Investing in real estate can be a lucrative venture, but securing the right loan for investment property is essential. With numerous financing options available, choosing the best one depends on your goals, financial standing, and type of investment property.

At Defy Mortgage, we offer 75+ non-traditional lending options tailored to entrepreneurs, freelancers, and real estate investors. From rental property loans like DSCR loans to short-term loans like fix-and-flip loans or construction loans, we can customize the best investment property loan that aligns with your needs.

In this guide, we’ll explore various investment property loan types and highlight their features, benefits, and drawbacks to help you make an informed decision.

Let’s begin!

DSCR Loans (Debt Service Coverage Ratio Loans)

Debt Service Coverage Ratio (DSCR) loans have gained popularity in recent years because they leverage a property’s rental income to cover its debt obligations, rather than relying on the borrower’s personal income.

The interest rates for DSCR mortgage loans may be adjusted based on the property’s DSCR, with a higher ratio often resulting in more favorable terms. These loans can be used to finance a wide variety of rental properties, including single-family homes, multi-family buildings, short-term rentals, as well as commercial and mixed-use real estate.

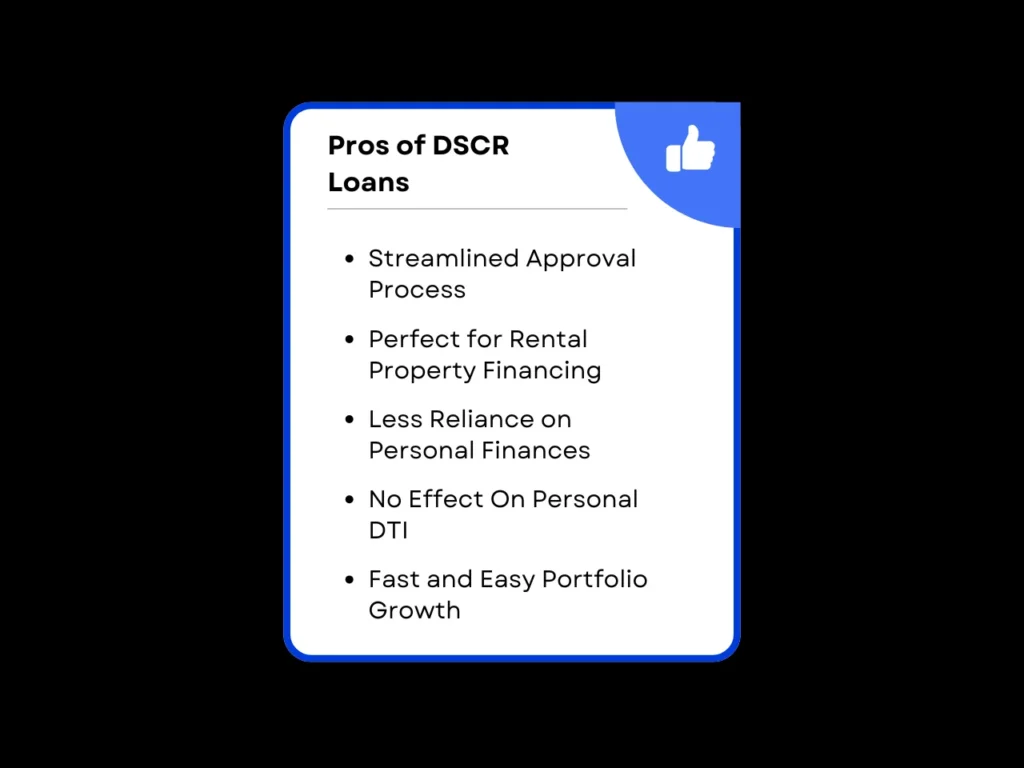

Pros of DSCR Loans:

- Streamlined Approval Process: DSCR loans offer a faster and more straightforward approval process compared to traditional loans, as personal income verification is not required.

- Perfect for Rental Property Financing: These loans are designed specifically for income-producing properties, making them ideal for real estate investors seeking favorable rates on high-DSCR properties to boost their ROI.

- Less Reliance on Personal Finances: Since approval is based on the property’s income rather than the borrower’s credit score or personal financial situation, investors with less-than-ideal credit histories or irregular incomes can still qualify.

- No Effect On Personal DTI: DSCR loans typically do not count towards your personal debt-to-income (DTI) ratio, since they’re based on the cash flow of the property rather than your own. A high personal DTI is not a dealbreaker for DSCR loan eligibility.

- Fast and Easy Portfolio Growth: With fewer restrictions on personal income or assets, DSCR loans allow investors to expand their property investment portfolios easily. As long as lenders approve additional DSCR loans, there is no limit to the number of properties you are allowed to finance.

