If you invest in properties or plan to do so, it’s important to understand the effect of mortgage rates on investment property in order to maximize your overall profitability. The amount you pay in interest can directly impact your cash flow as well as your return on investment (ROI).

At Defy Mortgage, we provide comprehensive and fully customizable investment mortgage solutions geared toward real estate investors, entrepreneurs, and self-employed individuals. Our expertise spans 75+ non-traditional loan options, including DSCR loans and Bank Statement loans. With our seamless platform and competitive rates, it’s easy to manage your mortgage.

In this article, we’ll explore the dynamics of investment property interest rates and how they impact your returns. While we can’t offer financial advice, we will share certain strategies that investors have employed to maximize their ROI despite fluctuating rates.

How Mortgage Rates Directly Impact ROI

The effect of mortgage rates on investment property ROI is simple: higher mortgage rates mean more money paid in interest, which reduces your cash flow and negatively impacts your ROI. This limits your ability to grow your investment.

Let’s break down how exactly interest affects your returns:

How Mortgage Interest Works

Most mortgages use simple interest, which is calculated based on the outstanding loan balance (principal). The interest you owe each month depends on the loan amount, the interest rate, and the length of time it takes to repay the loan.

In fixed-rate mortgages, a portion of your payment goes toward interest and the rest reduces the principal balance each month. Over time, as the principal decreases, the interest portion of each payment also decreases. This means that although the total monthly payment (principal + interest) stays the same for the life of the loan, the proportion of the payment allocated to interest decreases while the allocation to principal increases, both on a monthly basis.

The Effect of Higher Interest Rates

If you took out a mortgage for your investment property, your potential return largely depends on several factors including rental income and/or how much equity you’ve built by the time you resell or refinance. This is why flipping the property too quickly can likely result in a loss because most of your monthly payment goes towards interest rather than building equity.

Your break-even point can be pushed even further if the initial interest rate on the loan is high. For example, a $300,000 mortgage at 6% interest has a monthly payment of $1,798.65. But raising that interest rate by just 0.5% will increase the monthly payment to $1,896.20, which can significantly raise your cost over time.

When the Federal Reserve implements rate hikes, they intentionally raise interest rates to manage economic conditions. This monetary policy tool serves multiple critical purposes like inflation control and economy stabilization if the economy is growing to quickly. To slow down spending and investment, the Fed raises rates to help prevent the economy from becoming unsustainable and keeps inflation in check.

Keep in mind though that mortgage rates vary due to a variety of factors and are influenced by more than just the Fed rate and market conditions. The good news is that you always have the opportunity to refinance for a lower rate if you purchase a property when rates are higher. Options!

