With an effective property tax rate of just 0.49% and single-family home prices rarely breaking the $300,000 mark, West Virginia is one of the most affordable places to purchase an investment property in the United States. Real estate investors have a lot to gain from entering the real estate market in the Mountain State, with its picturesque views, popular tourist destinations, and coveted vintage properties. With a debt service coverage ratio loan or DSCR loan West Virginia, both new and seasoned property investors can tap into these benefits and create a strong portfolio in one of the lowest cost-of-living states in the country.

At Defy Mortgage, we specialize in simplifying the mortgage process for individuals with unconventional sources of income, such as real estate investors, freelancers, self-employed individuals, contract workers, and business owners. With our 75+ non-traditional mortgage products, including DSCR loans, bank statement loans, and foreign national loans, we have helped lots of borrowers from the US and beyond reach their investment goals.

Drawing from our experiences in providing DSCR mortgage services to all types of borrowers, we’ve written this beginner’s guide to give you everything you need to know about DSCR loans in West Virginia. We’ll go over how this type of loan gives investors an edge, discuss the requirements, and break down the steps to quickly get approved for a DSCR loan with ideal terms.

Why Consider DSCR Loans in West Virginia?

The main benefit of a DSCR loan West Virginia is that you don’t need to present proof of income to qualify. Aside from that, it offers several advantages that make real estate investment much more convenient, especially for individuals with irregular incomes, like freelancers and entrepreneurs.

Below we’ll cover the key factors that make a DSCR loan West Virginia an attractive option for some buyers.

No Need for Personal Income Verification

Skip the hassle of sharing tax returns or personal income documents. DSCR loan qualification relies on the property’s rental income instead of the borrower’s. This makes it easier to secure financing if you have an irregular income.

Quick Processing and Approval

Since DSCR loans tend to require less documentation than conventional mortgages and many other loan types, the loan approval process can be much faster, especially if the necessary documents are prepared ahead of time. This makes it perfect for capitalizing on tight investment windows, which can be common in the competitive commercial real estate market of West Virginia.

Access to Larger Loan Amounts

Since DSCR loans use the property’s income as the primary determiner of loan terms, you can potentially get a much larger loan than you would have been able to with a conventional investment property loan.

Flexible Investment Opportunities

DSCR loans are compatible with a wide range of properties, from residential to commercial and mixed-use. There’s no limit to how many DSCR loans you can have active at a time, so as long as your property and portfolio DSCRs are at ideal levels, you can use DSCR mortgages to rapidly expand your real estate portfolio.

Next, we’ll go over what you need to qualify for a DSCR loan in West Virginia.

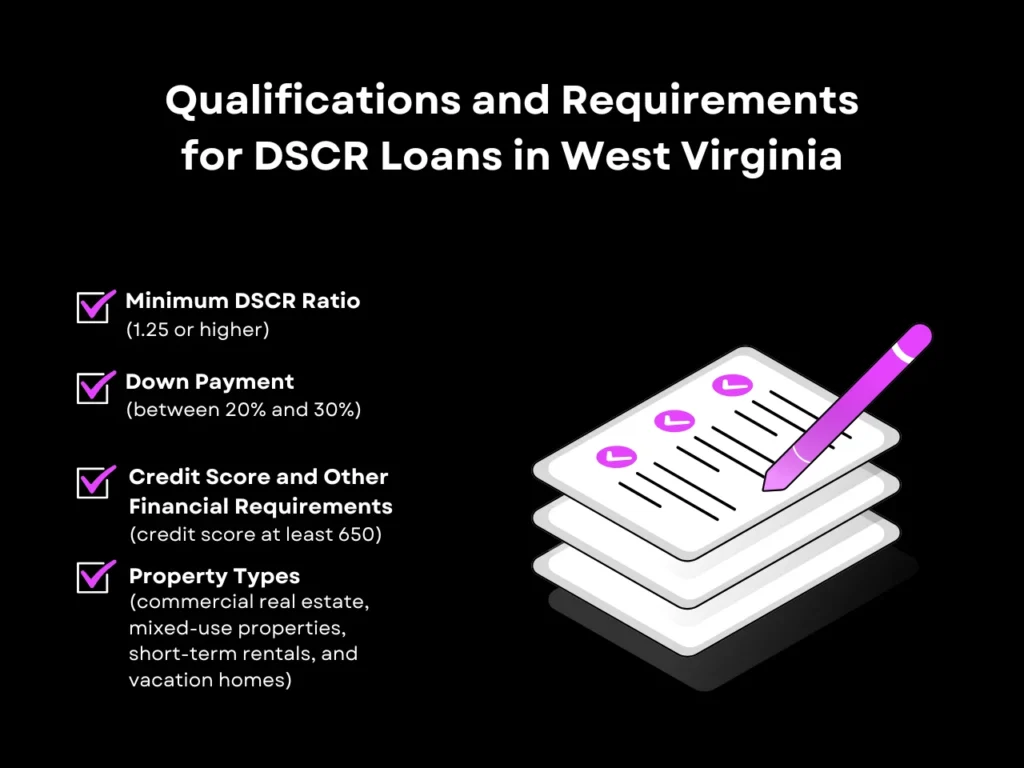

Qualifications and Requirements for DSCR Loans in West Virginia

DSCR loans mainly depend on the property’s DSCR, which must be proven by submitting revenue and expense records and conducting an appraisal. Depending on the property’s DSCR, mortgage lenders may also ask for further financial details about the borrower. Below we’ll discuss the key requirements lenders will look for.

