What’s the average home price in Los Angeles in 2025? Simply put, sources range from $950K to $1M.

The Los Angeles housing market in 2025 is as competitive as ever, with home prices continuing to rise. Whether you’re looking for an investment property in California or you want to build a home or renovate an existing one, you have options.

With that brief intro out of the way, let’s look into what all of the current data sources are telling us about average home prices in Los Angeles in 2025. If you’d like a more in-depth guide to the Los Angeles housing market, you can check that out here.

In this article, we’ll break down the following, and much more:

- The latest average home price in Los Angeles from top sources

- What’s driving home prices in LA

- How home affordability compares to previous years

- Mortgage options for buyers, investors, and self-employed borrowers

Average Home Price in Los Angeles in 2025 by Source

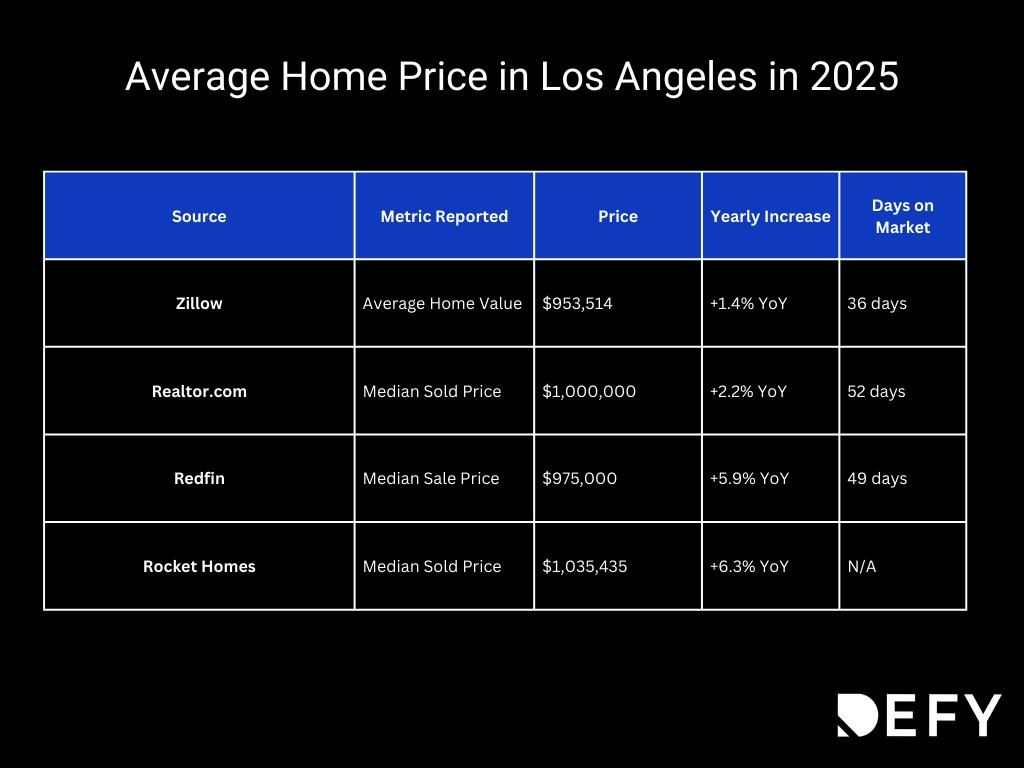

Data on the average home price in Los Angeles varies by the source. Zillow says it’s about $950k while Realtor.com reports that it’s around $1 million.

So let’s dive into what each high-quality source is currently saying about the market…

Zillow

As of January 2025, the Los Angeles housing market continues to exhibit robust activity, with home prices reflecting a steady upward trend. According to Zillow, the average home price in Los Angeles stands at $953,514, marking a 1.4% increase over the past year. Homes typically go pending in approximately 36 days, indicating a brisk market pace.

Realtor

Realtor.com reports a higher median listing price of $1.2 million for Los Angeles in January 2025, representing a 2.2% year-over-year increase. The median sold price is noted at $1 million, with properties generally spending around 52 days on the market. The sale-to-list price ratio stands at 99.02%, suggesting that homes are selling very close to their listing prices.

Redfin

Redfin provides additional insights, indicating that the median sale price in Los Angeles is $975,000, reflecting a 5.9% rise from the previous year. Homes typically receive three offers and sell in about 49 days, underscoring a somewhat competitive market environment.

Rocket Homes

Rocket Homes reports that the average home price in Los Angeles was $1,035,435 in January 2025, up 6.3% from the previous year, with a median price per square foot of $642.

Wall Street Journal

The recent wildfires in Los Angeles County have also impacted the housing market. In January 2025, wildfires consumed many homes in the region, exacerbating the existing housing shortage and driving up demand and costs for temporary rentals. Rebuilding efforts face challenges due to insufficient insurance payouts and high construction costs, potentially influencing future housing inventory and prices.

Why Are Home Prices Rising in Los Angeles?