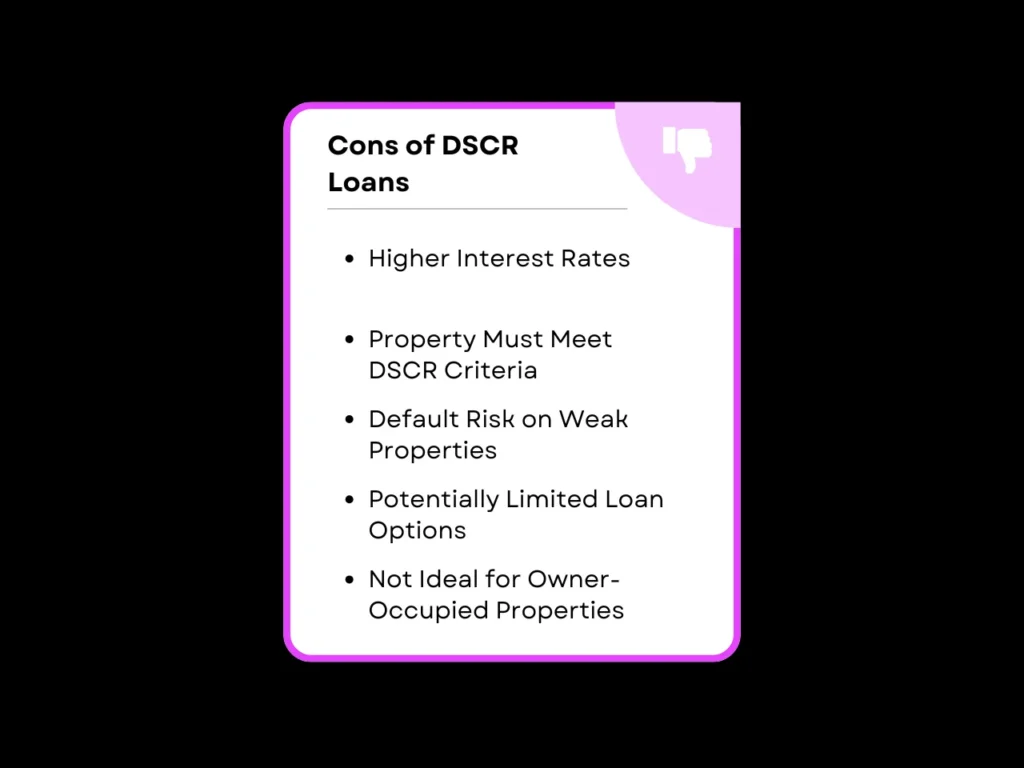

Cons of DSCR Loans:

- Higher Interest Rates: DSCR loans generally have higher interest rates compared to traditional financing, as lenders take on more risk by focusing on property income rather than the borrower’s overall financial profile. However, having a high DSCR can help secure more favorable rates.

- Risk of Default on Underperforming Properties: If the rental income from the property decreases or becomes unstable, the borrower may struggle to meet the debt obligations. This increases the risk of default in markets with fluctuating rental demand.

- Not Ideal for Owner-Occupied Properties: DSCR loans are designed specifically for investment properties and are generally not intended for owner-occupied properties.

DSCR loans are particularly appealing for investors looking to finance income-generating properties but with imperfect financials. While the interest rates can be higher than those of conventional loans, a strong DSCR ratio can help offset the extra costs.

Foreign National Loans

With foreign national loans, non-US residents can secure a mortgage without needing a US credit history or Social Security number. Instead of these, foreign national lenders employ alternative forms of financial verification to determine a borrower’s creditworthiness.

Pros:

- Available to Non-Residents: Foreign nationals can qualify for U.S. mortgages without needing a Social Security number or U.S. credit history, making homeownership or real estate investment accessible.

- Opportunity to Invest in U.S. Real Estate: These loans allow international buyers to benefit from the stability and appreciation potential of the U.S. housing market.

- Flexible Income and Asset Verification: Lenders may accept international credit reports, foreign bank statements, and business financials as proof of financial stability.

- Protection Under US Laws: US laws have several protections in place for property owners. Purchasing a hard asset in the United States gives you an investment that is protected against unlawful seizure and legal uncertainties that may be present in other countries.

Cons:

- Potentially Extensive Verification Process: Depending on the lender’s requirements, the borrower may need to provide references from their home country, such as banks and business partners who can vouch for their creditworthiness. The various ways lenders may want to ensure a borrower’s eligibility can extend the application timeline.

- Higher Down Payment Requirements: Foreign national loans often require a down payment of 25-40% to mitigate lender risk, which is higher than standard US mortgage requirements. This is because they are not backed by the US government, exposing them to more risk.

- Higher Interest Rates Than Conventional Loans: Due to the additional risk associated with lending to non-residents, interest rates for foreign national loans are typically higher than conventional loans.

Foreign national loans provide a crucial pathway for non-US residents to invest in the American real estate market. Some lenders, like Defy, offer foreign national loans in various forms, such as foreign national DSCR loans, giving foreign nationals added flexibility to get the most out of their investments.

Bank Statement Loans

Bank statement loans are an alternative mortgage option that uses a borrower’s bank statements over the past few years to verify that they have sufficient income to cover their mortgage payments. If you don’t have traditional W-2 income but have sufficient cash flow to make consistent deposits to your bank account, you can use your bank statements to secure a mortgage.

