Applying for a DSCR loan is one of the most effective ways that individuals with irregular income streams can finance investment properties. Debt service coverage ratio (DSCR) mortgage loans are non-traditional financing options that evaluate a property’s income potential rather than your personal financial profile, making them an attractive option.

This means that as long as you can find a property with a high income potential and prove that you can manage it, you can secure financing for it even if you don’t have a perfect financial history or a traditional income source.

At Defy Mortgage, we specialize in tailored mortgage solutions geared toward individuals with non-traditional incomes, such as real estate investors, freelancers, and contract workers. With 75+ non-traditional options such as DSCR loans, fix-and-flip loans, and construction loans, we can offer a vastly simplified experience at competitive terms. All of our loan types are fully customizable to whatever your needs may be.

In this guide, we’ve laid out the most common pitfalls that those new to DSCR financing often encounter, as well as how you can avoid them to secure favorable terms and expedite the process of applying for a DSCR loan.

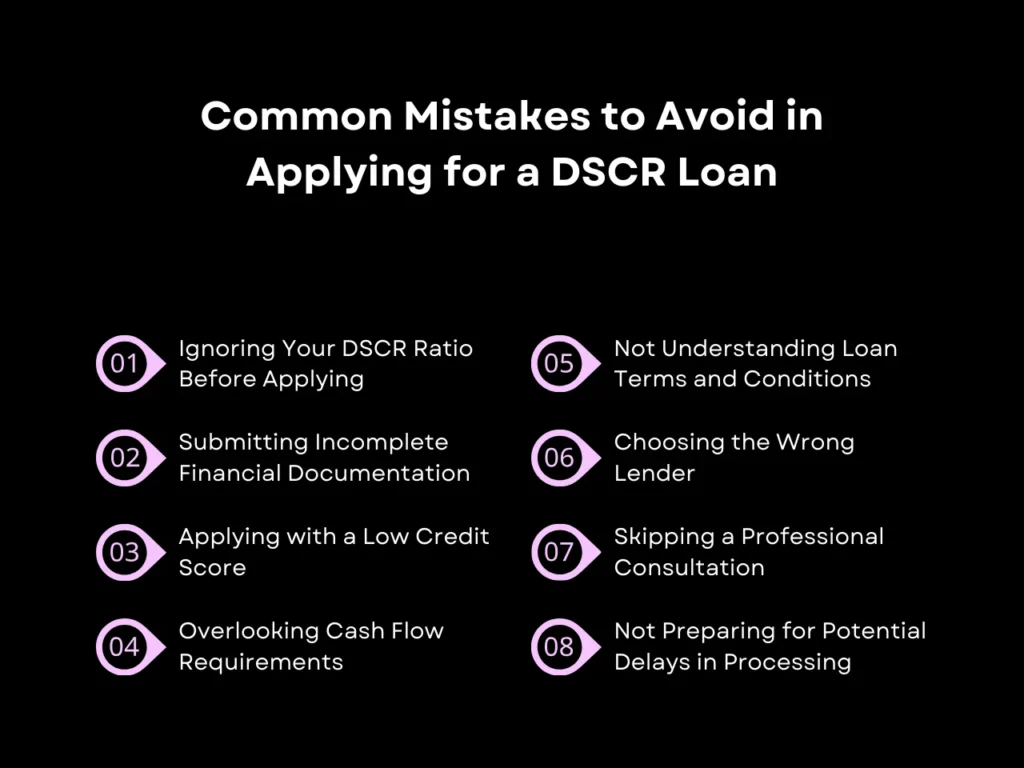

Common Mistakes to Avoid when Applying for a DSCR Loan

Along with meeting other eligibility requirements, ensuring a strong DSCR maximizes the chances of getting approved with a competitive DSCR interest rate when applying for a DSCR loan. But beyond seeing to the basics, there are nuances that even seasoned investors can overlook. Make sure to avoid these common mistakes.

1. Ignoring Your DSCR Ratio Before Applying

One of the most common mistakes when applying for a DSCR loan is failing to calculate your DSCR in advance. Lenders rely heavily on this ratio to assess whether your property generates sufficient income to cover debt payments.

Since the DSCR ratio is the main determiner of loan terms, it’s in your best interest to ensure that the DSCR of your selected property is as high as possible. Calculating your chosen property’s DSCR helps you evaluate whether the property is a good candidate for DSCR financing or whether you should consider searching for a different property to get better terms.

