The real estate market in Missouri is far less expensive compared to the national average. This is what makes a DSCR loan Missouri particularly advantageous for real estate investors in the state, especially those with irregular or unconventional income streams that might not qualify for traditional loans. With Missouri’s low cost of living, investors can now secure favorable DSCR loan terms—and even handle numerous loans simultaneously—if they choose their investment properties wisely.

At Defy Mortgage, we are deeply familiar with the unique needs of real estate investors who can be best served with DSCR loans, whether it’s in a high-end market like Calfornia or a buyer’s market like Alabama. We have a strong track record of providing stress-free mortgage experiences with DSCR loans, foreign national loans, VA loans, and other non-QM loans.

Applying our extensive experience in the non-QM loan space, we’ve created this essential guide to make it much easier for you to get into DSCR loans in Missouri. We’ll give you the rundown of all you need to know about DSCR loans and how they work. After reading, you’ll learn simple step-by-step instructions on how to apply for your first or subsequent DSCR loans.

Let’s jump right in and please keep in mind that this blog is intended to give an overview of the DSCR loan process as it might apply in Missouri. Processes may vary depending on several factors like the lender, loan option, location and more.

DSCR Loans in Missouri

A DSCR loan Missouri offers a compelling opportunity to maximize profits in the state’s real estate market with low initial investments. Missouri’s real estate market is among the most affordable in the U.S., with an average home value around $260,000, far below the national average of $400,000.

According to the U.S. News & World Report, the state’s cost of living is generally quite low, ranking #15 in this metric, and #10 in fiscal stability. These favorable market and economic conditions enable investors to capitalize on lower entry costs and potentially achieve higher returns. Whether you’re looking for a DSCR loan or securing better financing terms, Missouri’s real estate opens up a wider range of investment opportunities.

What are DSCR Loans?

Debt Service Coverage Ratio (DSCR) loans are a financing option in which the key qualification metric is the property’s income relative to its debt obligations. In other words, lenders look at how much a property makes and how much it costs to run. Once they have that information, they utilize it to determine whether or not the property is making enough income to pay its mortgage loan.

How Does a DSCR Loan Work?

Whether or not DSCR loans get approved and what loan terms are offered are based primarily on the Debt Service Coverage Ratio. This ratio helps lenders evaluate the risk of the loan based on the property’s financial performance rather than the borrower’s personal financial history.

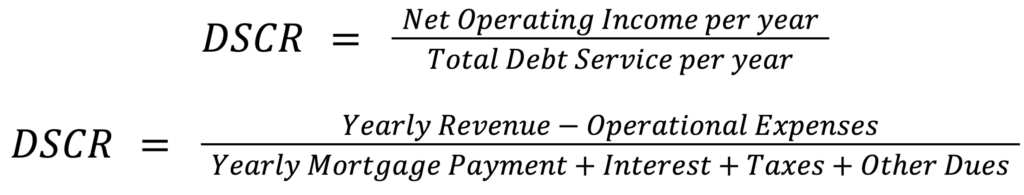

The DSCR is calculated by dividing the property’s net income (total revenue minus operating expenses) by its total debt service. Here is the formula:

DSCR = Net Operating Income per year/Total Debt Service per year

- Net Operating Income (NOI) is the total income generated from a property or business after operating expenses but before taxes and interest.

- Total Debt Service (TDS) is the total amount of debt payments due within a specific period, usually annually. This includes both principal and interest payments.

When applying for a DSCR loan in Missouri, some lenders typically assess the property’s Net Operating Income (NOI) by reviewing lease agreements and rental income statements. They may also conduct property appraisals and assess the property’s market value, occupancy rates, maintenance costs, property management costs, and taxes. This will give a rough estimate of the annual loan payments based on the proposed loan amount, term, and interest rate.

It’s important to note that the loan terms, including the final DSCR loan interest rate, will be determined by how high the DSCR is. When the property costs are low, the loan amount you need to take out is also low. Since the cost of living is low throughout the state, operational expenses are also driven. All in all, Missouri is a great option for securing favorable DSCR loans as long as you pick the right type of property.