Pros:

- No Income Verification Needed: Unlike conventional loans, bank statement loans do not require tax returns or W-2s, making them ideal for self-employed borrowers with fluctuating incomes.

- Easier Qualification for Self-Employed Borrowers: Lenders focus on actual cash flow rather than taxable income, allowing business owners to qualify even if their reported income is low due to deductions.

- Higher Loan Limits Available: Since approval is based on bank deposits rather than strict debt-to-income (DTI) ratios and other criteria, borrowers may qualify for larger loan amounts than with traditional loans if their bank statements reflect sufficient cash flow to cover a large mortgage.

- Flexibility in Fund Sources: Borrowers can use personal or business bank statements to demonstrate income, providing greater flexibility in qualification.

Cons:

- Potentially Higher Borrowing Costs: Down payment requirements and closing costs can depend on the lender, but they can be higher than those of conventional loans.

- Strict Cash Flow Requirements: Lenders scrutinize bank statements for consistent deposits in lieu of the borrower having a consistent verifiable income. This means that spending is also assessed, and large unexplained withdrawals may raise red flags.

- Limited Lender Availability: Not all lenders offer bank statement loans, so borrowers may need to shop around for ideal terms.

While bank statement loans can be more expensive than conventional loans, the higher rates can be mitigated by making a larger down payment. At Defy, we offer competitive rates for bank statement loans, with down payments as low as 10%.

Conventional Loans for Investment Property

Conventional mortgages are standard mortgage products offered by private lenders such as banks and other financial institutions. They are classified as Qualified Mortgages, or QM loans, meaning that they meet specific requirements set by entities such as Freddie Mac and Fannie Mae. This risk reduction allows lenders to offer lower interest rates.

Conventional loans typically require a minimum credit score of 620 to 680, depending on the lender. A down payment of 20-25% is generally required as well, along with conforming loan limits that vary per county. These loans typically have terms ranging from 15 to 30 years, offering both fixed and adjustable interest rate options.

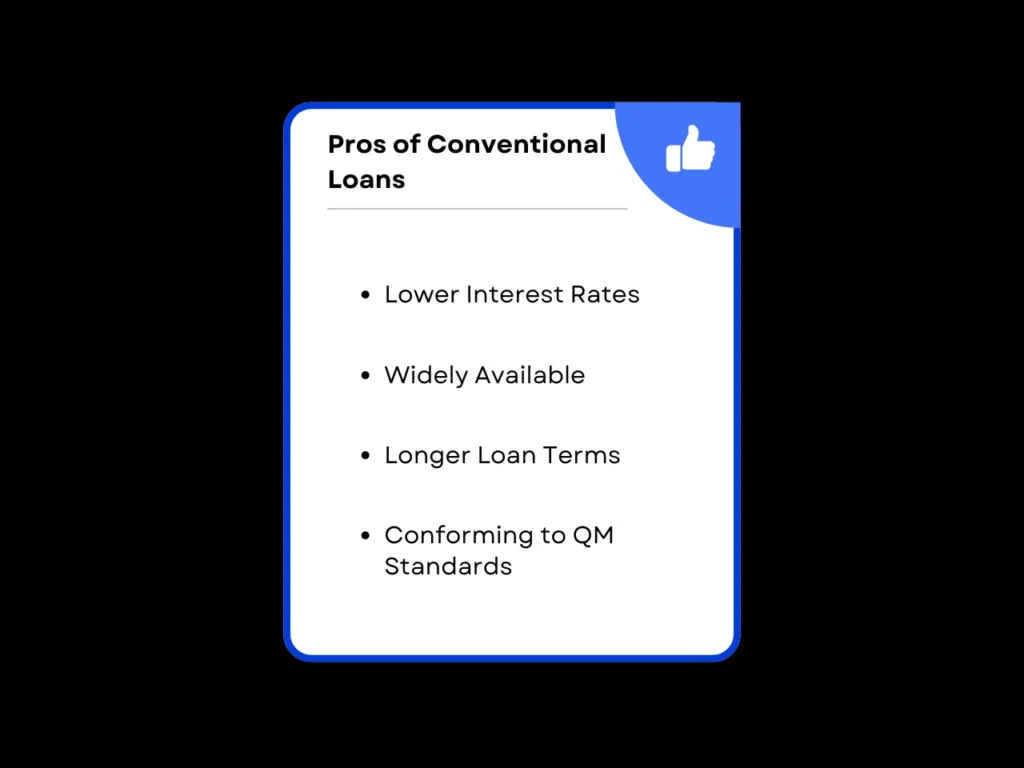

Pros:

- Lower Interest Rates: Conventional loans tend to offer lower average interest rates compared to other financing options like hard money or private money loans, particularly for borrowers with good to excellent credit.

- Widely Available: These loans are offered by a broad range of financial institutions, including banks, credit unions, and mortgage lenders, making them highly accessible.

- Longer Loan Terms: Extended repayment terms (typically 15 to 30 years) allow investors to manage monthly payments while benefiting from long-term property appreciation and recurring rental income.

- Conforming to QM Standards: Since conventional loans meet the Qualified Mortgage (QM) standards, they are less risky for lenders, which often results in lower interest rates for the borrowers.