How to Calculate Your DSCR

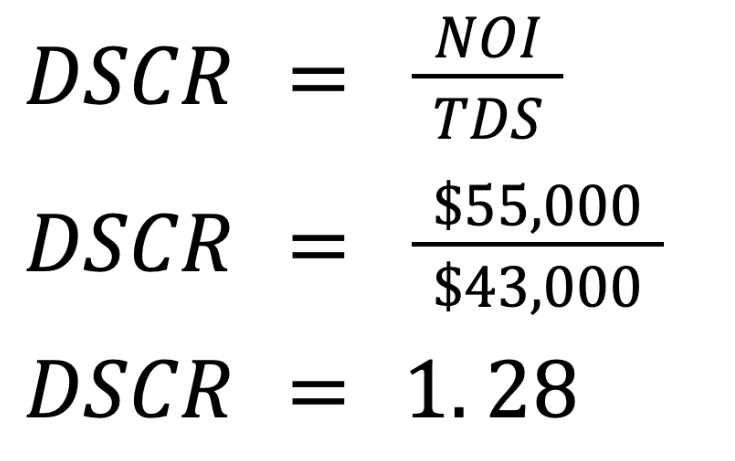

The debt service coverage ratio or DSCR is the ratio between a property’s net operating income (NOI), or its income after deducting all overhead and other operating costs, and its total debt service (TDS), or the total amount of yearly dues per year, including mortgage payments and other fixed recurring fees such as homeowner’s association fees and property taxes.

As an example, let’s say a property has a market value of $500,000 and makes $5,000 in monthly rental income. Assuming all tenants pay for their own utilities, that comes up to $60,000 in rental income per year.

The primary operating expense for most residential properties is maintenance. Real estate investing experts advise that property owners set aside 1 percent of the property’s value for maintenance per year, also known as the One Percent Rule. Using that, the property’s estimated operating expenses would be 1% of $500,000 or $5,000. Subtracting the total annual operating expense of $5,000 from the total annual income of $60,000, the property would have a net operating income of $55,000.

The NOI will then have to be divided by the total debt service to arrive at the DSCR. Currently the average interest rate for a DSCR loan is between 6% and 8%, and the down payment is usually around 20%.

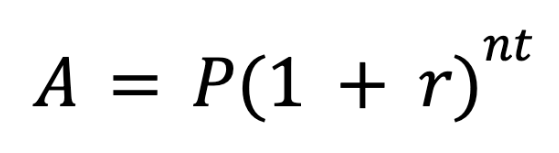

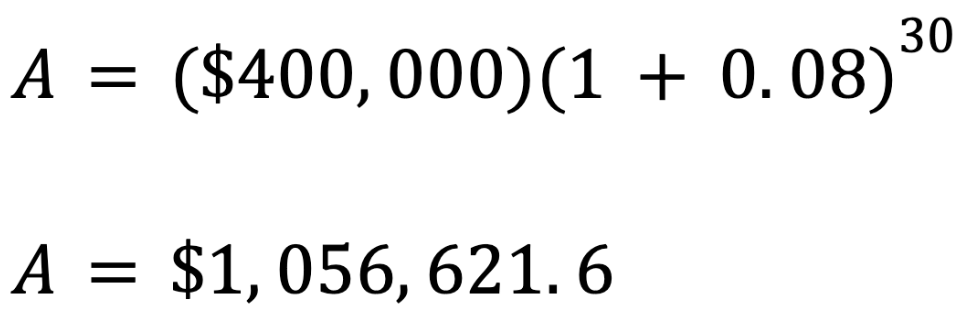

Assuming a 20% down payment on $500,000 yields a loan balance of $400,000. Then, we can apply the compound interest formula to calculate how much you will have to pay over the entire lifetime of the loan. To be conservative, we will use the higher interest rate of 8%:

Where A is the total amount after interest, P is the principal or initial balance, r is the loan’s interest rate, and nt is the time in years.

Therefore, we arrive at a total loan payment of $1,056,621.60 over 30 years, or $35,220.72 per year or $2,935.06 per month. Assuming that yearly taxes and homeowner’s association dues add up to $7,779.28, the property has a total debt service of $43,000 a year.

Now we can finally apply the simple DSCR formula, dividing the net operating income by the total debt service:

Thus, we determine that the property’s DSCR is 1.28, which is more than the 1.2 DSCR that most lenders look for. Having a higher DSCR than the minimum required gives borrowers extra leverage to negotiate for better loan terms.

