If you’re a real estate investor looking to take advantage of a tightening rental market, look no further than Kentucky. In 2019, Kentucky’s rental vacancy rate was 8.5%, but by 2023, it had dropped more than half to a whopping 3.5%. The steadily falling vacancy rates indicate a growing demand for rental properties in the Bluegrass State.

But how can you finance rental properties and expand your real estate portfolio without the strict requirements of conventional loans holding you back? This is where a DSCR loan Kentucky can be a groundbreaking tool to help you achieve your real estate investor dreams.

In this guide, we’ll be going over what you need to know before getting a DSCR loan in Kentucky to see if it’s right for you and your investing strategy.

What Are DSCR Loans?

DSCR loans, also known as debt-service coverage ratio loans, are a type of real estate financing option that bases qualification on the property’s income instead of your personal income. This makes it easier to qualify for a loan on an investment property without the limitation of your personal income, especially for those who have non-traditional income sources.

Since DSCR loans don’t use personal income as part of the approval process, they’re considered to be non-QM (non-qualified mortgage) loans. Non-QM loans aren’t required to follow the strict lending criteria set by the Consumer Financial Protection Bureau (CFPB).

How Does a DSCR Loan Kentucky Work?

To qualify for a DSCR loan, your property needs to be generating enough income to cover its own debt payments. This is why most DSCR lenders don’t need to look at your personal income – the rental property can pay for itself. Not to mention that there’s no hard limit on how many DSCR loans you can have, which simplifies portfolio expansion.

Calculating Your Property’s DSCR

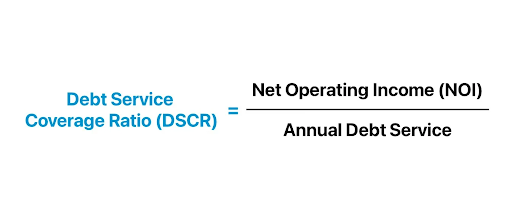

To calculate your property’s DSCR, you’ll need to calculate your property’s net operating income (NOI) first by subtracting your operating expenses from the property’s rental income. Next, divide the NOI by the annual debt payments to get to the property’s DSCR.

Here is a simplified version of the formula:

Interpreting Your Property’s DSCR

A DSCR of 1.0 or over means that the property can pay for itself, but most lenders still require a minimum DSCR of 1.25 or higher. At Defy, we allow DSCRs as low as 0.75.

Why Scale Your Kentucky Rental Portfolio Using DSCR Loans

It’s an ideal time to scale your rental property portfolio with Kentucky’s growing population and strong real estate market. In 2023, the population reached 4.53 million, up 0.32% from the previous year, fueling demand for housing. With the median rent price rising to $1,365 in October 2024 – $114 higher than last year – rental income potential is increasing. Additionally, Kentucky’s average home value has jumped 4.3% to $207,759, with properties going to pending in just 14 days.

If you’re an investor who’s been thinking of buying rental property in Kentucky, a DSCR loan can be the perfect way to finance your next venture.

What Types of Properties Can I Buy With a DSCR Loan?

With a DSCR loan, you can buy a several different types of properties, including:

- Single-family properties

- Multi-family properties

- Vacation homes

- Short-term rentals (e.g., Airbnb, Vrbo, etc.)

- Commercial properties

While you can get a DSCR loan for these different property types, keep in mind that the property will still need to meet the lender’s DSCR requirements to qualify.

DSCR Loan Kentucky Pros and Cons

Pros:

- No personal income documentation required (e.g., tax returns, W2s, pay stubs)

- Qualify mainly by using your property’s rental income

- No hard limit on how many DSCR loans you can have

- Scale your real estate portfolio without the limitations of your personal income

- More flexible qualification requirements and terms

Cons:

- Limited availability

- Potential to be over-leveraged

- Income fluctuations (e.g., unexpected vacancies) could make it difficult to meet loan obligations

Qualification Requirements for a DSCR Loan Kentucky

Every lender sets their own DSCR loan requirements, which means they can vary significantly depending on which lender you choose. While we can’t provide other lenders’ requirements, his is what we require at Defy for our DSCR loans:

- Minimum DSCR ratio of 0.75

- Minimum FICO score of 620+

- Maximum LTV of 85%

- 3 months cash reserve

- No maximum loan amount

- No income documents or tax returns

- Interest-only options available

DSCR Loan Kentucky Interest Rates

Compared to conventional rates, DSCR loan interest rates tend to be slightly higher because of the alternative income verification. While a higher rate isn’t ideal for most people, investors often find that the higher rate is worth it for exposure into the real estate market. With property prices continuing to increase each year, a DSCR loan gives you the opportunity to enter the market before prices get even higher.