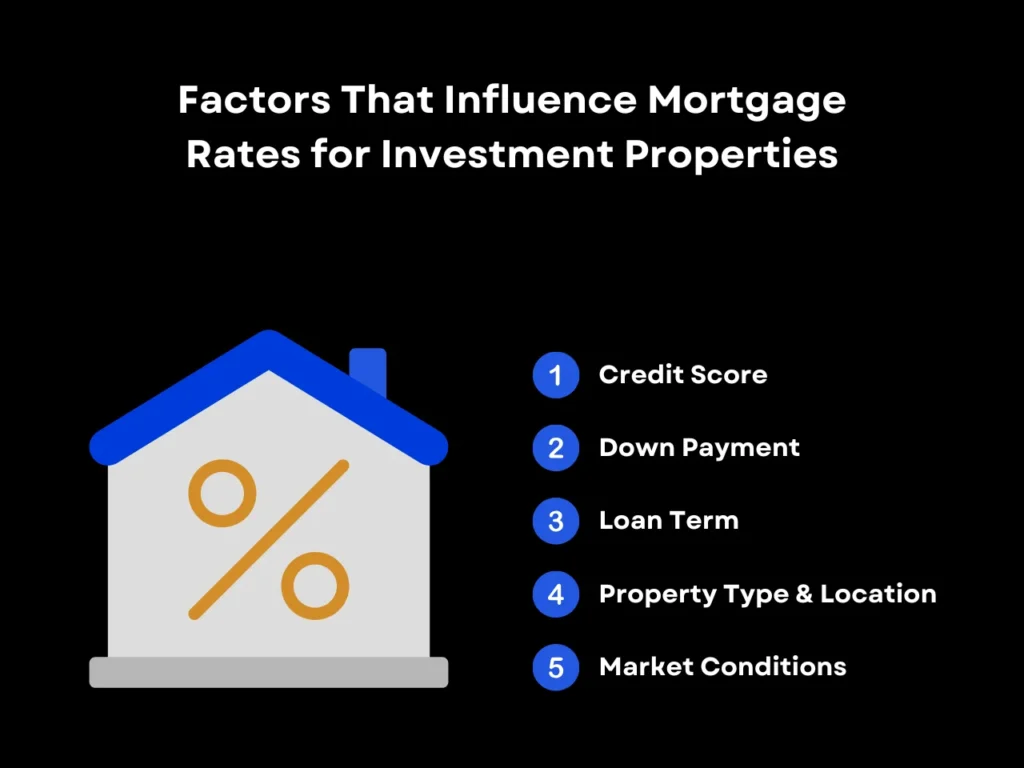

Factors That Influence Mortgage Rates for Investment Properties

Investment property loan rates are decided slightly differently than the rates for properties intended for personal use. While factors like loan amount and terms do play a role, it comes down to how much risk the lender would be taking by investing in you. Certain factors such as rental market health and location also have an effect on investment property rates.

Mortgage rates associated with obtaining a mortgage are subject to a variety of factors including but not limited to satisfactory property condition, location, down payment, property value, and appraisal as well as verification of application information (including income, assets, and credit), satisfying all underwriting conditions and no changes to the borrower’s credit rating or financial position. Let’s explore some of these factors below.

Credit Score

A higher credit score demonstrates financial responsibility, helping you secure lower rates. Different rental property mortgages often have their own credit score requirements. Some, like DSCR loans, can have favorable rates for those with FICO scores as low as 620 because they mostly take property income potential into account. Others, like conventional loans and jumbo loans, often require a minimum credit score above 700 to secure the best rates.

Down Payment

A larger down payment reduces the lender’s risk since you effectively reduce the amount of money they need to loan you. Some lenders offer more favorable interest rates for investment properties if you increase your down payment.

Most investment property loans require a minimum down payment of 20-25%. Aiming for higher than that can convince the lender to lower your rates, but by how much can vary from lender to lender, and at a certain amount your interest rate will likely not get any lower.

Loan Term

Shorter loan terms, such as 15 years, typically have lower rates than 30-year loans. Lenders look more favorably on short term loans because they get paid back in half the time. However, this comes with the tradeoff of having higher monthly payments, because the whole loan is compressed into a shorter timeframe to pay it off.

Property Type and Location

The type of property can also influence mortgage rates. For example, single-family homes generally have lower interest rates than multi-unit properties. Lenders assess properties in high-demand areas differently than those in less popular regions, factoring in historical sales, urban vs. rural location, default rates, and housing data availability.

Properties in areas with limited historical data or higher default rates may signal a slower rental market, which can lead to increased interest rates. Lenders also consider borrowing behavior in the area, such as default and early settlement trends, to further determine risk.

Market Conditions

On the macroeconomic level, factors like inflation and Federal Reserve policies can significantly influence interest rates, housing prices, and property investment returns. Inflation reduces the purchasing power and compels lenders to increase rates to ensure that returns outweigh this effect. In response to inflation, the Federal Reserve may adjust interest rates to stabilize the economy, setting the federal funds rate high to raise the interest rate floor and discourage spending and borrowing.