The above formulas should give you an estimate of your property’s DSCR. Keep in mind, however, that individual lenders can have their own amortization schemes, which can alter how they calculate your property’s DSCR. If you’re having trouble, you can also use online DSCR calculators. It can also help to consult a financial advisor to ensure accuracy given local market conditions and lender requirements.

2. Submitting Incomplete Financial Documentation

Providing incomplete or inaccurate financial documentation is one of the most common reasons for DSCR loan application delays and rejections. Lenders use your documentation to verify the property’s cash flow and your ability to manage the investment, so precision and thoroughness are key.

Documents You’ll Need for a Successful Application

- Cash Flow Statements: These detail the income and expenses of the property, giving lenders a clear picture of its performance.

- Lease Agreements: If the property is presently being rented, current leases are essential to confirm rental income.

- Asset and Liability Statements: These help assess your overall financial health and the reserves available to support the loan.

- Bank Statements: Typically, lenders require the last two months of statements to verify reserves, which often need to cover several months of debt service.

- Property Documentation: This includes items such as insurance policies, flood zone certifications (if applicable), and entity documentation for LLC borrowers.

- Renovation Records: If you’ve renovated the property, provide receipts, work orders, and any other relevant documentation to prove the improvements made.

By submitting well-organized and complete financial records, you not only expedite the approval process but also strengthen your credibility as a borrower. Lenders are more likely to offer favorable terms when they see a borrower who is prepared and detail-oriented.

Remember that although personal income is not a key focus, lenders may look at your bank statements and other documents to check your liquidity and gauge your spending habits. At Defy, however, we will never ask you to provide tax returns or W-2 income for DSCR loans.

3. Applying with a Low Credit Score

While DSCR loans primarily evaluate a property’s income potential, your credit score still plays a role in the approval process and the DSCR loan rates you may qualify for. A strong credit profile reassures lenders of your overall financial responsibility, even if your loan is primarily evaluated on the property’s cash flow.

Steps to Strengthen Your Credit Profile

- Review Your Credit Report: Check your credit reports over the past few months for any errors or inaccuracies that may be dragging your score down. Dispute and resolve any issues promptly.

- Reduce Outstanding Debt: Paying down existing debts not only improves your debt-to-income ratio but also demonstrates financial discipline. Consider consolidating your debt to lower your overall monthly payment.

- Avoid New Credit Lines: Resist the temptation to open new credit accounts or make significant financial changes in the months leading up to your application.

- Make Timely Payments: A consistent payment history significantly boosts your creditworthiness and reinforces your reliability as a borrower.

Borrowers with lower credit scores may receive higher rates or stricter terms, making it essential to address credit concerns before applying. Most lenders look for borrower credit scores above 650, although at Defy, we offer DSCR loans to borrowers with FICO scores above 620.

4. Overlooking Cash Flow Requirements

Lenders scrutinize your property’s cash flow to ensure it aligns with their DSCR standards. Failing to demonstrate consistent income can hinder approval. But beyond maintaining accurate records of rental income or business profits, it’s also prudent to ensure that your property’s cash flow is consistent and sufficient. A critical pitfall in real estate analysis is the tendency to inflate NOI projections which play a huge role in DSCR calculation.

Cash flow consistency communicates that your property is insulated against income disruptions, which can affect whether or not your property can support its debt obligations. If a property’s income goes up and down but its DSCR still exceeds the lender’s expectations, lenders will still note the fluctuations in income. If the differences are large enough, they could cast doubt on whether you could make timely payments throughout the lifetime of the loan.

When NOI calculations are inflated, they artificially boost the Debt Service Coverage Ratio, masking the true financial health of the investment. This distorted view can lead to dangerous miscalculations in investment decisions.

Action Steps You Can Take to Address Cash Flow Inconsistencies

- Assess Income Consistency: Review your property’s historical income records. If income fluctuates significantly, consider strategies to stabilize cash flow, such as securing long-term leases or diversifying tenant types.

- Research Local Rental Rates: Understand the area’s rental rates to determine whether your property’s income potential aligns with market expectations. This can help you set competitive rent while maximizing occupancy.

- Factor in Vacancy Rates: Include expected vacancy periods in your financial calculations. This ensures that your projected income remains realistic and accounts for potential gaps in rental revenue.

- Account Thoroughly for All Operating Expenses: List all operating expenses, including maintenance, property management fees, taxes, and insurance. Lenders want to see a clear picture of net operating income after deducting these costs.

