Being self-employed comes with many perks, but it also introduces its own unique frustrations, particularly when it comes to securing a mortgage. Traditional mortgages are difficult enough to get, but if you’re self-employed, you have to deal with the extra challenge of accurately representing your income to underwriters who don’t understand your business.

Bank statement loans are designed to let you qualify with your bank statements. The best part? The best bank statement loan interest rates are highly competitive with conventional loan rates, as long as you meet a few key criteria.

At Defy Mortgage, we specialize in crafting creative lending solutions for self-employed borrowers, real estate investors, business owners, and other borrowers with complex income pictures. We provide access to financing that works with real cash flow, from bank statement loans to qualify using your combined income from all sources to DSCR loans that let you take advantage of your investment properties’ rental income potential.

Here’s what you’ll take away from this article:

- How bank statement mortgage loan rates compare to conventional loan rates.

- The key factors that determine bank statement mortgage rates.

- How to reduce your loan rate.

- Alternative loan options if a bank statement loan isn’t the right fit.

Let’s dive in.

What Are Good Bank Statement Loan Interest Rates?

Bank statement loan interest rates are typically 0.5% to 2% higher than conventional loans. As of September 28, 2025, the average 30-year fixed conventional mortgage rate is 6.35%, so the average bank statement loan rate is between 6.85%-8.35%. But your actual rate depends on several factors.

A bank statement loan is a non-QM mortgage that allows borrowers to qualify using their bank statements instead of W-2s or tax returns. This makes it ideal for self-employed professionals, entrepreneurs, and investors whose income may not fit traditional underwriting boxes.

Why Choose Defy for Bank Statement Loans?

At Defy Mortgage, we specialize in making bank statement loans accessible and competitive. Here are our bank statement loan terms and requirements:

- No tax returns or W-2s required: All we need to verify your income are 12–24 months of business or personal bank statements

- Up to 90% LTV (loan-to-value): This means your down payment can be as low as 10%, depending on credit score and other factors.

- Minimum FICO score of 620

- Loan amounts up to $6M+

- Tailored loan scenarios

- No obligation and no application fee

We combine these flexible terms with one-on-one white-glove service to ensure you secure the best possible rate and structure for your situation.

But more than that, Defy serves as a trusted partner that understands the realities of self-employed income and builds flexible mortgage solutions designed to promote your long-term success.

How Are Bank Statement Loan Rates Determined?

