A mortgage pre-approval is a crucial step in the home-buying process. It provides potential buyers with a specific loan amount, type of loan, and interest rate. But what happens if my mortgage pre-approval expires? An expired pre-approval letter can lead to delays, complications, and potential setbacks in securing a mortgage loan. Any serious homebuyer needs to understand the importance of maintaining an active pre-approval and what steps to take if it expires.

At Defy Mortgage, we simplify and speed up the mortgage pre-approval process for entrepreneurs, freelancers, and real estate investors. We offer nontraditional mortgage solutions such as DSCR loans, bank statement loans, and foreign national loans, which are less cumbersome than traditional loans that require extensive tax documentation. With dedicated support, we ensure clients have real-time updates on their loan status to keep their pre-approval in check.

Built on our years of experience, we’ve crafted this guide to help you understand the consequences of an expired mortgage pre-approval. This blog explores the lifespan of a mortgage pre-approval and the steps to renew it. At the end of this blog, you will understand how to maintain your pre-approval status and stay ahead in your home search.

So, what happens if my mortgage pre-approval expires? Let’s find out.

The Lifespan of a Mortgage Pre-Approval

A mortgage pre-approval typically lasts between 60 and 90 days. Understanding this timeframe is crucial for potential homebuyers. During this period, buyers can use their mortgage pre-approval letter to make a competitive purchase. However, factors such as economic changes, personal financial situation, or lender policies can influence the expiration date.

Lenders usually review tax returns, pay stubs, and credit reports to determine the pre-approval period. They also assess the applicant’s credit score, credit history, and overall financial profile. If the pre-approval expires, homebuyers must update their financial documents and undergo a new credit check to renew their pre-approval. This process ensures that the latest pre-approval letter reflects the most accurate financial picture.

What Happens if My Mortgage Pre-Approval Expires? Top 5 Consequences

Mortgage pre-approval provides a clear picture of your purchasing power. However, its expiration can have a few significant consequences that may affect your home-buying process. Understanding what happens if my mortgage pre-approval expires is crucial for keeping mortgage prequalification up-to-date while maintaining a competitive edge in the market.

Find out these major consequences in case your mortgage pre-approval expires:

1. Credit Score Impact

One key consequence of your mortgage pre-approval expiring is your credit score. Lenders perform a hard credit check during the pre-approval process, which can impact your credit score by about five points. When the pre-approval expires, reapplying means another hard inquiry, which can further lower your score. This decrease in credit score might affect your eligibility for favorable loan terms in subsequent applications.

2. Potential Changes in Loan Terms

Loan terms may change when your mortgage pre-approval expires. Mortgage lenders reassess your financial situation with each application. This reassessment considers changes in your gross monthly income, monthly debt obligations, and credit card debt. An altered financial profile could result in different loan terms, affecting the specific amount you qualify for, the interest rate, and the monthly payment.

3. Potential Delays in Home Closing

Another significant consequence involves potential delays in the home closing process. A valid mortgage pre-approval shows sellers that you are a serious buyer, giving you an advantage in a competitive market.

An expired pre-approval requires reapplication, which can take anywhere from 3 to 7 business days to process depending on the lender and additional documentation required. These delays might cause you to miss out on purchasing your dream home, especially in a time-sensitive situation.

4. Re-Evaluation of Your Financial Situation

Your mortgage lender will reevaluate your financial situation. Changes in your financial status, such as new credit card debt, job loss, or fluctuations in your gross monthly income, could impact your loan eligibility. This reevaluation determines how much money you can borrow and may alter the home loan terms you initially qualified for. Such changes influence your price range and affect your ability to find the best home.

5. Need to Reapply for Pre-Approval

Reapplying for pre-approval becomes necessary when your mortgage pre-approval expires. This process involves submitting updated documents like proof of income and bank statements, similar to the initial mortgage application. Reapplying ensures your loan officer has the latest information to determine your eligibility for a home loan. Beginning this process promptly is an excellent idea to avoid further delays.

Steps to Take if Your Pre-Approval Expires

When your mortgage pre-approval expires, it can affect your home-buying process. It’s essential to take immediate action to secure your financing. Here are five crucial steps to follow if your pre-approval expires, ensuring you keep on track to purchase your dream home and avoid potential delays or complications in your home-buying journey.

Step 1: Review the Expiry Details

When your mortgage pre-approval expires, review the expiry details carefully. Understand how long a pre-approval is good for and note any specific dates. This information helps you plan your next steps effectively. Knowing how long a pre-approval lasts will guide you in managing your mortgage application process smoothly.

In doing so, assess the current market conditions and your financial situation. Determine how long a mortgage pre-approval lasts and compare it with your initial application period. This assessment will help you decide whether to reapply immediately or wait. Understanding how long pre-approval lasts ensures you remain informed and ready to act accordingly.

