Airbnb has turned average people into millionaires – perhaps more than any other side-gig platform. Today, Airbnb is so popular that it’s active in 98% of the world. There are over 8 million active listings worldwide, an insane number for a platform that’s less than 20 years old.

If you’re here, you probably already know how lucrative Airbnb can be, particularly in touristy areas: Hosts earned more than $57 billion in 2023 alone. However, for most borrowers, the problem is financing. How do you get into the Airbnb game with interest rates so high?

The answer: Airbnb loans.

An Airbnb loan is a specialized mortgage designed for short-term rental properties listed on Airbnb or VRBO. Unlike traditional home loans, these financing options cater to investors looking to maximize cash flow from short-term rentals.

Defy Mortgage provides customized, non-traditional lending solutions that allow investors to purchase, refinance, or cash out equity on Airbnb properties. Instead of relying solely on conventional underwriting metrics like W-2 income, Defy evaluates an investor’s full financial picture — making it easier for real estate entrepreneurs to secure funding.

What is an Airbnb Loan?

An Airbnb loan is a financing option designed specifically for investors who plan to rent out properties on Airbnb or similar platforms. Unlike traditional mortgage loans that assess W-2 income and tax returns, Airbnb loans can sometimes work like DSCR loans, which focus on the property’s rental income potential and an investor’s overall financial health.

Benefits of Investing in Airbnb

The short-term rental market continues to thrive, presenting investors with high cash flow potential and long-term appreciation opportunities. By 2026, analysts expect Airbnb to grow an additional 32%. The fundamentals are strong: more people are traveling today than at any other time in history – and they all need a place to stay.

Why Airbnb is a Smart Investment

- Massive demand – With Airbnb active in 98% of the world, there’s a huge pool of travelers looking for unique stays.

- Higher cash flow potential – Short-term rentals can generate 2-3x the income of long-term rentals.

- Scalability – Once you own one successful Airbnb, reinvesting profits into additional properties is easier.

- Diverse financing options – With lenders like Defy Mortgage, investors can secure creative financing without the strict requirements of traditional banks.

The best benefit, though, is the ability to generate cash flow while investing in a hard asset (real estate) that’s expected to grow alongside inflation. Airbnbs are a lot like rental properties on steroids. They require a little bit more elbow grease than the typical rental property, but the upside can be enormous.

Understanding Airbnb Financing Options

Defy Mortgage offers a range of financing options to help investors scale their short-term rental portfolio:

1. DSCR Loans for Airbnb

Best for: Investors who want to qualify based on rental income, not personal income.

- Loan approval is based on the property’s projected rental income rather than the investor’s W-2 income.

- No tax returns required — just a strong Debt Service Coverage Ratio (DSCR).

- Ideal for investors with multiple properties looking to scale.

2. Asset-Based Loans or Asset Financing

Best for: Investors with significant assets but non-traditional income sources & retirees who are looking to do Airbnb on the side.

- Approval is based on bank statements, investments, and real estate holdings instead of tax returns.

- Perfect for high-net-worth investors, self-employed individuals, and retirees.

- Note that not all lenders offer asset-based loans and asset depletion loans for investment properties so be sure to ask your lender of choice if they other one or both.

3. Fix-and-Flip Loans for Airbnb Investments

Best for: Fix-and-flip investors or those purchasing distressed properties for short-term rentals.

- Short-term, high-interest financing for quick acquisitions & renovations.

- Great for investors looking to buy off-market deals or properties needing rehab.

4. Cash-Out Refinance for Airbnb Properties

Best for: Existing Airbnb owners looking to unlock equity.

- Convert built-up home value into cash for property improvements, expansions, or additional purchases.

- Keep growing your Airbnb portfolio without needing new capital.

How to Qualify for an Airbnb Loan

Securing financing for an Airbnb investment property requires a lender that understands short-term rentals. While the exact process can vary by lender, here are the key factors most lenders consider:

- Credit Score Requirements – A minimum credit score of 620+ is typically required, though some lenders may have higher or lower thresholds.