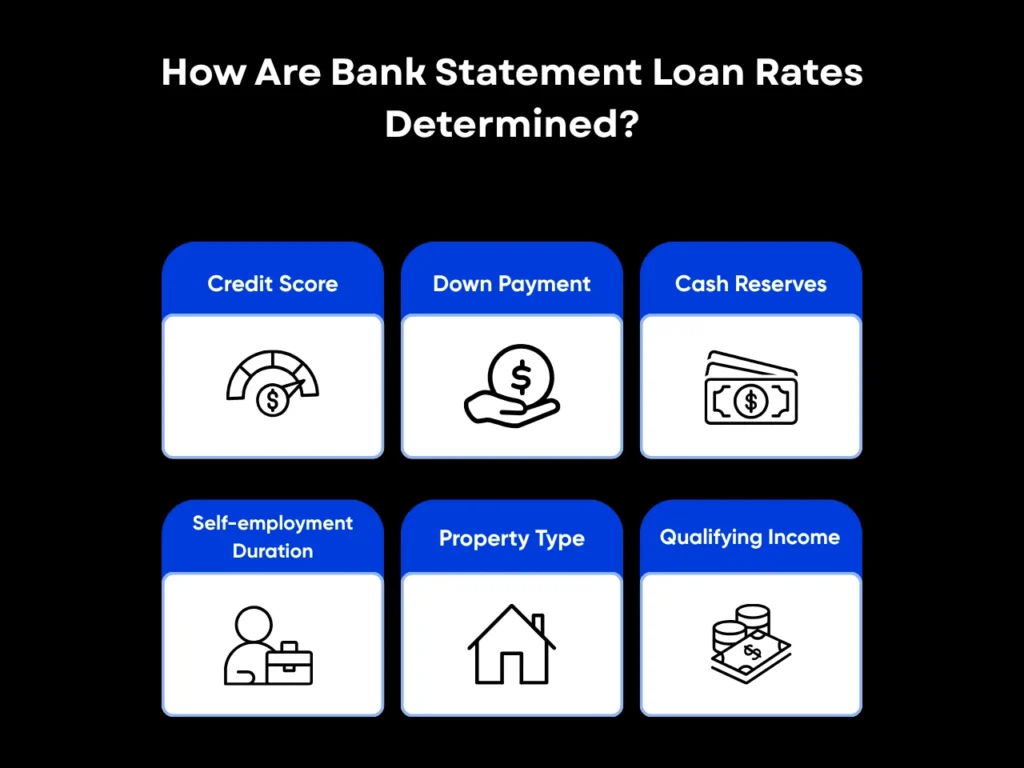

Like most loans, bank statement loan rates depend on multiple factors. Here’s a brief breakdown of the factors that affect terms:

- Credit score: This is the primary metric for how well you have met past debt obligations, and thus how risky you are as a borrower. At Defy, our minimum credit score for bank statement loans is 620, but a higher credit score of 680+ can unlock better rates.

- Down payment: At Defy, our bank statement loan LTVs go up to 90% of the property’s purchase price, meaning your minimum down payment can be as low as 10%. However, putting a larger amount down significantly mitigates lender risk, which could lower rates.

- Cash reserves: Although regular deposits are what mainly affect eligibility, having a lot of cash saved in your bank account can also help you qualify and get better terms. Lenders look at your cash reserves to gauge how much of the loan you might be able to cover with your savings should your income be interrupted.

- Self-employment duration: To some extent, how long you have been self-employed can also affect lender confidence. Demonstrating consistent self-employed income over the course of years can help you secure lower mortgage rates.

- Property type: If you intend to use the bank statement loan for home financing, the type of property can affect the risk profile. Properties that are in demand and display steady appreciation, such as urban properties in California and New York, are less risky and can invite better rates.

- Qualifying income: Although it mainly affects maximum loan size, demonstrating higher qualifying bank statement income can lead lenders to offer you lower rates, as it can be a sign that you’ll be more likely to have enough income to meet monthly debt payments.

How to Reduce Your Bank Statement Loan Interest Rate?

While bank statement loan rates can have slightly higher interest rates than conventional mortgages, you don’t have to settle for the first number a lender offers. With the right strategy, you can trim your rate down to only a fraction of a percentage point above average conventional loan rates.

- Shop Around for Mortgage Rates

Don’t accept the first offer you’re given. Instead, request multiple loan estimates, including principal, interest, fees, and structure from at least 3 different lenders. You can use this as leverage in negotiation.

Aside from rates and fees, you should also ask whether the rate is locked or if there’s a float-down provision if market rates drop. A rate lock is a guarantee that the agreed-upon interest rate at the time of signing will still apply when you close, as long as you do so within the lock period (typically 30–60 days). This protects you when rates are volatile and could increase significantly within a matter of days. But the downside is that if rates fall after you lock, you might miss out, unless your locking agreement includes a float-down option.

- Improve Your Credit Score

Your credit score tells your lender how risky it is to lend money to you, and the riskier it is, the higher your interest rate will be. To avoid this, you can lower your credit score by doing the following:

- Pay down outstanding balances, especially credit cards

- Keep credit utilization low (ideally under 30%)

- Avoid opening new credit lines in the months leading to an application

- Dispute any errors on your credit reports

- Maintain a clean payment history over time

- Increase Your Down Payment

For bank statement loans, a larger down payment can make a big difference. Since these loans are considered higher risk due to their alternative income verification, making a larger down payment helps offset that risk for the lender.

While you still have a chance of loan approval by meeting the minimum down payment requirements, offering more than the minimum may help you qualify for a lower interest rate or better terms.

- Strengthen Your Financial Profile

Bank statement loans rely on your cash flow instead of tax returns, so showing bank statements with steady, predictable income can give you the best rates. If your statements show irregular spikes or large unexplained deposits or transfers near your application period, it may be worth waiting until you’re able to present a consistent 12-24 months of deposits.

Your debt-to-income ratio is equally important. Make sure your monthly debt payments stay below 43% of your income, but ideally lower than 35%. It also helps to keep your personal and business accounts separate, which makes your finances easier to verify. To give mortgage lenders even more confidence in your ability to repay, demonstrate healthy reserves equivalent to at least three to six months of mortgage payments.

