Choosing the right mortgage is often a major factor in long-term financial stability, especially for first-time homeowners. For many homebuyers, VA loans and FHA loans are the most viable choices. Weighing the pros and cons of a VA loan vs FHA loan can help you identify which one has clear advantages over the other.

At Defy Mortgage, we offer a streamlined route to homeownership to borrowers of various backgrounds and incomes. While we specialize in the non-QM space, we have 75+ tailored mortgage options and have provided both VA loans and FHA loans to aspiring homeowners across several US states. Whether you’re a self-employed individual, service member, real estate investor, entrepreneur, or 1099 contract worker, we can formulate a mortgage solution that fits your needs perfectly.

In this blog, we’ll identify the parallels and key differences between VA loans and FHA loans. By the end, you should be able to make an informed decision about which one works best with your financial goals.

Overview of VA and FHA Loans

When choosing between VA loan vs FHA loan, it’s important to understand that these two loan types were designed with specific borrower profiles in mind. VA loans carry numerous advantages for eligible veterans, while FHA loans are intended for the general public.

What Is a VA Loan?

A VA loan is a mortgage program designed to support veterans, active-duty service members, and certain eligible military families to own a home. Backed by the Department of Veterans Affairs (VA), this loan program removes many traditional barriers to homeownership and offers benefits tailored to the unique needs of those who serve or have served in the military.

Key Features:

- No Down Payment Required: VA loans allow eligible borrowers to purchase a home without making a down payment, making it easier to secure a property without needing significant upfront savings.

- No Private Mortgage Insurance (PMI): Unlike conventional loans that typically require PMI for borrowers with less than a 20% down payment, VA loans eliminate this cost regardless of how much you put down, which helps reduce the monthly payment for most applicants.

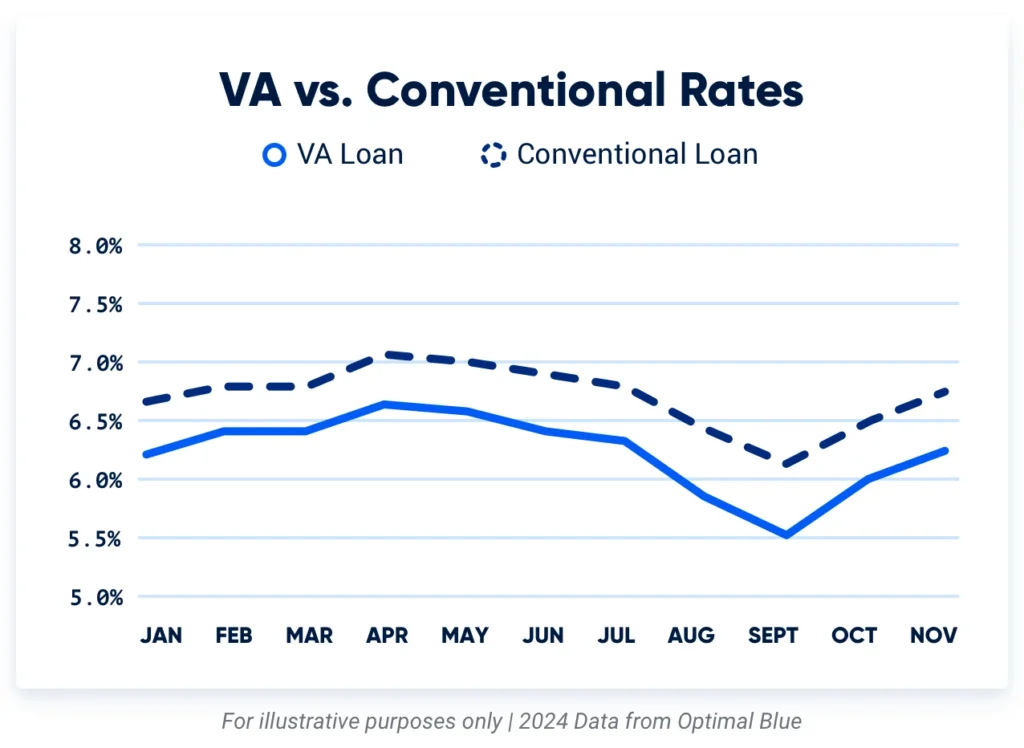

- Competitive Interest Rates: VA loans often have lower interest rates than conventional loans. This is due to the fact that VA loans are backed by the Department of Veteran Affairs, giving lenders more confidence to extend the loan.