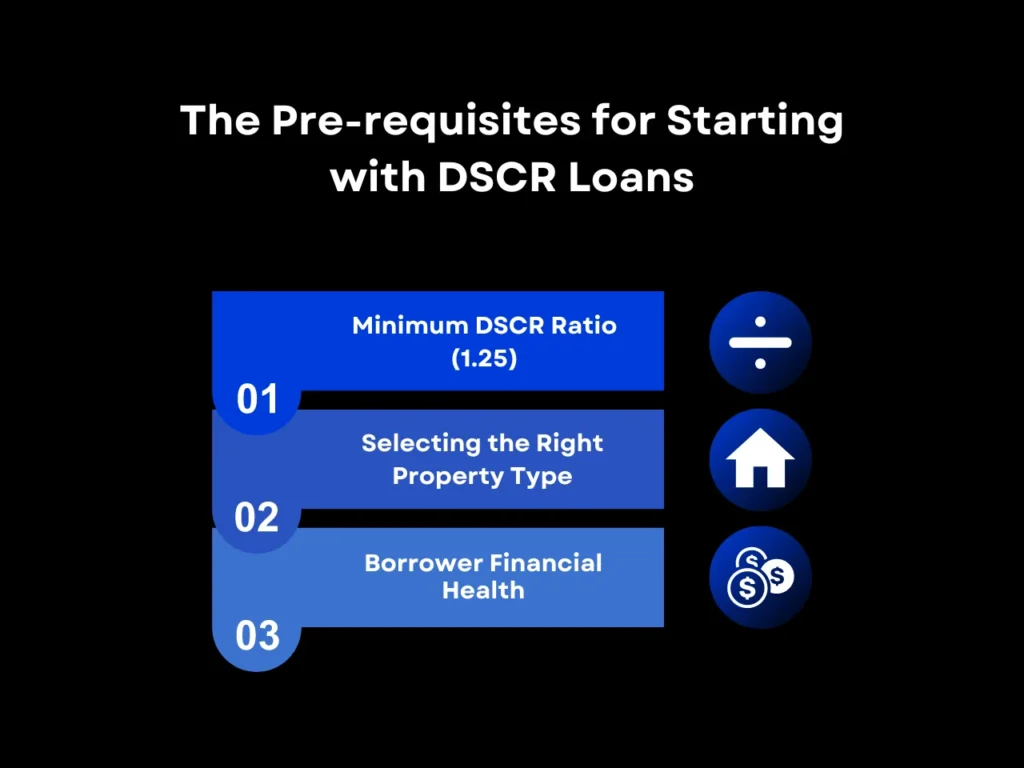

The Pre-Requisites for Starting with DSCR Loans

Before applying for a DSCR loan Missouri, it’s important to understand the prerequisites that will impact your application. Meeting these requirements ensures a smoother application process and increases your chances of approval. The following are the key metrics to consider.

Minimum DSCR Ratio

One of the most critical factors in securing a DSCR loan is the Debt Service Coverage Ratio. Most lenders require a minimum DSCR ratio of 1.25. This means that the property’s net operating income should be at least 1.25 times the total debt service. A higher ratio generally indicates a lower risk and a more favorable loan application.

A DSCR greater than 1 indicates that the borrower generates sufficient income to cover their debt obligations. For example, a DSCR of 1.2 means that the borrower generates 20% more income than needed to meet their debt payments. Conversely, a DSCR less than 1 suggests that the income is insufficient to cover the debt service.

Selecting the Right Property Type

DSCR loans can be used for various types of income-generating properties, including residential properties, commercial properties, and sometimes mixed-use properties. Each real estate property type may have different criteria and expectations, so it’s important to ensure that your property—whether it’s a single-family home, a multi-family unit (up to 4 units), or another type—meets the specific DSCR loan requirements set by the lender.

However, some types of properties tend to be better than others in terms of both feasibility and viability for Missouri DSCR loans. Population density in Missouri is on the lower end compared to many other states in the U.S, which makes the income-generating potential of commercial real estate lower. That means residential real estate may be a better choice over commercial real estate, unless you can find an ideal property to purchase in a densely populated part of the state such as the St. Louis Metropolitan Area.

Borrower Financial Health

While DSCR loans primarily assess the property’s income, lenders still consider the borrower’s overall financial health. These include credit history, financial background, and existing debts. A good credit score and strong financial background can enhance your application, although the primary focus remains on the property’s income performance.

In Missouri, specific state regulations or benefits may further influence the application process. Understanding these local nuances can help you navigate the loan process more effectively and take advantage of any available incentives.