- Invest in Income-Generating Properties

Bank statement loans intended for income-generating properties will be perceived as less risky. Assets like these can essentially pay for themselves, and with a stronger guarantee that you can pay for the mortgage, lenders will be enticed to offer you a better rate. If you can document reliable tenants or a strong rental history, you’ll strengthen your application and may even qualify for better terms.

However, if your goal is to qualify based on the rental income alone, you may be better served by a DSCR loan, which is specifically designed for that purpose. DSCR loans focus on the property’s ability to generate income rather than your personal finances, making them a great option if your own income documentation or debt-to-income ratio wouldn’t qualify you for favorable terms. There’s also no limit to how many DSCR loans you can take out, allowing you to expand your portfolio at your pace. Still, bank statement loans remain a strong alternative if you want to leverage your personal cash flow along with rental income.

- Negotiate Terms

Negotiating for better terms, such as adjusting loan structure and paying discount points, can often decrease your rate by a significant amount:

- Shortening your loan term: Many lenders view shorter loan terms as less risky, which is why a 15- or 20-year mortgage often comes with a lower rate than a 30-year term. Keep in mind, though, that while the rate may drop, your monthly payments will likely increase since you’re paying off the loan in a shorter period. Not all bank statement lenders reward shorter terms, so it’s worth confirming with your lender before committing.

- Changing loan structure: Adjustable-rate mortgages (ARMs) can offer lower introductory rates, though they carry the risk of future increases. Hybrid options or interest-only periods may also reduce your upfront costs, but you should understand how and when the payment terms reset to avoid surprises down the road. At Defy, we offer all of these options

- Purchasing discount points: Paying one point (equal to 1% of your loan amount) at closing typically reduces your rate by about 0.125% to 0.25%. This can add meaningful savings over time, especially if you plan to stay in the loan long enough to reach the “break-even” point, when the interest savings outweigh the upfront cost. For long-term borrowers, this can be an effective way to lock in a more affordable rate.

- Refinance Strategically

Even if you may not be able to get the lowest possible rate at first, exploring refinancing options once economic conditions improve can lower your long-term costs and monthly payments. If market rates decline, refinancing into a more competitive loan can save you thousands over the life of the mortgage, especially if your credit has improved or your equity has increased significantly since then.