What Is an FHA Loan?

An FHA loan is a mortgage program insured by the Federal Housing Administration, designed to assist individuals who may face challenges qualifying for conventional loans. It caters particularly to first-time homebuyers, those with lower credit scores, or those with limited savings for a down payment.

Key Features:

- Low Down Payment Requirement: Borrowers can qualify with a down payment as low as 3.5%, making it accessible for individuals who may not have substantial savings.

- Flexible Credit Score Criteria: FHA loans are known for their lenient credit requirements, allowing borrowers with lower credit scores to qualify.

- Mortgage Insurance Premiums (MIP): Borrowers must pay both an upfront and an annual mortgage insurance premium, which protects the lender in case of default. This is an added cost compared to some other loan types.

Similarities Between VA and FHA Loans

VA and FHA loans share several key similarities that make them appealing alternatives to conventional mortgages, particularly for first-time homebuyers and individuals with financial or credit challenges. These similarities include:

- Government-Backed Support: Both VA and FHA loans are backed by federal government agencies—the Department of Veterans Affairs for VA loans and the Federal Housing Administration for FHA loans. This backing reduces risk for lenders, enabling them to offer more favorable terms to borrowers.

- County-Based Loan Limits: Both loan types adjust their loan limits based on the median home prices in the county where the borrower would like to purchase a home, with higher limits for homes in more expensive counties. That said, VA loans lift this limit for those with full entitlement.

- Accessible to First-Time Homebuyers: Both programs are designed to make homeownership more attainable, benefiting individuals in particular circumstances. Flexible credit requirements and favorable terms help enhance housing accessibility.

- Alternative to Conventional Loans: VA and FHA loans provide pathways to homeownership for those who may not qualify for conventional loans due to their own financial and personal circumstances. They are both great options for borrowers seeking less stringent qualification requirements.

Key Differences Between VA and FHA Loans

| VA Loan | FHA Loan | |

| Eligible Borrowers | Restricted to eligible veterans, active service members, and some military families. | Open to anyone meeting credit and income requirements, regardless of military affiliation. |

| Financial Criteria | At least 620 FICO score for most lendersIdeally 41% debt-to-income ratio, although approval for higher DTIs | At least 500 FICO score, but lenders may set a higher minimumUp to 50% debt-to-income ratio |

| Property Standards | Must be a primary residenceRequires working electric and HVAC systems Adequate roofing with a minimum 3-year lifespan, as well as a clear Section 1 pest inspection Must have clean, continuous water supply without leaks, as well as proper drainage and sanitary sewage disposal Free of lead-based paint, wood-destroying pests, and rot Must be accessible via all-weather public or private roads Must be properly vented | The rules are mostly the same as those for VA loans, but the HUD does not explicitly require a Section 1 pest inspection. Homes are to be given a full standard pest inspection only if signs of an active infestation are found during the initial inspection.FHA loans also enforce the installation of self-closing fire doors between the home and an adjoining garage. |

| Down Payment Requirements | Requires no down payment. | 3.5% down payment for borrowers with a credit score of 580 and up 10% down payment for borrowers with a credit score of 500-579 VA mortgage lenders may impose their own credit score requirements |

| Mortgage Insurance Costs | Does not require PMI, reducing monthly costs. | Requires both upfront and annual mortgage insurance premiums (MIP). |

| Loan Limits and Interest Rates | No official loan limit for those with full VA entitlement. Lenders decide the loan amount.Average interest rate ~6% | Maximum loan limits vary by region and may be lower than VA loans.Average interest rate ~7% |

| Closing Costs | VA loan funding fee of 2.15% on average, but can be as high as 3.3% or as low as 0.5%. Can be waived if your disability rating is high enough. | 3-6% of the home’s purchase price, plus 1.75% in upfront MIP |

Choosing the Right Loan for First-Time Homebuyers

When a VA Loan May Be Best

With all their unique benefits, VA loans are often the strongest option for those who are eligible. They are particularly beneficial for the following situations:

- Eligible borrowers with military affiliation: Since VA loans do not require a down payment, veterans, active-duty service members, and some military families can purchase a home without saving a large sum to meet the upfront payments. This eliminates one of the biggest hurdles for first-time homebuyers.