Understanding market conditions is crucial for estimating the potential return on an investment property because factors like inflation and Federal Reserve policies directly impact borrowing costs, property prices, and market demand. Investors must carefully evaluate these dynamics to sustain long-term gains.

Strategies to Mitigate High Mortgage Rates and Boost ROI

Although mortgage rates for investment properties are often higher than those of a primary residence mortgage, there are steps you can take to reduce the effect of this disadvantage and maximize the return on your investment.

Shop Around for the Best Rates

Different lenders offer varying rates, and their area of specialization can also influence their offerings. For example, some private lenders might focus on specific loan types, while others, like Defy, specialize in broader options such as non-QM lending. Comparing multiple offers allows you to secure the best terms for your investment.

Improve Your Credit Score

Similar to securing good rates for a primary residence, it’s a good idea to get your credit score as high as possible before applying. This increases the likelihood of getting better investment property interest rates. You can do this by paying down credit cards or consolidating debt with a home equity loan, as well as checking your credit reports for inaccuracies that you can contest to get a higher corrected FICO score.

Increase Your Down Payment

If you have the cash flow, a larger down payment can reduce the loan-to-value (LTV) ratio, reducing lender risk and making you eligible for lower rates. It also reduces your principal and can significantly lower the total interest in the long run.

Consider Interest-Only Options

Using an interest-only loan as a strategy can be effective for increasing your ROI on investment properties, especially if you prefer freeing up your cash flow early on. Interest-only loans allow you to pay only interest payments for a set period. This period typically lasts 5-10 years, after which you will get charged the principal as well as any remaining interest you haven’t yet paid. This is a great option for properties that need some time to get up and running at full profitability.

For example, let’s say you purchase a multi-family property for $500,000 with a 20% down payment, which requires a $400,000 loan. With a conventional mortgage at the average interest rate of around 6.5%, your monthly payment would be $2,528.27 including $2,166.67 in interest and $361.60 in principal.

With an interest-only loan, your monthly payment would be limited to the $2,166.67 interest payment during the interest-only period. However, your monthly payment will rise after the initial 5-10 years, making it $2,982.29 for the rest of the loan term. This method makes sense if you believe the future rental income on this property would justify the higher mortgage amount at that time.

Explore Refinancing Options

Refinancing can be a smart move for your investment properties if it helps lower your costs. One strategy is to refinance from a fixed-rate mortgage to an adjustable-rate mortgage or vice versa, depending on your goals and market conditions.

Fixed-Rate vs. Adjustable-Rate Mortgages

- Fixed-rate mortgages provide stability over the loan’s lifetime but often have higher initial rates than ARMs. They are best for locking in low rates during periods of low inflation or slow market conditions.

- Adjustable-rate mortgages (ARMs) start with lower rates but fluctuate over time based on the market. They are best suited for investors who plan to sell or refinance before significant rate adjustments take place.

Fixed-rate mortgages have the distinct advantage of letting borrowers “lock in” a favorable rate. With a 30-year ARM, even a small increase in rates means paying significantly more interest.

Finally, always factor in closing costs to ensure the savings outweigh the expenses if the loan is refinanced. These one-time costs, which include loan origination fees, appraisal fees, mortgage insurance, title insurance – which can add up to 2%- 5% of the total loan amount – and recording fees.

Mortgage Rates On Investment Property FAQ

How do I get the best mortgage rate for an investment property?

Improving your credit score and offering a larger down payment are options that can help drive improvement, but it’s not a given. You should also shop around for a lender that offers the best investment property rate. Keep in mind that depending on the lender and timing, interest rates may change or not be available at the time of loan commitment or lock-in.

Why are investment property mortgage rates higher than primary home rates?

Investment properties are generally a higher risk for lenders. A primary residence is an immediate need rather than an investment. During financial hardships, borrowers are more likely to default on an investment property loan and prioritize paying for their primary residence.