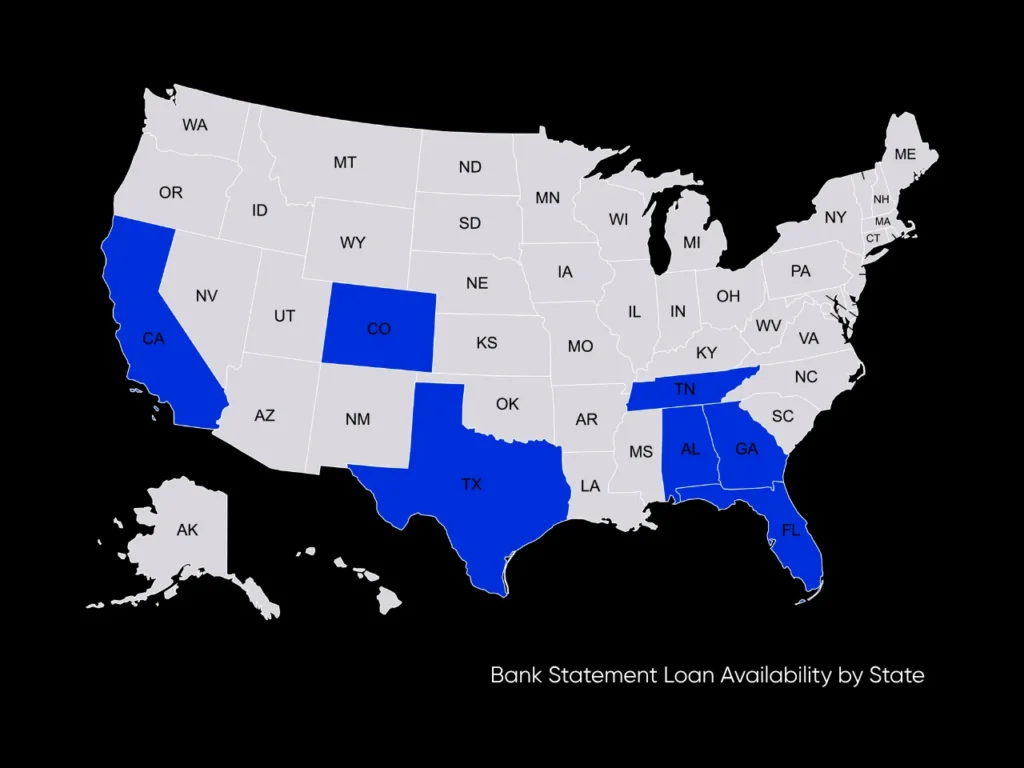

Bank Statement Loan Availability by State

At Defy, we’re proud to provide bank statement mortgage programs in the majority of U.S. states. Whether you’re self-employed, an investor, or a professional with non-traditional income, our team is here to structure a loan that fits your unique financial profile and long-term goals.

We currently offer bank statement loans in:

- Alabama

- Colorado

- California

- Florida

- Georgia

- Tennessee

- Texas

From first-time homebuyers and entrepreneurs to real estate investors and high-income earners seeking jumbo financing, we build solutions that align with your financial story, not just your paperwork. With personalized one-on-one service, zero-obligation applications, and flexible loan structures, Defy makes the path to homeownership and real estate investment straightforward and stress-free.

Other Non-QM Loans as Alternatives to Bank Statement Loans

If bank statement mortgage rates aren’t ideal for you, you might be interested in other non-QM mortgage options that better fit your situation. Here are a few of the best alternatives to bank statement loans:

- DSCR Loans: This type of loan uses an investment property’s income potential for qualification, instead of your personal income.

- P&L Loans: Use business profit and loss statements to demonstrate income. Ideal if you want to use business income to qualify, but would rather not use business bank statements.

- Foreign National Loans: A category of loans that provide mortgages for foreign nationals without a US credit score or Social Security number.

- Asset Depletion Loans: Use liquid assets like stocks and bonds to stand in for income. The total value of these assets is divided by the total months over the life of the loan, and this average is considered the borrower’s income.

- Interest-Only Loans: Pay only interest for up to 10 years for more manageable payments while you develop your income streams.

- Portfolio Loans: These mortgages are kept by the lender themselves in their portfolio, rather than selling it on the secondary mortgage market. Having full control over the loan, they have more discretion with loan criteria and qualifications.

- FHA Loans: This government-backed loan offers low down payment (as low as 3.5%) and rates, but comes with minimum property requirements and mortgage insurance premiums (MIPs), both upfront and annually.

Key Takeaway

With competitive bank statement loan interest rates, bank statement loans offer a valuable mortgage alternative for self-employed borrowers, entrepreneurs, and investors. They unlock financing options for those whose tax returns don’t tell the whole story, making homeownership and real estate investment more accessible for high-performing professionals with unconventional income.

To secure the most competitive rate, focus on strengthening your borrower profile. Improve your credit score by paying down balances and keeping utilization low, increase your down payment to reduce lender risk, and maintain predictable cash flow with a healthy DTI ratio. Always shop around for better rates and consider options like shorter loan terms, discount points, or refinancing down the line. Strategic preparation now can save thousands in long-term interest.

If bank statement loans sound like the right choice for you, don’t hesitate to schedule an appointment with Defy so we can discuss how you can achieve your real estate goals. Our experienced loan officers each have decades of experience working with self-employed borrowers, allowing us to tailor our mortgage products around your unique situation.

If you’re a mortgage broker, DefyTPO can give you access to all 75+ of Defy’s ultra-flexible loan products and rich industry expertise. With our products, you can tap into the non-QM sector that most lenders overlook and expand your reach to the fastest-growing borrower segment in the market.

Frequently Asked Questions

How do lenders calculate qualifying income from bank statements?

Lenders take the regular, recurring deposits on your bank statements. These can come from payroll, business receipts, and client payments. Any one-time or unsourced transfers aren’t considered. The sum of your regular deposits are then averaged over the documentation period, whether it’s 12-24 months. This will serve as your qualifying income.

What are the biggest red flags for underwriters?