- Buyers who want to be long-term homeowners: Savings on Private Mortgage Insurance (PMI) make VA loans ideal for individuals planning to stay in their homes for many years. Because VA loans do not require PMI, borrowers can save significantly on their monthly payments, especially over the life of the loan.

- Buyers who want to purchase a home that exceeds FHA limits: Borrowers with full entitlement can borrow an unlimited amount, subject to lender approval. This makes VA loans even more ideal for those who want to take out a loan that’s above the FHA loan limit. You can use this calculator to see what the FHA mortgage limits are for the county that the property is in.

Keep in mind: while VA loans have no loan limit for eligible borrowers, the larger the loan amount, the higher the upfront costs.

When an FHA Loan May Be Best

There are a few situations in which an FHA loan may be preferable to a VA loan. These primarily revolve around difficulties meeting VA loan eligibility requirements:

- Non-military buyers: Those who are not veterans or military-affiliated will not be eligible for a VA loan.

- Military buyers who don’t meet VA loan eligibility criteria: While VA loans offer amazing benefits for military personnel and their families, there are other qualification criteria that can impact eligibility. If you believe you’re eligible for a VA loan, be sure to verify your eligibility status using your Certificate of Eligibility (COE), which you can obtain either through your lender or on your own.

How to Choose If You’re Eligible for Both

If you are eligible for both VA and FHA loans, congratulations! You’re the minority that gets to compare both cost-saving options that may not be available to the vast majority of buyers in the market.

While we can’t give financial advice, we recommend that you consider how each loan option aligns with your current and future financial goals. VA loans are generally a great option because of their robust benefits. Without the upfront down payment and PMI, VA loans are generally more cost-effective right out of the gate and can free up assets that you can use for investing elsewhere.

VA loans can be more advantageous than FHA loans in the long run as well if you’re able to secure the lowest interest in the market. Be sure to talk to your lender and compare all the available options to determine if it’s right for you.

VA Loan vs. FHA Loan FAQ

Can I qualify for both VA and FHA loans, and how should I decide which to choose?

If you meet the VA’s service requirements as well as the FHA loan’s eligibility requirements, you can qualify for both. The choice between the two depends on your specific financial situation, but if you can get pre-qualified for a VA loan with an approved lender, it’s often more advantageous to go with a VA loan.

What credit score is required to qualify for a VA or FHA loan?

VA loans don’t have a strict minimum, but lenders may require a score of 620 or higher. FHA loans typically require a score of 580 for a 3.5% down payment.

Are there limits on the property type or location for these loans?

Both loans must be used for primary residences. The full list of property requirements can be found on the official sites of the HUD and the VA. However, as a rule of thumb, the property must be safe and secure, with adequate utilities and ventilation, no pests, and be accessible from an all-weather road.

How do VA and FHA loans handle refinancing?

VA loans offer streamlined refinancing through the Interest Rate Reduction Refinance Loan (IRRRL). They also back cash-out refinance loans and other refinance options. FHA loans, on the other hand, offer their own streamline refinance program.

Can I use a VA or FHA loan to purchase an investment property?

No, both loan types are intended for primary residences only.

Key Takeaway

When deciding between a VA loan vs FHA loan, consider the benefits each one has to offer and how they fit your unique situation. If you do not meet VA loan eligibility requirements, FHA loans are a strong alternative thanks to their low down payment and flexible requirements. However, if VA loans are available to you, you gain access to various benefits that FHA loans do not have.

With zero down payment and no PMI, VA loans offer lower costs in the short and long term. Although there is a funding fee of 2.15% of the loan amount, this can be waived for veterans who were disabled in the line of duty, which means that eligible borrowers can secure a home with essentially zero closing costs.

Looking for VA loans, FHA loans or maybe other loan options that also provide a lot of flexibility? Get started with Defy today, and let’s get the ball rolling on your next home purchase (or refinance!) We also offer various non-QM options for those with unconventional incomes, including bank statement loans and P&L loans.