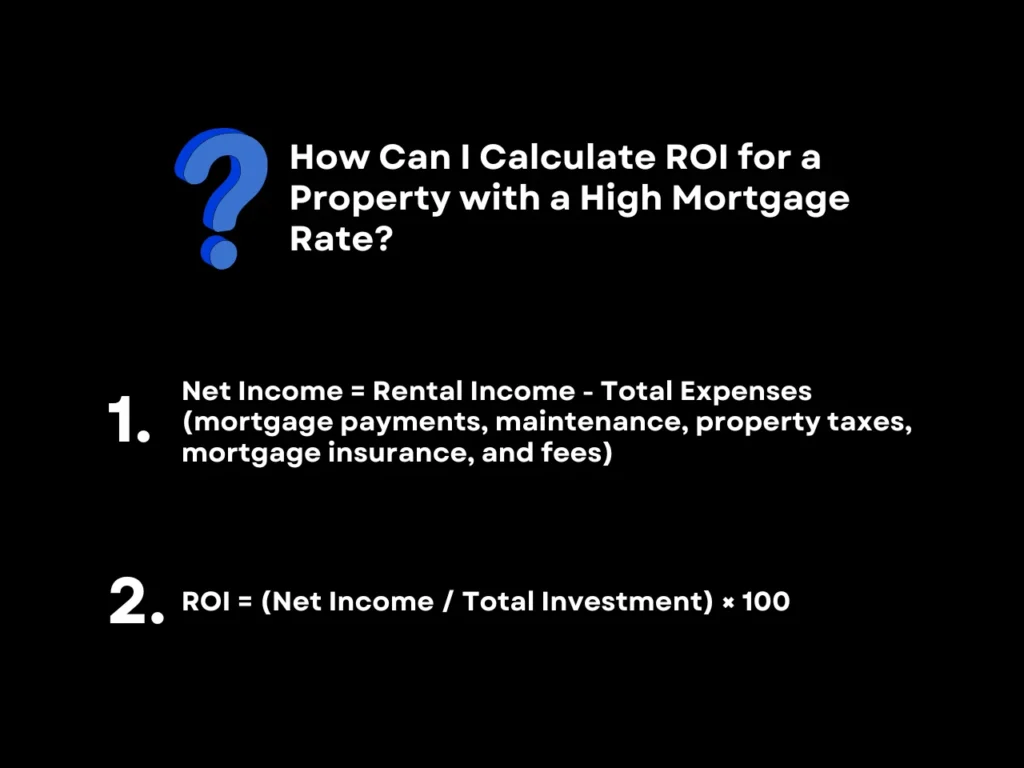

How can I calculate ROI for a property with a high mortgage rate?

Calculating ROI for any investment property begins by subtracting your total expenses (mortgage payments, maintenance, property taxes, mortgage insurance, and fees) from your rental income. Then, divide the resulting net income by your total investment in the property, which includes the purchase price and any improvements, and multiply by 100. This will give you your ROI percentage, which reflects how well the property performs despite the higher mortgage rate.

Is it worth refinancing an investment property to lower mortgage rates?

Yes, refinancing can be a great way to secure lower interest rates. Certain loan types, like DSCR, can potentially offer lower rates based on specific factors such as high rental performance. However, refinancing involves extra closing costs and fees, so it’s important to calculate whether refinancing would truly result in savings in the long run. Remember that ever situation is different so be sure to speak with your lender of choice about specific rates, terms and fees.

Key Takeaway

Mortgage rates on investment property significantly impact your ROI and are one of the biggest factors that can make or break your profitability. When possible, you should try to secure the lowest mortgage rate on your investment properties in order to reduce your costs.

Employing strategies like shopping for better rates or increasing your down payment can help you maximize your returns. Refinancing, if done correctly, can be a great tool to lower your interest payment in the long run.

Are you interested in taking out a non-QM loan to finance your next real estate investment? Start a conversation with Defy today and learn about our various investment property loan offerings, all with fast pre-approvals. Let’s start planning your next successful venture today!