If your chosen property is lacking in income consistency, it may be a good idea to look for other properties that have steadier cash flow.

5. Not Understanding Loan Terms and Conditions

DSCR loans feature unique terms, such as adjustable mortgage rates, prepayment penalties, and specific repayment schedules. Failing to fully understand these terms before submitting your DSCR loan application can lead to unexpected financial strain and challenges in managing your investment.

Best Practices for Reviewing Loan Terms

- Consult with Your Lender: Schedule a detailed discussion with your lender to go over the loan terms thoroughly. A knowledgeable lender can clarify any complexities and ensure you understand all conditions before signing.

- Ask Specific Questions: Inquire about potential changes to your interest rate, the implications of early repayment, and how the repayment schedule aligns with your cash flow projections.

- Review Loan Documents Carefully: Take the time to read all documentation in detail. Highlight areas that concern or confuse you and seek clarification where needed.

Being well-informed about your DSCR loan’s terms helps you avoid surprises and ensures that the loan aligns with your financial goals. A proactive approach to understanding the loan conditions strengthens your position as a borrower and prevents costly misunderstandings.

6. Choosing the Wrong Lender

With real estate investments remaining the most popular long-term financial venture in the US, it can be more common to see private lenders and financial institutions offering DSCR loans. However, not all lenders are equally skilled at providing them.

Key Attributes of Ideal DSCR Loan Lenders

- Specialization in Non-Traditional Financing: DSCR loans require a deep understanding of real estate and local markets. You’re also more likely to get the best results from a lender whose expertise lies in non-QM financing, as they can often facilitate a faster process and offer you terms that align more accurately with your property’s potential and market conditions.

- A Proven Track Record: Consider a lender’s track record and reputation before you shortlist them as one of your potential picks. You can do this by looking up unbiased reviews and mentions of the lender on social media and on forums. Those with a history of providing DSCR loans are most likely well-versed in structuring loans to maximize profitability and meet the unique needs of investors.

- Strong Communication Skills: As you interact with potential lenders, assess how they handle your inquiries. A reliable lender will maintain open lines of communication, ensuring you’re well-informed at every stage. They should be quick to answer your questions, address concerns, and provide transparency regarding the loan terms. Good communication can prevent misunderstandings and give you confidence that your loan is being managed properly.

Defy Mortgage excels at all three. We provide DSCR loans and other non-traditional financing products across the United States and beyond. Our mortgage experts have years of experience working in local real estate markets throughout the country. With our dedicated support, you can be sure that you get the insights and guidance you need to make informed decisions.

7. Skipping a Professional Consultation

Skipping financial or legal advice can result in missed opportunities or costly mistakes on your DSCR loan application. Professionals can help you structure your application, identify potential issues and opportunities, and negotiate better terms.

- Market Analysis: Experts analyze current market trends, property values, and growth areas to identify the best investment options suited to your goals and budget.

- Property Evaluation: Professionals assess a property’s condition, uncover potential repairs or issues, and provide accurate valuations to ensure you’re not overpaying.

- Investment Strategy Guidance: Consultants develop investment strategies tailored to your financial situation and risk tolerance, considering factors such as rental income and capital appreciation potential. These can be from investment advisors, financial advisors, wealth managers, etc.

- Legal Due Diligence: A thorough review of legal titles, zoning regulations, property surveys, and environmental concerns ensures you avoid unforeseen complications.

- Negotiation Support: Seasoned professionals can leverage their experience to negotiate favorable terms and pricing on your behalf.

- Access to Off-Market Properties: Some consultants can also provide exclusive access to off-market listings, offering unique investment opportunities.

- Local Expertise: Real estate professionals with local market knowledge understand neighborhood dynamics, future development plans, and potential risks. For example, certain property types may be on a downward trend in a certain area due to recent market developments. Professionals stay on top of such developments in their locale, which can help you make well-informed decisions.

8. Not Preparing for Potential Delays in Processing

Expecting a quick turnaround when applying for a DSCR loan can lead to frustration, as these loans often require extensive documentation and underwriting, including financial statements and property appraisals. Processing times can vary depending on the lender, loan size, and your financial situation, making delays a common occurrence.

Best Practices for Managing Processing Delays

- Set Realistic Expectations: Ask your lender upfront about typical processing times and potential hurdles to avoid surprises.

- Maintain Open Communication: Regularly follow up with your lender for updates and address any additional documentation requests promptly.