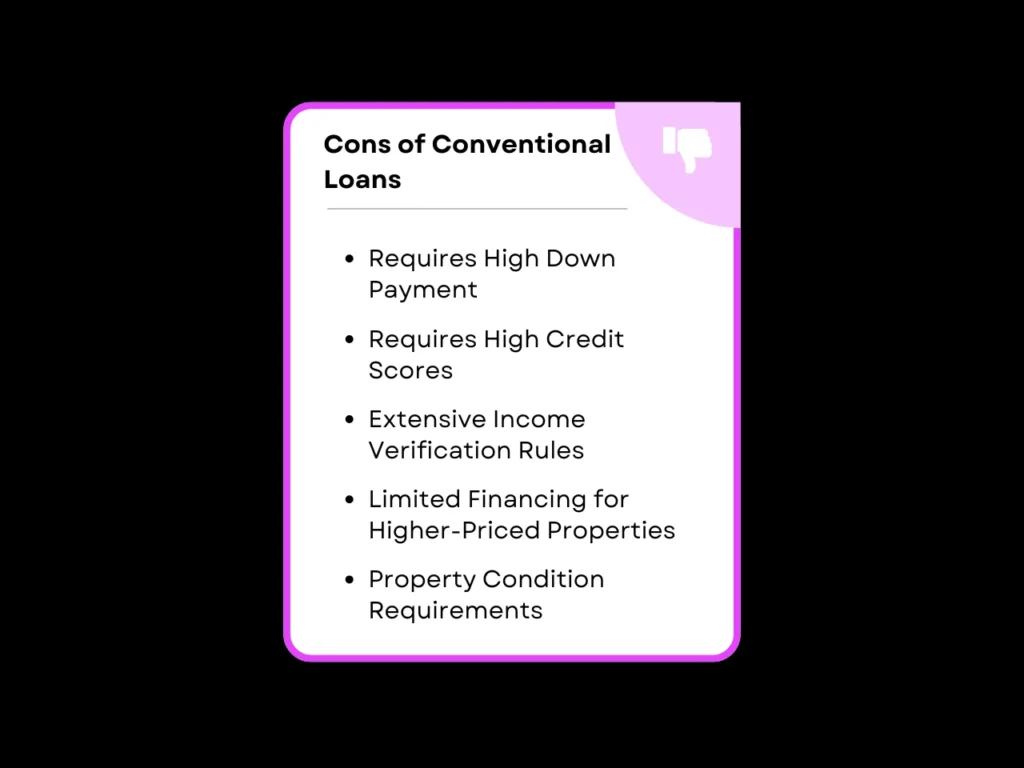

Cons:

- Requires High Down Payment: Conventional loans generally require a down payment of 20-25%, which can be a barrier to entry for investors who lack upfront capital.

- Requires High Credit Scores: The credit score requirements for conventional loans tend to be 620 or higher. Borrowers with a low credit score tend to have higher interest rates and lower approval odds.

- Extensive Income Verification Rules: Lenders typically require detailed documentation to verify the borrower’s income, including tax returns, pay stubs, and bank statements. This can be a challenge for investors with non-traditional income sources such as rental income.

- Limited Financing for Higher-Priced Properties: For properties above the conforming loan limits, borrowers may need to make an even larger down payment, meet additional qualifications, or explore alternative financing options.

- Property Condition Requirements: Lenders may impose strict property condition standards on investment properties, potentially disqualifying the ones that require significant repairs or renovations.

Conventional loans are among the most common types of loans for investment property, offering competitive interest rates and long-term repayment terms. However, the higher credit score, down payment requirements, and stricter income verification rules make them less accessible and appealing to certain investors.

Government-Backed Loans for Investment Properties

Government-backed loans are primarily designed for owner-occupied residences. However, there are ways to use these properties as both residences and investments. Here are two types of government-backed loans that can be used for this purpose:

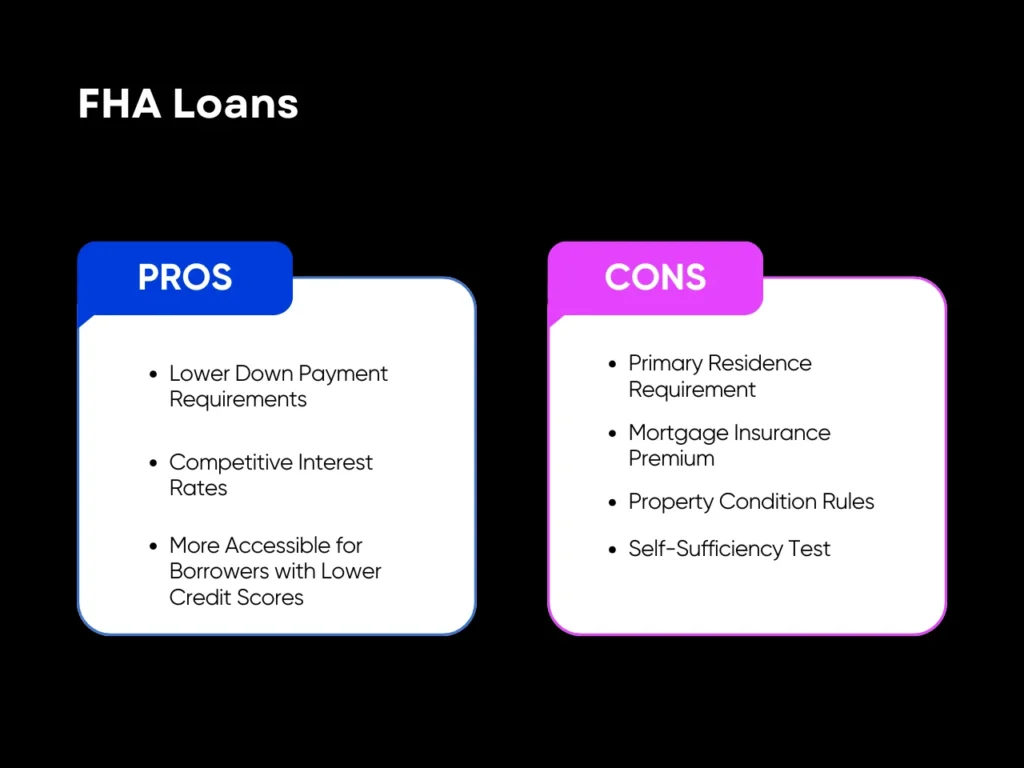

FHA Loans

FHA loans are government-backed mortgages insured by the Federal Housing Administration, designed to be more flexible and accessible for first-time homeowners. Borrowers with credit scores of 580 or higher can qualify with a minimum down payment of 3.5%, and those with scores between 500 and 579 may still qualify with a 10% down payment.

FHA loans are eligible for properties with up to four units, as long as the borrower occupies one as their primary residence. However, the property must meet FHA-specific guidelines to qualify. One unique feature of FHA loans is that they are assumable, meaning future buyers can assume an existing FHA loan, adding more flexibility if the first borrower decides to sell before the mortgage is fully paid off.

Pros:

- Lower Down Payment Requirements: Down payments ranging from 3.5% to 10% of the purchase price make it easier for first-time investors or those with limited savings. Some states also offer down payment or closing cost assistance to further decrease the total cost upfront.

- Competitive Interest Rates: FHA loans’ average interest rates fluctuate around the low 7% range. By contrast, a borrower would have to have at least good credit to get a similar rate for conventional home loans.

- More Accessible for Borrowers with Lower Credit Scores: Borrowers with FICO scores as low as 500 can be approved for an FHA loan, creating opportunities for investors with less-than-perfect credit history.

Cons:

- Primary Residence Requirement: Borrowers must use the property as their primary residence for 12 months in order to qualify for a FHA loan.

- Mortgage Insurance Premium (MIP): Unlike other loan types, MIP is mandatory for FHA loans regardless if you make a down payment of 20% or more. MIP includes both an upfront fee of around 1.75% of the loan amount and annual premiums ranging from 0.15 to 0. 75% of the loan amount.

- Property Condition Rules: To be approved for an FHA loan, a property must meet FHA safety and livability standards. Some properties can be approved if the borrower renovates the property to meet minimum standards, but this can increase the overall cost and effort needed.

- Self-Sufficiency Test: To rent out multi-family properties, you must pass the FHA Self-Sufficiency Test, in which you have to prove that the projected rental income will cover mortgage payments. The projected net rental income, as determined by a third-party appraiser, must exceed the monthly payments for principal, interest, taxes, and insurance in order to pass.

