Real estate investors, particularly those interested in short-term, high-yield opportunities, often turn to fix and flip loans to finance their projects. This specialized loan type provides quick access to capital for purchasing and renovating properties, allowing investors to improve and sell them for a profit. A fix and flip loan Texas excels at generating great returns thanks to the state’s ever-growing residential demand.

Defy Mortgage provides a seamless, streamlined experience for real estate investors, homebuyers, freelancers, and business owners. Specializing in non-traditional financing options like DSCR loans and bank statement loans, we’ve helped real estate investors across the US realize their goals and reap excellent returns.

From our comprehensive experience in guiding both seasoned and beginner flippers through the fix-and-flip process, we’ve crafted this blog to go over the essentials of fix and flip loans in Texas. We’ll talk about the requirements to qualify for one, and we’ll break down the steps to follow to get the most out of this type of financing.

Read on to learn all you need to know about house flipping loans in Texas.

What is a Fix and Flip Loan Texas?

A fix and flip loan in Texas is a short-term financing solution designed for investors who purchase, renovate, and sell properties in Texas within a limited timeframe, typically six to 24 months. It provides flexible financing for real estate investors who intend to develop and sell properties quickly.

Fix-and-flip loans often take various forms, including hard money fix and flip loans, bridge loans, business lines of credit, and private loans. These loans provide faster access to funds compared to traditional financing. However, they also tend to have higher interest rates than conventional loans.

Despite these sometimes higher interest rates, however, fix and flip loans can be more manageable due to the short duration. Plus, these loans can also be structured with interest-only payments, further easing cash flow for investors during the renovation phase. Texas fix and flip loans can give borrowers the agility to quickly capitalize on property deals, which can be invaluable in the state’s dynamic property markets.

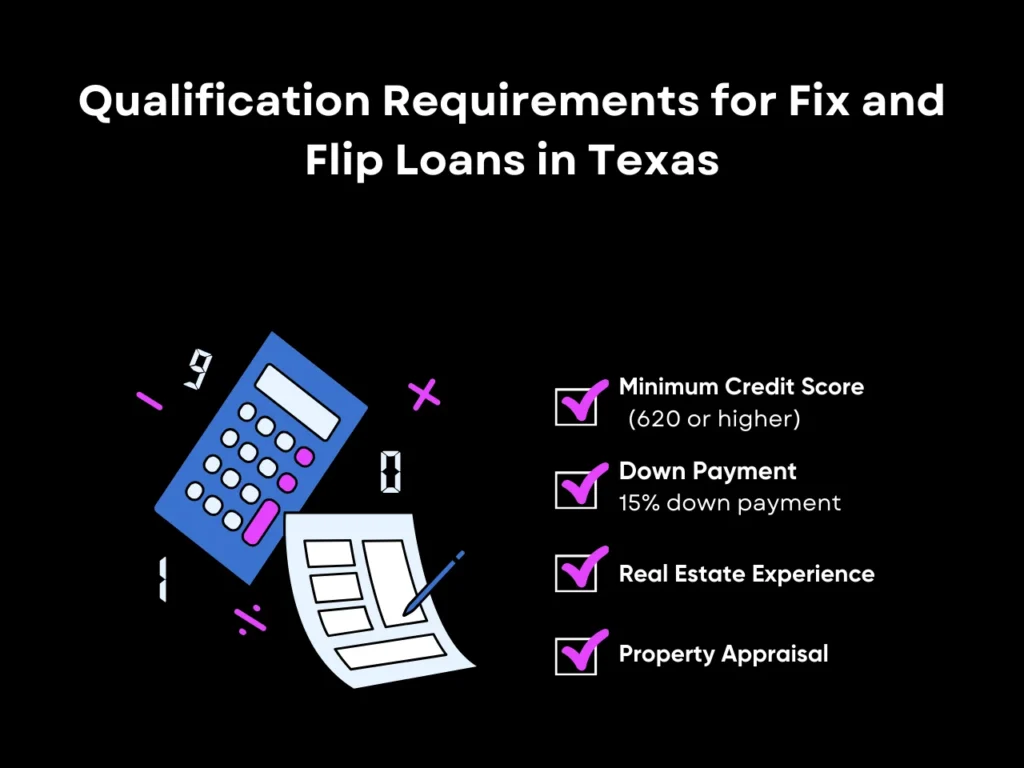

Qualification Requirements for Fix and Flip Loans in Texas

To secure a fix and flip loan in Texas, borrowers typically must meet several requirements. These typically include a minimum credit score, real estate investing experience, and enough capital for the down payment. Most lenders also require borrowers to formulate project plans to ensure successful and profitable resale.

