Buying your first home can be a major source of excitement, but it can also be overwhelming if you’re unfamiliar with your financing options. This can be especially true in Maine, where median home prices just broke $400,000 for the first time in 2024. In these market conditions, an FHA loan Maine can present the best opportunity for homeownership, with their flexible terms and lower credit and down payment requirements.

At Defy Mortgage, we provide a simplified and streamlined home-buying process with our range of over 75 traditional and non-traditional lending options. Each solution can be tailored to the unique needs of virtually every type of borrower, whether you’re a self-employed individual, entrepreneur, or real estate investor. Although we do not currently offer FHA loans in Maine, our FHA offerings are available in states such as Alabama, California, and Texas.

Using our long-standing industry experience, we’ve put together this guide. In it, we will explore the key advantages of an FHA loan in Maine, eligibility criteria, and steps to take toward securing one.

Let’s get started.

Eligibility Criteria for FHA Loan Maine

An FHA loan Maine requires borrowers to meet certain eligibility criteria to qualify. Most lenders look for a minimum credit score, which will affect the down payment amount. However, FHA requirements are more lenient, allowing even those who have experienced bankruptcy to qualify.

Minimum Credit Score Requirements

FHA loans generally require borrowers to have a FICO score of at least 580 if they want the minimum down payment option. Lenders may still allow borrowers to get an FHA loan if they have a credit score between 500 and 579, but they must make a bigger down payment.

Down Payment Requirements and Options

FHA loans allow buyers to put down as little as 3.5% of the home’s purchase price if they have a credit score above 580. If you have a credit score between 500 and 579, you may still get approved for an FHA loan, but you’ll need to put at least 10% down.

However, keep in mind that individual lenders may have their own overlay requirements on top of the ones that the FHA prescribes, so you may need a higher score than 580 to avail of the lowest interest rate, which may not be 3.5% as well. Remember to check with your lender to determine how much they diverge from the FHA’s guidelines.

In most cases, however, the maximum interest rate you’ll have to pay is 10%, much better than the usual 20-25% you need to put down for conventional loans. Maine also has programs that enhance home loans for first-time home buyers (remember that the federal government defines “first-time homebuyer” as someone who has not had ownership interest in the last 3 years). These include the MaineHousing First Home Loan Program, combined with an FHA, RD, or VA loan to serve as a down payment and closing cost assistance, significantly reducing the upfront cost of owning a home.

Preparing to Apply for an FHA Loan in Maine

Preparation is key to ensuring a smooth application process for an FHA loan. Here’s what you need to do before you apply.

Necessary Documentation and Information

FHA lenders ask for certain documents to ensure you can pay off your mortgage. Gather these key documents early on to save you from delays:

- Proof of Income: You may need to provide recent pay stubs to demonstrate your ability to repay your FHA loan. Profit & loss statements or 1099 forms can be used for self-employed applicants or contract workers.

- Credit Report and History: Many lenders will ask permission to pull your credit history, but you can hand them your credit report directly to speed up the process.

- FHA Appraisal Report: Lenders typically order the property appraisal from an FHA-approved appraiser. They usually hand the finished report to the lender directly, but it also helps to keep a copy to give to the lender yourself in case the appraiser is delayed in submitting the report.

- Other Financial Documents: You may also be asked to submit bank statements or federal tax returns so your lender can better understand your finances and liquidity. If you purchase a multi-family unit to rent out, you must also submit a self-sufficiency rental income analysis to demonstrate that the property makes enough rental income to cover monthly mortgage payments.

The full list of required documents can vary between private lenders, so make sure to check with your chosen lender to find out what specific documents they require.

Assessing Your Financial Readiness

Before applying, it’s essential to understand your financial situation thoroughly. Review your debt-to-income ratio (DTI), which FHA loan lenders generally prefer to be under 43%, although some can make exceptions for those with fair credit. You should also remember that the Federal Housing Administration requires borrowers to get private mortgage insurance to reduce the risk they take with an FHA loan further.