Step 2: Contact Your Lender

When your mortgage pre-approval expires, contact your lender immediately. Discuss the reasons for the expiration and seek guidance on renewing your pre-approval. Your lender will provide specific instructions on what to do next. Understand the importance of this step to avoid delays in your home-buying process.

Other than that, ensure you ask your lender about any changes in the lending criteria since your initial pre-approval. Changes in interest rates or loan terms can impact your loan approval. Prompt communication with your lender helps you stay informed and prepared. Addressing this early will keep your home search on track. This proactive approach ensures that you know what happens if your mortgage pre-approval expires and how to handle it efficiently.

Step 3: Gather Updated Financial Documents

When your mortgage pre-approval expires, gather updated financial documents as soon as possible. Lenders need recent information to assess your current financial status. Provide these documents to ensure the renewal process is completed on time, potentially affecting your ability to secure a loan.

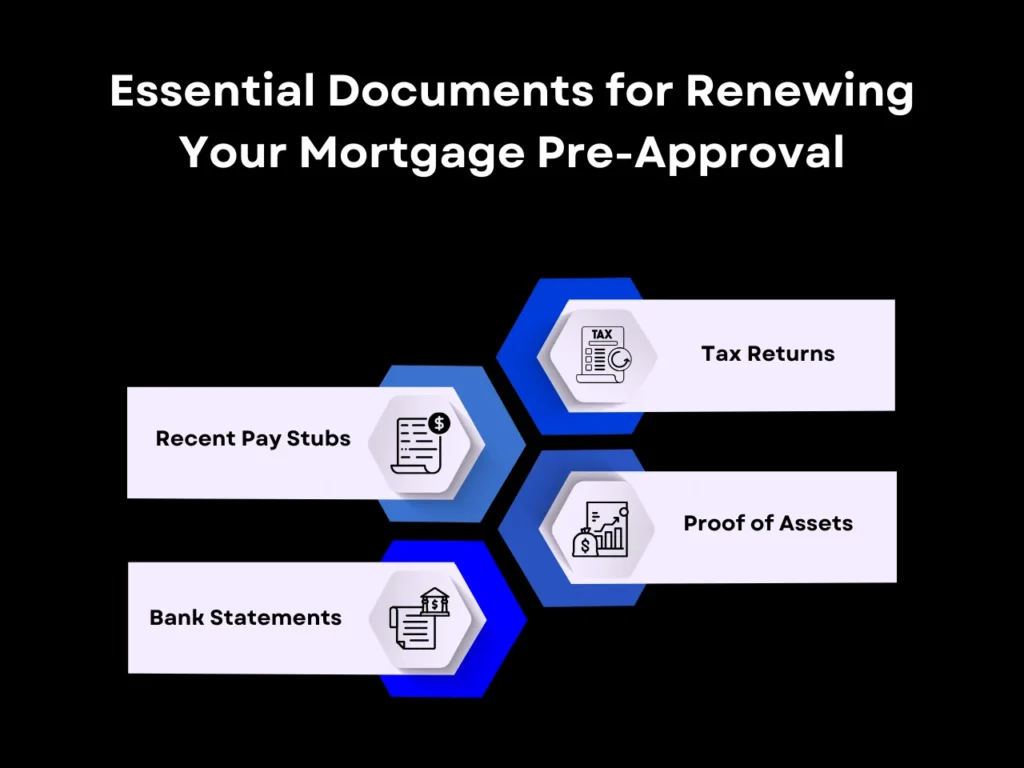

Here are the documents you need to gather:

- Recent Pay Stubs: Show proof of your current income. Lenders require the latest pay stubs to verify your employment status and salary.

- Bank Statements: Provide statements from the past two months. These help lenders evaluate your savings and checking account balances.

- Tax Returns: Submit the most recent tax returns. They offer a comprehensive view of your financial health and income sources.

- Proof of Assets: Include documentation of any investments or properties. This showcases additional financial stability.

Preparing these documents beforehand ensures a smooth renewal process. Lenders appreciate accurate and up-to-date information, facilitating quick approval. Stay organized to avoid unnecessary delays. If you wonder how long pre-approval lasts, always check with your lender for specifics.

Step 4: Submit Your Renewal Application

If your mortgage pre-approval expires, act promptly to avoid delays. Start by contacting your lender. Inquire about their renewal process and required documents. You must submit recent pay stubs, tax returns, and bank statements. Renewing your pre-approval ensures your financing remains secure.

Consider these factors before renewing your mortgage pre-approval:

- Interest Rate Changes: Interest rates can fluctuate. A new pre-approval might offer a different rate.

- Credit Score: Check your credit score. Any recent changes can impact your renewal.

- Property Market: Market conditions may affect your pre-approval amount.

- Financial Stability: Ensure your financial situation remains stable to avoid issues.