Minimum Credit Score

Lenders generally look for a credit score of 620 or higher. Although private lenders may have more flexibility, keeping your FICO score no lower than 620 is generally better for accessing ideal terms, such as ideal rates and LTV ratios.

Down Payment

Most lenders agree to an up to 85% loan-to-purchase ratio, meaning that they’re willing to cover 85% of the purchase of a property, leaving the borrower to put down at least a 15% down payment. However, some lenders may ask for up to 20% or more so it’s important to check with each lender about their down payment requirements as they vary.

Most lenders usually cover all renovation expenses, so they don’t have to be rolled into the down payment, but they usually implement construction draws, in which they control the distribution of funds for all the work that needs to be done. Lenders can decide to hold the money back until work is underway, with some lenders only disbursing funds once a particular renovation has been completed. Be sure to ask your lenders about renovation expenses before making any decisions.

Real Estate Experience

Some lenders prioritize borrowers with a solid history of successful flips, as fix and flip loans are typically considered high-risk. A solid real estate investment track record, particularly in fix and flip projects, can potentially increase your likelihood of getting approved with good loan terms. This isn’t a given, but important to note. Ensure your portfolio contains clear evidence of your acquisitions, renovation expenses, and successful sales.

Property Appraisal

While some lenders may approve fix and flip loans even to borrowers without a concrete business plan, borrowers are still required to have the property assessed to determine its initial value and what renovations are needed to make it liveable and add resale value. Borrowers are expected to come up with an accurate estimate of renovation costs and what each renovation adds to the home’s value.

The sum of the initial value and the value added by the renovations is known as the after-repair value (ARV), which the property is expected to be resold on the market for. Lenders often base the final loan amount on the property’s ARV, which factors into whether or not a fix-and-flip loan is approved.