1. High Demand & Low Inventory

One of the biggest reasons for rising home prices in Los Angeles is the ongoing imbalance between supply and demand. The city has limited available land for new development, and strict zoning laws prevent large-scale expansion in many residential neighborhoods.

Key Factors Affecting Inventory:

- Geographic Constraints: LA is bordered by the ocean to the west and mountains to the north, restricting outward expansion.

- Strict Zoning Laws: Many neighborhoods limit high-density housing, reducing the number of new homes that can be built.

- Slow Construction Approvals: The process of getting permits and approvals for new developments in California is complex and time-consuming.

- Aging Housing Stock: Many homes in LA were built decades ago, and new construction isn’t keeping up with population growth.

At the same time, buyer demand remains high, especially among:

- High-income professionals looking to buy homes near major job centers.

- Investors purchasing properties to rent out or renovate for resale.

- International buyers are drawn to Los Angeles’ global appeal and strong real estate market.

Simply put, there are more buyers than available homes. This supply-demand dynamic pushes prices higher.

2. Increasing Construction Costs

Building a home in Los Angeles has become significantly more expensive in recent years. The rising costs of land, labor, and materials make it harder for developers to bring affordable homes to market.

Why Are Construction Costs Rising?

- Land Prices: With limited land available for new housing, the cost of purchasing lots has skyrocketed.

- Labor Shortages: The construction industry faces a shortage of skilled workers, leading to higher wages and slower project timelines.

- Material Costs: Inflation, supply chain disruptions, and increased global demand have made construction materials — such as lumber, steel, and concrete — more expensive.

- Regulatory Costs: California has strict building regulations, environmental impact requirements, and safety codes, all of which add to the cost of new construction.

Wildfires & Natural Disasters Are Worsening the Housing Shortage

Los Angeles County has experienced significant wildfires, destroying thousands of homes and reducing the available housing supply. In January 2025, LA experienced the most damaging wildfire in city history, prompting California Governor Gavin Newsom to ask the government for $40 billion worth of aid. The cost of rebuilding these homes is high due to:

- Insurance challenges: Many homeowners struggle to get full insurance payouts after disasters.

- High labor and material costs: Rebuilding is expensive, especially for those who don’t have comprehensive coverage.

- Limited construction resources: Builders are already stretched thin with new projects, delaying reconstruction efforts.

As a result, fewer homes are being built, and existing homes in safe areas are becoming even more expensive.

3. Interest Rate Trends & Their Impact on Buyers

Mortgage interest rates play a major role in housing affordability. While rates have fluctuated throughout 2025, many buyers are rushing to lock in financing before rates potentially rise further.

How Mortgage Rates Affect Home Prices:

- Lower Interest Rates = More Buyers: When rates are low, buyers can afford larger loans, increasing demand for homes.

- Higher Interest Rates = Reduced Buying Power: Rising rates make monthly payments more expensive, limiting how much buyers can afford.

- Fear of Future Rate Hikes: Many buyers are purchasing homes now to avoid higher costs down the road, which is keeping demand strong despite market challenges.

Even with higher mortgage rates than previous years, the Los Angeles housing market remains highly active, as buyers try to secure properties before borrowing costs rise further.

4. Investment & Rental Market Growth

Los Angeles is not just a popular destination for homebuyers — it’s also one of the hottest rental markets in the U.S. Investors are purchasing homes at a rapid pace, competing directly with traditional homebuyers and driving up home prices.

Why Are Investors Buying So Many Properties?

- Rising Rental Prices: Los Angeles has one of the highest rental rates in the country, making rental properties a profitable investment.

- Short-Term Rental Demand: Platforms like Airbnb have increased demand for vacation rentals, especially near tourist hotspots.

- Long-Term Appreciation: Investors see Los Angeles real estate as a long-term wealth-building strategy, given historical price growth.

- Institutional Investors: Large investment firms and hedge funds are purchasing properties in bulk, further reducing the supply of available homes for regular buyers.

Many investors are outbidding traditional buyers, offering cash purchases with quick closing times, making it difficult for first-time homebuyers to compete.