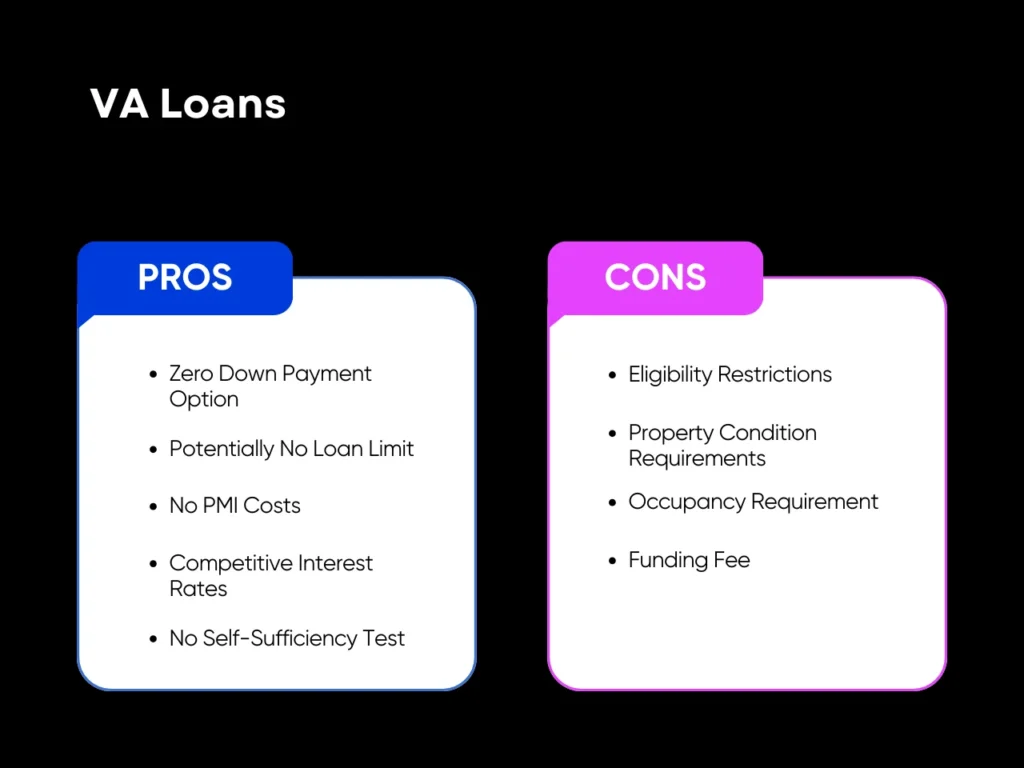

VA Loans

Similar to FHA loans, VA loans administered by the Department of Veteran Affairs allow financing for properties with up to four units, provided the borrower occupies one unit as their primary residence. However, they come with several distinct advantages. One key benefit is that borrowers with full entitlement can finance 100% of the property’s purchase price.

Additionally, borrowers with full entitlement and who were disabled in the line of duty may have closing costs waived. Unlike FHA loans, VA loans do not require Private Mortgage Insurance (PMI), meaning that borrowers can close on a mortgage deal while paying little to nothing out of pocket.

Pros:

- Zero Down Payment Option: VA loans require no down payment for those with full entitlement. Full entitlement means that the borrower has not used a VA home loan before, or has paid all their prior VA loans in full.

- Potentially No Loan Limit: Borrowers with full entitlement also enjoy unlimited loan amounts (within what lenders are willing to provide). Those with only partial entitlement are subject to county-based loan limits similar to FHA loans.

- No PMI Costs: Unlike FHA loans, VA loans do not require private mortgage insurance. This lowers monthly payments and increases cash flow.

- Competitive Interest Rates: At the time of writing (January 2025), the 30-year-fixed VA loan rate is 5.99%, whereas conventional loans are around 7%. VA loan typically has favorable rates compared to conventional loans, which results in considerable savings over time.

- No Self-Sufficiency Test: Unlike FHA loans, VA loans don’t require you to prove self-sufficiency for multi-family homes. You would only need to meet the minimum property requirements and prove intent to occupy one of the units for at least a year.

Cons:

- Eligibility Restrictions: VA loans are available only to veterans, active-duty service members, and certain qualifying groups such as surviving spouses or members of the Public Health Service.

- Property Condition Requirements: Similar to FHA loans, VA loans also have their own minimum property requirements. These may exclude fixer-uppers unless the borrower agrees to make all the necessary repairs and renovations.

- Occupancy Requirement: Borrowers must live in one unit of the property for at least 12 months, which can restrict its use for investment purposes. Buying a property with the maximum amount of units allowed by a VA loan–a fourplex– can offset this disadvantage.

- Funding Fee: Apart from donations and grants, VA loans are supported primarily by the funding fee paid by borrowers, which typically amounts to 2% of the loan amount. However, borrowers who have a service-connected disability rating of 10% or higher are exempt from having to pay the funding fee.

Although these mortgages are intended to provide an easier path to homeownership, it is still legal to use them to purchase an investment property as long as you occupy them for at least a year. If you can meet the minimum property requirements and pass the self-sufficiency test if necessary, these loans can be a fantastic way to purchase a multi-unit home and earn rental income under a single mortgage.