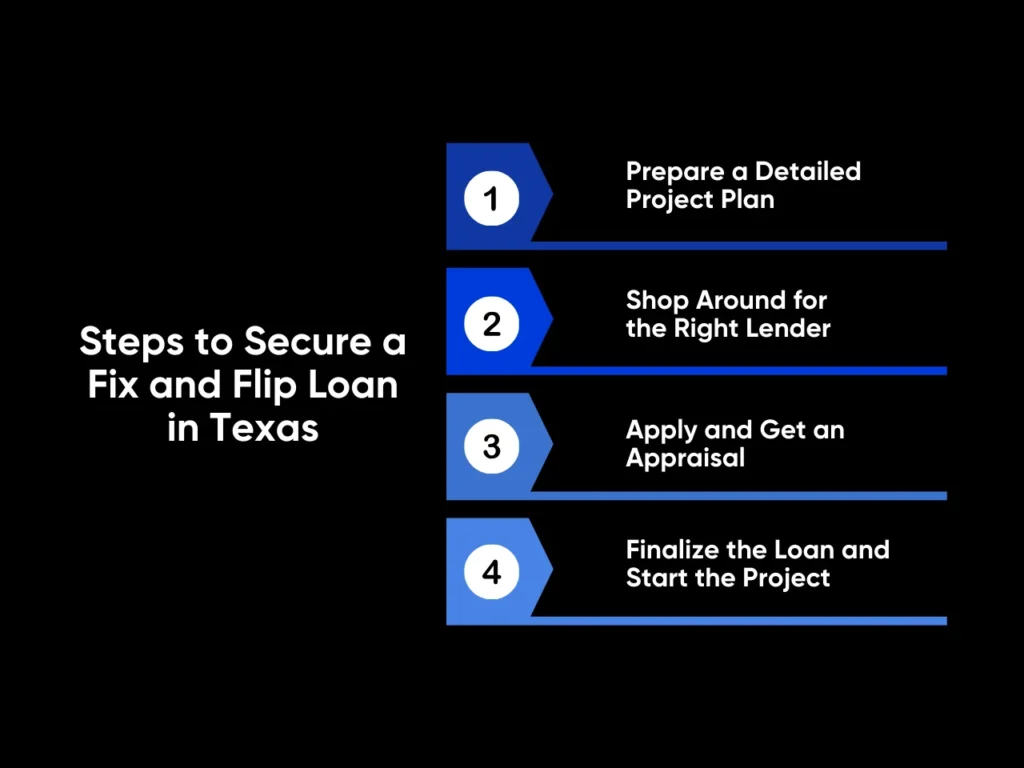

Steps to Secure a Fix and Flip Loan in Texas

After you’ve identified a property that’s a good candidate for a fix and flip, you can obtain financing for your investment. Securing a fix and flip loan Texas involves taking several key steps:

Step 1: Prepare a Detailed Project Plan

Before looking for a lender, it’s best to have a project plan detailing how you intend to make the property marketable and profitable. Unlike traditional mortgages, fix and flip loans focus on the sale potential of a property rather than the borrower’s personal financial history. Presenting a thorough project plan allows you to demonstrate that the fix-and-flip can be completed successfully and with an ideal ARV and property potential.

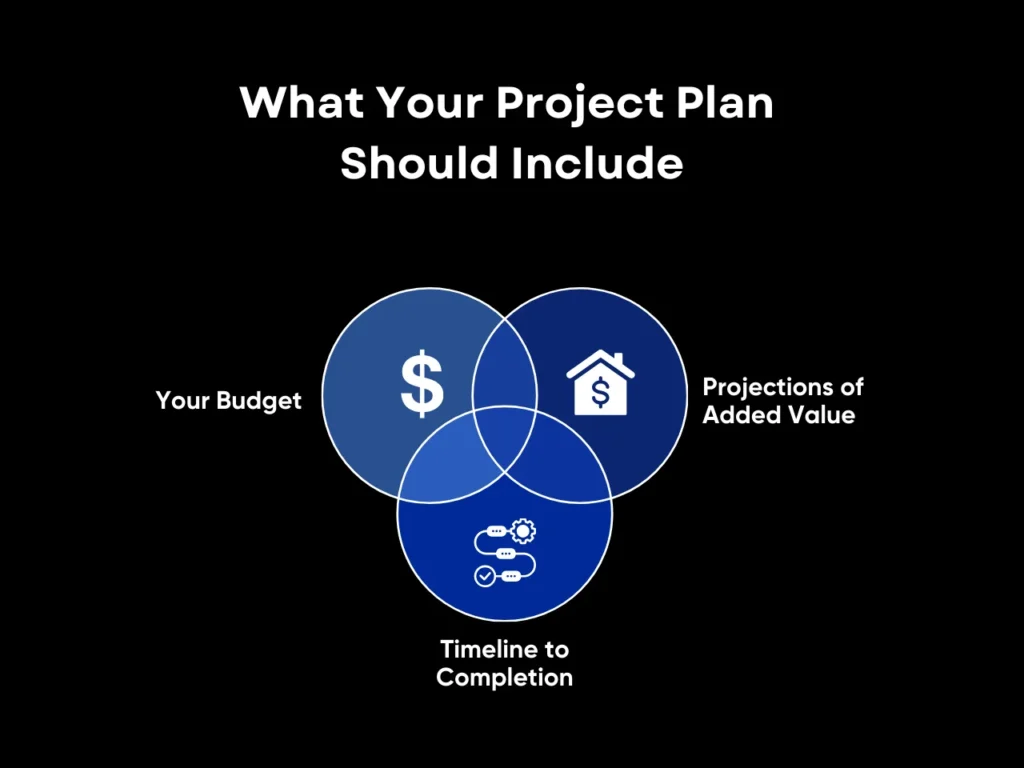

What Your Project Plan Should Include

- Your Budget: Create an itemized breakdown of each planned renovation’s cost, allowances for carrying costs, or the costs associated with holding on to a property before resale, closing, and marketing costs. Accurately itemizing renovations will be vital to getting the optimal construction draw plans for a smooth renovation process.