Make sure to keep in touch with your lender throughout the process. Ask about any changes in your financial situation that might impact your pre-approval. Review and organize your documents meticulously to avoid errors or delays throughout this process.

Step 5: Plan Your Home Search

When your mortgage pre-approval expires, promptly plan your home search. This period necessitates a structured approach to finding your dream home. Review your budget and loan amount to align your expectations with current market conditions. This proactive step ensures a smoother home-buying process.

Efficiently planning your home search involves several key actions:

- Identify Your Needs: List essential features, such as the number of bedrooms, location, and amenities.

- Set a Timeline: Establish a realistic timeframe for your search and subsequent move.

- Research Neighborhoods: Investigate areas that meet your criteria, focusing on schools, safety, and convenience.

- Visit Homes: Schedule viewings to assess potential homes in person, taking notes and comparing options.

Proactive planning and strategic actions will help you navigate the home-buying journey effectively, even after your pre-approval expires. Remain dedicated to your search, and maintain clear communication with your lender and realtor to achieve your homeownership goals.

Key Takeaway

What happens if my mortgage pre-approval expires? When your mortgage pre-approval expires, you may face several challenges when buying an investment property in the US. You must reapply for pre-approval, which could affect your ability to close on a house. Lenders might reassess your financial status, potentially altering your pre-approval status or loan terms.

Keep in mind that maintaining an active mortgage pre-approval is crucial. This ensures that you can move forward smoothly with the process of closing a house. If your pre-approval expires, you risk losing out on your desired property. Moreover, portfolio loan interest rates and terms changes could impact your new pre-approval application.

Wondering what happens if my mortgage pre-approval expires? Reach out to expert non-QM mortgage lenders for customized support. At Defy Mortgage, we assist clients in understanding the importance of maintaining an active pre-approval. We guide you through the steps to renew or extend your pre-approval, ensuring you remain competitive in the real estate market.

Frequently Asked Questions

1. Can I extend my mortgage pre-approval before it expires?

Yes, you can extend your mortgage pre-approval before it expires. Typically, lenders offer pre-approvals valid for 60-90 days. Extending this period usually requires updating your financial documents, such as pay stubs and bank statements. Consult your lender before expiration to ensure a smooth extension process.

2. What is the difference between pre-approval and pre-qualification?

Pre-qualification is a preliminary assessment of your borrowing power based on a self-reported financial profile. A mortgage pre-approval, on the other hand, involves a more thorough verification of your financial documents by a qualified lender.

3. Does updating pre-approval affect my credit score?

It depends. When you renew a pre-approval, lenders may perform another hard inquiry on your credit report, which can cause a minor dip in your score, typically five points. However, the impact should be minimal if you manage your credit responsibly. Additionally, some lenders may use a soft inquiry for renewals, which doesn’t impact your credit score.

4. What happens if I find a home after my pre-approval expires?

If ever you find a home after your pre-approval expires, you must reapply for a new pre-approval. This involves resubmitting financial documents and possibly undergoing another credit check. The process ensures that your financial information is current and reflects your ability to secure a mortgage for the new property.

5. How many times can I renew my pre-approval?

You can renew your pre-approval multiple times, typically up to one year. Each renewal may require updating financial documents to reflect any changes in your financial situation. Be aware that lender policies may change, affecting your eligibility for the same terms. Consult with your mortgage advisor to navigate this process effectively.

6. Can I switch lenders if my pre-approval expires?

Yes, you can switch lenders if your pre-approval expires. You can stick with the same lender for your new pre-approval. However, switching lenders may require additional documentation and another credit check. Compare offers from different lenders to ensure you get the best terms.

7. How do I qualify for a mortgage?

First and foremost, it’s crucial that you get pre-approved and remember that qualifications for mortgages vary depending on the lender, loan type and more. Homebuyers face a diverse array of mortgage choices in today’s lending landscape. Among these, the conventional conforming loan stands out as a popular and widely-used option.

For those seeking alternatives, the non-QM loan presents another pathway to homeownership, offering unique features that set it apart from more traditional mortgage products.

Qualification requirements differ between lender/loan type, however, most borrowers will need to show the following. It’s important to check with your lender though to confirm their requirements:

- Income/tax returns or alternative income verification methods

- Credit Score

- Debt-to-income ratio (DTI)

- Financial reserves

8. If my pre-approval expires, should I get pre-approved again?

Yes. Getting pre-approved again even if your pre-approval expires is important. Securing a mortgage pre-approval lets sellers know you’re serious, it alerts lenders that you may be taking out a mortgage in the near future, it shows you how much you can afford (and what you can’t), it can speed up the home buying process, and can give you a competitive advantage come offer time. If you want certainty faster, reliable pre-approvals are kind of our thing at Defy. Get pre-approved.