- Property Analysis – Lenders often focus on the property’s ability to generate rental income rather than the borrower’s personal income.

- Loan-to-Value (LTV) Ratios – Most lenders offer 75-80% financing, meaning you’ll need 20-25% down.

- Proof of Rental Income (for DSCR Loans) – If using a Debt Service Coverage Ratio (DSCR) loan, the property’s projected or actual rental income must be documented through Airbnb income statements or market rent analysis.

- Fast Approval Process – Many lenders offer quick pre-approvals, allowing investors to move fast in competitive markets.

The Airbnb Loan Process

While the process can differ from lender to lender, it generally follows these steps:

- Apply Online or Get Pre-Approved – Submit an application and receive a custom quote.

- Receive a Loan Offer – Get a term sheet tailored to your investment strategy and financial profile.

- Submit Required Documents – Provide rental income statements, property details, and credit information for lender review.

- Loan Underwriting & Approval – The lender will assess your property and financials, streamlining the approval process where possible.

- Close & Fund – Once approved, receive funds and begin earning income from your Airbnb rental.

Since different lenders may have unique requirements and timelines, it’s always best to compare options and choose a lender that aligns with your investment goals.

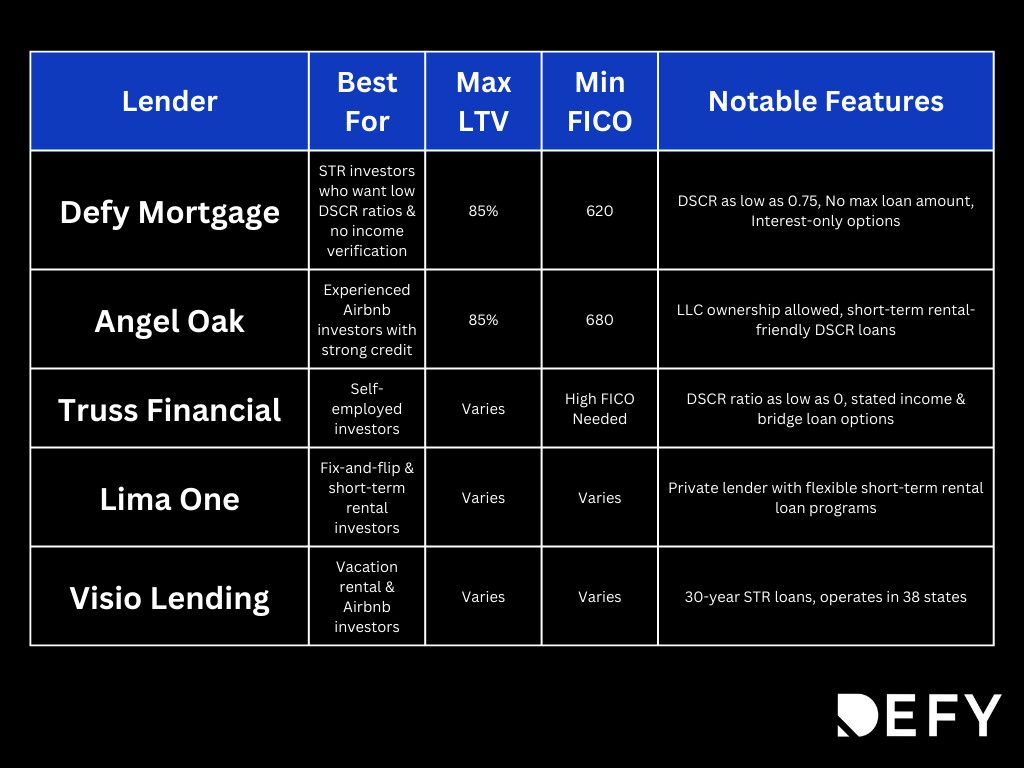

The Top 5 Airbnb Lenders in 2025

So, who are the best lenders for Airbnb loans in 2025? The best lenders for Airbnb loans are also some of the best lenders for DSCR loans – the two have a lot of overlap:

1. Angel Oak Mortgage Solutions

Angel Oak Mortgage Solutions provides flexible lending solutions for Airbnb investors who need non-traditional financing. Their Debt Service Coverage Ratio (DSCR) loans make it easy to qualify based on projected Airbnb income rather than personal W-2 earnings.