Minimum DSCR Ratio

DSCR, or debt service coverage ratio, is the ratio between a property’s yearly net operating income, or income after all operating expenses have been deducted, and its total debt service, or how much it has to pay per year in mortgage payments and other fees such as property tax, insurance and homeowner’s association dues.

Most lenders look for a DSCR of 1.25 or higher, meaning that the property has to be profiting at least 25% more than it needs to pay in debt payments. Some private lenders might approve borrowers looking to finance a property with a lower DSCR, but this often comes with larger down payments, stricter credit score requirements, and higher rates. At Defy, we offer DSCR loans for properties that have a DSCR as low as 0.75.

Down Payment

Down payments for DSCR loan programs typically range between 20% and 30%. Unlike FHA loans, VA loans, and USDA loans, DSCR loans are non-QM or non-qualifying mortgages. This means typically DSCR loan programs unfortunately cannot accommodate smaller down payments where conventional loans insured by Fannie Mae or Freddie Mac could.

Minimum Credit Score and Other Financial Requirements

Although DSCR loans don’t focus on the borrower’s income, other financial details, like a borrower’s credit score, will be taken into account. Lenders typically require DSCR borrowers to have a credit score of at least 650. At Defy, however, the minimum FICO score we look for is 620.

In addition to credit score, DSCR lenders may evaluate the borrower’s cash reserves and other assets to gauge their liquidity, as an assurance that they can find a way to meet their financial obligations if the income from the property is disrupted for any reason. You may also be asked to provide bank statements from the past few months to prove that you have stable and sufficient cash flow for your personal needs. Various documents may be requested to verify that you’re in good financial standing. At Defy, we won’t ask our borrowers to provide tax returns or W-2 income.

Property Types

Common candidates for DSCR loans are single-family homes and multi-family units. Multi-family units can be an attractive option especially in areas where rental demand is highest, such as in the vicinity of the West Virginia University campus in Morgantown or thriving commercial hubs such as Huntington.

But that’s not all. DSCR loans are versatile, allowing borrowers to invest in commercial real estate, mixed-use properties, short-term rentals, and vacation homes. Borrowers looking to purchase a property in popular tourist areas like Berkeley Springs could also benefit from a DSCR loan.

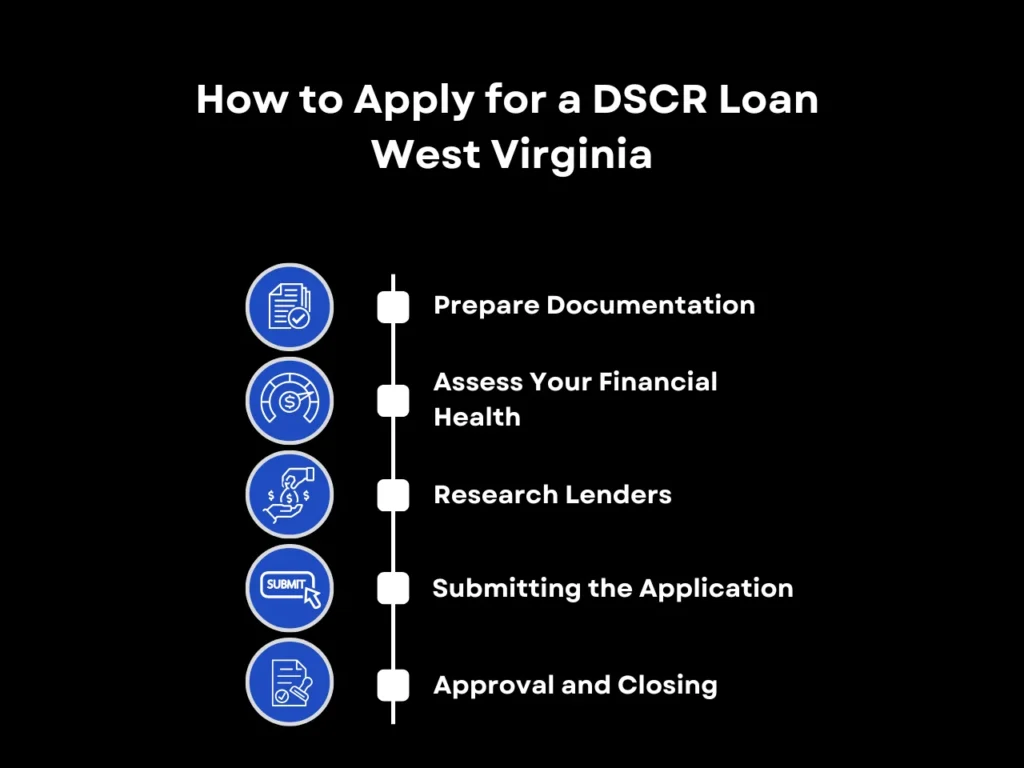

How to Apply for a DSCR Loan West Virginia

Beyond selecting a well-performing property, we recommend applying for a DSCR loan West Virginia after you have gathered all the documents for the property as well as your financials, and confirm that you meet the requirements set by most lenders. Here’s a step-by-step breakdown of the process:

Step 1: Prepare Documentation

The debt service coverage ratio is the primary metric that DSCR lenders consider, so you will need to gather documents that provide accurate details on the property’s income and expenses, as well as all records of the periodic property expenses, such as insurance and taxes. Lenders may also request bank statements and asset records detailing your liquidity. If you’re purchasing under an LLC, which many lenders prefer, you should also prepare the relevant documents pertaining to your stake in the LLC. Having these documents on hand drastically speeds up the application process.

While gathering this information, you can also calculate a rough estimate of your property’s DSCR by taking the estimated average cash flow per year after all operating expenses and dividing it by the total expenses, including the yearly DSCR mortgage payments. If the DSCR estimate on your chosen property falls below the minimum required by your preferred lenders, it may be time to look for other candidates.

Step 2: Assess Your Financial Health

Examine your most recent credit reports to ensure that you meet the lender’s minimum threshold. If you don’t, consider paying down some of your loans or consolidating your debt. You should also take this time to review your credit reports and raise concerns about any errors that could be driving your score down.

Step 3: Research Lenders

Once you’ve got your documentation and finances in order, it’s time to start shopping around for reputable mortgage lenders. We recommend focusing on lenders with a track record of providing investment property loans, particularly DSCR mortgages, as these lenders tend to have an expertise in the space which they can draw from when helping you navigate the process. Defy is one such lender, specializing in non-QM mortgages, including DSCR loans, and catering to borrowers’ unique needs across the US.

Create a shortlist of lenders who offer DSCR loans with competitive interest rates to arrive at the one that best fits your needs. Applying for pre-approval could be helpful as it’ll let you know the maximum loan amount and terms a lender is willing to offer. It also makes you more attractive as a buyer.

Step 4: Submitting the Application

Once you’ve which lender to partner with, you can complete a loan application with them and submit all the requested documentation. Once the lender reviews and confirms they have everything they need, the lender will order an appraisal to verify the property’s market value and income-generating potential. The appraisal will enable lenders to calculate the property’s DSCR, which will be used to determine loan approval and terms.

Step 5: Approval and Closing

After underwriters have reviewed your documents and the appraisal results, the lender will give you an update on your approval status. This can take anywhere from a few days to six weeks. Once approved, your loan officer will send you your closing papers to sign.

If you’re happy with the loan terms and conditions, you can sign the loan agreement and pay the closing fees. After 3 to 5 business days, the lender will disburse the funds to the property seller, who will then transfer ownership of the property to you.

DSCR Loan West Virginia FAQ

What is the minimum DSCR required for a loan in West Virginia?

Most lenders require a DSCR of at least 1.25, meaning the property must generate 25% more income than its debt obligations. Properties with slightly lower DSCRs may still be approved by some individual lenders, but this can come with higher mortgage rates, higher down payment, and higher credit score requirements. At Defy, the minimum DSCR we look for is 0.75.

Do I need a high credit score to qualify for a DSCR loan?

DSCR loans emphasize the property’s income over personal financial history, but borrowers are often required to have a credit score between 650 and 680. This indicates a history of good financial management. At Defy, however, we offer DSCR mortgage loans to borrowers with credit scores of at least 620.

What types of properties are eligible for DSCR loans in West Virginia?

Eligible properties include single-family homes, multi-family units (up to 4 units), short-term and vacation rentals, commercial real estate, and mixed-use properties. Manufactured homes and single-room rentals would not qualify.

How much of a down payment is required for a DSCR loan?

Lenders typically look for a down payment of 20% to 30%, but this can vary depending on the lender, the property’s DSCR, and the borrower’s credit score as well as other financials.

Can I have multiple DSCR loans?

Yes, there is no limit to how many DSCR loans you can have active, making them an excellent option for building a diversified investment portfolio. Keep in mind, however, that the more properties you include in your portfolio, the more likely lenders are to assess your DSCR at the portfolio level, accounting for the overall net operating income and total debt service across all your properties.

Key Takeaway

A DSCR loan West Virginia can turn the already investor-friendly real estate market of the Mountain State into one where your prospects can flourish. With low purchase prices and low cost of living driving down your operating costs, DSCRs for properties in the state can be high. This significantly raises your borrowing power and can make managing an extensive portfolio much easier, thanks to the financial buffer that higher profit margins can create.

If a DSCR loan West Virginia sounds like something you could use to grow your portfolio and secure long-term financial success, remember to evaluate your property’s income potential and connect with experienced lenders for tailored solutions.

Interested in learning more about your real estate investment options? Reach out to Defy to get expert advice on your next financial move. Apart from DSCR loans, we also offer other investment mortgages such as fix-and-flip loans, all fully tailorable to fit your unique needs.