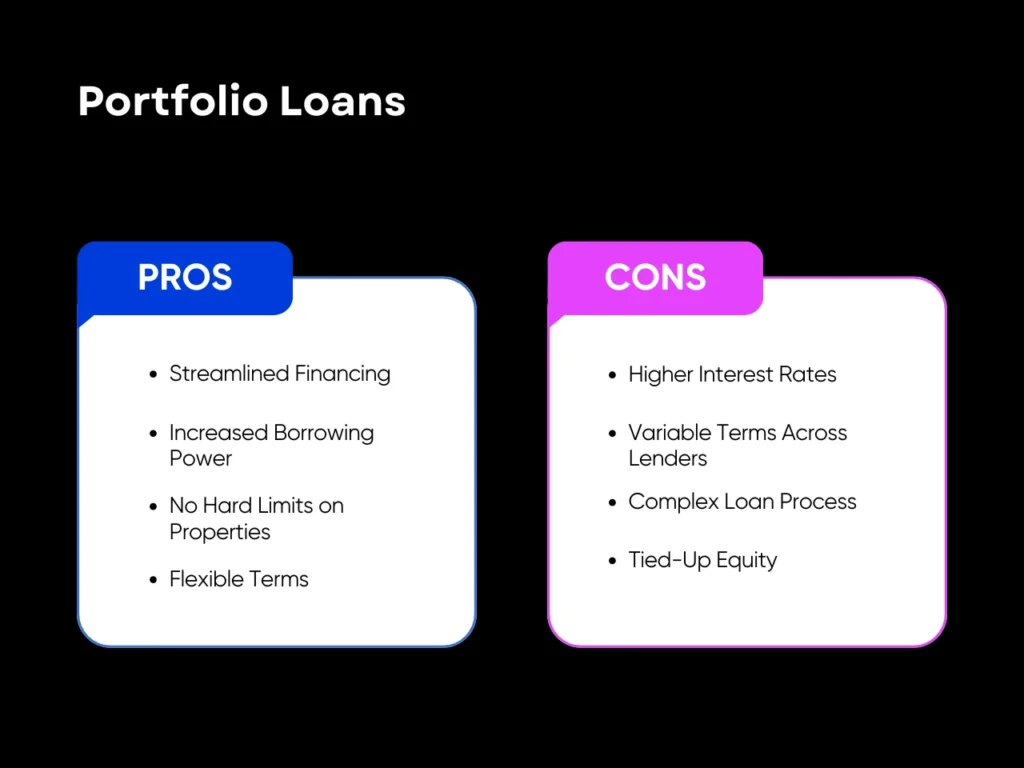

Portfolio Loans for Real Estate Investors

Portfolio loans are specialized financing options designed for real estate investors who own or plan to own multiple properties. Unlike conventional mortgages, these loans originate directly from the lender’s funds. Because these loans remain in the lender’s portfolio and are not sold on the secondary market, they usually have more flexibility in terms and conditions.

Since the lender sets their own terms and conditions, portfolio loans can include unique repayment plans, adjustable LTV ratios, and unique interest structures. For example, some lenders may give the borrower the option of consolidating all properties into a single loan, which reduces administrative overhead and combines debt obligation into one monthly payment.

Pros

- Streamlined Financing: Consolidating multiple properties into a single loan simplifies the management of multiple properties, making it simpler to track expenses.

- Increased Borrowing Power: Depending on the lender’s flexibility, the borrower can potentially finance larger portfolios.

- No Hard Limits on Properties: The number and types of properties you can finance depend on your negotiations with the lender, ideal for investors with expansive or growing portfolios.

- Flexible Terms: Lenders can offer unique repayment schedules, interest rates, or conditions closely tailored to the investor’s needs.

Cons

- Higher Interest Rates: Portfolio loans often come with higher rates than conventional loans due to the increased risk retained by the lender.

- Variable Terms Across Lenders: Conditions, rates, and requirements can differ significantly, requiring careful comparison and due diligence.

- Complex Loan Process: Consolidating properties into a single loan may involve additional paperwork and property appraisals, making it less appealing to some borrowers.

- Tied-Up Equity: Using multiple properties as collateral can limit your ability to sell or refinance individual properties without obtaining lender approval.

With more control over loan terms and the ability to consolidate a portfolio of investment properties under a single mortgage, portfolio loans can be an invaluable tool for simplifying financial management. However, keep in mind that dealing directly with the lender may come with requirements that aren’t present in other loan agreements.

Due to the risky nature of this type of loan, it’s also not commonly offered by lenders. If you’re having trouble finding a lender that provides portfolio loans, an alternative would be to explore other non-QM options for real estate investors.