Angel Oak’s DSCR loan options include the following terms:

- Minimum FICO of 680

- Max LTV of 85%

- Minimum loan value of $100,000

- Maximum loan value of $3m

- Properties can be owned by an LLC

- Vacant properties allowed

- Short-term rentals allowed

They also offer additional non-QM loans, including self-employed loans, asset qualifier, closed-end second mortgages, and jumbo home loans.

2. Defy Mortgage

Defy Mortgage is built for real estate entrepreneurs who want to scale their Airbnb portfolio without jumping through traditional lending hoops. Their Airbnb loan programs provide creative, non-traditional solutions, allowing investors to qualify based on rental income rather than tax returns or W-2s.

- Up to 85% LTV (about 5% higher than the industry average)

- No Tax Returns or W2s needed

- Minimum FICO of 620

- Minimum of 3 Months Reserve

- Options for Foreign Nationals looking to purchase an investment property in the US

- Interest Only Option Available

- DSCR Ratio of 0.75 (compared to 1 of many competitors)

- Qualify using exclusively rental income

- No application fees or obligation EVER

- Great for STR investors

- Options for seasoned or novice real estate investors

With Defy Mortgage, your Airbnb rental income does the talking — no need for outdated underwriting rules that don’t apply to modern real estate investors.

3. Truss Financial Group

Truss Financial Group has been financing Airbnb and short-term rental properties since 2006. They offer flexible lending solutions, particularly for self-employed investors and business owners.

Truss Financial’s Benefits:

✔ DSCR Ratio as Low as 0.0 (for high-FICO borrowers with 25% equity)

✔ No Tax Returns or Personal Income Verification Required

✔ Flexible Loan Options for STR Investors

Truss specializes in lending to self-employed investors who may not qualify for traditional loans. They offer stated income loans, bank statement mortgages, jumbo Airbnb loans, and bridge loans — perfect for short-term rental investors looking to expand quickly.

4. Lima One Capital

Lima One is a private lending company that provides funding for rental properties (like for Airbnbs), new construction builds, fix-and-flip projects, and multifamily investments all across the United States.

Headed by CEO Jeff Tennyson, they have decades of experience in the mortgage industry with a primary focus on non owner-occupied properties.

5. Visio Lending

Visio Lending is one of the leading lenders for vacation rental loans, with nearly $3 billion in loan originations since 2012. Their primary focus is on short-term rental financing, with about $821M specifically for Airbnb-style properties.

Visio’s DSCR Loan Terms for Airbnb Investors:

- No Personal Debt-to-Income (DTI) Requirement

- No Tax Returns Required

- Full 30-Year Loan Terms – No Balloon Payments

- 5/4/3/2/1 Prepayment Penalty Structure (5% penalty in Year 1, decreasing annually)

Visio operates in 38 states and has a proven track record in vacation rental financing. If you’re looking for a lender that specializes in Airbnb and VRBO properties, they are worth considering.

Which Airbnb Loan Lender is Right For You?

If you’re ready to take the next step in your Airbnb investment journey, choosing the right loan product and lender is critical. Whether you’re looking for no-income verification loans, low DSCR requirements, or maximized leverage, these lenders offer some of the best Airbnb financing solutions available today.

