Interest-Only Options

A loan option for self-employed, annual/quarterly commissioned borrowers, or for clients

looking for lower monthly payment options or for flexible payment options to purchase or refinance.

- No principal paydown during the IO period

- Pay off your mortgage as you see fit (yes, really)

- IO periods of 5, 7, or 10 years

- Options for purchase, RT refi and cash-out

Give yourself some breathing room. Explore Interest-Only, okay?

Defy Mortgage Interest-Only Loan Options

- Max Loan Amount: Up to $6,000,000

- Min Loan Amount: $150,000

- Max LTV (Purchase & R/T Refi): Up to 90% | Up to 80% LTV C/O refinance

- Min FICO: As low as 640

- Property Types: Single Family (SFR, PUD, Town Home, Row Home, Site Built Condo, Modular Home), Condominium (Warrantable Condo, Non-Warrantable), Co-ops and Condotels, and 2-4 Units

- Loan Types: Purchase, Rate/Term Refinance, and Cash-out Refinances available for Primary, Second, and Investment Properties (see our Refinance Page to learn more about Refinances on a general sense)

- State Licensing: Defy Mortgage is licensed and able to process Interest-Only Loan Options in the following states: Alabama (AL), California (CA), Colorado (CO), Florida (FL), Georgia (GA), Tennessee (TN), and Texas (TX)

- Fixed Rates: Periods of 5, 7, or 10 years

- 30-Year or 40-Year Loan Amortization: After the IO period, the loan amortizes over the remaining term (30 or 40 years).

- Alternative Income Documentation:

- 1 Year Tax Return with a Year-to-Date Profit and Loss Statement

- 1 Year W2 with check Paystub

- Bank Statements (12 or 24 months Personal or Business)

- CPA prepared 12 12-month P&L validated with 2 months of bank statements

- CPA prepared 12-month P&L Only (with a 700+ score)

- 1 or 2 Year 1099 Document Only

- Asset Depletion or Asset Utilization

Important Note: The specific max LTV, loan amount, and DTI will vary based on your credit score and occupancy type.

FREE UP SOME CASH: Opt for Interest-Only

Interest-Only Loans allow borrowers to pay only the interest on the loan for a set period of time, with fixed rates and no requirement for a principal paydown. Following that period, you can either refinance, pay the remaining balance in full or begin making regular monthly payments.

So, basically if you’re getting paid once a quarter, don’t sweat it. See for yourself. Hit us up for a customized quote. No obligation ever.

Loan Options for Commissioned Employees

Contract workers, entrepreneurs, business owners, annual or quarterly paid employees… WHATEVER, interest-only options are gold for those who want flexibility in principal reduction payments or peeps expect an increase in income within the near future. Want to learn more? See below.

Interest-Only Option FAQs

How long do you pay only the interest on an Interest-Only option?

The initial interest-only period on an interest-only mortgage depends on the specific loan terms. However, common interest-only periods are 5, 7, or 10 years.

Check out more on P&L loans in our Complete IO Loan Guide!

How do Interest-Only loans work?