- Be Organized: Have all financial and property documents ready in advance to streamline the underwriting process.

By anticipating delays and staying proactive, you can reduce frustration and ensure your DSCR loan application stays on track.

9. Choosing the Wrong Property Type

The property’s classification – whether residential, commercial, or mixed-use – plays a crucial role in determining its DSCR performance. Each category carries distinct income characteristics and risk profiles.

Property Types for Applying For DSCR Loans

- Residential Properties: Typically offer steady, predictable rental income, while commercial properties might generate higher returns but face more market volatility.

- Long-term Rental Properties: Traditional residential rentals with long-term leases often provide consistent monthly payments

- Short-term Rental Properties: Vacation rentals like Airbnbs, VRBOs and other STR investment properties where the rental time-period is for days/weeks might experience seasonal fluctuations.

- Mixed-use Commercial Developments: Can provide income diversification but require more complex management.

When evaluating a property investment, the reliability of its income stream is paramount. Commercial spaces may offer premium rents but could be more vulnerable to economic downturns or changing market conditions. Properties with erratic cash flows, particularly those heavily dependent on short-term rentals or specialized commercial uses, may find it challenging to maintain the consistent debt service coverage ratios that lenders require.

10. Not Understanding DSCR As A Concept

DSCR serves as a critical metric that extends far beyond lender requirements. Consider this scenario:

An investor purchases a $1 million property with an 80% LTV loan ($800,000) at 6% interest over 30 years. The monthly payment would be approximately $4,796, requiring annual debt service of $57,552. To maintain a minimum DSCR of 1.25 (a common lender requirement), the property would need to generate at least $71,940 in annual NOI.

Failing to grasp DSCR’s significance often leads to excessive leverage. Should this happen, the investor is likely to face cash flow shortfalls and potential default risk.

DSCR can be a new concept for some, so it’s important to ask questions to ensure that you are getting as much information as possible to understand your options fully and make an educated decision.

Applying for a DSCR Loan FAQ

What is the minimum DSCR ratio required for loan approval?

Most lenders require a minimum DSCR of 1.2, though different lenders can have different DSCR loan requirements. Some lenders, for example, may require a higher DSCR if your credit score isn’t high enough. At Defy, however, you can get approved for a DSCR loan for a property with a DSCR as low as 0.75.

Can I apply for a DSCR loan with inconsistent cash flow?

Inconsistent cash flow often makes DSCR loan approval more difficult. Exceptions may be found in properties whose lowest reported income still gives it a DSCR above what the lender requires.

Short-term rentals and vacation homes are also common candidates for DSCR loans as long as the borrower can demonstrate high-income periods that drive up its yearly income enough to meet the DSCR requirements. However, in most other cases, inconsistent income is a red flag. Make sure to check with each lender you are interested in applying for a DSCR loan with and ask them about their requirements as cash flow requirements vary by lender.

How can I improve my chances if my credit score is low?

If your credit score is below the minimum required, the first thing you can do is try to improve it and speak with a financial advisor on specifics surrounding how. Although we can’t give financial advice, we would suggest speaking with your advisor about paying off your highest-interest loans or considering consolidating your debt to drive up your FICO score.

If you’re only slightly below the requirement but won’t be able to get a higher credit score anytime soon, it may be possible to get approved by choosing a property with a higher DSCR and building up your cash reserves.

However, unless you’ve found an exceptionally lucrative investment opportunity with a rapidly closing window, it’s probably best to wait until your credit score improves before getting started with DSCR financing to secure the best rates and terms.

Can I get a DSCR loan for my primary residence?

No, you can’t use a DSCR loan for your primary residence. DSCR loans are only for income-generating properties such as short-term rentals, long-term rentals, mixed-use properties, and more. Applying for a DSCR loan is a great option for real estate investors with investment properties, rather than homeowners looking for a home loan on their primary property.

Do all lenders offer DSCR loans for investment properties?

Not all lenders offer DSCR loans. Private lenders are often more likely to offer this type of loan than your average financial institution, which generally focuses on lower-risk conventional loans.

Key Takeaway

Avoiding common mistakes when applying for a DSCR loan ensures a smoother process and better outcomes. From calculating your DSCR ratio to choosing the right lender, preparation is key. Consult professionals, understand loan terms, and maintain organized documentation to maximize your chances of approval.

Are you ready to take your property investment strategy to the next level? Get started with Defy today and let our mortgage experts work out a financing solution that’s in line with your goals.