Several anomalies can be considered red flags by underwriters:

- Frequent overdrafts or non-sufficient funds (NSF) fees: Frequent overdrafts or NSF fees, which indicate overdrafts, can be a sign of cash-flow stress.

- Large unexplained deposits: These may raise concerns about borrowed funds being temporarily “parked” to inflate income, or unverified income sources that don’t demonstrate sustainable cash flow.

- Inconsistent deposit patterns: Can indicate everything from undisclosed debt to unstable or seasonal income that may not reliably support a mortgage.

Can I refinance with a bank statement loan?

Yes! Many borrowers, especially self-employed individuals, often choose to refinance into a bank-statement program when their income becomes non-traditional. Defy offers bank statement rate and term refinance, bank statement cash-out refinance, and bank statement home equity refinance for borrowers whose bank statements demonstrate strong cash flow.

How many months of statements do I need?

Most non-QM lenders ask for 12-24 months of personal or business bank statements. 24 months usually gives underwriters a fuller view, which may increase chances of better pricing.

What is a non-QM loan?

A non-QM (non-qualified mortgage) loan is any mortgage that doesn’t meet the Consumer Financial Protection Bureau’s rules for “qualified mortgages”. These rules add restrictions for various loan features and require strict income verification, making them safer but less flexible. Instead, non-QM lenders use alternative underwriting, such as bank statements, P&L statements, property DSCR, and assets to assess a borrower’s ability to repay.

What if I have seasonal income?

It’s best to let your lender know upfront if you have seasonal income. As long as the income appears consistently year after year, it can qualify just like other monthly income. However, it may be best to show 24-36 months of bank statements to fully exhibit that your seasonal income is consistent and reliable.

What are my alternatives if I don’t qualify for a bank statement loan?

Depending on your goals, you have several:

- DSCR loans: Let you qualify based on the property’s cash flow instead of your own.

- P&L loans: Use profit-and-loss statements instead of bank statement loans.

- Asset depletion loans: Use the combined value of your liquid assets averaged over the loan term to serve as your qualifying income.

And many more. Reach out to us at Defy to learn more about all the options available to you, each completely customizable to fit your exact circumstances.

Who is a good candidate for a bank statement loan?

Bank statement loans are best for borrowers whose true cash flow doesn’t show up on tax returns. That includes self-employed owners, 1099 contractors, consultants, gig workers, high-net-worth borrowers with write-offs, and real estate investors.

How much down payment is required for a bank statement mortgage?

Defy’s bank statement programs accept as little as 10% down (up to 90% LTV) for qualified borrowers. Other lenders may require up to 20% minimum, depending on your credit score and bank statement income.

What’s the difference between a bank statement loan and a traditional loan?

Traditional loans verify income with W-2s, pay stubs, and tax returns. Bank statement loans instead analyze deposits and cash flow from 12–24 months of bank statements to establish qualifying income. This key difference allows those with strong cash flow but low taxable income to qualify for a mortgage with favorable terms.

Can I use a bank statement loan on a second home?

Absolutely. Bank statement financing can be used for primary residences, second homes, vacation properties, and investment properties. Keep in mind that rates may differ depending on the occupancy and property type, but you have a high chance of getting the best rate if you purchase an investment property with strong income potential.

Do bank statement loans require PMI?

Most non-QM / bank-statement programs do not use conventional PMI because they’re portfolio or alternative loans. This is partly why bank statement loan rates are often 0.5%-2% higher than conventional loan rates.

How much income do I need for a bank statement loan?

As of September 28, 2025, the rate for 30-year conventional fixed mortgages averages at roughly 6.3%. Since bank statement loans usually run about 0.5%-2% higher than conventional loan rates, that means your rate will range between 6.8% and 8.3%, depending on your FICO score.

At Defy, we allow DTI ratios up to 45%, so to qualify for a $300,000 mortgage at an ideal (~6.8%) interest rate and at 10% down, your debt payments must not exceed 45%. Let’s assume that $1,000 of your monthly income goes to existing debts ($12,000 per year). A $300,000 mortgage at 10% down comes up to roughly $2,000 per month or $24,000 a year. That means $36,000 must comprise less than 45% of your income. In other words, you have to make $36,0000.45= $80,000 a year, minimum. This estimate can vary widely depending on the various other factors surrounding the loan.

How do I apply for a bank statement loan?

If you’re ready to apply, click HERE to get started.