The mortgage insurance requirement for an FHA loan consists of two types of premiums:

- Upfront Mortgage Insurance Premium (UFMIP): A one-time fee, typically 1.75% of the loan amount, paid at closing or rolled into the loan balance.

- Monthly Mortgage Insurance Premium (MIP): An ongoing premium added to your monthly payment, calculated based on loan size, term length, and loan-to-value ratio.

This fee provides the lender immediate protection, especially for smaller down-pay loans. In addition to the upfront premium, borrowers will pay the MIP monthly, which helps secure the loan over time. The exact cost of this monthly premium will depend on factors like loan size, term length, and loan-to-value ratio.

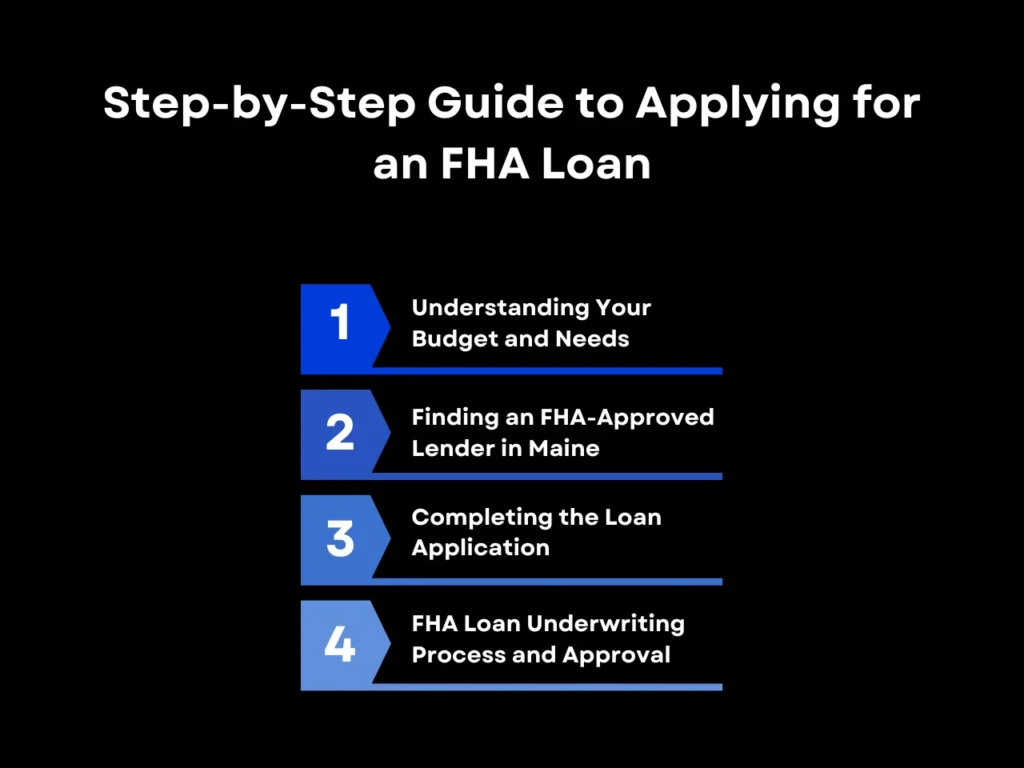

Step-by-Step Guide to Applying for an FHA Loan

Once you have your documents ready and finances in order, it’s time to start the application process. Here’s a step-by-step guide to help you along your journey.

Step 1: Understanding Your Budget and Needs

FHA loans can cover many property types, but the maximum amount you can purchase each type varies. The FHA also sets limits depending on the county, as real estate prices can differ vastly between counties.

Most counties in Maine have median home sale prices lower than 65% of the national conforming loan limit, so the FHA’s floor limit of $498,257 for single-family units, $637,950 for duplexes, $771,125 for triplexes, and $958,350 for fourplexes applies. However, in Cumberland, Sagadahoc, and York counties, home prices have ballooned above $400,000–a record high–and thus, the limits in these counties are $546,250 for single families, $699,300 for duplexes, $845,300 for triplexes, and $1,050,500 for fourplexes.