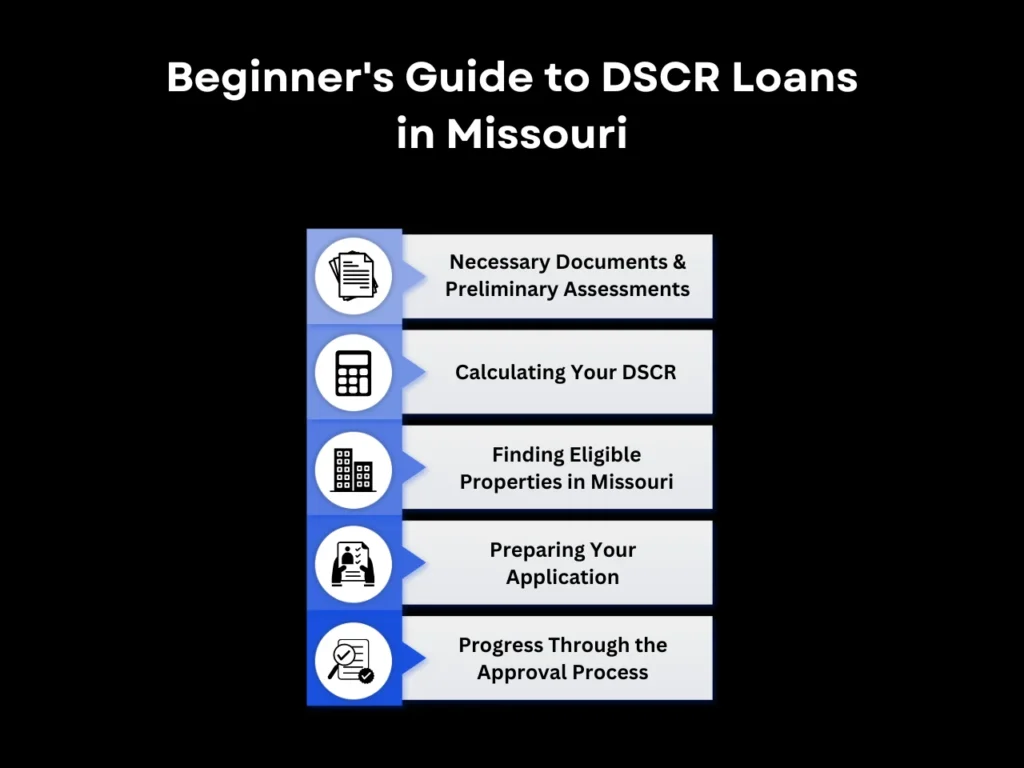

Beginner’s Guide to DSCR Loans in Missouri

For those new to DSCR loans, the application process might seem daunting. But as long as you follow this guide, you should be able to navigate it smoothly from start to finish.

Necessary Documents and Preliminary Assessments

To apply for a DSCR loan program, you will need to gather several documents and complete preliminary assessments, including:

- Proof of Income: This may include rental income statements, lease agreements, and any other sources of income related to the property.

- Property Details: Documentation such as the property appraisal, recent income statements, and current lease agreements are crucial.

- Investment Plans: It can be beneficial to provide a detailed plan outlining how you intend to manage and improve the property. Some lenders may also ask for proof of your track record in real estate management.

Preliminary financial assessments are essential to determine if a DSCR loan is suitable for your situation. This involves evaluating the property’s income potential and ensuring that it meets the minimum DSCR ratio required by lenders, which is typically 1.25. At Defy, however, we allow for a negative DSCR ratio down to .75.

Furthermore, the borrower’s personal financial details, such as credit score, personal assets, and income, may also be examined. Different lenders prefer different minimum credit scores to approve DSCR loans.

At Defy, we require a minimum FICO score of 620. We streamline the application process by not asking for your personal income documentation or tax returns. If you’re foreign nationals who may not have a U.S. credit score or social security number, you’re also welcome to apply for our DSCR loans. Schedule your appointment now to get started, or follow first our beginner’s guide to calculating your DSCR for a clearer roadmap:

Step 1: Calculate Your DSCR

To calculate the DSCR, use the following formula:

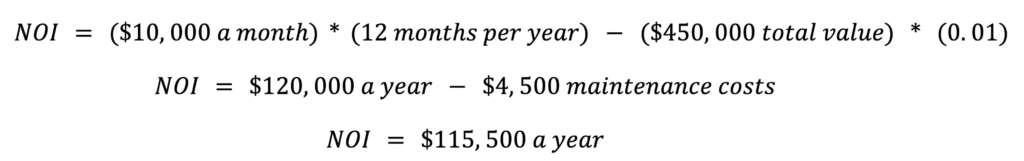

For example, consider a multi-family rental property in Missouri valued at $450,000 that earns $10,000 a month. Since tenants pay for their own utilities, the only operational expenses you’ll have are maintenance costs. Following the 1% rule, the estimated maintenance you’ll spend each year will be 1% of the total value.