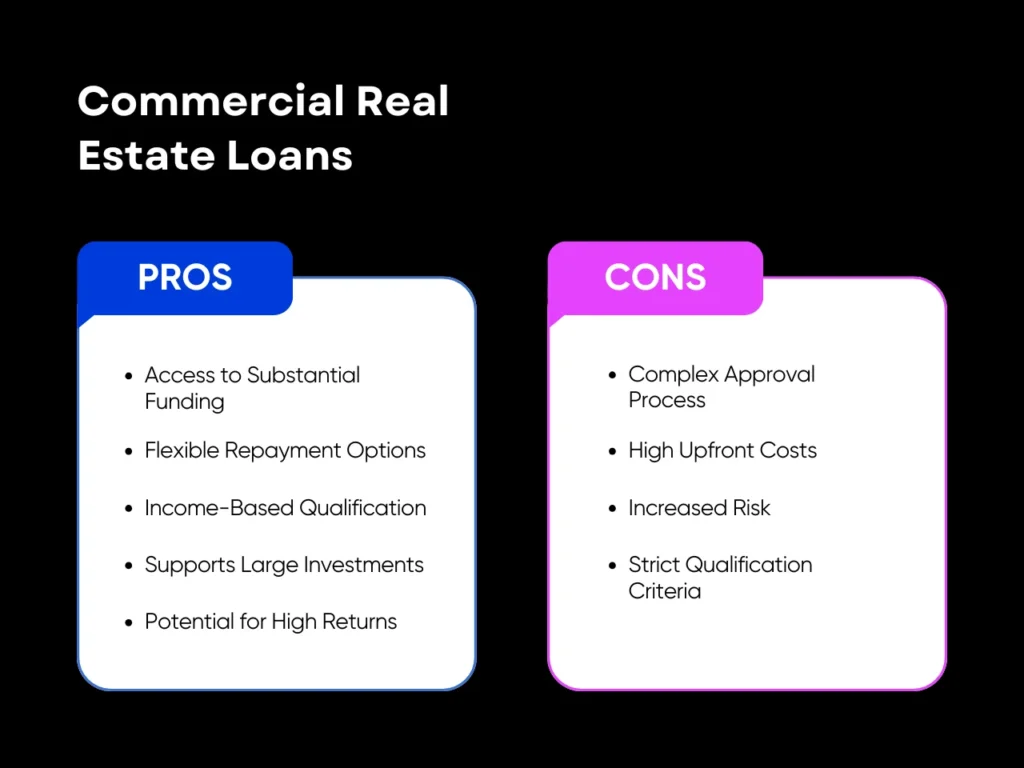

Commercial Real Estate Loans for Investment Property

Commercial real estate loans are designed for financing larger-scale investment properties, such as multi-unit residential complexes, office buildings, or mixed-use developments. Like DSCR loans, these loans prioritize the income potential of the property itself rather than relying solely on the borrower’s personal financial profile. However, not all residential lenders offer commercial loans, and vice versa.

These loans provide substantial funding amounts, catering to larger-scale or high-value projects. With larger loan amounts and higher risk, this type of loan typically requires a down payment of 25-30% of the property’s value. Due to the complexity of these loans, the underwriting and approval process can take several weeks or even months.

Pros

- Access to Substantial Funding: Enables financing for large-scale investments that might otherwise be unattainable, providing access to properties that have much higher ROI than average rental properties.

- Flexible Repayment Options: Loan structures can be customized to align with the cash flow generated by the property, offering more flexibility.

- Income-Based Qualification: Prioritizes property income over personal financials, making it more accessible for high-value projects.

- Supports Large Investments: Ideal for acquiring or developing multi-unit or mixed-use properties.

- Potential for High Returns: Large-scale investments often yield significant income and appreciation over time.

Cons

- Complex Approval Process: The detailed application and underwriting process involves extensive documentation, including appraisals, business plans, and income projections.

- High Upfront Costs: Requires a significant down payment and may include fees for appraisals, legal reviews, and loan origination.

- Increased Risk: Large loan amounts and extended timelines for profitability can pose financial risks if the property underperforms.

- Strict Qualification Criteria: Borrowers must demonstrate a strong business case and meet stringent lender requirements.

Types of Loans for Investment Property FAQ

What is an investment property loan?

An investment property loan is any loan designed primarily to secure real estate that is intended to generate income, whether through rental income or by being sold on the market. Investment property loans can have different requirements than home loans, often pertaining to the value and income potential of the property.

What credit score is needed to qualify for an investment property loan?

The minimum credit score to qualify for an investment property loan can range between 620 to 680, depending on the property and the type of loan you’re applying for. DSCR loans only require a FICO score of at least 620 because of its unique way of evaluating eligibility.

How do DSCR loans compare to conventional loans for rental properties?

Conventional loans require extensive personal income verification and can often have higher credit score requirements than DSCR loans. DSCR loan rates are primarily based on the property’s income-generating potential, making them more accessible for investors whose personal income may not meet conventional loan standards.

How much down payment do I need for a conventional investment property loan?

Down payment varies according to the loan type. Conventional loans typically range from 20%-25%, while FHA loans (3.5% down) and VA loans (0% down) can be used for house hacking, although they come with strict requirements.

Other investment loan types can have down payments ranging from 10% to 30% or more, depending on lender LTVs, property type, property location, and perceived risk. DSCR loans often have LTVs up to 75%, meaning that their down payments should be at least 25%. At Defy, however, our DSCR loans have up to 85% LTV, making the minimum down payment 15%.

Can I use an FHA loan for investment purposes?

Yes, FHA loans can be used to purchase properties with up to four units, allowing you to rent out the additional units as an investment but with certain restrictions. In order for this to be possible, you must meet eligibility and minimum property requirements and use the property as your primary residence for at least a year. You may also have to prove that the rental income from the rental units can cover your mortgage payments. That said, alternative lending options such as DSCR loan options might be a better type of loan for investment property than FHA loans.

What is the difference between a hard money loan and a private loan?

Hard money loans are secured by property value and are typically offered by private lending institutions. They often come with high interest rates, shorter terms, and a quicker approval process. Private loans, on the other hand, are funded by individual investors and can have more flexible terms. However, they can be more variable due to the lack of formal underwriting of hard money loans.

Key Takeaway

Different types of loans for investment property offer distinct advantages and challenges. Before choosing a loan, evaluate your financial situation, investment goals, and property type to ensure you select the most suitable financing option.

Consider factors like interest rates, repayment terms, and eligibility requirements, as these can significantly impact your investment’s profitability. By thoroughly researching and planning ahead, you can confidently secure a loan that aligns with your long-term real estate strategy.

Need help understanding your options? No problem! At Defy, our mortgage experts offer free consultations. Give us a call at (615) 622-1032 today, we’d be happy to assist you and answer any questions that you might have on investment property loans, or other loan options.