- Projections of Added Value: Each planned renovation item should also come with an estimation of how much it adds to the property’s potential resale value. This will add to a projected ARV, one of the most significant deciding factors in loan approval.

- Timeline to Completion: Fix and flip loans are short-term loans, meaning lenders expect the project to be completed and the home up for resale in a relatively short timeframe. Providing a detailed timeline for each renovation item can increase lender confidence that you can accomplish that.

Step 2: Shop Around for the Right Lender

Texas offers a variety of local lenders that cater to real estate investors, but not all may be experienced in fix and flip financing. Make sure to look into a lender’s track record and area of specialization to determine whether they’re versed in the ins and outs of investment property loans, particularly fix and flip loans in Texas.

A good rule of thumb is whether they’ve had success with fix and flip projects in both busy parts of Texas, like around Austin and Georgetown, as well as cooler housing markets like San Angelo and Baytown. It also helps to ask other flippers in the area for their recommendations.

Step 3: Apply and Get an Appraisal

Submit your application and schedule a fix and flip appraisal. This is the step where a qualified appraiser will verify your estimated ARV based on the potential. The appraisal should arrive at an ARV accurate to your initial estimate; otherwise, the loan amount may be adjusted, or the likelihood of approval could be affected.

Step 4: Finalize the Loan and Start the Project

Once underwriting is complete, you can close the loan, purchase the property, and renovate. Most lenders require you to stick to the schedule you agreed upon during the loan application, so make sure each stage of the renovation begins and ends in the timeframes you specified.

Keep in mind that private lenders’ preferences can vary widely, especially with hard money loans like fix and flip loans. Some have specific insurance requirements, while others require borrowers to form an LLC before they begin renovations.

Fix and Flip Loan Texas FAQ

What is the average interest rate on fix and flip loans in Texas?

Interest rates on fix and flip loans in Texas often range from 9.5% to 12% but can vary depending on the lender and loan structure. Be sure to ask each lender about their interest rates before deciding on which lender to use.

How much down payment is typically required for a fix and flip loan?

Most lenders require a down payment of 15-20%. However, this is only a percentage of the property’s purchase price before all renovations have been made. Lenders typically cover 100% of the renovation costs, meaning they’re not rolled into the down payment, but this isn’t always the case. Be sure to ask each lender about down payment requirements and renovation costs as they vary.

Can I get a fix and flip loan Texas with no prior experience?

Yes, though being an experienced real estate investor can improve approval odds and give you better loan terms. New investors can still qualify by preparing detailed project plans that exhibit a sound overall strategy. A good project plan should include a budget that accounts for the cost and resale value added by each renovation and a realistic timeline for the work that needs to be done. It also helps to choose lenders that are more open to beginners.

How is the After-Repair Value (ARV) used to determine my loan amount?

ARV influences the loan amount by assessing the property’s expected value after renovations. Lenders typically base loan-to-value (LTV) ratios on the ARV.

What fees are typically associated with fix and flip loans in Texas?

Fix and flip loans often have fees beyond interest rates. Common charges include origination fees (1-3% of the loan amount), closing costs, and appraisal fees. Additionally, some lenders may require inspection fees during renovation milestones and prepayment penalties if the loan is paid off early. Make sure to ask your lender about this when considering fix and flip loans in Texas.

Key Takeaway

A fix and flip loan Texas is one of the most effective financial tools for seizing valuable short-term opportunities in one of the most competitive real estate markets in the US. With flexible terms and the potential for high returns, these loans are ideal for individuals ready to take on the renovation and resale process.

However, success can hinge on preparing a comprehensive project plan. Along with choosing the right lender, exhibiting that you have done your due diligence in identifying which renovations can lead to the most resale value can be what tilts lender confidence in your favor. Realistic budget, timeline, and after-sale value projections are essential components of this.

Ready to learn more about investment property loan options? Talk to Defy today, and let’s discuss which financial solution best fits your investment goals, whether it’s a fix and flip loan, DSCR loan, jumbo loan, or conventional loan.