In this case, the estimated annual maintenance cost would be:

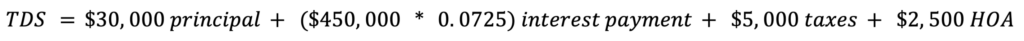

For the Total Debt Service, let’s say you’re to pay the principal amount of $450,000 over 15 years. This means your yearly principal payment would be $30,000. Assuming an annual interest rate of 7.25%, your yearly interest payments would be calculated based on the outstanding balance of the loan. Additionally, factor in annual tax payments of $5,000 and HOA fees of $2,500. Here’s a breakdown:

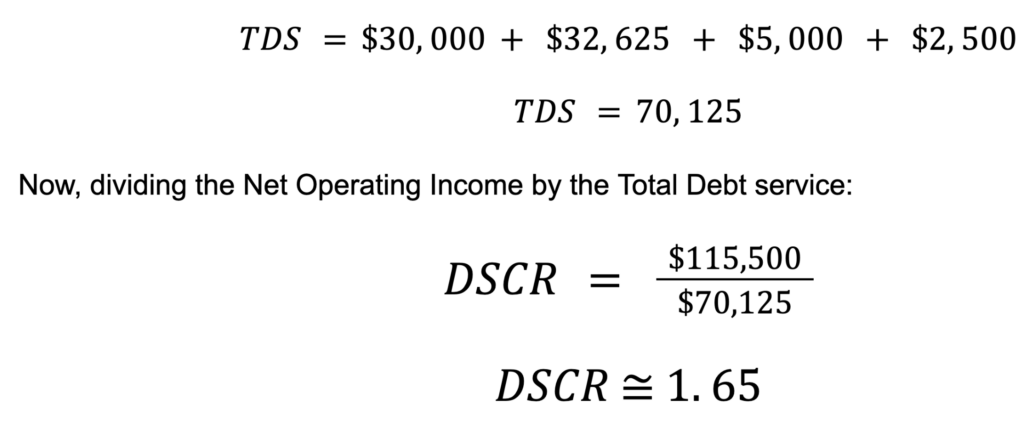

A DSCR of 1.65 means that the property is making 65% more income than it needs to cover its debt payments. Lenders usually look for a DSCR of at least 1.25, making this property very favorable for loan approval and getting good loan terms such as lower interest rates.

Step 2: Find Eligible Properties in Missouri

An essential part of getting approved for a DSCR loan is to choose a property that demonstrably generates stable and predictable rental income. Consider these vital factors to determine the best choice to get a DSCR loan:

- Location: Properties in high-demand areas tend to attract more tenants and offer better rental income potential.

- Condition: Well-maintained properties are more likely to achieve higher rental income and attract reliable tenants.

- Market Trends: Research local market trends to identify areas with strong rental demand and potential for capital appreciation.

Step 3: Prepare Your Application

A strong application is key to securing a DSCR loan with good terms. Make sure the following important documents are complete, accurate, and up-to-date:

- Financial Statements: Ensure that income statements, expense reports, and other financial documents are detailed and accurate. This can also include any personal documents you can submit, such as credit reports and bank statements.

- Property Documentation: Include comprehensive information about the property, including appraisals, current leases, and any improvement plans.

- Investment Plan: It also helps your case to provide a clear and detailed plan of how you intend to manage and optimize the property.

Accuracy and completeness are crucial in the application process to avoid delays and increase the likelihood of approval. Ensure that important documents are in order regardless of whether the lender you’re applying to explicitly asked for them in case they might ask for them later.

Step 4: Proceed With the Approval Process

Once you’ve chosen the most viable property and submitted a strong application, all that’s left to do is to finish the approval process. This typically involves these stages:

- Initial Review: The lender reviews your application and documentation to ensure all requirements are met.