Step 2: Finding an FHA-Approved Lender in Maine

Once you’ve settled on a property type and location that fits your budget, the next thing to do is to find an FHA-approved lender. Different lenders may offer varying interest rates and terms, so comparing options is essential. The HUD’s lender list is a great search tool for finding and comparing lenders.

Local lenders are often best for FHA loans, as they’re often the most well-versed in the local market. This familiarity makes them better equipped to provide fairer terms and additional guidance and resources for home loans in the state. They are also more likely to participate in first-home buyer programs unique to Maine.

Step 3: Completing the Loan Application

The FHA loan application process involves completing forms with details about your income, debts, and employment. Review all application sections carefully to avoid errors, which could delay the approval process. If you have co-borrowers, ensure they fully understand the loan terms before they sign off on the application.

Step 4: FHA Loan Underwriting Process and Approval

Once you submit your application, it will go through underwriting, where an underwriter will assess your financial stability and eligibility for the loan. This is also the phase in which the lender will order the FHA appraisal. Make sure the home you want to purchase meets the HUD’s guidelines so you don’t have to pay for any repairs later on.

Depending on the lender, the process can take a few weeks, but having all documents in order may speed up the decision. Once complete, the FHA will transfer the purchase funds to the seller, who will hand you the keys to your home.

FHA Loan Maine FAQ

Who qualifies for an FHA loan in Maine?

Anyone with a credit score of at least 580 and intending to purchase an eligible property can take out an FHA loan. However, some lenders may require that borrowers have a debt-to-income (DTI) ratio under 43% to ensure they won’t get overwhelmed with debt payments and fail to pay off their mortgage.

Can I buy a home in Maine with a low down payment through FHA?

Yes, FHA loans allow down payments as low as 3.5% for those with a credit score of at least 580. However, individual lenders may have their own rules in addition to what the FHA prescribes.

What are the current FHA loan limits in Maine?

For 2024, the loan limits in most Maine counties are $498,257 for single-family units, $637,950 for duplexes, $771,125 for triplexes, and $958,350 for fourplexes. Cumberland, Sagadahoc, and York are exceptions, and their limits are $546,250 for single families, $699,300 for duplexes, $845,300 for triplexes, and $1,050,500 for fourplexes to account for higher home prices.

Can you use an FHA loan to flip a home?

Yes, but not immediately, and you will have to move temporarily. FHA loans are designed for owner-occupied properties and thus require the borrower to live in the home for at least 12 months. In the meantime, you can use an FHA 203(k) loan to fund renovations for the house.

Can you use an FHA loan to buy a rental property?

Yes, but it will have to be at least a two-family unit, and you will have to live in one of the units. Single-family homes with one-room rentals don’t count. You must also submit a self-sufficiency report to verify that rental income is enough to cover mortgage payments.

Key Takeaway

FHA loan Maine can be one of the most accessible and flexible pathways to homeownership in the state. Its benefits extend beyond low down payments, including non-occupying co-borrowers, gift funds, and assumable loans. You can even use an FHA loan to finance developments that give tax credits, such as FHA Energy-Efficient Mortgage Loans for energy-saving developments and the FHA 203(k) program for general renovations.

To get the most out of an FHA loan in Maine, make sure you’re financially ready with an ideal debt-to-income ratio and credit score. It’s also imperative to prepare your budget for mortgage insurance and be aware of the loan limits in the county you want to move into. When selecting a home, remember to focus on properties that meet the FHA’s appraisal standards to avoid having to pay for costly repairs later on.

Are you or anyone you know interested in taking out an FHA loan or refinance in Alabama, California, Colorado, Florida, Georgia, Oregon, Tennessee, or Texas? Contact Defy today to learn more about your FHA mortgage options. Although we do not currently offer FHA loans in Maine, we do offer FHA loans in a variety of other states.