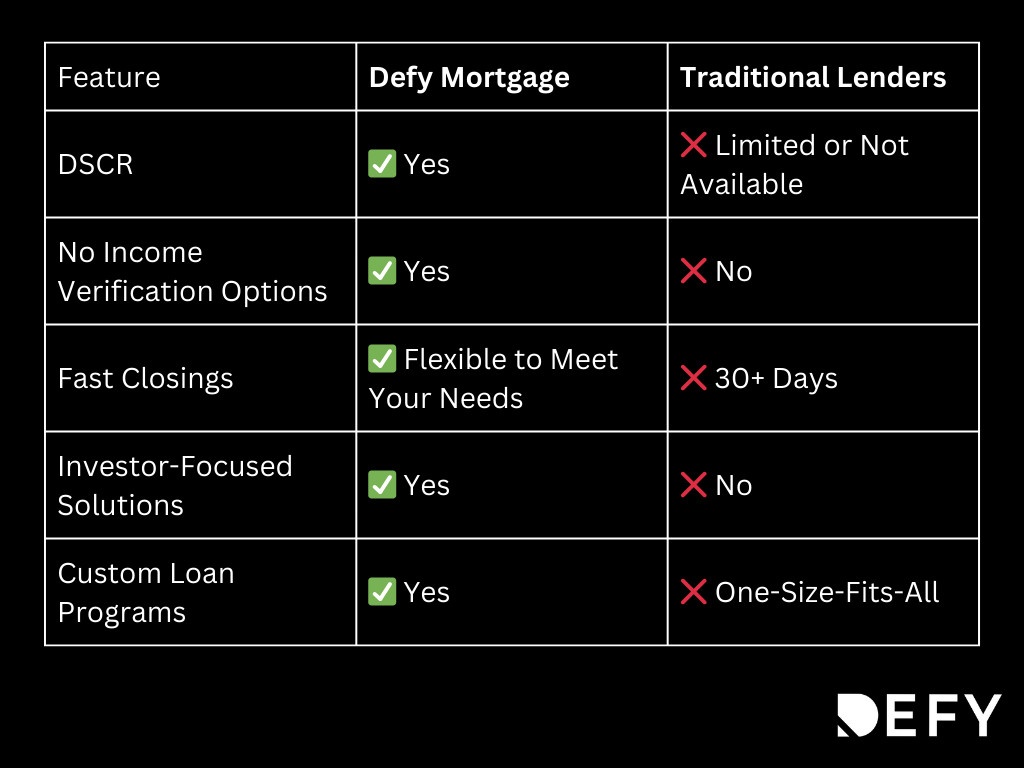

Why Defy Mortgage Stands Out

While other lenders offer short-term rental financing, Defy Mortgage is uniquely positioned as a non-traditional, investor-first lender.Investor-Focused Lending: Designed for Airbnb entrepreneurs & real estate investors.

Flexible Qualification: DSCR loans and bank statement options for those without tax returns.

Fast & Efficient Process: We help you close fast and make the process easy.

Customizable Options: 75+ Non-QM lending solutions to fit your needs

Expert Experience: 4.8 star reviews and 25+ years of experience working with real estate investors looking for airbnb loans.

Frequently Asked Questions: The Ultimate Guide for Securing Your Airbnb Loan

What credit score do I need for an Airbnb loan?

Depends on the lender, however, most programs require a 620+ credit score, but lower scores may be considered with additional assets.

What do you need for an Airbnb loan?

Most lenders require a 620+ credit score, 20-25% down payment, and proof of rental income (Airbnb statements or market projections). Loan approval depends on DSCR qualifications and property details.

How much down payment is needed for a DSCR loan?

This also varies by lender, but typically 20-25%, though some lenders allow as low as 15% and some require as high as 30%+.

Can my Airbnb be my second home?

This is usually only possible with certain loan types. Since a DSCR loan, for example, depends on the amount of income that the property generates, this is not possible for this specific loan type. However, there are many ways a lender can structure an Airbnb loan. If you have a desire for your Airbnb to be your second home, work with a lender with customizable solutions.

Can I qualify based on Airbnb rental income?

Yes! You can get a DSCR loan for an Airbnb. With a DSCR loan, rental income — not personal income — determines eligibility.

What type of insurance should I have for my Airbnb?

Investors should have short-term rental insurance that covers guest liabilities and property damage.

How can I ensure my Airbnb complies with local regulations?

Research local short-term rental laws before purchasing. Some cities have permit requirements or rental restrictions.