- Property Appraisal: Lenders often conduct an independent appraisal to assess the value and income potential of the property. Borrowers are often charged for fees.

- Income Verification: The lender verifies the property’s income through the statements, leases, and other documentation you’ve submitted. In some cases, some lenders also conduct their own investigations.

- Underwriting: The loan is underwritten to assess risk and determine specific loan terms.

- Final Approval: Once the underwriting is complete, the DSCR lender outlines the finalized loan terms, and if the borrower finds these agreeable, they give the final approval for the loan.

Keep in mind that the entire DSCR loan process can take several weeks depending on the above stages, so staying in close contact with your lender and providing prompt responses to any requests can help expedite approval.

DSCR Loan Missouri FAQs

What Makes a Good DSCR Ratio?

A good DSCR ratio is generally 1.25 or higher. This indicates that the property generates sufficient income to cover its debt obligations with some margin for a safety net. However, some lenders, like Defy, offer DSCR loans for properties with DSCRs as low as 0.75.

Can I Qualify for a DSCR Loan with a Low Credit Score?

While a low credit score might be a concern, DSCR loans primarily focus on the property’s ability to service its debt rather than the borrower’s. Some lenders may still approve loans with lower credit scores if the property’s DSCR is strong. At Defy, we look for a fairly minimum FICO score of 620.

Are There Specific Properties That Do Not Qualify for DSCR Loans in Missouri?

Properties that do not generate enough rental income or have inconsistent income streams may not qualify for DSCR loans. Make sure that the property you’re looking to invest in meets the lender’s specific income criteria and ensure that it is in-fact an investment property. Properties that don’t generate income are not eligible for DSCR loans in Missouri (or DSCR loans in general).

How Long Does the Approval Process Take?

The approval process for a DSCR loan can vary, but it typically takes several weeks. Factors such as the complexity of the application and the lender’s workload can affect the timeframe. Because DSCR loans don’t require tax returns, this often speeds up the approval process.

What Happens if My DSCR Improves After Getting the Loan?

If your DSCR improves, it can enhance your ability to refinance or obtain additional financing in the future. Improved DSCR demonstrates better financial performance and lower risk.

Can DSCR Loans Be Used for Renovations or Only Purchases?

DSCR loans can be used for both property purchases and renovations, provided the property continues to generate rental income that meets the lender’s DSCR requirements.

How Does Rental Income Affect DSCR Loan Eligibility?

Rental income is a critical factor in determining DSCR loan eligibility. Higher and more stable rental income improves the DSCR, making it easier to qualify for the loan.

What Are the Alternatives If I Don’t Qualify for a DSCR Loan?

If you do not qualify for a DSCR loan, consider alternative financing options such as traditional mortgages and hard money loans, or reach out to the best DSCR lenders for personalized assistance. Defying the mortgage game, Defy Mortgage stands out in bringing innovative solutions tailored to your QM and non-QM mortgage needs.

Tips for First-Time Investors Considering DSCR Loans

- Understand the Market: Research the Missouri real estate market to identify lucrative investment opportunities.

- Maintain Accurate Records: Keep detailed records of all property-related income and expenses. Good records can increase the chances of getting approved for a DSCR loan. They can also make it less likely for you to incur extra fees and higher interest rates in case the lender finds a discrepancy between what you’re reporting and the actual state of the property.

- Seek Professional Advice: Consult with real estate experts, accountants, and mortgage brokers who are experienced with DSCR loans, such as Defy Mortgage. Defy’s expertise in real estate can be instrumental in ensuring the success of your investment.

Key Takeaway

With Missouri’s relatively low property prices, more investment property loan options become viable. A DSCR loan Missouri can be the most strategic choice if you have an unconventional income stream or are planning to invest in multiple properties. The state’s market conditions make it much more likely to help you get highly favorable DSCR loan terms, giving you a notable edge over choosing conventional loans.

The success in the real estate investment with DSCR loans hinges on choosing properties with strong rental income potential. Ensure all financial and property documents are accurate and complete for a smooth application process. Choosing the right property type and maintaining good credit can further enhance your chances of loan approval.

Considering DSCR loans for your next investment? Reach out to Defy Mortgage for a seamless, hassle-free experience. Our team of experts is here to assist you every step of the way with our wide range of mortgage solutions tailored to your specific investment needs and goals for 2024 and beyond.