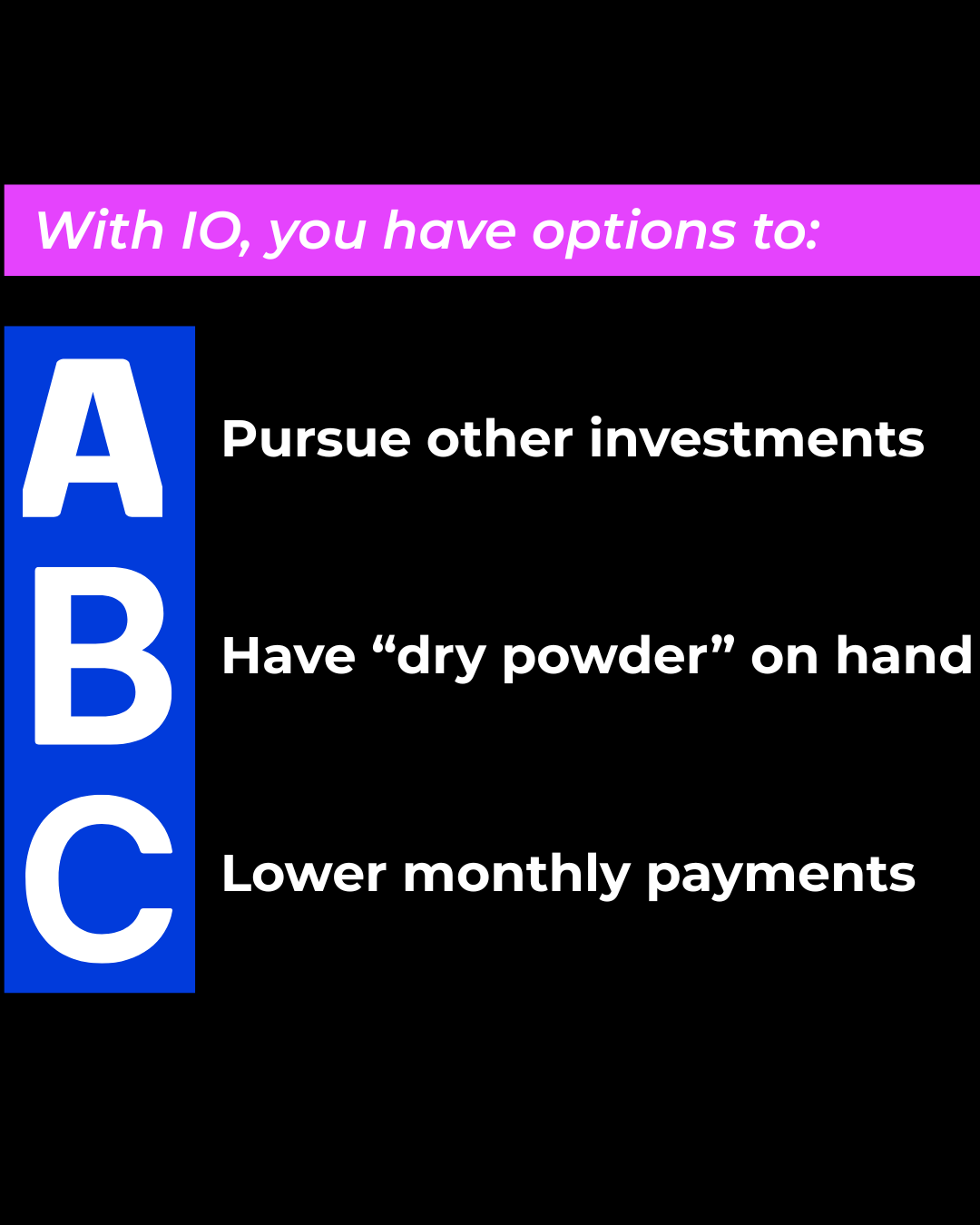

Interest-only loans split into two phases: interest-only (up to 10 years), then interest + principal. During phase one, payments cover interest alone—zero principal, zero equity build. But that's the point. The cash you're NOT throwing at principal? Deploy it however you want: stack reserves, fund other investments, grow your business, or keep it liquid for the next move.

Who should get an Interest-Only loan?

These loans ideal for those who want flexibility in principal reduction payments or expect an increase in income within the near future. This could include: self-employed individuals, freelancers, high-net-worth individuals, contract workers, entrepreneurs, business owners, annual or quarterly commission-based employees, real estate investors and more. These loans are also an excellent choice for borrowers who are looking for a way to free up cash, planning to sell or refinance within a short timeframe, or expecting to come into money before the end of the interest-only period.

Is an Interest-Only option a good idea?

Interest-only loans keep more money in your pocket. With lower monthly payments, you free up cash to pay down debt, invest in your business, or pursue other opportunities—all while owning your home. Speak to a lender about your options and see if one is right for you.

Are Interest-Only loans for real estate investors too?

Yes, Interest-Only loans are also for real estate investors who are looking to purchase an investment property, refinance or take cash out of an investment. Keep in mind that LTV can depend on occupancy type. For example, at Defy Mortgage we offer up to 85% LTV IO options for those with a 700+ FICO and a loan amount up to $1.5M, however, this is only for primary residences.

Have more questions on IO loans? We are here to help. Hit us up!

Does Defy Mortgage offer Interest-Only loans in Tennessee?

Yes. Defy Mortgage is licensed and able to process Interest-Only Loan Options in the following states: Alabama (AL), California (CA), Colorado (CO), Florida (FL), Georgia (GA), Tennessee (TN), and Texas (TX).

Fixed rates, zero mandatory paydown. When the term ends, refinance, cash out, or go traditional. You decide.

When the interest-only period ends, payments jump—you’ll start covering principal too. This means larger monthly payments. OR you don’t. Refinance, sell, or pay off the balance. Totally and completely your call. You’ve got options. Pretty cool, huh?

Still unsure of exactly what you need? No worries. JUST ASK US!

Date the rate, marry the property, hit up Defy...

State Licensing

Defy Mortgage is licensed in the following states: Alabama (AL), California (CA), Colorado (CO), Florida (FL), Georgia (GA), Tennessee (TN), and Texas (TX)