DSCR Loan Kentucky Down Payment Requirements

Minimum DSCR loan down payment requirements vary by lender, but you can usually expect to put down anywhere between 15-25% for a DSCR loan depending on your credit score. At Defy, we require a minimum down payment of 15%.

DSCR Lenders in Kentucky

Choosing the right DSCR lender can be a pivotal choice when you’re thinking of your next investment. When searching for lenders, be sure to find one that offers above-and-beyond customer service and has experience with DSCR loans in Kentucky’s rental market.

At Defy, our mortgage experts provide personalized advice, along with tailored loan solutions, so you always get the best fit. Don’t settle for average when you can get a smooth, top-tier mortgage experience with Defy. Schedule a free consultation or give us a ring at (615) 622-1032 to speak with one of our mortgage experts.

DSCR Loan Kentucky Alternatives

If a DSCR loan isn’t right for you, consider these other non-QM loan alternatives that we also offer at Defy:

- Bank Statement Loan: Use your bank statements to qualify.

- P&L (Profit & Loss Statement) Loan: Use your business’ CPA-produced P&L statements to qualify.

- Asset Depletion Loan: Use your liquid assets to qualify.

- Fix-and-Flip Loan: Qualify based on historical experience to flip a property for a profit.

- Construction Loan: Qualify based on historical experience and/or construction plans to build a property from the ground up.

DSCR Loan Kentucky FAQs:

- What is a DSCR loan?

A DSCR loan, also known as a debt-service coverage ratio loan, is a real estate financing option that allows you to qualify for a mortgage based on the property’s income instead of your personal income. These loans are typically used to fund rental properties where cash flow is a key factor.

- How can I calculate my property’s DSCR?

To calculate your property’s DSCR, first take the rental income and subtract your operating expenses from it to arrive at your net operating income (NOI). Then, divide the property’s NOI by its total loan payments to get its DSCR. A DSCR that’s greater than 1.0 means that the property makes enough income to cover its debt.

- What DSCR is required for a DSCR loan Kentucky?

The minimum DSCR required depends on each lender, but most lenders require a DSCR of at least 1.25 to qualify. However, some lenders, like us at Defy, only require a minimum DSCR of 0.75.

- What types of properties can I finance with a DSCR loan Kentucky?

You can use a DSCR loan in Kentucky to finance several different types of investment properties. From single-family and multifamily homes to Airbnb and commercial properties, as long as it generates income, it may qualify.

- Can I finance multiple properties using DSCR loans?

Yes! You can finance multiple properties using DSCR loans as long as each property can meet the lender’s DSCR requirements. There’s no hard limit on how many DSCR loans you have, making it easier for investors to grow their portfolios.

- Do I need tax returns to qualify for a DSCR loan?

No, tax returns aren’t usually required to qualify for a DSCR loan since approval is based on the property’s income rather than your own.

- What are the credit score requirements for a DSCR loan Kentucky?

Credit score requirements may vary by lender, but at Defy, we require a minimum FICO score of 620 or higher. Keep in mind that higher credit scores can often help you secure better loan terms.

- How are DSCR loan interest rates compared to conventional rates?

DSCR loan interest rates are usually slightly higher than conventional loans, but the exact rate could depend on the lender, your credit score, and the current mortgage rates.

- Can I refinance one of my rental properties with a DSCR loan Kentucky?

Yes! You can refinance an existing rental property with a DSCR loan in Kentucky. This could be a good strategy to access better terms or pull cash out of your investment based on the property’s cash flow.

- Can I get a DSCR loan Kentucky for short-term rentals like vacation homes or Airbnb?

Yes! DSCR loans can be used to finance short-term rental properties like vacation homes or Airbnb, as long as the rental income supports the required DSCR.