, homeowners don’t face that same issue. The interest rate is often locked in for the entire 30-year term.

The Rise in Demand for Home Equity Loans in 2024

The demand for home equity lending is at the highest level since 2008 according to CoreLogic’s latest report on home equity loans (see the image above.)

Recent years have seen homeowners increasingly turn to home equity products as a financial solution amid challenging market conditions. With property values remaining high and mortgage rates elevated, many are leveraging their accumulated home equity to fund essential expenses, including home renovations and debt consolidation.

The sharp rise in interest rates has made traditional refinancing a bit less attractive compared to the record-low rates of 2021, leading homeowners to explore alternative borrowing options. But this doesn’t mean that people aren’t refinancing.

As a result, HELOCs and home equity loans have emerged as popular alternatives to cash-out refinancing. This trend is particularly notable among homeowners who secured favorable mortgage rates in previous years and wish to maintain those terms while still accessing their property’s equity. The substantial build-up of home equity during recent market appreciation has provided many homeowners with this financial flexibility.

Top 5 Metro Markets for Home Equity Loans in 2024

Home equity loan activity grew significantly across major U.S. cities in early 2024 – primarily metro markets in California. In the second quarter of 2024, the average California homeowner gained approximately $55,000 in equity during the past year. Among the top 15 metropolitan areas, Los Angeles led with $1.88 billion in home equity loans, showing a dramatic six-fold increase from 2023.

Other California cities also saw substantial home equity loan volume, with Anaheim reaching $1.02 billion and San Diego following at $967 million. Cities that experienced the largest home price increases in recent years typically saw the biggest jumps in home equity loan activity – reflecting a growing trend of homeowners accessing their property’s value through these loans.

- Los Angeles – Long Beach, CA

- Santa Ana – Irvine, CA

- San Diego, CA

- Riverside – San Bernadino, CA

- Las Vegas, NV

The Importance of Financial Planning

Careful financial planning is crucial for homeowners weighing the pros and cons of tapping into home equity, especially during periods of high interest rates. Before making decisions, it’s important to evaluate both immediate financial needs and long-term objectives, ensuring that tapping home equity aligns with broader financial goals. While we can’t give financial advice, engaging a financial advisor can provide insight into the nuances of high-rate borrowing, such as how it might affect overall liquidity and future debt options.

High-rate environments often place pressure on borrowers to balance liquidity needs with the long-term consequences of diminished equity. By thoroughly assessing the implications of a home equity loan or line of credit, homeowners can make informed decisions that not only support immediate goals but also safeguard their financial future.

Borrowers should consider factors like potential interest rate shifts, future property value trends, and their overall debt tolerance when assessing the impact of home equity borrowing.

Ultimately, homeowners who approach equity borrowing with a strategic mindset — focused on preserving both liquidity and future flexibility — are more likely to achieve financial resilience in an unpredictable rate environment.

Conclusion

In a high-interest-rate environment, homeowners must carefully weigh the decision to tap into home equity, keeping both short-term needs and long-term financial goals in mind. Strategic planning, which considers both the costs of borrowing and the potential impact on long-term equity, is essential to successfully navigating periods of elevated borrowing costs.