Los Angeles Home Prices vs. Other California Cities

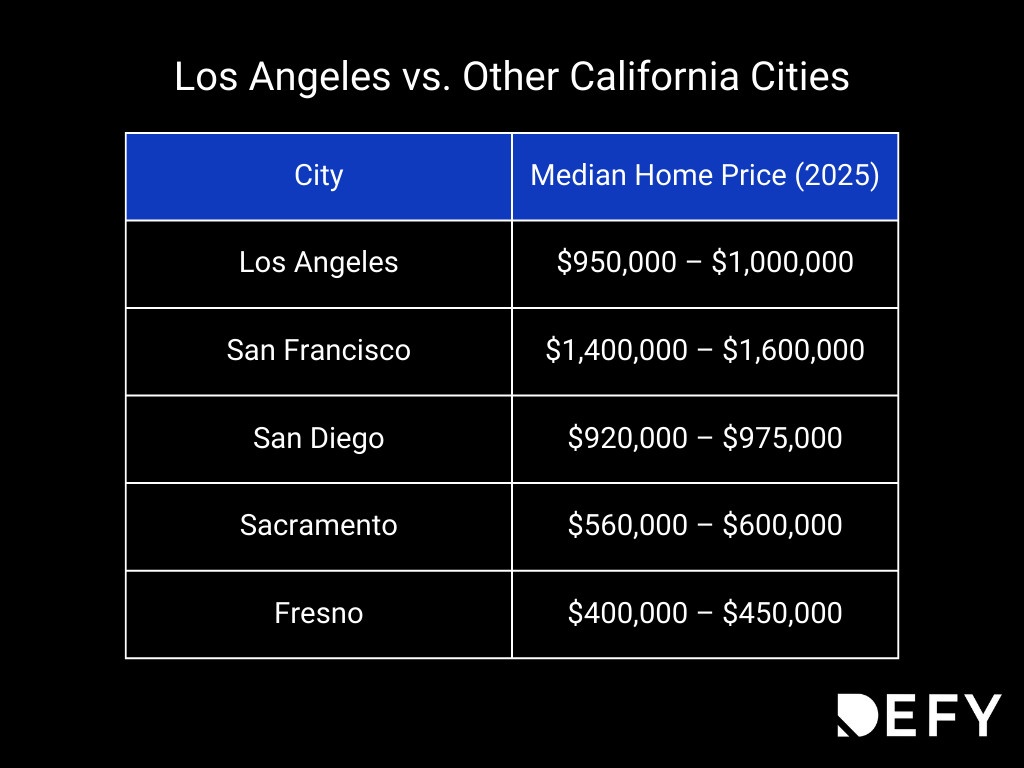

How does LA’s real estate market compare to other major California cities?

Los Angeles remains more affordable than San Francisco but is still one of the most expensive real estate markets in the country.

How to Buy a Home in Los Angeles in 2025

If you’re looking to purchase a home in LA, working with a lender who understands this competitive market is essential. We here at Defy Mortgage have helped dozens of LA homeowners and investors purchase properties, unlock their equity or refinance.

If you’re self-employed or an investor, Defy Mortgage offers flexible bank statement loans, asset depletion, and non-QM loan options to help you qualify.

Overall, the Los Angeles housing market remains dynamic, with home prices experiencing modest increases. Buyers and sellers should stay informed about market trends and consider the potential impacts of recent events, such as wildfires, on housing availability and pricing.The LA market has experienced the most growth out of almost any major US city over the past 30 years. In 1995, the median home value in LA was just $133,000. Today, it’s hovering right below $1M. That’s a massive price increase – and the fundamentals that drove that increase are still there. The city is still a massive economic center, and homes are still in high demand. If you’re interested in buying a home in LA, the upside is definitely still there.

FAQs: Average Home Price in Los Angeles in 2025

What’s the average home price in Los Angeles?

In 2025, home prices in Los Angeles vary depending on the source, but almost all of them report a median price around $900k to $1M.

Will housing prices drop in 2025 in California?

Housing prices are unlikely to drop by much in 2025 in California. As noted above, the city has experienced an almost 10% increase in median home values year-over-year in Q4 2024. With interest rates on the decline, prices are likely to go up.

How much will LA home prices go up in 10 years?

No one has a crystal ball, so it’s impossible to say for certain how much LA home prices will go up. While we can’t look forward, though, we can look back: In 2015, the median home value in LA was about $475,000. Today, it’s roughly double. That rate of growth is unlikely going forward – but certainly not impossible.

What are my mortgage options if I’m self-employed in Los Angeles?

Many traditional lenders require W-2 income verification, which can make it difficult for self-employed individuals to qualify. At Defy Mortgage, we offer loans that consider:

- Bank statements instead of tax returns

- Asset depletion loans

- Profit and loss loans

- Debt-Service Coverage Ratio (DSCR) for investors

How much do I need for a down payment for a home in Los Angeles?

Down payment requirements vary by loan type:

- Conventional Loans: As low as 3%

- Jumbo Loans: Typically 10-20%

- Investor Loans: Often require 20%+

- New Construction Loans: Usually 20-30%

If you’re concerned about down payment costs, we can help you explore low-down-payment options and alternative financing solutions.

Can I qualify for a mortgage in Los Angeles with a low credit score?

While traditional lenders may require a minimum credit score of 620-700, we offer non-QM loans that consider alternative credit factors. If you’ve had past credit issues but have strong income or assets, we can help you find a solution.

Can I use home equity to finance another home purchase in Los Angeles?

Yes! If you already own a home, you can tap into your home equity through:

- Home Equity Line of Credit (HELOC)

- Cash-Out Refinance

- Bridge Loan

These options provide liquidity for home renovations, real estate investments, or other financial goals.

What are today’s mortgage rates in Los Angeles?

Mortgage rates fluctuate daily. To get the most accurate and up-to-date rate quotes, contact us directly for a personalized assessment.